Government Shutdown: Markets About to Break? - Week 40 | Technical Analysis by Jasper Lawler

Zusammenfassung:Week Ahead📅 October 6–12, 2025Markets enter the second week of October against a backdrop of political gridlock in the US, a thin economic calendar, and upcoming earnings that could help shape sentim

Week Ahead📅 October 6–12, 2025

Markets enter the second week of October against a backdrop of political gridlock in the US, a thin economic calendar, and upcoming earnings that could help shape sentiment. Here‘s your digest of last week’s moves and whats on deck.

Week in Review📰 News

US government shutdown: Congress failed to agree on a budget, halting the release of most official economic data. The Fed, as a self-funded institution, remains fully operational.

EZ inflation: Eurozone flash CPI rose to 2.2% (from 2.0%), broadly in line with forecasts, likely keeping the ECB on hold.

RBA hawkish hint: The Reserve Bank of Australia left rates unchanged but flagged “persistent” inflation in its statement, leading markets to scale back expectations of a rate cut this year.

China PMI: Official manufacturing PMI ticked up to 49.8, still below the 50 expansion threshold.

France politics: Prime Minister Lecornu is struggling to push through a budget, raising speculation that President Macron could eventually be forced into a snap election.

💹 Price Action

Gold: Surged to fresh record highs following the US shutdown, but trimmed gains after hawkish Fed commentary

Oil: Logged its sharpest weekly drop in more than three months amid talk that OPEC+ may increase production in November.

Japanese yen: Strongest-performing G10 currency after BOJ dove Noguchi suggested rate hikes may be warranted, signalling a growing hawkish tilt at the central bank.

Small Caps: The Russell 2000 index hit a record high

Week Ahead: Key Events

FOMC Minutes – Oct 8

Septembers 25bps cut was widely backed, but divisions remain. The minutes could show what conditions the Fed needs to see before the next cut. Any emphasis on inflation risks could lead markets to scale back expectations of two more cuts this year.

RBNZ Rate Decision – Oct 9

Markets expect a 25bps cut, though some see a risk of 50bps. A dovish statement could send NZD lower towards 0.5750, while a hawkish surprise could push it to 0.59.

Canada Jobs Report – Oct 11

Unemployment expected at 7.1% with +15k jobs added. A weak print would reinforce the BoC‘s dovish tilt, potentially keeping USDCAD above 1.40.

🌍 Other Data

Monday: Swiss jobless rate

Tuesday: Australia Westpac consumer confidence, Canada Ivey PMI

Wednesday: Australia NAB business confidence

Thursday: Germany trade balance

Friday: US Michigan consumer sentiment (if not delayed by the shutdown)

Earnings Calendar

Imperial Brands – Tue, Oct 7 (Q4 2025)

Shares doubled since 2023 lows. Watch: NGP growth and new CEO Paravicini’s first outing.

Constellation Brands – Tue, Oct 7 (Q2 2026)

Berkshire Hathaway-backed brewer at 5-year lows. Watch: downgraded guidance and tariff impact.

PepsiCo – Thu, Oct 9 (Q3 2025)

Stock stable, margins in focus. Watch: EPS expected $2.26, volumes under pressure.

Levi Strauss – Thu, Oct 9 (Q3 2025)

Shares rebounded strongly this year. Watch: tariff resilience, EPS 28–30c guidance.

Technical Analysis

We look at hundreds of charts each week and present you with three of our favourite setups and signals.

EUR/JPYSetup

Bearish: Potential long term top.

Bearish engulfing candlestick from multi-year highs

RSI has dropped from 70 overbought

Signal

Fakeout: Looking for rebound to stall near the former resistance at 174.

RSI bearish divergence, taken out support

Caution: uptrend line has held so far. A break would confirm trend reversal.

