Supreme Court Scrutinizes Trump Tariff Authority; Ruling Delay Leaves Policy Intact for Now

Zusammenfassung:Key Takeaways:The U.S. Supreme Court scrutinizes Trump‘s tariff authority, with justices expressing skepticism over the administration’s use of emergency powers.“Liberation Day” tariffs remain in forc

Key Takeaways:

The U.S. Supreme Court scrutinizes Trump‘s tariff authority, with justices expressing skepticism over the administration’s use of emergency powers.

“Liberation Day” tariffs remain in force, as the Court issues no immediate ruling or injunction following the hearing.

Judicial caution tempers market sentiment, lifting Wall Street from recent lows while keeping the Dollar steady amid policy uncertainty.

Market Summary:

Financial markets closely monitored proceedings in the U.S. Supreme Court yesterday, which held over two and a half hours of oral arguments examining the legal basis for the Trump administration's widespread use of tariff powers. While the bench expressed broad skepticism, questioning the application of a 1970s statute never previously invoked for such purposes and citing potential overreach of the International Emergency Economic Powers Act, the court issued no immediate orders, stays, or injunctions.

Consequently, the “Liberation Day” tariffs announced by President Trump remain in full effect following the hearing. The U.S. Dollar, which had appreciated significantly in recent sessions, traded flat as markets digested the developments.

The perceived judicial skepticism toward the administration's trade authority helped fine-tune sentiment on Wall Street, contributing to gains across major indices and interrupting their recent bearish trend. With the Court's final opinion not expected until next year, near-term market dynamics for both the Dollar and equities will remain sensitive to commentary from President Trump and administration officials regarding trade policy, as investors assess the potential for a significant shift in the U.S. approach to global tariffs.

Technical Analysis

Dollar Index, H4

The U.S. dollar index exhibited robust bullish momentum in recent sessions, achieving a decisive breakout above the key 99.45 resistance level and rallying approximately 0.6% in its aftermath. The upward move, however, faced firm rejection upon approaching the significant psychological barrier of the 100.00 mark, prompting a period of consolidation and a nascent technical correction.

Despite this near-term pause, the underlying bullish structure remains intact. The index is expected to find substantial technical support near the 99.75 level, which represents a retest of the prior breakout zone. A successful hold above this support is likely to catalyze a fresh technical rebound, reinforcing the positive near-term bias.

Momentum indicators reflect the current shift in dynamics. The Relative Strength Index (RSI), while retreating from overbought territory, remains elevated, suggesting the broader uptrend is not yet exhausted. Meanwhile, the Moving Average Convergence Divergence (MACD) is showing early signs of a bearish crossover, indicating that near-term bullish momentum is indeed easing. The index's trajectory will likely be determined by its interaction with the 99.75 support; a firm hold there would signal a healthy consolidation within the broader uptrend, while a break below could signal a deeper pullback toward the 99.45 level.

