User Reviews

More

User comment

70

CommentsWrite a review

2026-01-01 04:25

2026-01-01 04:25

2025-12-17 22:47

2025-12-17 22:47

Score

15-20 years

15-20 yearsRegulated in South Africa

Derivatives Trading License (EP)

MT4 Full License

Global Business

Belarus Forex Trading License (EP) Revoked

High potential risk

Benchmark

Influence

Add brokers

Comparison

Quantity 43

Exposure

Score

Regulatory Index3.60

Business Index8.00

Risk Management Index0.00

Software Index9.14

License Index0.00

Single Core

1G

40G

Danger

Danger

More

Company Name

Weltrade Ltd

Company Abbreviation

Weltrade

Platform registered country and region

Saint Lucia

Company website

X

Company summary

Pyramid scheme complaint

Expose

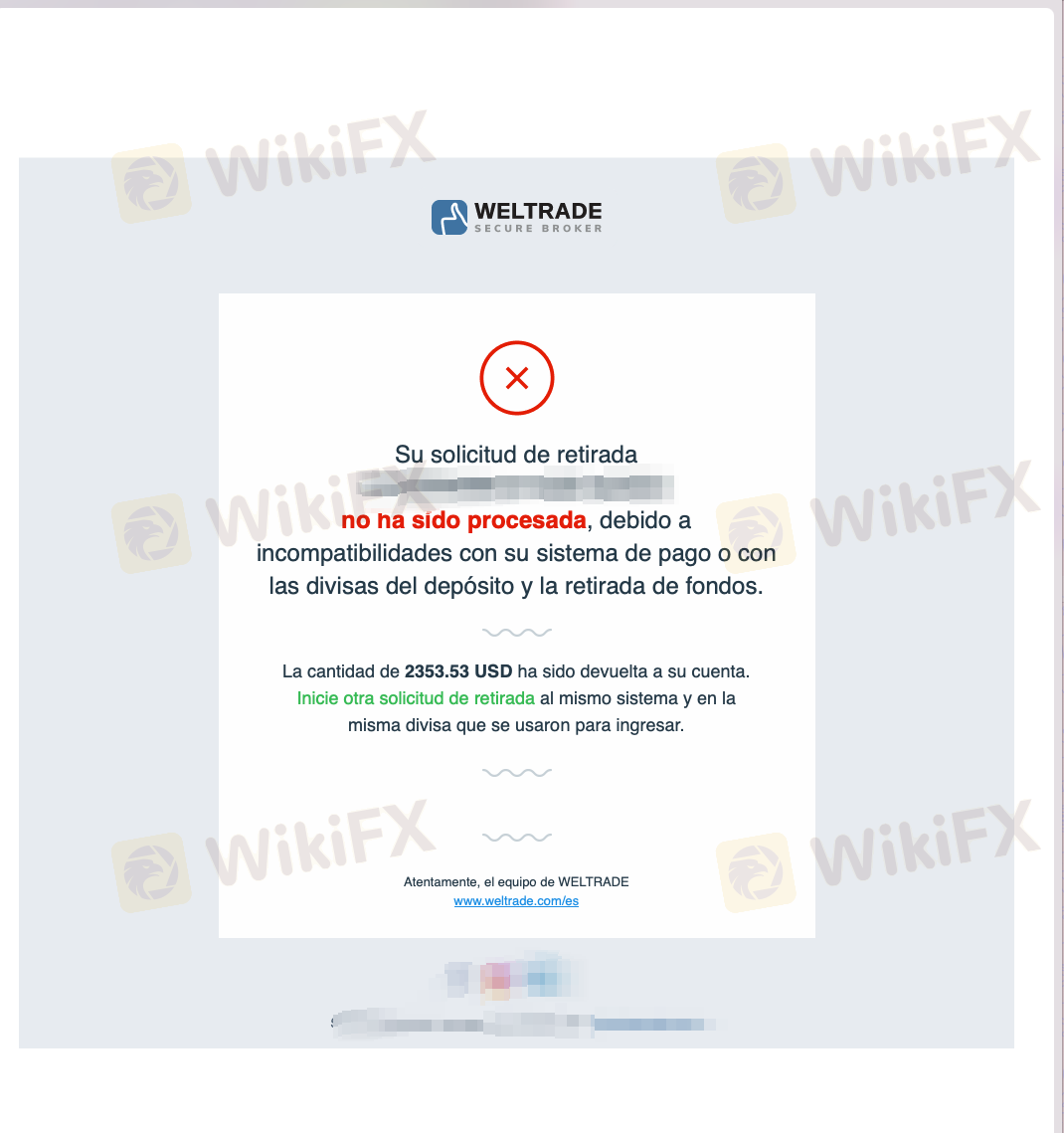

I cannot withdraw

I deposited RM53,000 to trade, but every profitable trade was canceled due to a "system error," while losing trades remained active! Last week, I made a profit of RM15,000 on a USD/CAD short trade, but suddenly I couldn't log in. Later, I requested a withdrawal, leaving me with RM38,000, but the platform directly rejected it. "WELTRADE, you are garbage! You are scamming Malaysians! Your servers are down all the time! Especially during the evening trading hours (Malaysian time), the frequency of disconnections is ridiculously high. Because of your disconnections, my stop-loss wasn't triggered, and I lost $5,000 in one margin call. Stop screwing us over

