User Reviews

More

User comment

138

CommentsWrite a review

2026-01-06 00:21

2026-01-06 00:21

Score

5-10 years

5-10 yearsRegulated in Cyprus

Market Making License (MM)

MT4 Full License

Regional Brokers

High potential risk

Offshore Regulated

Benchmark

Influence

Add brokers

Comparison

Quantity 49

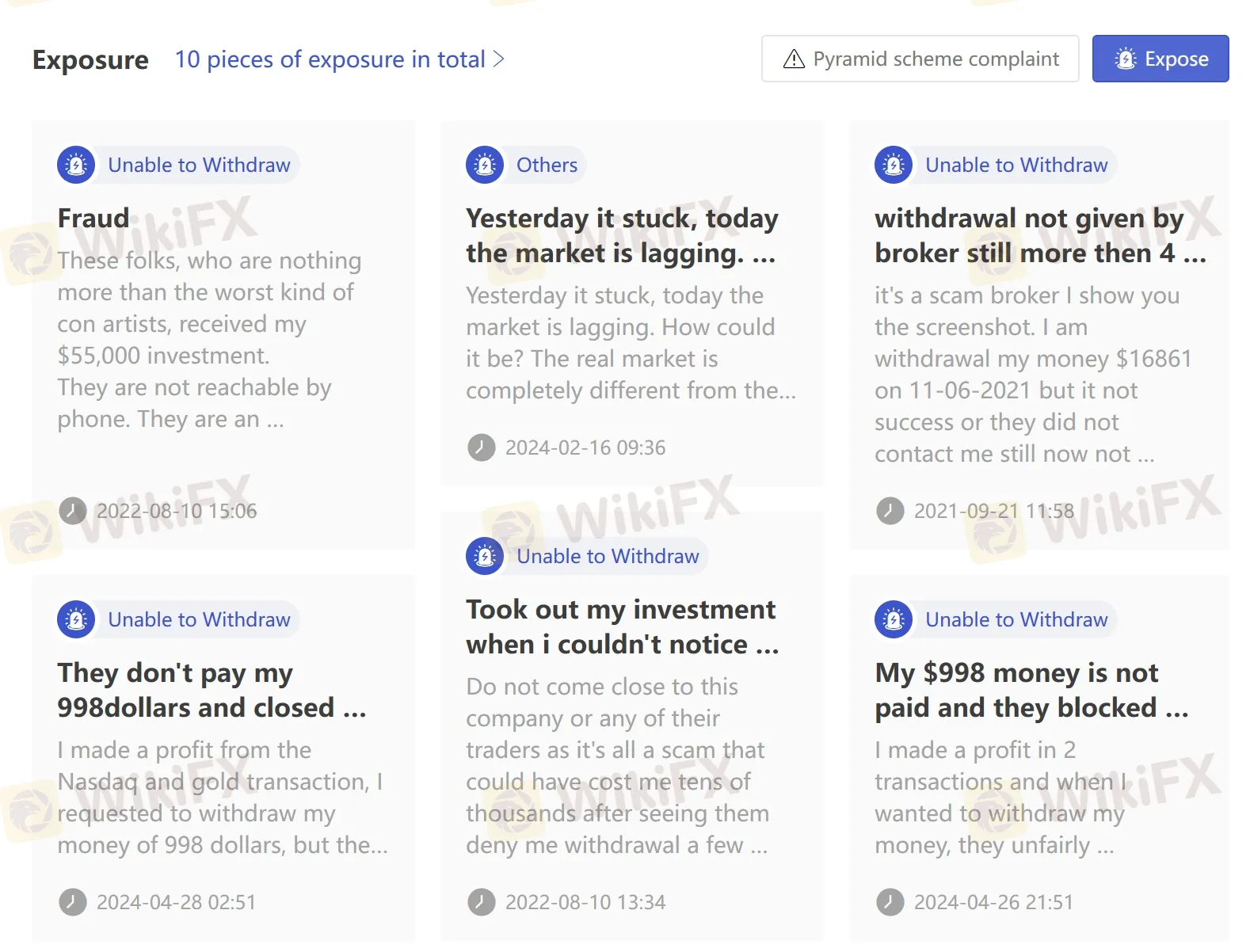

Exposure

Score

Regulatory Index7.04

Business Index7.83

Risk Management Index0.00

Software Index9.99

License Index7.68

Single Core

1G

40G

More

Company Name

Doo Technology Singapore Pte. Ltd

Company Abbreviation

D prime

Platform registered country and region

Singapore

Company website

X

YouTube

Company summary

Pyramid scheme complaint

Expose

no promotion of 10% on deposit given as advertised.ultimately failed to withdraw funds

This broker is a scam! I submitted a withdrawal request several days ago, but I still haven't received my money. Despite contacting support multiple times, they just keep making excuses. Beware! New users should stay away from this platform. They are not trustworthy at all.

Hello, I am Abdul Ahad. I am an experienced forex trader. My withdrawal id 46****9 amount 678.38$ was declined after 24 hrs. wait doo prime support said my withdrawal will be available after pending deduction .After some time my all amount 628.38 is deducted from my account without any notification and only 50$ remaining in my account. I contact several times to their live support and even sent many emails at en.support dooprime.com but there is no response from Dooprime. Dooprime is totally scam broker .please beware of this fraud broker. They will never give you withdrawals .they only want deposit from us. I am really worried about my withdrawal. So please someone help me with this matter and I need my amount 628.38$ back from dooprime . Otherwise I will highlight and raise my voice in all social media platforms

My incident occurred on August 18, 2025. I have been sending compensation requests via email to the exchange for over three months, but I have received a dismissive response and no compensation. Instead of apologizing, they blamed me. On November 8, 2025, the exchange confirmed the compensation request and committed to disbursing the funds to my wallet by November 10, 2025, but as of November 26, 2025, I still have not received the compensation money. Previously, on August 13, 2025, I also encountered a rather rare technical error on my account **** 3341 when I transferred money from my account to my wallet, the website displayed an error showing 00 USD instead of the correct balance or 0.00 USD as an empty account. This surprised me, and I reported it to technical support. I was able to withdraw money the next day, and technical support also informed me that this was a rare case.

Seeing profitable traders, they play dirty tricks by not allowing withdrawals. They arbitrarily disable the withdrawal function on customers' accounts. Those bastards.

Dooprime Fraud-Scam Since 14 months DooPrime illegally seized USD 8,100 from my account without presenting a single valid reason.forcefully reduced my balance without any evidence. I have contacted account manager and also emailed many times, but they refused to return my funds. This is a fraudulent and abusive act against investors. I have already reported this to regulators also.

