User Reviews

More

User comment

2

CommentsWrite a review

2023-02-20 10:02

2023-02-20 10:02

2023-02-14 16:28

2023-02-14 16:28

Score

5-10 years

5-10 yearsRegulated in Bulgaria

Derivatives Trading License (EP)

MT5 Full License

High potential risk

Influence

Add brokers

Comparison

Quantity 2

Exposure

Score

Regulatory Index2.49

Business Index7.52

Risk Management Index0.00

Software Index8.39

License Index0.00

Single Core

1G

40G

More

Company Name

Deltastock AD

Company Abbreviation

DeltaStock

Platform registered country and region

Bulgaria

Company website

X

YouTube

Company summary

Pyramid scheme complaint

Expose

| DeltaStock Review Summary | |

| Founded | 1998 |

| Registered Country | Bulgaria |

| Regulation | FSC (Exceeded) |

| Market Instruments | 900+ CFDs on Forex, Commodities, Cryptos, Indices, Shares, ETFs |

| Demo Account | ✅ |

| Leverage | Up to 1:33 (retail clients) |

| Up to 1:200 (professional clients) | |

| EUR/USD Spread | 2 pips |

| Trading Platform | Delta Trading (Web/Desktop/Mobile), MT5 (Web/Desktop/Mobile) |

| Minimum Deposit | 100 USD/100 EUR/200 BGN |

| Customer Support | Phone: +359 2 811 50 50, Dealers: +359 2 811 50 61 |

| Email: sales@deltastock.com, frontoffice@deltastock.bg | |

Founded in 1998, DeltaStock is a Bulgaria-based broker run under Financial Supervision Commission (FSC) control. Its more than 900 CFD instruments cover commodities, equities, cryptocurrencies, and foreign exchange. It serves a wide spectrum of traders using both proprietary and MT5 systems. Its regulatory status, thus, is marked “Exceeded”, suggesting the license could not be in good standing.

| Pros | Cons |

| Regulated by FSC (Bulgaria) | License status “Exceeded” |

| Offers 900+ CFDs including cryptos, stocks, ETFs | No MT4 or copy trading support |

| Supports Delta Trading and MetaTrader 5 platforms | No Islamic accounts |

Deltastock AD is a Bulgarian FSC-licensed broker. RG–03–146 is its Common Financial Service License. The broker is permitted, but its regulatory status is “Exceeded,” which may indicate a license lapse or bad standing.