They changed their name and entered Thailand to deceive people! They have a long history of misconduct dating back to when they were still called SystemForex. WELTRADE's market delay caused my 95 million baht investment to disappear. WELTRADE deliberately prevented my Take Profit order from being executed. Last Wednesday, after the U.S. Federal Reserve meeting, I was watching the USD/IDR chart, which showed 15,280, but when I placed the order, it said 'price adjusted to 15,350,' a slippage delay of 70 points, resulting in a loss of 4.2 million baht. Even worse, my Stop Loss order set at 15,300 was not executed due to the delay, and by the time of trading, it had already risen to 15,380. An 80-point slippage wiped out my account. WELTRADE is an 18-year-old scammer.

Weltrade secretly tampered with my take-profit and stop-loss settings, causing me a loss of 68,000 rupees! Last Wednesday, I was trading in USD/INR and had set take-profit 74.50 and stop-loss 74.70. But when I checked my position that afternoon, the system showed that take-profit had changed to 74.30 and stop-loss to 74.80. As a result, when the price reached 74.48, I prematurely closed my position and lost 12,000 rupees. The next day, the price dropped to 74.75, and since I had set my stop-loss too high, I lost another 56,000 rupees—the exact amount I had earned from a small IT project! After filing a complaint with SEBI, I discovered that Weltrade's Indian 'Operation Center' was fake, located in a residential building in Gurugram. Now, I'm even struggling to pay my employees. WELTRADE is scamming people by manipulating their operating parameters. Do not trust them!