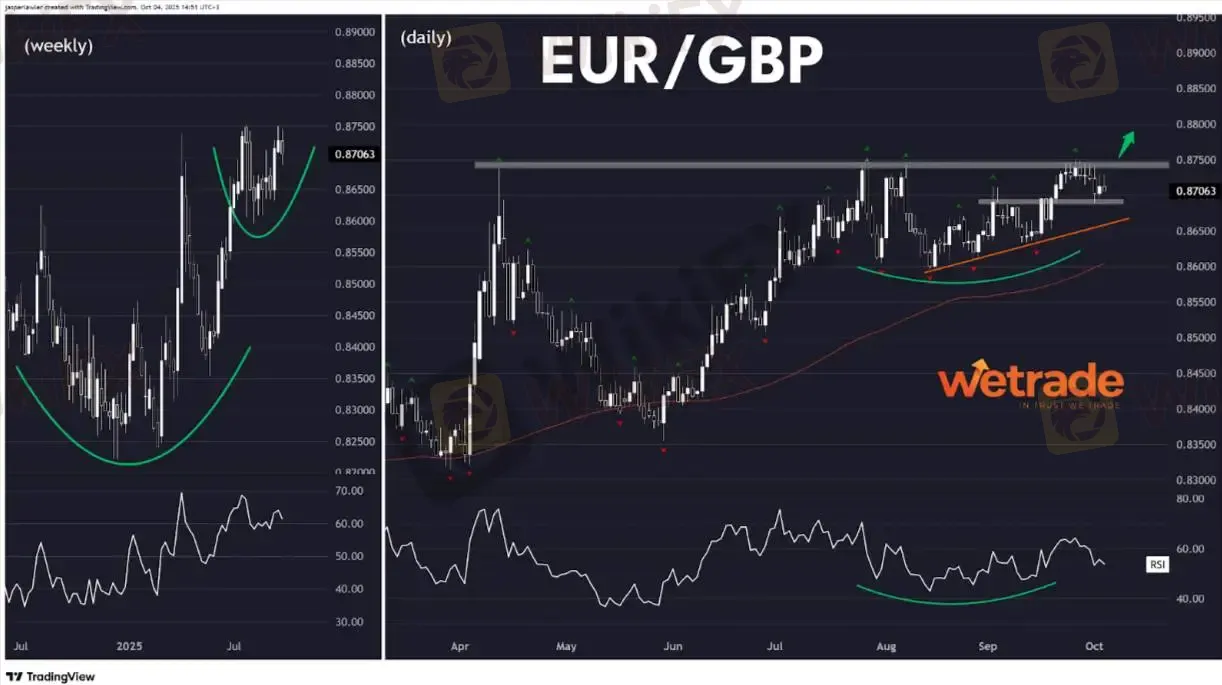

EUR/GBP

Setup

Bullish. Potential breakout

Cup & Handle pattern

Signal

Awaiting daily close above 0.875 resistance for confirmation of breakout

Price has formed a base underneath 0.875, holding above the 100 SMA

RSI maintains a bullish range

WTI Crude OilSetup

Bearish. Breakdown

Bearish engulfing candle

Failure at key 65.0 pivot

Signal

Looking to sell while price holds below support-turned-resistance at 62.

(Watch for possible intraday fakeout above 62 before daily close lower)

But - as always - thats just how the team and I are seeing things, what do you think?

WikiFX-Broker

Aktuelle Nachrichten

Bitcoin und Ethereum verzeichnen Kursverluste, nachdem die Fed eine „vorsichtige Zinssenkung” vorgenommen hat

Aave Preis-Prognose: AAVE ist bereit für einen Ausbruch, da sich die bullischen Signale verstärken

Ripple-Preisprognose: XRP konsolidiert über der Unterstützung von 2,00 USD

Oracles Kurssturz ist ein weiteres Warnsignal für KI-Investoren

Solana-Preisprognose: SOL fällt, da die hawkishe Geldpolitik der Fed die Marktstimmung dämpft

Bitcoin-Preisprognose: BTC fällt auf 90.000 USD, da die hawkishe Haltung der Fed den Risiko appetit dämpft

Wechselkursberechnung