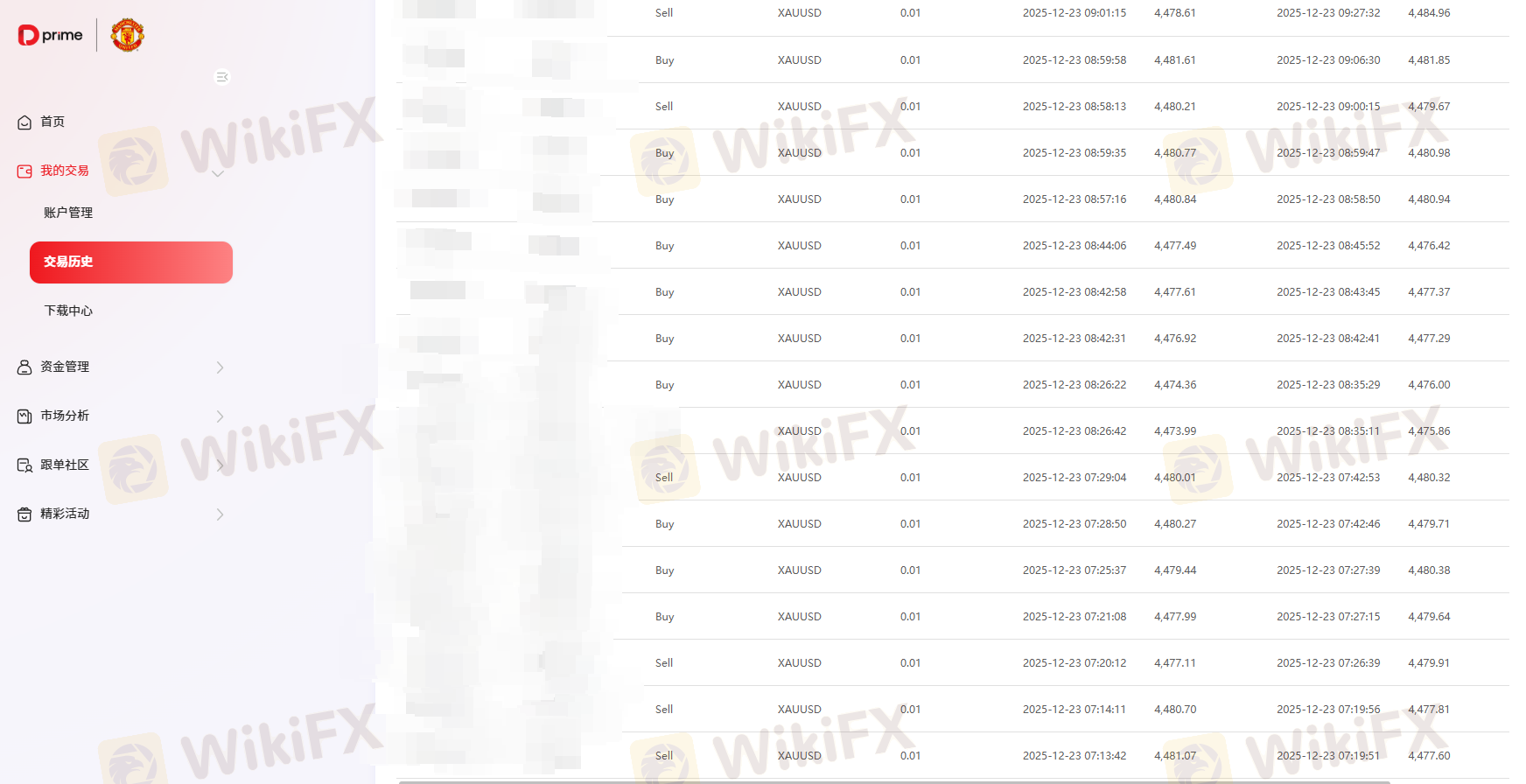

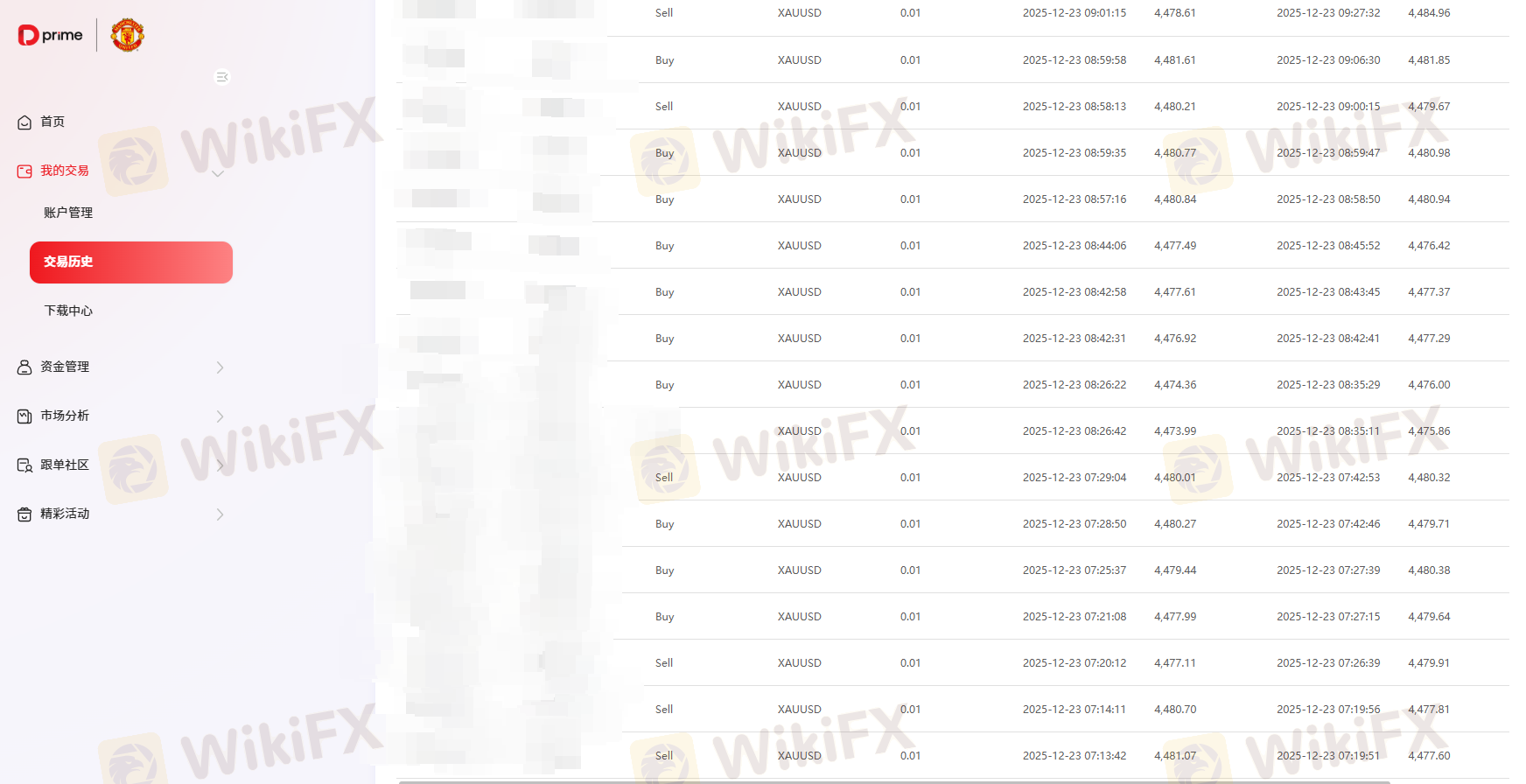

I am Nguyen Quoc Truong, CRM number 786900, MT4 60034657, from Vietnam. On 06/11/2025, I deposited $1500 into trading account MT4 60034657. From 06/11/2025 to 06/16/2025, I traded following the upward trend of XAUUSD with 23 trades, trading volume of 2.45 lots XAUUSD, achieving a total profit of $3557.4. I manually traded, setting TP/SL, and sometimes manually closing trades when I felt I had enough profit. I simply traded following the XAUUSD upward trend, without fraudulent behaviors, market manipulation, or abuse of bonus because I had never used the 10% bonus. However, Dooprime deducted my entire profit of $3557.4 without providing any evidence. I demand Dooprime to pay my valid profits. If Dooprime doesn't handle this, I will report to the Vietnam police to implement measures to block, investigate, and deal with Dooprime's fraudulent behaviors.