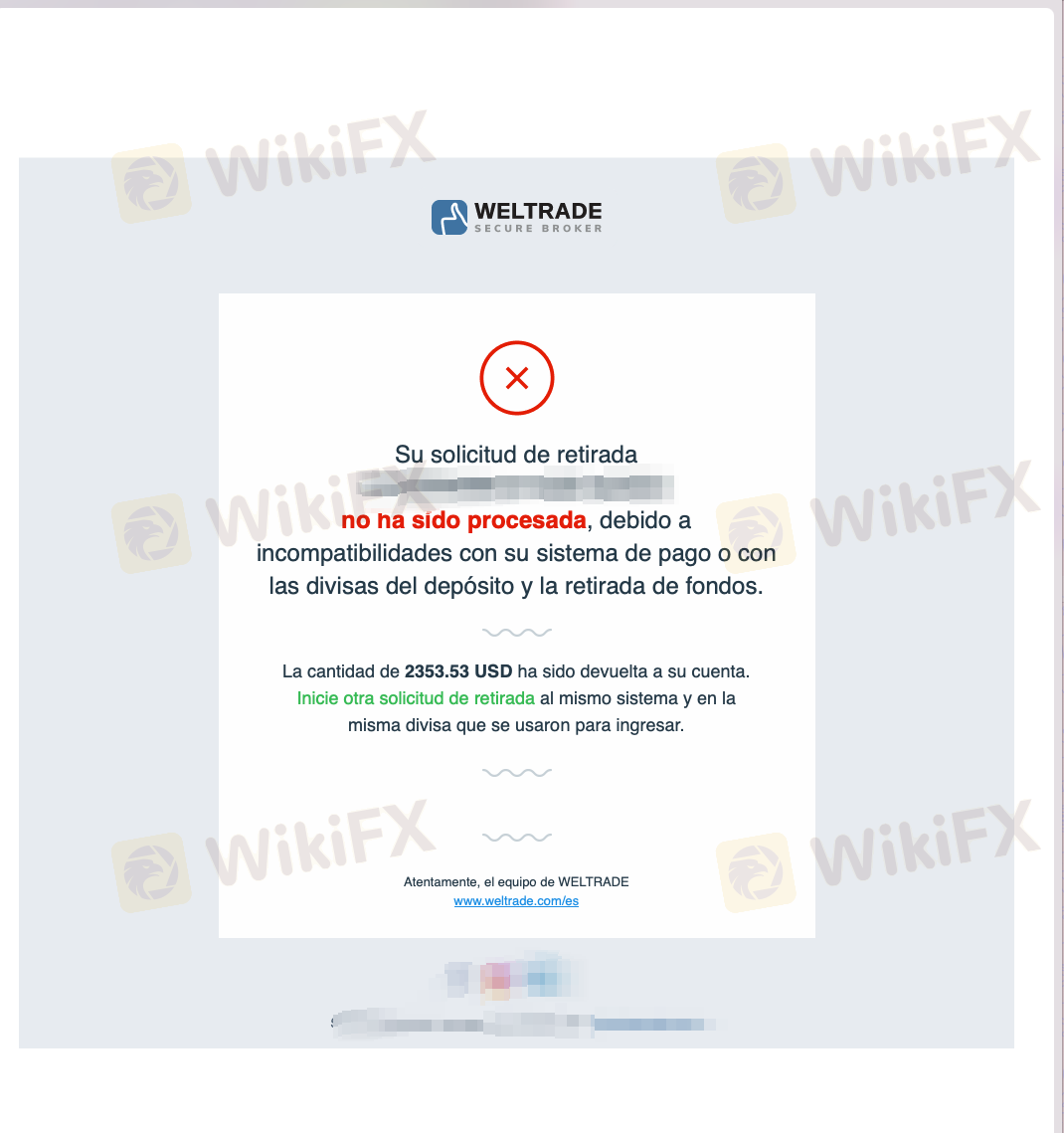

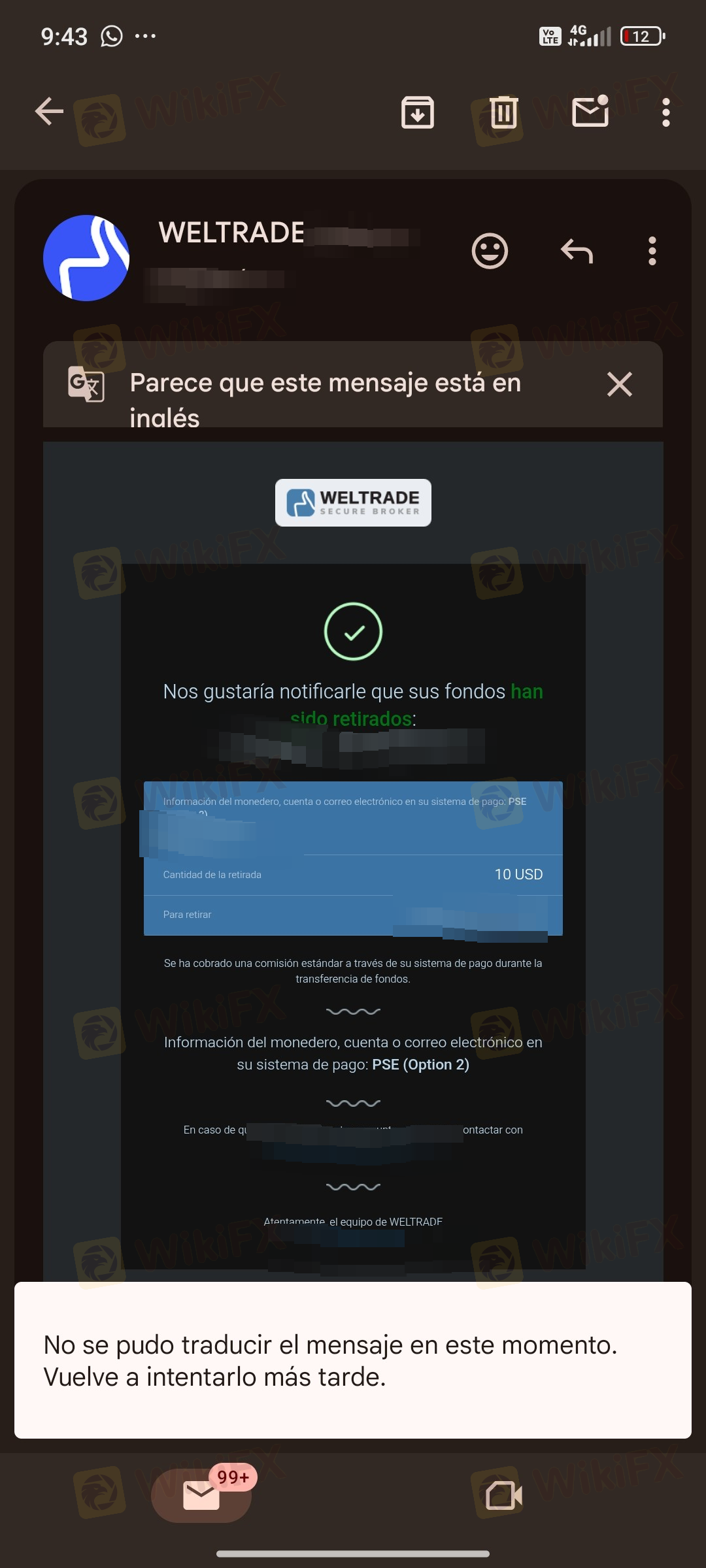

Very bad experience with Weltrade. They accept deposits without any problems, but when you want to withdraw your own money, they start making excuses about verification and country, rejecting documents and blocking the withdrawal. It seems like a strategy to retain funds, not a serious compliance process. I do not recommend trading with this broker.

The Weltrade company had increased the spread for Gold, almost 1600 % from what it usually was and my account could not withstand. Moreover, Systemgates Ltd aka Weltrade is changing its registration every single year, from one offshore country to another. In 2016 it was Vanuatu, in 2017 it was Belize and in 2018 it is Saint Vincent and the Grenadines. I found out that Systemgates Ltd has no licence whatsoever to engage in forex trading since the Financial Services Authority does not issue a licence to a company engaging in forex. I have lost 56 000 USD and trying to get them back . The company refused to return the money after I lodged my complaint with it more than 10 times.

