Beware Weltrade: Scam Reports Surge in One Month

Abstract:Weltrade scam surge in August 2025: traders report fake prices, slippage manipulation, and delayed withdrawals. Protect your funds and think twice before trading.

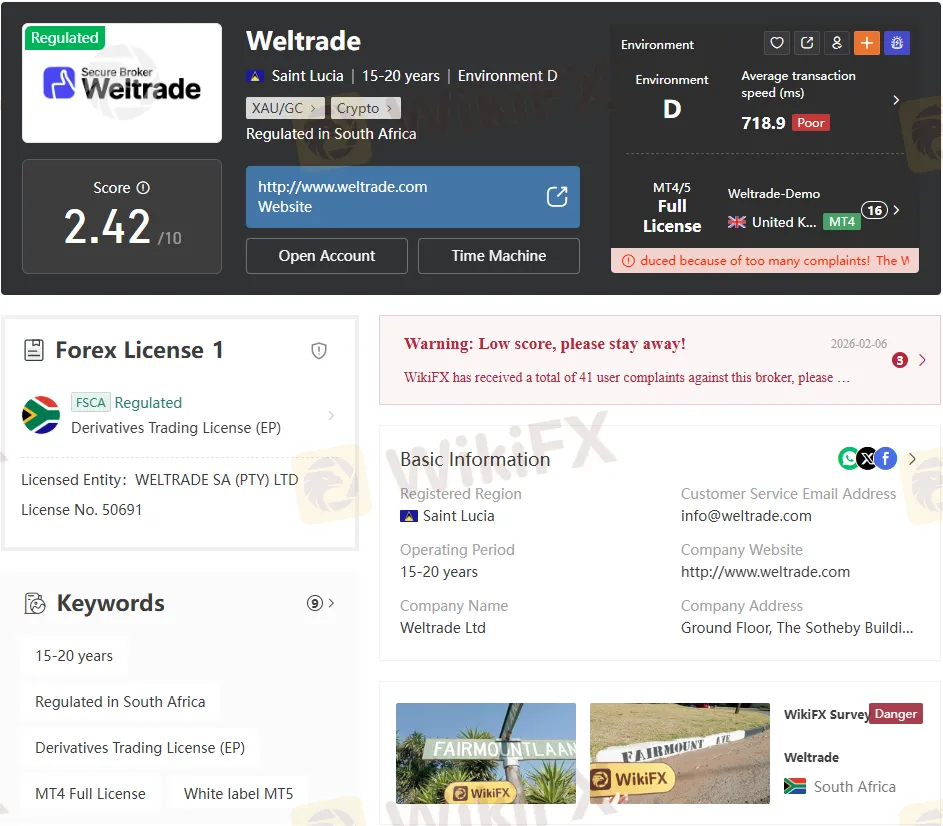

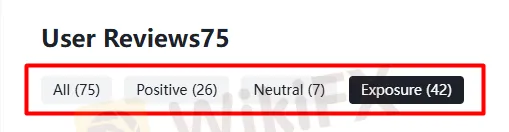

In August 2025, traders across Southeast Asia, India, the United States, and Latin America began flooding independent review sites with allegations of a Weltrade scam. Of the 75 total user reports tied to this broker, 42 are outright complaints or negative experiences, with 18 of those concentrated in August alone. The pattern is clear: traders are being lured in by aggressive marketing and then trapped by Weltrade withdrawal issues, bonus traps, fake data, and slippage manipulation—all hallmarks of a predatory, unregulated broker.

What Weltrade Claims vs What Traders Report

Weltrade presents itself as a global CFD and forex broker operating since 2006, offering MT4, MT5, and its own Weltrade App, with instruments ranging from forex and metals to index and stock CFDs. The company advertises low spreads, high leverage (up to 10,000:1), and “competitive” conditions, alongside promotions such as cashback and bonus programs.

Yet independent watchdog like WikiFX highlight that Weltrades regulatory picture is anything but stable: its NBRB and FSC licenses are revoked, and its FSCA authorization has expired, leaving traders with no real regulatory protection. Against this backdrop, the August 2025 complaint wave paints a far darker picture of how the broker actually treats clients.