FACTS OF THE CASE 1. I hold a MT5 accounts with “Doo Prime” now known as “D Prime”, with a total combined equity of USD 8,200.00 2. In July 2024, the company canceled my withdrawal without any specific reason. 3. I subsequently write an email and asking for my withdrawal. Also I reputedly communicate on phone calls with my allocated account manager Miss. Diya 4. This withdrawal has been illegally withheld since November 2024 from my trading account. DIGITAL EVIDENCE TAMPERING On after November 2024, after my withdrawal request, “Doo Prime” now known as “D Prime” withheld my balance without any notice and information. These frauds and suspicious activity constitute digital evidence tampering and is a violation under UAE Federal Law No. 5 of 2012 on Cybercrimes. EVIDENCE IN POSSESSION I hold the following evidence: - Complete communication history with the company’s given email id. - MT5 account statements, including data that

Used it for over a year without any issues, not sure what's going on this time. It's been half a day and still unresolved, withdrawals are not being processed, will continue to defend my rights.

I made a deposit of $28 to trade and decided to withdraw because the minimum amount to trade is $100. They simply didn't pay me, and it's been several days already! Scam company—many complaints about withdrawal blocks. A disgrace of a company, they threw this regulation in the trash to rob clients. The status shows as approved, but nothing arrived in my bank account. Pathetic market pirates, this DOO PRIME.

Hello Dooprime Support Team, I am Thi Thanh Tam Nguyen, customer ID 779109. On June 6, 2025, I deposited an amount of $382.49, equivalent to 9990000VND, via local bank QR code into my MT4 60033298 trading account. The 10% bonus amount received is $38.2. From June 6, 2025, to December 6, 2025, I executed 15 trades of XAUUSD product with a total volume of 1.37 lots, achieving a profit of $2569.78, with transaction costs of about $50. I traded based on the clear upward trend of XAUUSD. The trading history I attach below. On June 16, 2025, Dooprime reported me for fraudulent bonus abuse and deducted all my profits from trading. Dooprime cannot provide any information or evidence to prove my fraud. I did not defraud because my trading costs were much greater than the bonus amount I received, so there could be no fraud. I request Dooprime must pay my profit.

Doo Prime has scammed me. All my trading was fully manual. Doo Prime had already processed and paid withdrawals of around USD 40,000 from the same accounts without any issues. After I made an additional profit of USD 165,000, they blocked my profits and terminated my accounts without proper justification. I have live video recordings clearly proving that all trades were executed manually. I sent multiple emails with explanations and evidence, but after the termination email, Doo Prime completely stopped responding. Their service and support are extremely poor and unprofessional. Doo Prime had already approved and processed withdrawals from these same accounts: 702****8, 70****79, and 70****18. If any real violation had existed, these withdrawals would not have been approved after their internal reviews. Blocking profits only after a trader becomes highly profitable raises serious concerns about fairness and transparency. I strongly advise traders to be cautious when dealing DooPrime

I've registered an account with this platform a long time ago, but it seems they don't want to pay me. Please help me get support. I have spoken to their support team and always received the same responses.

DooPrime illegally seized USD 10,000 from my account without presenting a single valid reason. They manipulated my MetaTrader 5 account, forcefully reduced my balance, and later claimed “bonus manipulation” without any evidence. I never used any bonus in my trades and I have shared all documents and transaction records to prove it. Despite this, the company ignored the facts and refused to return my funds. This is a fraudulent and abusive act against investors. I have already reported this to regulators and will continue exposing DooPrime publicly.

Hello, I am Abdul Ahad. I am an experienced forex trader. My withdrawal id 4671549 amount 678.38$ was declined after 24 hrs. wait doo prime support said my withdrawal will be available after pending deduction .After some time my all amount 628.38 is deducted from my account without any notification and only 50$ remaining in my account. I contact several times to their live support and even sent many emails at en.support dooprime.com but there is no response from Dooprime. Dooprime is totally scam broker .please beware of this fraud broker. They will never give you withdrawals .they only want deposit from us. I am really worried about my withdrawal. So please someone help me with this matter and I need my amount 628.38$ back from dooprime .doo prime about my withdrawal amount 628.38 $ deducted from my wallet without any Abdul Ahad Do prime Client id 1784049

Subject: Urgent Complaint! DooPrime unreasonably withholds profit funds, forbids withdrawals, and threatens to close the account! I strongly demand the return of my hard-earned money! With extreme anger, frustration, and disbelief, I urgently appeal to your platform regarding the abhorrent actions of the DooPrime platform (Regulation Number: C119023907)! Not only have they unreasonably deprived me of my deserved profit through legal trading and risk-taking, but they are also trying to close my account, claiming my principal and profit for themselves! This is nothing short of outright robbery! The facts: I established an account with DooPrime on May 27, 2025, and subsequently performed two completely compliant forex trades. Both transactions were based on my analysis and judgment of the market, strictly adhering to the platform's trading rules. The results of both trades were profitable. This is the return that I deserve for bearing market fluctuation risks and using trading skills! When I followed the normal procedure to withdraw these profits that belonged to me (**and my principal), DooPrime unexpectedly refused my withdrawal request on the grounds of "illegal trading"! More appalling, they failed to provide any specific, verifiable evidence of illegal behavior! There were no trading detail screenshots, no specific violation of rule clauses, only a cold, vague, and malicious "illegal" accusation! My bottom-line demand (non-negotiable): 1. Immediately lift the withdrawal restrictions! 2. Full refund of my hard-earned money: [principal + profit in US dollars! 3. Revoke the threat to close the account! (or allow me to decide after withdrawal) I beg for help: 1. Intervene urgently! Press DooPrime to face the holes in the evidence! 2. Expose them! If they refuse to refund, please blacklist them to avoid more tragedies! 3. Help me reclaim my debt! I just want to get my money back, but I'm bullied! DooPrime's actions have not only caused me direct economic losses but also brought about great mental pressure and a crisis of trust. I believe the Forex Eye platform will uphold justice and speak for me.

Doo Prime is a regulated broker offering 10,000+ popular trading products with spreads starting at 0.1 pips. The platform provides access to MT4, MT5, Doo Prime InTrade, TradingView, and copy trading. While it appears promising, let's dive deeper to assess if it truly meets its claims of providing an exceptional trading environment.

| Quick Doo Prime Review in 10 Key Points | |

| Registered in | UK |

| Regulated by | FSA (Offshore), FINRA, LFSA, VFSC (Offshore), ASIC |

| Years of Establishment | 2014 |

| Trading Instrument | Currency pairs, indices, commodities, metals, energy, stocks, futures, securities |

| Minimum Initial Deposit | $100 |

| Maximum Leverage | 1:1000 |

| Minimum Spread | From 0.1 pips |

| Trading Platform | MT4, MT5, Doo Prime InTrade, TradingView |

| Deposit & Withdrawal Method | VISA, Mastercard, Skrill, Neteller, epay, etc. |

| Customer Service | Email/ phone number /live chat /24/7 |

Doo Prime is a wholly-owned subsidiary of Doo Prime Holding Group, founded in 2014, headquartered in London, UK, with operations offices in Hong Kong, Taipei, Dallas, Kuala Lumpur, and Singapore.

Doo Prime offers a diverse selection of tradable assets, including forex, contracts for difference (CFDs), indices, and cryptocurrencies. Doo Prime offers different account types to suit individual preferences. Traders can commence their trading journey with a minimum deposit of $100.

In terms of leverage, Doo Prime offers flexibility with leverage options of up to 1:1000. The widely recognized MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms provide an extensive range of analytical tools, indicators, and expert advisors for comprehensive market analysis and automated trading.