WELTRADE, you are a true cancer in the financial world! Price updates were a full fifteen minutes behind the real-time market conditions, completely rendering all stop-loss settings useless. Causing financial lossesBy the time I could operate them, my position had already been liquidated! I immediately contacted your Indonesian customer service for an explanation, but they claimed that "global market fluctuations are uncontrollable" and even asked if there was a problem with my internet connection. Even more abominable, one of the representatives directly mocked me, saying, "If you don't understand trading, don't play!" Your platform makes money from data services, yet when problems arise, you completely shirk responsibility? This isn't just poor service; it's a blatant financial scam!

Last week, your Thai client who claimed to be the 'Head Data Analyst' contacted me on Facebook, boasting about 'internal data sources from the stock exchange' and the ability to accurately predict crude oil inventory data. I foolishly believed your lies and heavily traded crude oil based on your advice before the EIA data was released. The market crashed by 3.50 dollars! The most shocking part was that you manipulated the closing price! The market closed at 81.50, but your platform displayed a price of 80.80, forcing me to liquidate my long position! Afterward, I compared data from up to 8 different platforms and found that only your platform showed such a significant discrepancy in the closing price! After I got a margin call, your Thai customer service even shamelessly claimed, 'It's an automatic price settlement system,' and had the audacity to recommend I purchase their 'Supreme Data Service' for 12,000 baht per year, claiming I could access 'real settlement data'!

There is no reason. There is no reason for what they told me to do to verify my identity. I submitted all the documents, did everything, but they did nothing. They did not proceed in a way that would allow me to withdraw my money. The only reason I can see is harassment and discrimination. More than 24 hours have passed. Hours while I was processing and history

วันนี้การเทรดของผมพังพินาศไปเลยเพราะระบบห่วยๆ ของทีมไทยของคุณ! ราคาอัพเดทช้ากว่าตลาดไปสิบนาที แถมการตั้งค่า Stop Loss ของผมก็ใช้การไม่ได้อีกต่างหาก กว่าจะเริ่มเทรดได้ สถานะก็พังไปแล้ว! ผมรีบติดต่อฝ่ายบริการลูกค้าชาวไทยของคุณทันทีเพื่อขอคำอธิบาย แต่พวกเขากลับอ้างว่า "ความผันผวนของตลาดโลกควบคุมไม่ได้" แถมยังถามอีกว่าอินเทอร์เน็ตผมไม่ดีด้วยซ้ำ ที่น่าขยะแขยงยิ่งกว่านั้นคือ มีคนหนึ่งมาเยาะเย้ยผมตรงๆ ว่า "ถ้าไม่เข้าใจการเทรดก็อย่าเล่น!" ทีมไทยของคุณไม่มีทักษะและทัศนคติเอาเสียเลย แม้แต่การซิงค์ข้อมูลพื้นฐานก็ยังทำไม่ได้ แถมยังกล้าคิดค่าธรรมเนียมอีก! นี่ไม่ใช่แค่บริการแย่ๆ แต่มันเป็นการหลอกลวงชัดๆ! ผมแนะนำให้นักลงทุนทุกคน: ใช้ชีวิตให้คุ้มค่าและอย่าไปยุ่งกับ WELTRADE โดยเฉพาะในส่วนที่ทีมไทยดูแล ไม่งั้นคุณจะล้มละลายเป็นรายต่อไป!

The bonus system traps your original deposit and the withdrawal requires a high condition. I was deceived by the '50% bonus' of WelTrade and deposited THB 200,000 for a THB 100,000 bonus. But when I wanted to withdraw THB 150,000 in December, I was told that I must trade '300 times the volume' to unlock it. From my typical trade, I would have to continuously trade 3,000 lots, which is impossible in the network environment of Thailand. What's worse, they secretly changed the terms, prioritizing account closing profits before the bonus. When I requested to cancel the bonus and only withdraw the principal, the customer service told me 'the account money is already linked to the bonus, and a forced withdrawal will incur a 50% penalty'. Now, my THB 280,000 in the account is seized. This platform is terrible, don't trust it at all.

My withdrawal request hasn't been processed for three weeks, and customer service always gives the same excuse: "It's under review by the finance department." How did my original deposit arrive so quickly? Now I'm being harassed trying to get my money back! Your so-called "data-driven" risk control system is nothing but extortion! Every time I withdraw money, they inexplicably claim there's "unusual trading activity" in my account and require additional verification. Even after I provided my ID, bank statements, utility bills, and even a selfie, you still keep demanding more proof. Even more ridiculous, while you're withholding my withdrawals, you're constantly emailing me promotional deposit promotions! I clearly confirmed the use of hedging strategies when I opened my account, but now your risk control department is suddenly saying my Martingale strategy violates regulations and is freezing my account and imposing a fine? WELTRADE is a completely unregulated, dishonest platform!

WELTRADE's market delay wiped out my investment of 95 million rupiah. Last Wednesday, after the Federal Reserve meeting, the USD/IDR exchange rate showed 15.280, but when I placed an order, a message appeared saying 'Price updated to 15.350'—a 70-pip difference, resulting in a loss of 4.2 million rupiah! Even worse, my stop-loss order at 15.300 was not triggered due to the delay, and by the time it was executed, the price had already reached 15.380. This 80-pip difference wiped out my account.