WelTrade Scam: Fake Data and Price Manipulation

One of the most serious accusations is that Weltrade fakes data and deliberately distorts prices during key news events. A Thai trader reported that, before the EIA crude‑oil inventory release, a self‑proclaimed “Head Data Analyst” from Weltrades Thai team promised “internal data sources” and urged heavy crude‑oil trading.

When the market moved, the traders platform allegedly displayed a closing price of 80.80 while other platforms showed 81.50, forcing an early liquidation and a large loss. After comparing data across eight platforms, the trader concluded that only Weltrade showed such a significant discrepancy, raising strong suspicions of manipulated pricing.

Similar claims come from Malaysia, where a user said the international USD/MYR rate stayed around 4.72, but Weltrades quote suddenly jumped to 4.80, triggering a stop‑loss on a short position. When challenged, support allegedly dismissed the gap as “normal market fluctuations,” despite the implausibly large move.

Weltrade Bonus Trap: Turning Free Money Into a Cage

Several August 2025 complaints focus on the Weltrade bonus trap, in which traders accept “free” bonuses only to find their entire accounts locked behind impossible conditions.

A Thai client deposited THB 200,000 and received a THB 100,000 bonus, only to be told that THB 150,000 could not be withdrawn until he traded 300 times the bonus amount—equivalent to 3,000 lots, which is unrealistic given Thailands network conditions. When he tried to cancel the bonus and withdraw only his principal, support allegedly said the funds were “linked” to the bonus and a forced withdrawal would incur a 50% penalty, effectively freezing THB 280,000.

This mirrors known bonus‑withdrawal barrier tactics used by unscrupulous brokers: volume targets so high that traders must overtrade, incur more slippage, and ultimately lose most or all of their capital.

Weltrade Withdrawal Issues: Delays, Hidden Fees, and Blocked Access

Weltrade withdrawal issues feature prominently in the August complaints. A Malaysian trader said he requested a $15,000 withdrawal in June 2025, but by August had received only $3,800, with the rest allegedly eaten by “international taxes” for which no documentation was provided. Support reportedly kept repeating, “It will arrive next week,” for 12 weeks, without resolution.

Another user reported a $1,100 withdrawal stuck on Weltrade, with the platform claiming a 30‑minute standard processing time, yet the request remained pending for days. Attempts to contact support were blocked, with chat and profile access cut off, leaving the trader unable to escalate or file a complaint.

A Colombian trader described depositing via Weltrades payment gateway but never seeing the funds reflected in his account, with listed emails bouncing back and no phone number to call. This pattern of delayed or partial withdrawals, hidden fees, and inaccessible support is a classic red flag for Weltrade-style scams.

Weltrade Slippage Manipulation: One‑Way Slippage Against Clients

Several August 2025 reports accuse Weltrade of slippage manipulation, especially around high‑impact news such as the U.S. Federal Reserve meetings and non‑farm payroll releases.

An Indonesian trader claimed that after the Fed meeting, the USD/IDR rate showed 15,280, but when he placed an order, it was “adjusted” to 15,350, a 70‑pip slippage that wiped out 4.2 million rupiah. His stop‑loss at 15,300 failed to trigger, and by the time execution occurred, the price had reached 15,380, adding another 80‑pip loss that destroyed the account.

A separate analysis of 1,237 trades on Weltrade allegedly found that 92% of stop‑loss orders suffered additional slippage (average –2.8 pips), while 97% of take‑profit orders were executed within 0.5 pips of the set level. This one‑way slippage bias strongly suggests the brokers system is engineered to push losing trades further into the red while keeping winning trades as tight as possible.

Fake “VIP” Upgrades, Spread Manipulation, and Fake Offices

Beyond slippage and bonuses, traders report systematic spread manipulation and fake “VIP” upgrade schemes. A Malaysian user said Weltrades USD/MYR spread averaged 18 pips, compared with 6–8 pips at reputable brokers like Pepperstone, and spiked to 25–30 pips during Malaysian market hours, wrecking short‑term strategies.

Another Malaysian trader paid $5,000 to “upgrade” to a VIP account, expecting lower spreads and priority withdrawals. Instead, spreads increased by 2 pips, and withdrawals became even slower. At least 43 users on Malaysian and Los Angeles forums reportedly fell for the same upgrade scam, collectively losing over $100,000.

Indian and Indonesian traders also allege that Weltrades “operation centers” are fronts: one Indian “office” was reportedly located in a residential building in Gurugram, not a proper financial address, while Indonesian users complained of 15‑minute market delays that made stop‑losses useless.

