DBG Markets: Market Report for Sep 17, 2025

Zusammenfassung:Markets Await Fed Decision and Projections; US Dollar Eyes September PathAll eyes are on the Federal Reserve‘s policy decision tonight, with markets widely expecting a 25-basis-point rate cut. While t

Markets Await Fed Decision and Projections; US Dollar Eyes September Path

All eyes are on the Federal Reserve‘s policy decision tonight, with markets widely expecting a 25-basis-point rate cut. While the move itself is almost fully priced in, the real focus lies in Chair Powell’s forward guidance and the updated economic projections.

Rate Expectations and Market Positioning

Markets continue to bet on a dovish path, with expectations building for as many as three cuts in 2025. The U.S. yield curve reflects this bias: short-term yields remain under pressure while longer-dated yields are more stable or only slightly lower. This indicates that investors are steadily adding exposure to longer-term Treasuries, positioning for the start of a monetary easing cycle.

That said, markets will be watching closely for the policy tone in Powells press conference (midnight ET / early Asia session). If the Fed strikes a cautious note—stressing inflation risks and data dependency—it could temporarily push back against aggressive rate-cut bets and provide short-term support for the dollar.

Fed Economic Projections & Forward Guidance

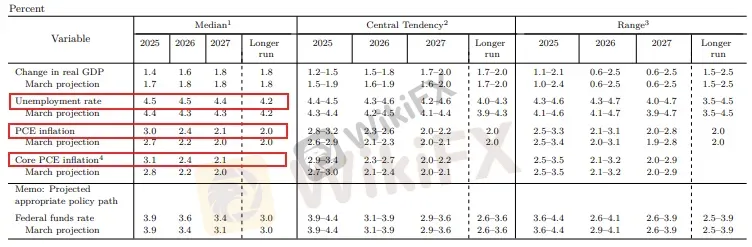

Another key element of tonight‘s meeting will be the Fed’s Summary of Economic Projections (SEP), which is released quarterly. The SEP offers crucial insight into how policymakers view the path of growth, inflation, and rates.

Fed June Meeting Economic Projection; Source: Federal Reserve

At the June meeting, the Fed projected:

· A weaker labor market outlook for 2025.

· Inflation staying elevated through 2025, only moderating toward 2.4% in 2026.

If tonights SEP shows only modest downward revisions to inflation despite the rate cut, it may suggest that the Fed is effectively adjusting to a new post-pandemic inflation reality—where inflation stabilizes within a 2–3% band rather than strictly at 2.0%.

Such a shift would imply that the Fed could still open the door to more cuts, provided inflation remains controlled within that broader range, even if it does not fall all the way back to 2.0%.

US Dollar Faces Pressure, Bearish Momentum May Resume

Should the Fed tilt toward a dovish stance tonight, the US Dollar could face renewed downward pressure, continuing the weakness that has been evident in recent sessions.

USD Index, Daily Chart

The US Dollar Index (DXY) has recently broken below its consolidation range of 98.50–97.50, forming a descending triangle pattern. This structure points to a potential continuation of the bearish trend in the dollar.

The next key support lies around 96.00. A decisive break below this level—or sustained trading below the 98.50–97.50 range—would likely reinforce the bearish outlook, signaling that the dollars weakness may extend further in the near term.

EURUSD, GBPUSD Set to Benefit from Dollar Weakness

With the US Dollar showing signs of renewed bearish momentum, EURUSD has extended its recent gains to a four-year high, breaking decisively above the 1.1800–1.1740 zone.

EUR/USD, Daily Chart

The breakout above 1.1800 signals renewed upside momentum for the pair. However, failure to sustain above this zone could lead to sideways consolidation or a temporary pullback.

The key market driver remains tonights Fed decision and forward guidance. A clearly dovish tone could further accelerate EURUSD strength, while a more cautious message from the Fed may cap gains and push the pair back toward the 1.1800 level.

GBP/USD, Daily Chart

Meanwhile, GBPUSD also broke above 1.3600 yesterday. If this level holds, it could signal a bullish breakout, with the pair potentially targeting 1.3770 or higher in a continued upside scenario.

The Bottom Line

Tonight‘s Fed decision and accompanying projections will be the decisive catalyst for the US Dollar and EURUSD in the short term. While markets are largely pricing in a 25-basis-point cut, the nuances in Powell’s forward guidance and the SEP could determine whether the dollars bearish momentum accelerates or pauses.

Overall, the next 24–48 hours are likely to set the tone for broader USD and euro dynamics heading into the rest of September.

WikiFX-Broker

Aktuelle Nachrichten

SOL hebt ab! Solana über 137 Dollar – Großanleger pumpen Millionen hinein

Krypto-Rally geht weiter: Bitcoin über 92.000 Dollar – XRP hebt ab

ADA auf Angriff! Cardano hält wichtige Marke – aber geopolitische Risiken bremsen

ETH-Kaufrausch! Mega-Firma schnappt sich fast 33.000 Ethereum – Kurs vor nächstem Sprung?

Ripple: XRP explodiert – was jetzt wirklich hinter dem Kurssprung steckt

Ripple explodiert: Diese XRP-Zahl entscheidet 2026

Morgan Stanley: Diese sechs Faktoren sorgen für steigende Aktienkurse in 2026

Wechselkursberechnung