On the night of the May non-farm payroll data release, I traded the USD/IDR currency pair on WELTRADE, setting a take-profit point of 15,200. When the market hit 15,205, the platform delayed closing my position for 30 seconds, ultimately closing it at 15,080. My original profit of 1.2 million rupiah turned into a loss of 850,000 rupiah. This slippage only occurs during the early morning hours of Indonesian time (02:00-05:00 Jakarta time), when European and American markets are active but local regulatory complaint channels are closed. By July, my initial investment of 5 million rupiah had lost 2.3 million rupiah due to similar slippage. Yet, the platform continues to push "low spread trading" ads on LINE. I believe this is a scam.

WELTRADE, you're a fucking scam! I've lost everything to your fake data, and now I can't even withdraw my last bit of capital! When I was trading forex, I always followed your platform's data closely to place orders, but every time I reached a critical profit and was supposed to close a position, your data would jump up and down like crazy! The international market clearly showed the USD/RM was stable at 4.72, but your platform suddenly soared to 4.80 without warning, forcing a stop-loss on my short position! I went to customer service to argue, and they brazenly said, "It's normal market fluctuations due to sudden market news"—a fluctuation of 0.08 pips? The most infuriating thing is the withdrawal issue! I submitted a withdrawal request 15 days ago, and I haven't seen a single cent! This is clearly a deliberate excuse to delay and withhold our funds!

WELTRADE, you garbage platform, all the money pits I've struggled to find in Thailand! Last Monday at 9.00, I was staring at the GBP/THB movement chart. The night before, I analyzed nearly a week's worth of trading data and decided to buy 5 lots at 32.15. It turned out that after placing the buy order, the platform directly displayed 'order submission failed.' I thought it was a network issue, so I tried three more times, but the page remained stuck! After 10 minutes, it returned to normal, but the price had already surged to 32.48. I ended up with 64,500 THB less. What's even more infuriating is that when I contacted customer service, they said, 'You were too slow and missed the best timing.' They even used 'data logs' as an excuse, claiming network delays when I submitted the order. At that time, I was using the fastest fiber optic in Bangkok, with internet speed tests showing 100 Mbps—how could there be delays? I've lost nearly 200,000 THB in the past half-month due to platform freezes and failed orders. WELTRADE, are you deliberately playing games and trying to swallow my money?!

| WELTRADE Review Summary | |

| Founded | 2006 |

| Registered Country/Region | Saint Vincent and the Grenadines |

| Regulation | NBRB/FSC (Revoked), FSCA (Exceeded) |

| Market Instruments | Forex, metals, index CFDs, commodities, stock CFDs |

| Demo Account | ✅ |

| Spread | Floating from 1.5 pips (Micro account) |

| Leverage | Up to 10000x |

| Trading Platform | MT4, MT5, Weltrade App |

| Minimum Deposit | USD 1 |

| Customer Support | Live chat, FAQ |

| Social platforms: Facebook, LinkedIn, Instagram | |

| Email: info@weltrade.com | |

| Registered Address: Unit Suite 305, Griffith Corporate Centre, PO BOX 1510, Beachmont, Kingstown, Saint Vincent and the Grenadines | |

| Email and registered offices in other countries: https://www.weltrade.com/customersupport/ | |

| Restricted Regions | USA, Canada, EU, Belarus and Russia |

WELTRADE was initially registered in Saint Vincent and the Grenadines and also now operates in dozens of countries worldwide. The broker offers a wide range of trading services in forex, metals, index CFDs, commodities, stock CFDs. It offers a demo account for you to get familiar with the platform and your trading strategy. Besides, four tiered live accounts are available to suit different levels of investors.

Traders can excute trades on the well-acclaimed MetaTrader 4 and 5 platforms, as well as the broker's self-developed Weltrade App. Trading tools such as trading/pip/profit/Fibonacci calculators, tradingview charts and economic calenders are available to enhance trading efficiencies.

Moreover, the broker offers a series of educational resources including webinars and seminars, MetaTrader guides, indicators, etc to help traders better understand the financial world and trading.

However, one fact that cannot be neglected is that although the broker claims to be regulated by the NBRB, FSC, and FSCA, none of them is normal.

| Pros | Cons |

| Demo accounts | Revoked NBRB and FSC license |

| MT4 and MT5 platforms | Exceeded FSCA license |

| Multiple trading tools | Abnormal high leverage levels |

| Affordable minimum deposit | |

| Promotion programs | |

| No trading commissions | |

| Rich educational resources |

No. WELTRADE currently has no valid regulations. It only holds revoked NBRB and FSC licenses, and an exceeded FSCA license. Please be aware of the risk!