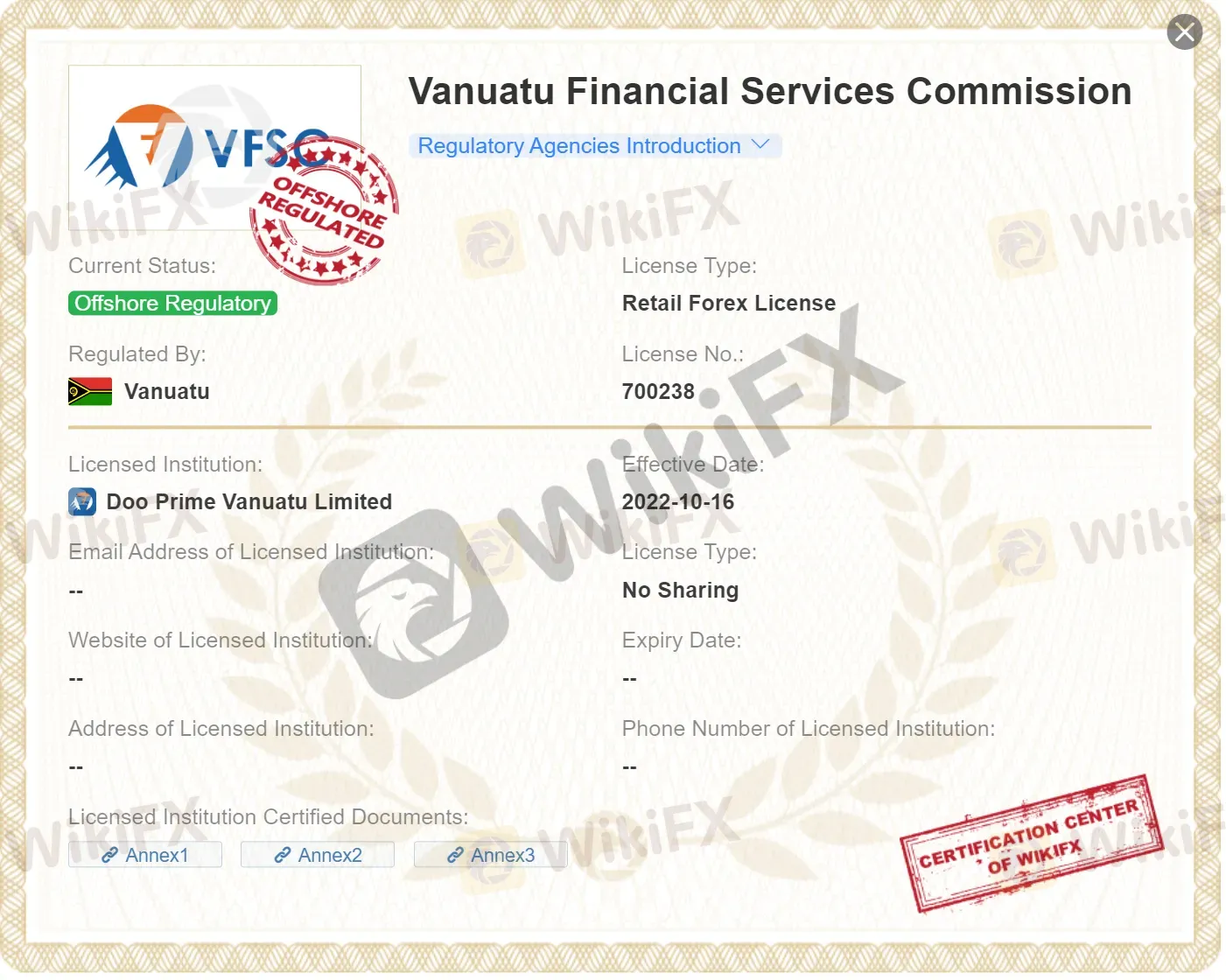

Yes, Doo Prime is legally operating in different jurisditions, as it is subject to regulatory oversight from multiple regulatory authorities, FSA (Financial Services Authority) in Seychelles, FINRA (Financial Industry Regulatory Authority), LFSA (Labuan Financial Services Authority), VFSC (Vanuatu Financial Services Commission), and ASIC (Australia Securities & Investment Commission).

| Regulated Country | Regulated Authority | Regulated Entity | License Type | License Number |

| FSA | Doo Prime Vanuatu Limited | Retail Forex License | SD090 |

| FINRA | PETER ELISH INVESTMENTS SECURITIES | Financial Service | 24409 / SEC: 8-41551 |

| LFSA | Doo Financial Labuan Limited | Straight Through Processing (STP) | MB/23/0108 |

| VFSC | Doo Prime Vanuatu Limited | Retail Forex License | 700238 |

| ASIC | DOO FINANCIAL AUSTRALIA LIMITED | Investment Advisory License | 222650 |

Doo Prime Seychelles Limited, its entity in Seychelles, is authorized and regulated by the Seychelles Financial Services Authority (FSA) under regulatory license number SD090, holding a license for Retail Forex operation.

PETER ELISH INVESTMENTS SECURITIES, its entity in the United States, is authorized and regulated by the Financial Industry Regulatory Authority (FINRA) under regulatory license number 24409 / SEC: 8-41551, holding a license for Financial Service.

Doo Financial Labuan Limited, its entity in Malaysia, is authorized and regulated by the Labuan Financial Services Authority (LFSA) under regulatory license number MB/23/0108, holding a license for Straight Through Processing (STP).

Doo Prime Vanuatu Limited, its entity in Vanuatu, is authorized and regulated by the Vanuatu Financial Services Commission (VFSC) under regulatory license number 70038, holding a license for retail forex operation as well.

DOO FINANCIAL AUSTRALIA LIMITED, its Australian entity, is authorized and regulated by the Australia Securities & Investment Commission (ASIC) under regulatory license number 222650, holidng a license for Investment Advisory Lincense.

Doo Prime offers over 10,000 popular tradable assets, and multiple trading platforms, providing flexibility and choice for traders. Furthermore, the availability of social trading features is proovided. However, traders should be mindful of the commission charged per trade and the limitations in terms of educational resources and account customization. Additionally, Doo Prime's promotional offerings may be limited.

| Pros | Cons |

|

|

|

|

|

|

| |

|

| Trading Assets | Available |

| Securities | |

| Futures | |

| Forex | |

| Precious Metals | |

| Commodities | |

| Stock Indices |

Doo Prime offers a comprehensive range of market instruments to cater to the diverse trading needs of its clients. These instruments encompass a variety of asset classes, including securities, futures, forex, precious metals, commodities, and stock indices.

To open a most basic account, that is Cent Account, $100 is required, same as its standard account requirement. However, $100 to open a cent account is a little bit sticky, compared to HTFX's $5 to open a cent account. Well, $100 to open a standard account is acceptable.

Here is a table to show Doo Prime's minimum deposit with other brokers:

| Broker | Minimum Deposit |

| $100 |

| $200 |

| $100 |

| $1 |

Doo Prime offers three types of live trading accounts tailored for different trading needs:

| Account Type | CENT | STP | ECN |

| Account Currency | USD | ||

| Minimum Deposit | $100 | $100 | $5,000 |

| Spreads | High | Medium | Low |

| Free Demo | |||

| Expert Advisor | |||

| Hedging Positions | |||

| Order Execution | Market Execution | ||

The Cent account is designed for those who are starting their trading journey or prefer to trade with smaller volumes. With a minimum deposit of $100, the Cent account provides accessibility to the markets without the availability of a demo account. Traders can gradually build their trading skills and experience while managing lower trade sizes.

For traders looking for a Standard account, Doo Prime offers an option with a minimum deposit of $100. This account type allows traders to access a wider range of trading opportunities. The Standard account also provides the advantage of a demo account, enabling traders to practice their strategies and familiarize themselves with the platform before engaging in live trading. This feature helps traders gain confidence and refine their trading approach.