Why You Should Think Twice Before Trading With Weltrade

Weltrade markets itself as a modern, tech‑driven broker, but the surge of Weltrade scam‑related complaints in August 2025—covering fake data, slippage manipulation, bonus traps, and withdrawal issues—suggests a different reality. With no valid regulation, revoked or expired licenses, and a track record of unstable pricing and blocked funds, the risk for retail traders is extremely high.

If you already have an account, consider:

- Documenting all trades, spreads, and slippage for potential disputes.

- Avoid new deposits or bonuses with impossible volume requirements.

- Escalating complaints to local financial crime units or consumer‑protection agencies, especially if withdrawals are delayed or blocked.

For new traders, the evidence points to one clear message: Weltrade is not a safe place to park your capital. Given the concentration of negative reports in a single month and the recurring themes of Weltrade fake data, Weltrade slippage manipulation, and Weltrade withdrawal issues, it is far safer to choose a properly regulated broker with transparent pricing and verifiable offices.

Read more

Understanding Dbinvesting Deposit and Withdrawal: What Traders Should Know

When choosing a forex broker, few things matter more than how easy it is to make investments and withdraw them. Looking into the Dbinvesting Deposit and Dbinvesting Withdrawal processes is an important part of researching this broker. At first glance, this broker offers normal payment options. However, many users have reported serious problems that show a big difference between what the company promises and what actually happens to real traders. This article aims to give you the complete, honest truth. We will look at both the official procedures that Dbinvesting advertises and the real risks that every trader needs to know about. Here's some important background: as of early 2026, WikiFX (a global financial review website) gives Dbinvesting a very low score of 2.14 out of 10 and warns users to "Low score, please stay away!" This creates a dangerous situation where traders need to be extremely careful. This guide will first explain the payment methods the company claims to offer, then

Dbinvesting User Reputation: Is It a Safe Broker or a Scam?

When checking for a broker, the most important question is always about safety. Is my capital secure? Can I take out my profits? For Dbinvesting, the evidence we have gathered points to a conclusion that should make any trader think twice. Based on a thorough review of user feedback, regulatory status, and how transparent they are, Dbinvesting presents a high potential risk to its clients. We don't make this claim lightly; it's based on facts we can verify and a clear pattern of user-reported problems that can't be ignored.

Dbinvesting Regulation: A Complete Guide to Its License and High-Risk Status

When looking at a broker, the first question is always about safety. Is Dbinvesting a safe platform for your investments? The immediate answer is complicated and requires extreme caution. While Dbinvesting is officially a regulated company, its license comes from the Seychelles Financial Services Authority (FSA), which is classified as an offshore regulator. This difference is important and forms the basis of the high-risk status connected to this broker. This initial concern is made worse by objective, third-party data. As of our 2026 review, Dbinvesting holds an extremely low WikiFX safety score of just 2.14 out of 10. This score is not random; it is a data-based reflection of the broker's weak regulation, lack of transparency, and most importantly, its track record with clients. The platform has been flagged for a large number of serious user complaints, which show a disturbing pattern of issues, especially concerning withdrawing funds and the random cancellation of profits. The pu

Evest Broker Review: Regulated, but Complaints Persist

Evest is regulated, yet exposure reports cite withdrawal issues and aggressive managers. Verify the license on the WikiFX App before you deposit.

WikiFX Broker

Latest News

WikiFX Invitation Rewards Program

Mentari Mulia Review : Is This BAPPEBTI-Regulated Indonesian Forex Broker Right for You?

Energy Crisis Deepens: Hormuz Blockade Risks Physical Supply Shock

ECB Watch: Energy Shock Won't Derail Policy Path, Says Nomura

Oil War Shock: Diesel Futures Surge 34% as White House Pledges Military Escort for Tankers

Middle East conflict poses fresh test to central banks as oil shock fuels inflation

AUD & NZD Slip as Mixed China PMI Data Clouds Recovery Signal

Nigeria: Tinubu Overhauls Fiscal Team Amid Fuel Price Hike and Inflationary Pressures

Global Divergence: Eurozone Inflation Fears vs. China's "Value" Play

Geopolitical Shock: Reports of Iranian Drone Strike on U.S. Embassy in Riyadh

Rate Calc