| Regulated Country | Regulator | Current Status | Regulated Entity | License Type | License No. |

| National Bank of the Republic of Belarus (NBRB) | Revoked | LLC SystemGates Limited | Retail Forex License | 192727233 |

| Financial Services Commission (FSC) | Revoked | Systemgates Capital Ltd. | Retail Forex License | IFSC/60/350/TS/17 |

| Financial Sector Conduct Authority (FSCA) | Exceeded | WELTRADE SA (PTY) LTD | Financial Service Corporate | 50691 |

| Trading Instruments | Supported |

| Forex | ✔ |

| Metals | ✔ |

| Index CFDs | ✔ |

| Commodities | ✔ |

| Stock CFDs | ✔ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

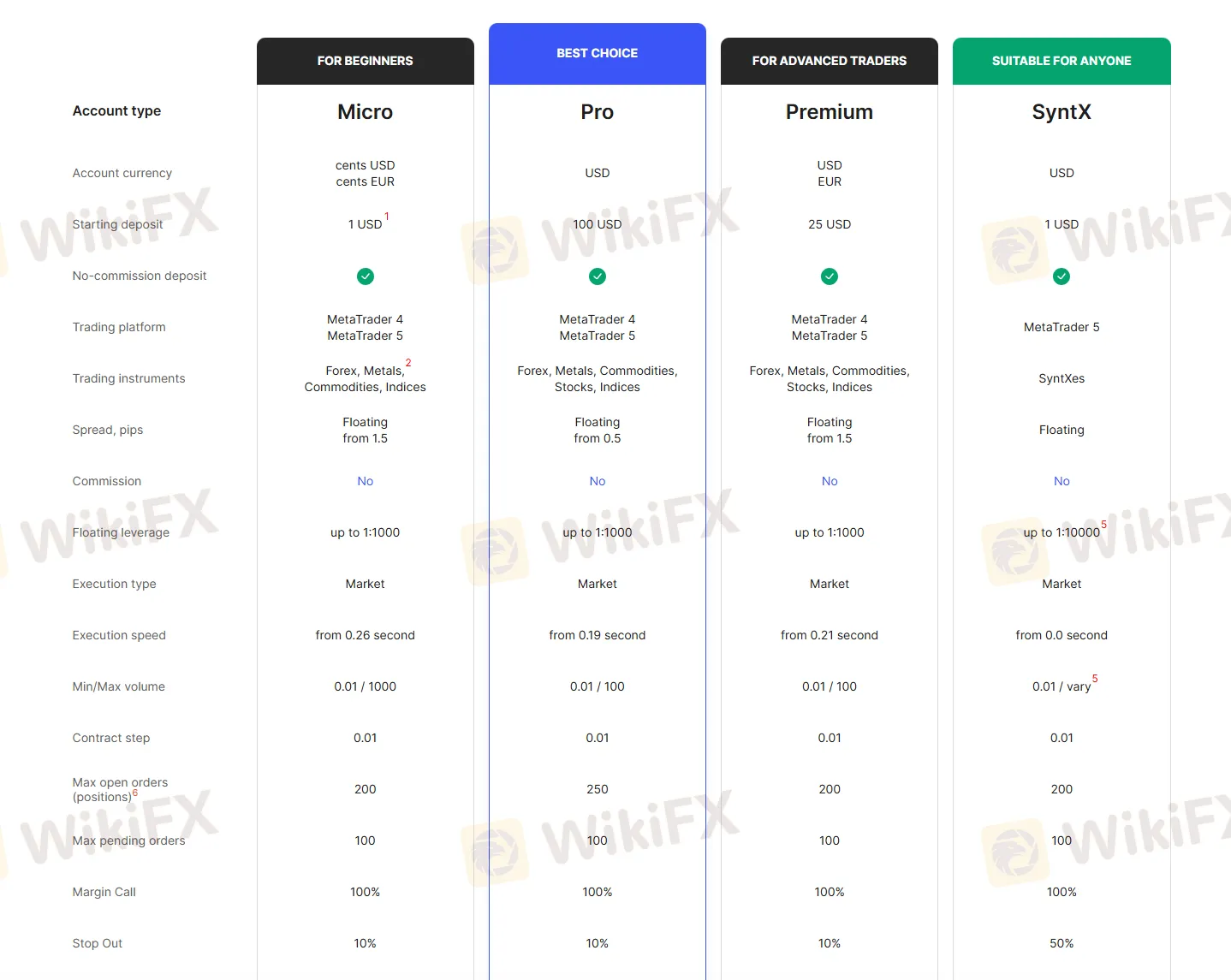

WELTRADE not only offers a demo account for you to simulating real trading with virtual funds before tapping into real trading, but also four tiered live accounts with different traidng conditions to suite various levels of investors and different products:

| Account Type | Minimum Deposit | Accepted Currencies | Spread | Commission |

| Micro | USD 1 | Cents USD, cents EUR | Floating from 1.5 pips | ❌ |

| Pro | USD 100 | USD | Floating from 0.5 pips | |

| Premium | USD 25 | USD, EUR | Floating from 1.5 pips | |

| SyntX | USD 1 | USD | Floating |

WELTRADE offers leverage up to 10000x, which is not normal among most brokerage companies. Usually leverage not only signifies profits, but also losses, thus it's strongly recommended that you should deal with leverage with this broker in extreme caution.

| Account Type | Maximum Leverage |

| Micro | 1:1000 |

| Pro | |

| Premium | |

| SyntX | 1:10000 |

WELTRADE claims to use the world renowned MetaTrader 4 and 5 platforms, which are well-recognized by its advanced charting tools and robust functionalities.