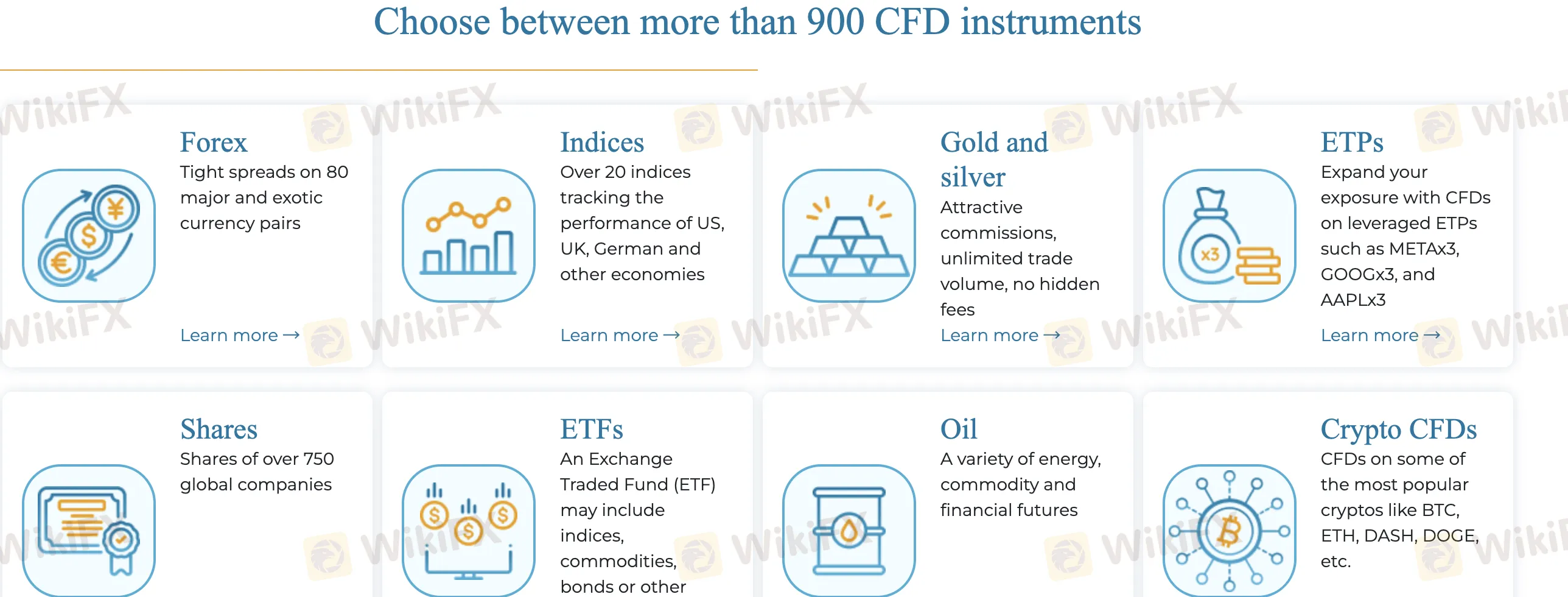

Covering key worldwide markets, DeltaStock provides a broad spectrum of more than 900 CFD instruments. Traders can access 80 forex pairs, 20+ indices, 750+ shares, and multiple CFDs on cryptocurrencies, commodities, and ETFs.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Indices | ✔ |

| Gold & Silver | ✔ |

| ETPs | ✔ |

| Shares | ✔ |

| ETFs | ✔ |

| Oil | ✔ |

| Crypto CFDs | ✔ |

| Bonds | ❌ |

| Options | ❌ |

DeltaStock has two primary account types, a Demo Account for practice and a Live Account for actual trading. It does not offer accounts free of swaps per Islamic law. Suitable for a broad spectrum of traders—from novices to pros, the live account supports Delta Trading and MetaTrader 5 systems.

DeltaStock offers leverage of up to 1:200 for professional clients and up to 1:33 for retail clients. While high leverage increases the potential for greater returns, it also amplifies risk.