Resistance Levels:100.40, 101.15

Support Levels: 99.45, 98.60

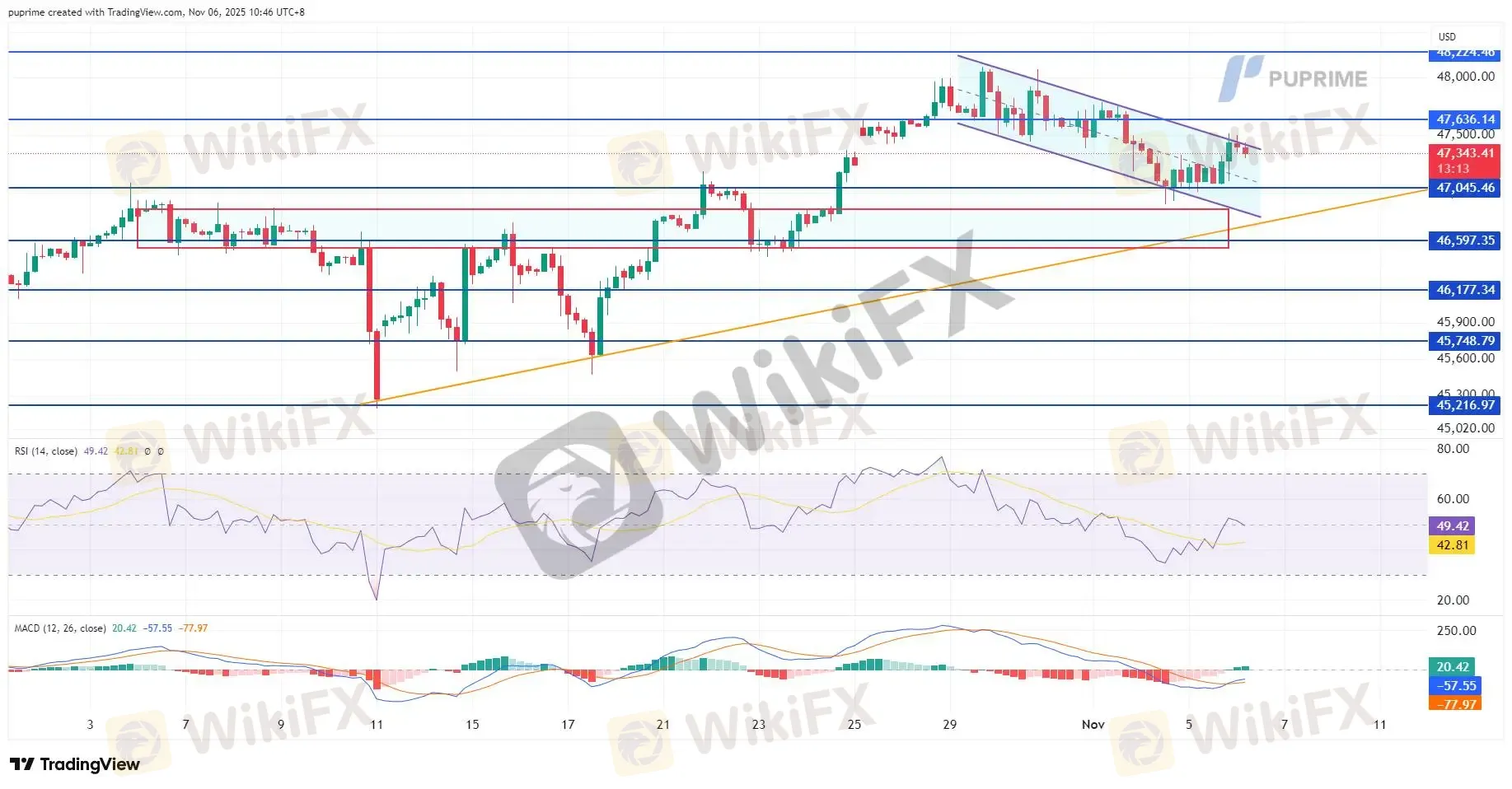

Dow Jones, H4

The Dow Jones Industrial Average registered a technical rebound in the previous session; however, the index continues to trade firmly within its defined downtrend channel, confirming the broader bearish trajectory remains unchallenged. The rally lost momentum as prices approached the upper boundary of the descending channel, with a failure to secure a decisive breakout underscoring the persistent dominance of selling pressure.

Momentum indicators align with the constrained price action. The Relative Strength Index (RSI) remains subdued below the 50 mid-line, reflecting a lack of strong bullish conviction, while the Moving Average Convergence Divergence (MACD) continues to track below its zero line. This configuration suggests that despite short-term bounces, the underlying bearish momentum remains intact.

The index's inability to overcome channel resistance reinforces the current negative bias. For the near-term bearish structure to be invalidated, a sustained break above the channel's upper boundary is required. Until then, the path of least resistance remains skewed to the downside, with the Dow vulnerable to a retest of the channel's lower support near the 46,600 level.

Resistance Levels:47,640.00, 48,225.00

Support Levels: 47,045.00, 46,600.00

WikiFX-Broker

Aktuelle Nachrichten

Eine Gruppe von rund 20 US-Investoren plant, im März nach Venezuela zu reisen

SOL hebt ab! Solana über 137 Dollar – Großanleger pumpen Millionen hinein

Krypto-Rally geht weiter: Bitcoin über 92.000 Dollar – XRP hebt ab

ADA auf Angriff! Cardano hält wichtige Marke – aber geopolitische Risiken bremsen

ETH-Kaufrausch! Mega-Firma schnappt sich fast 33.000 Ethereum – Kurs vor nächstem Sprung?

Ripple explodiert: Diese XRP-Zahl entscheidet 2026

Ripple: XRP explodiert – was jetzt wirklich hinter dem Kurssprung steckt

Morgan Stanley: Diese sechs Faktoren sorgen für steigende Aktienkurse in 2026

Wechselkursberechnung