You can reach the platforms on web, or download app from Windows, mobiles phones and Mac.

Besides, the company also developed its own trading platform WELTRADE App, downloadble from both iOS and Android devices.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 | ✔ | iOS, Android, Windows, MacOS, Web | Beginners |

| MT5 | ✔ | iOS, Android, Huawei, Windows, MacOS, Web | Experienced traders |

| Weltrade App | ✔ | iOS, Android | / |

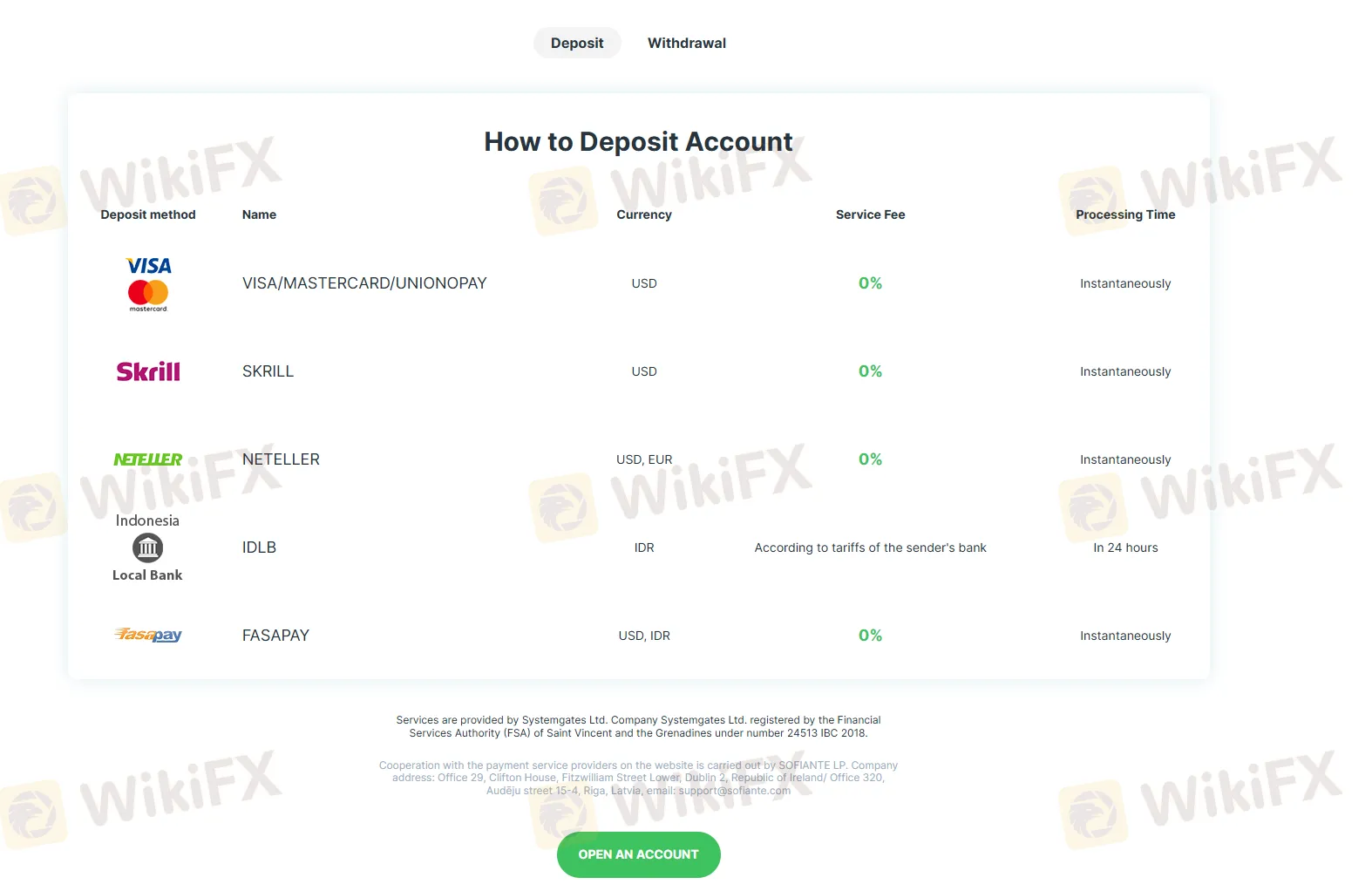

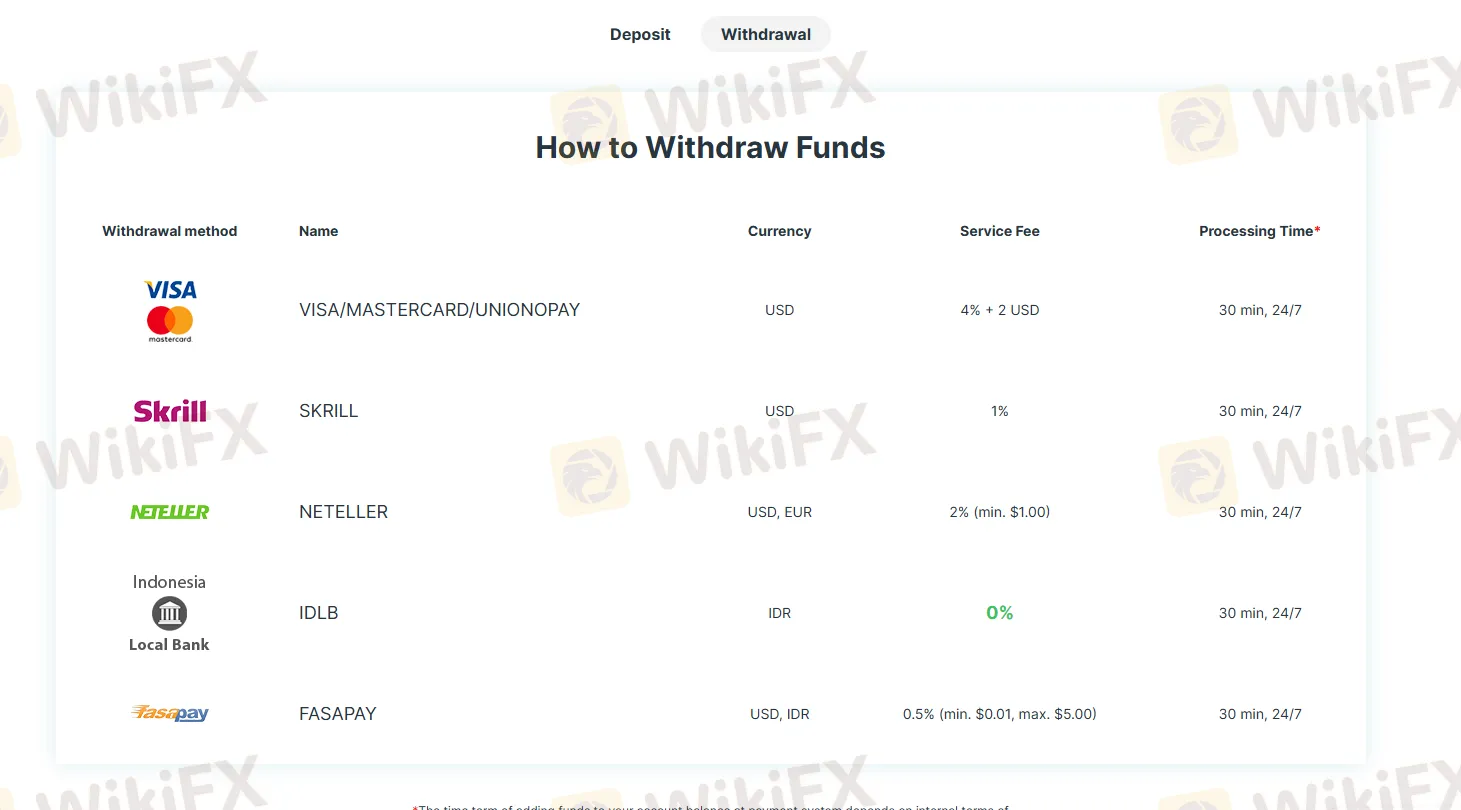

WELTRADE supports several funding methods:

| Payment Method | Accepted Currencies | Deposit Fee | Withdrawal Fee | Deposit Time | Withdrawal Time |

| VISA/MASTERCARD/UNIONPAY | USD | ❌ | 4% + 2 USD | Instantaneous | 30 min, 24/7 |

| Skrill | 1% | ||||

| Neteller | USD, EUR | 2% (min. $1.00) | |||

| IDLB | IDR | Sender's bank tariff | ❌ | Within 24 hours | |

| FasaPay | USD, IDR | ❌ | 0.5% (min. $0.01, max. $5.00) | Instantaneous |

Weltrade operates under a South African FSCA license but faces severe safety concerns due to revoked registrations in Belarus and multiple investor warnings in Southeast Asia. Recent user reports through 2024 and 2025 highlight significant risks regarding withdrawal delays, extreme slippage, and account freezing.

WikiFX

WikiFX

Weltrade scam surge in August 2025: traders report fake prices, slippage manipulation, and delayed withdrawals. Protect your funds and think twice before trading.

WikiFX

WikiFX

Weltrade, established in 2006 and headquartered in Saint Lucia, presents a conflicting profile in the 2025 landscape. While it holds a regulatory license from South Africa's FSCA, its overall WikiFX Score has dropped to a concerning 2.42/10 due to a high volume of investor complaints. Recent data highlights over 40 severe complaints within three months, ranging from withdrawal refusals to system instability. This review analyzes the dichotomy between its regulatory status and the practical risks reported by traders globally.

WikiFX

WikiFX

The European Central Bank says a rate hike may take longer than expected.

WikiFX

WikiFX

More

User comment

70

CommentsWrite a review

2026-01-01 04:25

2026-01-01 04:25

2025-12-17 22:47

2025-12-17 22:47