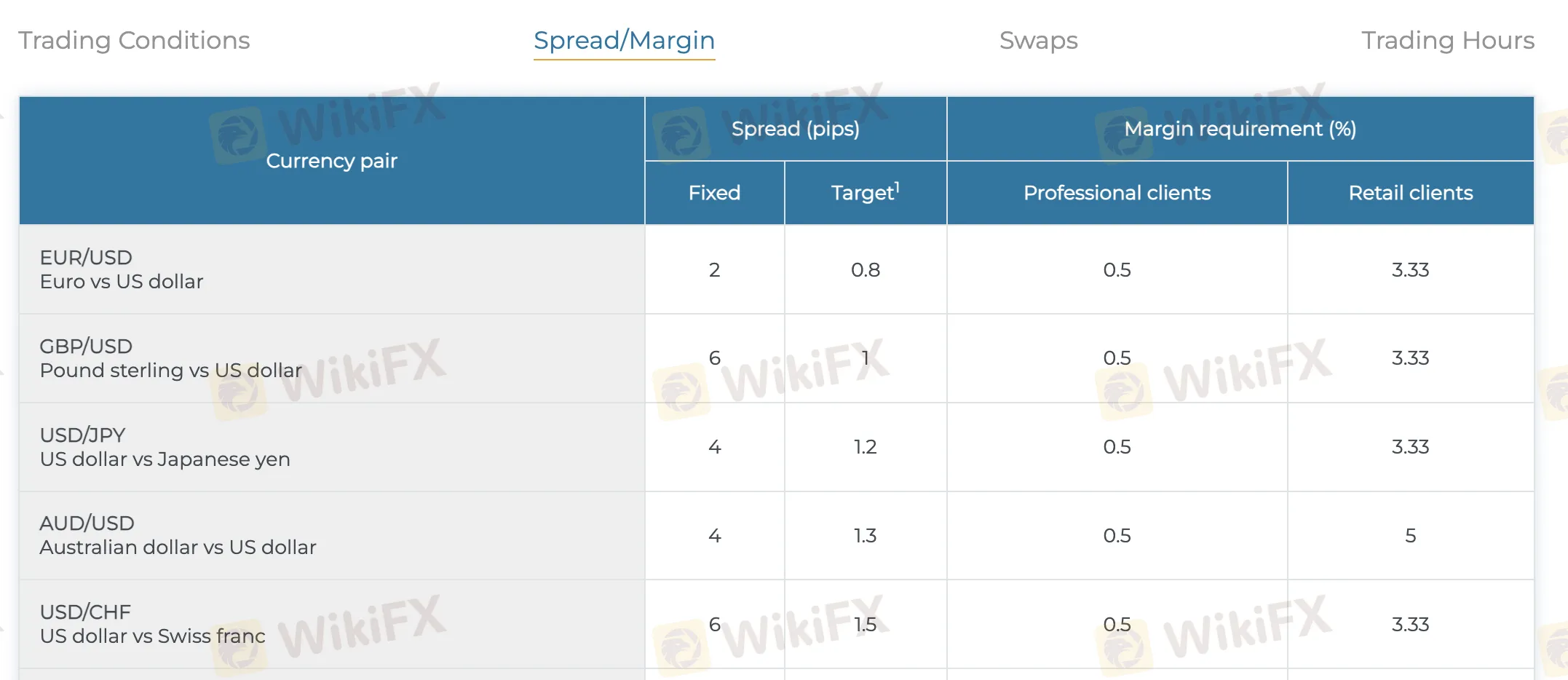

Compared to industry standards, DeltaStock's total trading costs are reasonable. It provides clear overnight swap rates, no trading fees, and fixed or target spreads. Although spreads for majors like EUR/USD are modest, exotic pairs can have larger spreads.

Trading Fees – Spreads & Margins (Key Examples):

| Currency Pair | Spread | Professional Margin | Retail Margin |

| EUR/USD | 2 pips | 0.5% (1:200) | 3.33% (1:30) |

| GBP/USD | 6 pips | 0.50% | 3.33% |

| USD/JPY | 4 pips | 0.50% | 3.33% |

Swap Rates – Sample Overnight Fees:

| Currency Pair | Long Position | Short Position |

| EUR/USD | -0.98 | 0.35 |

| USD/JPY | 1.3 | -2.17 |

| GBP/JPY | 1.46 | -2.52 |

Non-Trading Fees

| Non-Trading Fee | Detail |

| Deposit Fee | Free for EEC bank transfers in BGN/EUR; others incur bank fees or 1.50% for card/ePay |

| Withdrawal Fee | Free for card withdrawals; bank transfers charged min. 1 BGN |