Doo Prime also offers an ECN account, specifically designed for more experienced traders seeking direct market access and enhanced trading conditions. With a higher minimum deposit requirement of $5000, the ECN account provides access to deep liquidity and tight spreads. Similar to the Standard account, the ECN account also includes a demo account option, allowing traders to test and fine-tune their trading strategies in a risk-free environment.

Notably, Doo Prime restricts demo accounts to Standard and ECN account holders. Additionally, if clients don't log in to their demo accounts for over 60 days, those accounts become inactive.

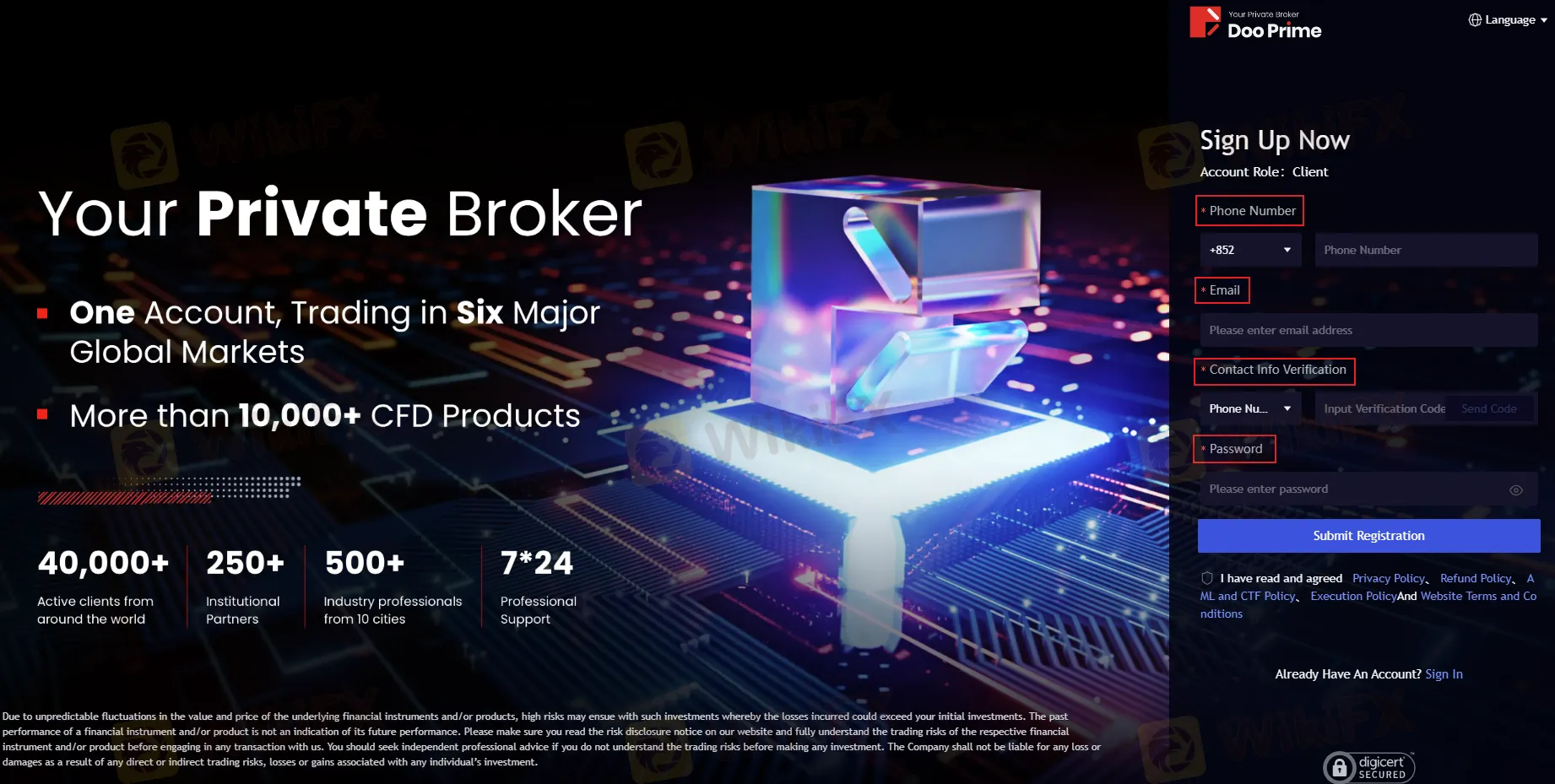

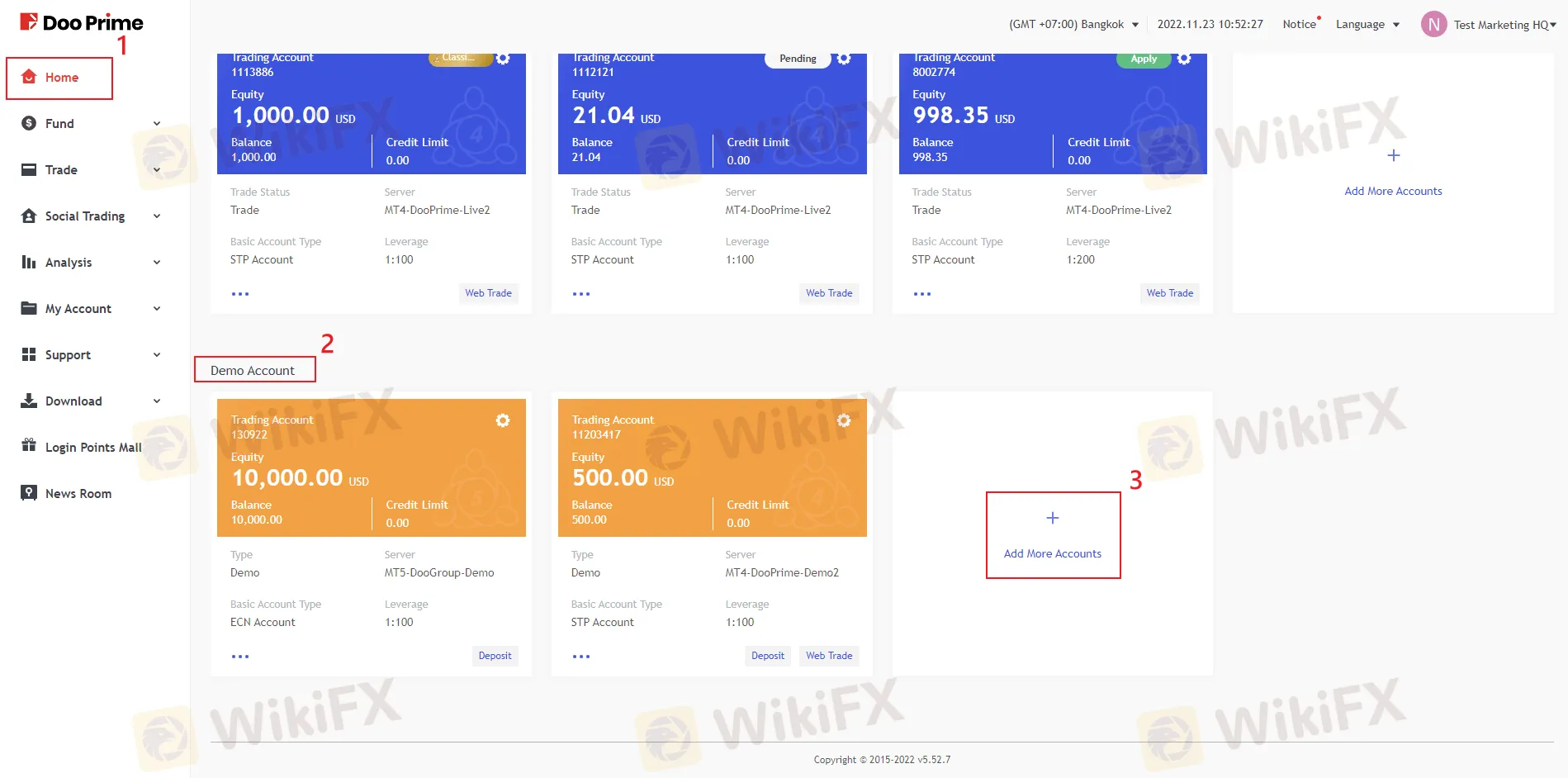

Here are some easy steps for you to open a demo account:

Step 1:Visit Doo Prime – Official Website and click “Demo Account”on the top right corner.