| Inactivity Fee | Not mentioned |

| Trading Platform | Supported | Available Devices | Suitable for |

| Delta Trading | ✔ | Web, Desktop, Mobile | / |

| MetaTrader 5 (MT5) | ✔ | Web, Desktop, Mobile | Experienced traders |

| MetaTrader 4 (MT4) | ❌ | / | Beginners |

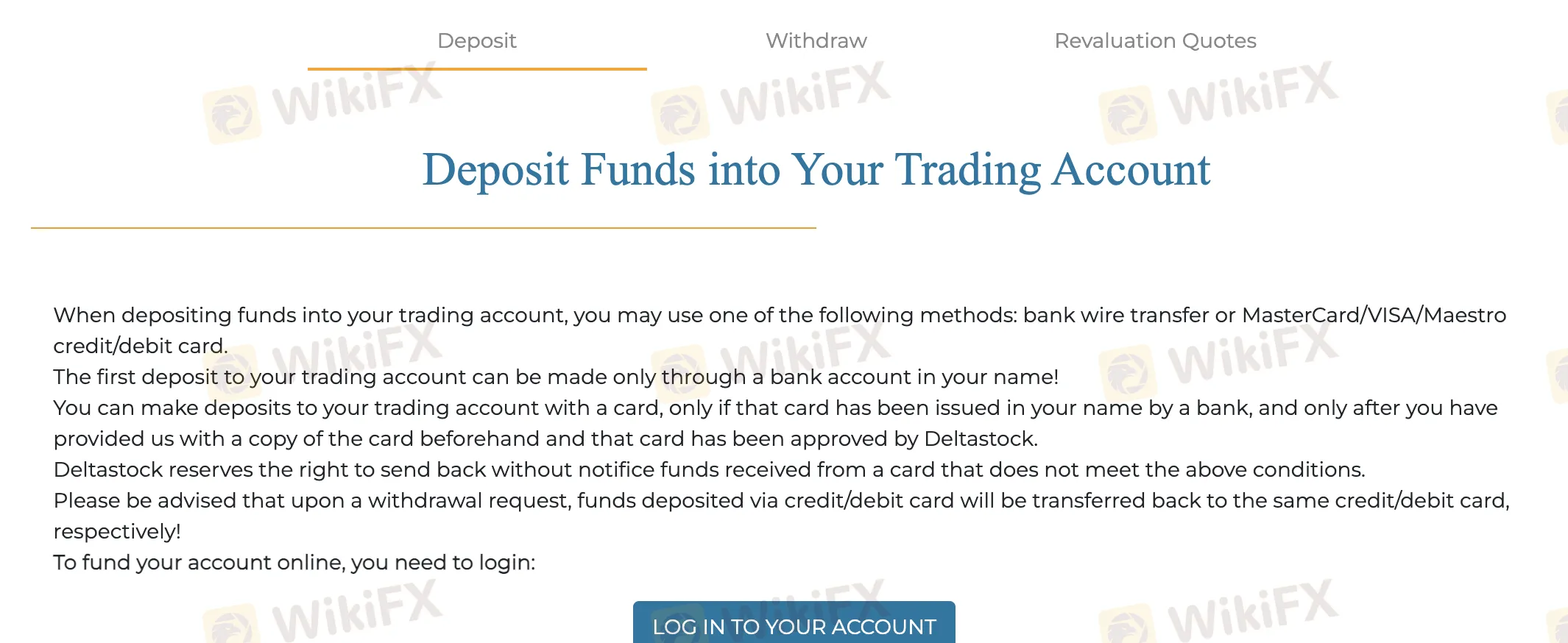

Most deposit and withdrawal options incur little or no cost with Deltastock. Depending on the currency of your account, the minimum deposit is 100 USD, 100 EUR, or 200 BGN. Bank wire transfer, credit/debit cards, and ePay allow deposits and withdrawals. We do not allow third-party payments under any circumstances.

Deposit Options

| Deposit Method | Minimum Deposit | Deposit Fees | Deposit Time |

| Bank Wire Transfer | 100 USD / 100 EUR / 200 BGN | Free (EEC); min. 1 BGN elsewhere | 1–3 business days |

| Credit/Debit Cards | 1.50% of deposit amount | Instant–1 business day | |

| ePay |

Withdrawal Options

| Withdrawal Method | Withdrawal Fees | Withdrawal Time |

| Bank Wire Transfer | Wire fee (min. 1 BGN) | 1–5 business days |

| Credit/Debit Cards | ❌ | 1–3 business days |

Regulatory compliance, transparency, and trustworthiness should always come first when we choose a forex broker. Unfortunately, many traders fall victim to unregulated brokers or poorly monitored platforms that put their funds at risk. In this article, we’ll highlight several brokers with low WikiFX scores and serious complaints from traders worldwide. If you’re looking for a safe trading environment, you should be extremely cautious with the following names.

WikiFX

WikiFX

Bulgarian broker DeltaStock faces mounting regulation concerns as questions over its license status emerge—triggering investor caution and urgent calls for verification.

WikiFX

WikiFX

When you choose any broker to invest your money, do you also check whether any regulatory warnings have been issued against them? If not, it's important that you do. Otherwise, you may risk falling victim to a scam. We bring this up because DeltaStock appears to be actively offering its services in the market. However, several reputable authorities have issued warnings against this broker. Check out those warnings below and be Scam Alert.

WikiFX

WikiFX

Please be advised that there will be alterations to the trading hours of select CFD markets during the period of Oct. 29 – Nov. 5, 2023, owing to the transition from Daylight Saving Time (DST) to standard time in Europe.

WikiFX

WikiFX

More

User comment

2

CommentsWrite a review

2023-02-20 10:02

2023-02-20 10:02

2023-02-14 16:28

2023-02-14 16:28