Step 2: Account Registration: Simply enter your phone number and email on the registration interface, choose verification via email or phone, click “Send Verification Code,” set your password upon successful verification, and then agree to the terms before clicking “Submit Registration.”

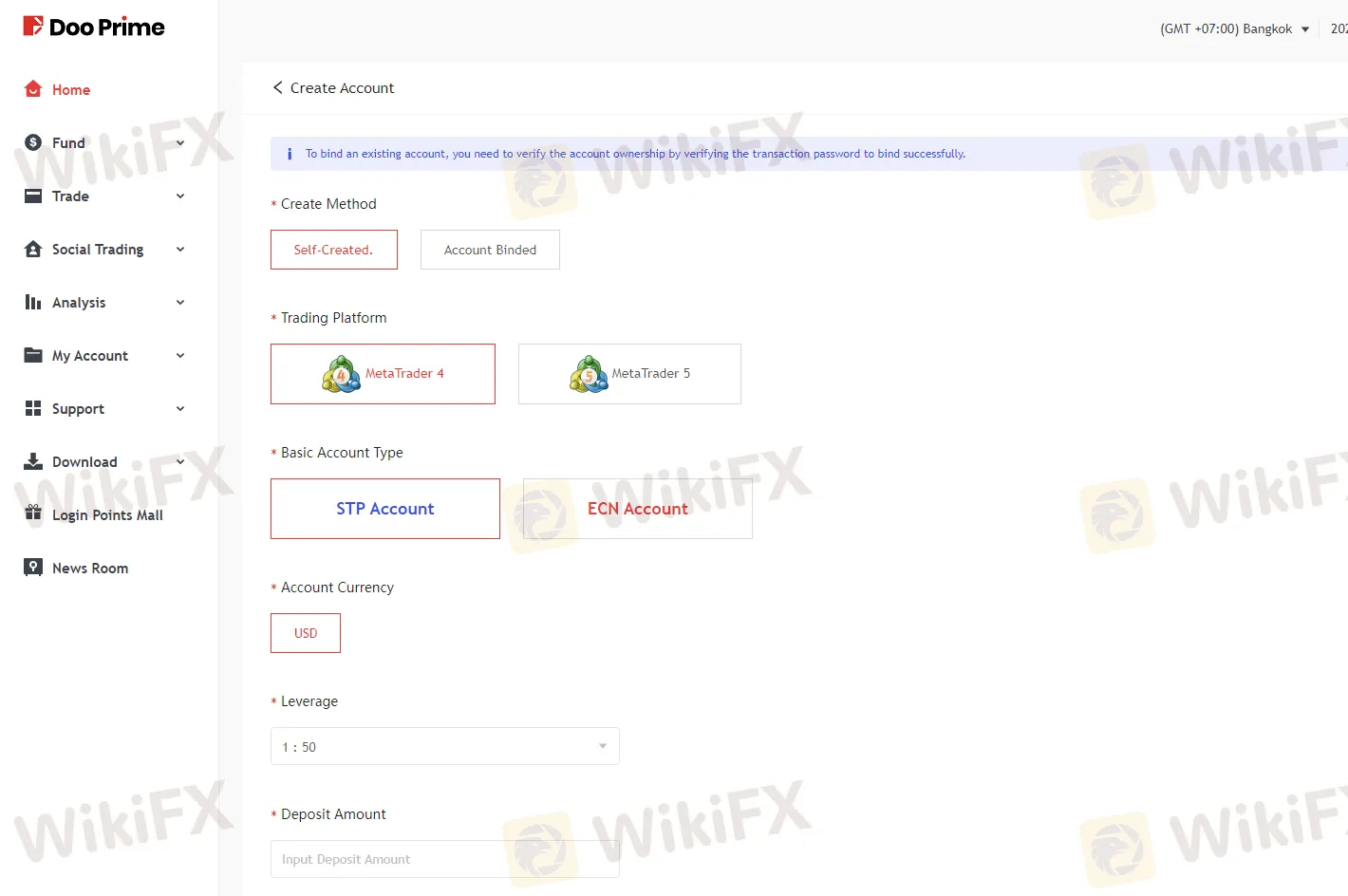

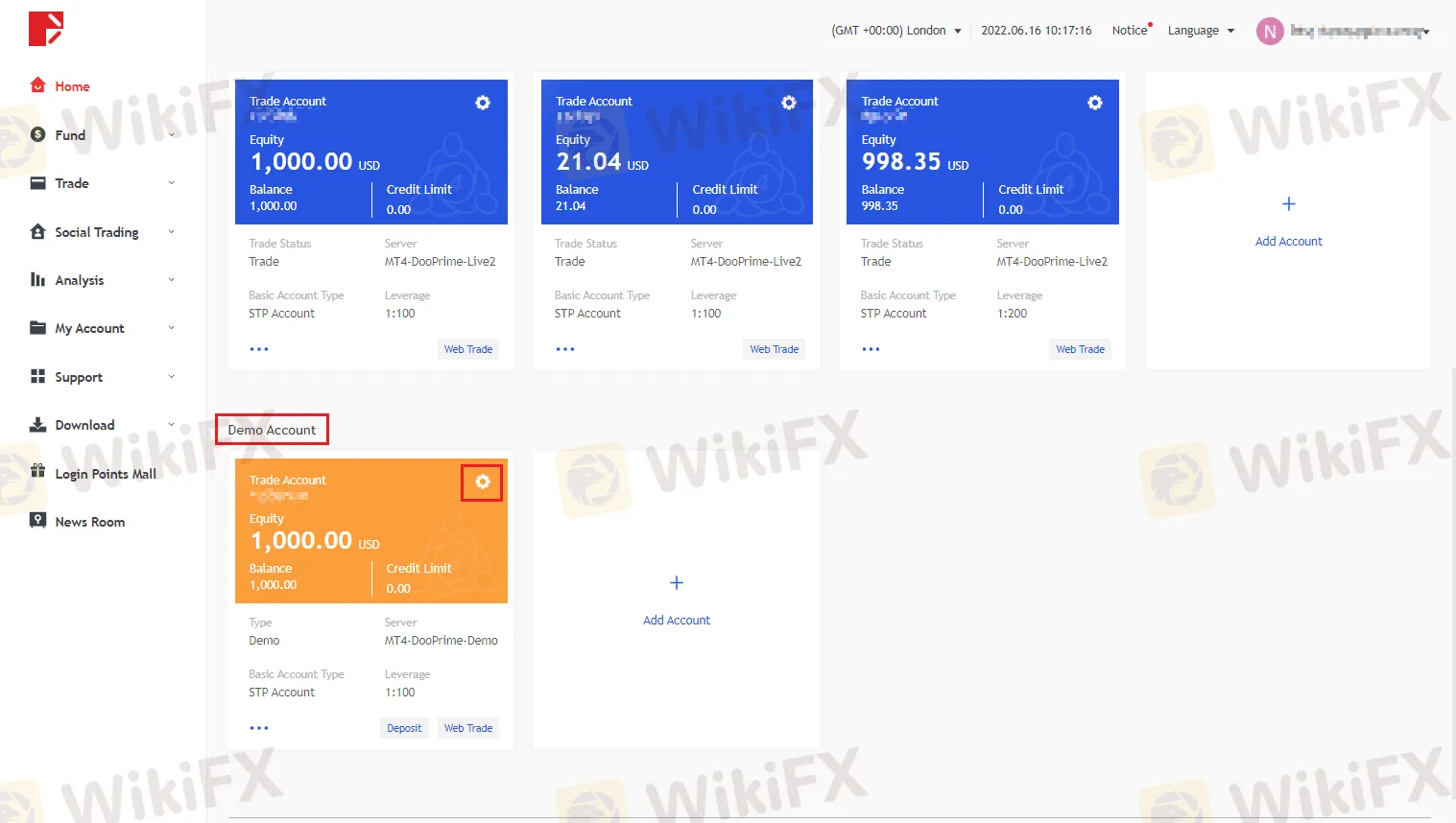

Step 3: Add a demo account: In the Doo Prime User Center, go to the homepage and choose “Add Account” below the demo account section.

Step 4: Customize your demo account: You can add an account by selecting the “Creation method,” “Trading Platform,” “Basic Account Type,” “Account Currency,” “Leverage,” and specifying the “Deposit Amount.” Then, set your “Trading Password” and “Read-only Password” to complete the process.

Step 5: Demo account is sucessfully opened: Once registration is complete, users can access their personal mailbox to retrieve their demo account login details, which include the chosen “Trading Platform,” “Demo Account,” and “Server Name.”

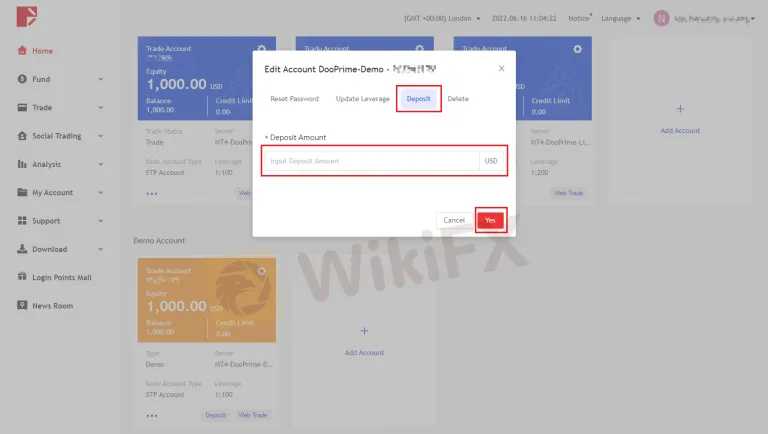

To add your demo account funds, follow just two steps:

Step1: Within the Doo Prime User Center's Demo Account screen, simply click the gear icon located in the upper right corner.

Step 2: Input the desired deposit amount into the “Deposit” field, then confirm by clicking “Yes.”

Then, the added amount will be displayed in the demo account.

Leverage, in the context of trading, refers to the ability to control a larger position in the market with a smaller amount of capital. Doo Prime offers leverage of up to 1:1000. This means that for every dollar of trading capital, traders can control a position up to 1000 times larger.

Leverage is a double-edged sword, whch means it has the potential to magnify both profits and losses. When used wisely, leverage can amplify trading gains and allow traders to capitalize on market opportunities with a smaller investment.

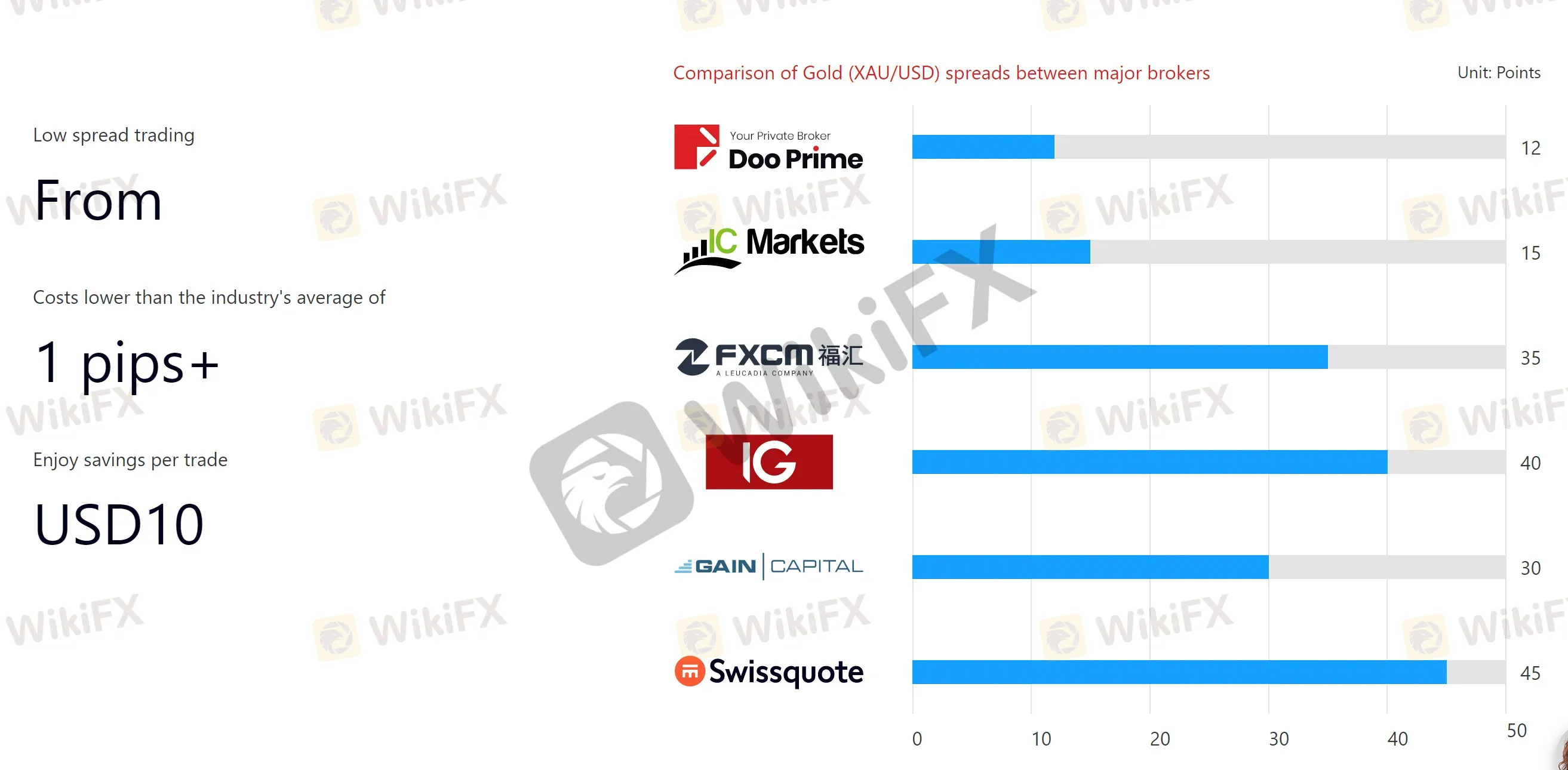

Doo Prime offers spreads starting from 1 pip with a commission of USD 10 per trade. Spreads represent the difference between the bid and ask price of a financial instrument, indicating the cost that traders incur when entering a trade. With spreads starting from 1 pip, Doo Prime provides a competitive pricing structure that may appeal to traders seeking cost-effective trading opportunities.

In addition to spreads, Doo Prime applies a commission of USD 10 per trade. The commission is a fixed fee charged on each trade executed by the trader. This transparent commission structure ensures clarity regarding the cost of trading, allowing traders to accurately assess the expenses associated with their transactions.

As for the trading platform, Doo Prime provides its clients with many options. There are public platforms such as tradingview, MT5 and MT4 that have served many clients worldwide, also Doo Prime's own platform Doo Prime InTrade. If you didn't want to spend time familiarizing yourself with a new platform, you could choose public platforms. But Doo Prime's own platform provides better compatibility with businesses, as they are specially developed and customized platforms. The choice is yours.

MetaTrader 5 (MT5): Doo Prime also supports the advanced MetaTrader 5 platform, which builds upon the features of MT4 and offers expanded functionalities. MT5 includes additional asset classes, improved charting tools, and enhanced order execution capabilities. Traders can access a more extensive range of analytical tools, utilize depth-of-market (DOM) functionality for more precise order placement, and benefit from advanced built-in indicators and graphical objects for comprehensive market analysis.

Doo Prime Intrade: Doo Prime introduces its proprietary trading platform, Doo Prime Intrade, designed specifically for its clients. This platform combines advanced charting features, intuitive navigation, and swift order execution. Traders can enjoy a seamless trading experience with access to real-time market data, customizable charting tools, and the ability to execute trades swiftly and efficiently.

TradingView: Doo Prime integrates with TradingView, a popular and powerful charting and social trading platform. TradingView offers an extensive range of technical analysis tools, customizable charting features, and the ability to follow and interact with other traders in the TradingView community.

Social trading, a feature provided by Doo Prime, revolutionizes the way traders engage in the financial markets by combining the power of technology and social interaction. In social trading, traders have the opportunity to observe and replicate the trading activities of experienced and successful traders.

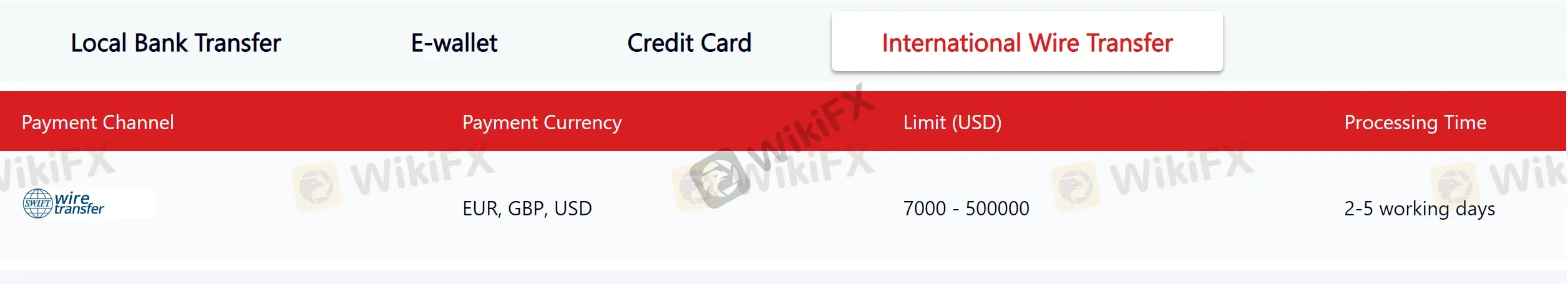

Doo Prime offers multiple payment methods. The available payment channels, their supported payment currencies, deposit limits, and processing times are as follows:

Doo Prime recommends a minimum withdrawal amount of USD 50, and it offers various withdrawal methods to accommodate the needs of its clients. For international wire transfers, withdrawals can be made in multiple currencies, including EUR, GBP, HKD, and USD. The processing time for international wire transfers is relatively quick, with funds typically being processed within one working day for withdrawal amounts up to USD 50,000. For withdrawal amounts ranging from USD 50,001 to 200,000, the processing time extends to two working days. Withdrawals of USD 200,001 to 1,000,000 require approximately five working days for processing, while withdrawals above USD 1,000,001 may take around six working days to complete.

For local bank transfers in CNY (Chinese Yuan) and VND (Vietnamese Dong), Doo Prime provides a good option for clients based in those respective regions. The processing time for local bank transfers may vary depending on the specific local banking systems. It is advisable to check with Doo Prime for the estimated processing time for local bank transfers in CNY and VND.

Doo Prime offers access to renowned market analysis provider Trading Central, providing traders with research, technical analysis, and trading ideas across various financial markets.

Additionally, Doo Prime provides Virtual Private Server (VPS) services, which offer traders enhanced trading performance and uninterrupted connectivity.

On WikiFX website, you can see that some users have reported scams. Please be aware and exercise caution when investing. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

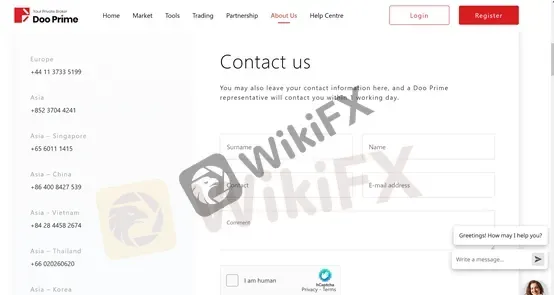

Below are the details about the customer service.

Languages: English, Chinese, Japanese, Korean, Spanish, Thai, Vietnamese.

Service Hours: 24/7

Contact Form

Email: en.support@dooprime.com

Phone: +44 11 3733 5199

Social media: Facebook, Instagram, LinkedIn, twitter

To wrap up, Doo Prime is a well-established brokerage firm with certain pros and downsides. Positively, reputable authorities' oversight of Doo Prime inspires confidence in its financial standards and investor protection.

However, even though Doo Prime has competitive spreads, traders should compare them to other brokers to get the best pricing. Without a Cent account demo account, new traders may have fewer chances to practise and learn the platform.

Is Doo Prime legit?

Yes, Doo Prime is regulated by FSA (Offshore), FINRA, LFSA, VFSC (Offshore), and ASIC.

What is the minimum deposit required to open an account with Doo Prime?

The minimum deposit required to open an account with Doo Prime is $100.

What is the maximum leverage available at Doo Prime?

The maximum leverage offered by this broker is up to 1:1000.

What are the available trading platforms at Doo Prime?

MetaTrader 4 (MT4), MetaTrader 5 (MT5), Doo Prime Intrade, and TradingView.

What assets can be traded on Doo Prime?

Forex currency pairs, contracts for difference (CFDs) on various financial instruments, indices, and cryptocurrencies.

D Prime, the brokerage arm of Doo Group, is closing its Limassol office after layoffs, as the firm realigns operations and faces regulatory scrutiny.

WikiFX

WikiFX

Malaysian police inspect Doo Group’s Kuala Lumpur call center amid nationwide crackdown on financial scams. Operations remain unaffected.

WikiFX

WikiFX

Doo Prime rebrands to D Prime in 2025, revealing a refreshed logo and website aimed at improving client experience and boosting its global presence in the fintech industry.

WikiFX

WikiFX

Doo Group opens a new 800sqm office in Cyprus, strengthening its EMEA presence and commitment to delivering top-tier financial services worldwide.

WikiFX

WikiFX

More

User comment

138

CommentsWrite a review

2026-01-06 00:21

2026-01-06 00:21