User Reviews

More

User comment

18

CommentsWrite a review

2025-12-17 08:38

2025-12-17 08:38

2025-12-16 23:06

2025-12-16 23:06

Score

5-10 years

5-10 yearsRegulated in Cyprus

Forex Execution License (STP)

MT4 Full License

Regional Brokers

High potential risk

Offshore Regulated

Benchmark

Influence

Add brokers

Comparison

Quantity 14

Exposure

Score

Regulatory Index5.87

Business Index7.60

Risk Management Index0.00

Software Index9.96

License Index4.29

Single Core

1G

40G

Danger

More

Company Name

Equiti Brokerage (Seychelles) Limited

Company Abbreviation

equiti

Platform registered country and region

Seychelles

Company website

X

YouTube

2484671934

Company summary

Pyramid scheme complaint

Expose

Now they asking me to deposit 5000 so that i can get my profit of 73 000

After withdrawing funds, I found the withdrawal port disappeared. I contacted the account manager, who said it was under review and asked for some time via email. I've given you over half a month, but now I can't find customer service on the official website, and emails go unanswered. My account is even down over 10,000. If I had made tens of thousands in profit, I wouldn't say anything, but you're not letting me withdraw even when I'm losing money. How impressive.

Unable to withdraw, the platform has disabled my withdrawal option. It has been over half a month now, and they still haven't reactivated the withdrawal option. Contacting the customer service manager yielded no response, and emails have gone unanswered.

If you can't afford it, don't open a platform. The account ledger is in the red, yet they won't let you withdraw funds. Their emails never address the actual issue.

The broker simply withheld my profits without any valid reasons or evidence.

Speechless, it's a disaster. I am once again one of the victims. I really can't believe it. Foolish people with money will be deceived day by day. I am truly speechless. I traded for several months and in the end, it was all for nothing. Everything is empty. When I try to log into my account on the website, it shows a blank page. And logging into MT4 is even more amazing. At first, I could still try to connect, but later it directly shows an invalid account. It's really a disastrous thing.

Trashy trading platform. After trading for a long time, they suddenly deducted all my principal and profits without any communication, claiming I abused the system. What a joke. With this kind of behavior, they still dream of expanding their market? Everyone should stay away from this platform.

The platform maliciously deducted 2365.41 USD from my account on September 1st, and also banned my trading privileges. It has been two days since I sent an email, but the issue remains unresolved.

There is no customer service response; it's a scam platform with no staff responding or handling issues.

In the MT4 account on the EQUITI platform, there are 3 spot gold orders. During the process of the gold price surging after the opening on Monday, December 4th, the positions were liquidated. However, the liquidation price was 2186+. I cannot accept this liquidation price. I understand that although the prices of major platforms worldwide and US futures gold have risen, they have not reached the level of 2185+. For these three orders, my requirement is that they need to proactively provide detailed order information and legitimate proof issued by regulatory agencies, but they have not responded at all! I have deposited over 5 million at the peak! I never expected it to be a black platform!

Equiti market personnel induced me to open an account and deposit funds for trading with low spreads, interest-free conditions, etc. After the account made profits, the platform deducted the account profits on the grounds of irregular trading. When negotiating with the platform, they had a rude attitude, refused to handle the issue, and even rejected my appeal email.

My account was banned for no reason, saying that I was engaged in improper trading and abusing transactions. I sent an email to the platform, but no matter what I said, they gave me the same reason. Then they deducted over 9000 dollars from me.

Unable to withdraw funds. Both the principal and profits have been deducted, and after being rejected, I don't know where my funds are.

I must share my alarming experience with Equiti Brokerage (Seychelles) Limited regarding my trading account (number 3540396). I have never received any contract documentation, which raises significant concerns about their legitimacy and ethical practices. After executing 2,352 trades, I was abruptly accused of "improper trading" without prior warning or any evidence. This lack of transparency is unacceptable. Additionally, my withdrawal requests have been blocked multiple times without explanation, severely impacting my financial situation. The timing of these invasive actions—three months into my trading—raises serious questions about their operational integrity. The overall lack of communication and accountability has eroded my trust. I strongly advise potential clients to reconsider before engaging with Equiti Brokerage. My experience highlights significant risks, and I urge others to choose a broker that prioritizes transparency and client trust.

| EquitiReview Summary | |

| Founded | 2008 |

| Registered Country/Region | Seychelles |

| Regulation | CYSEC, FSA (Offshore) |

| Market Instruments | FX pairs, commodities like gold, digital currencies, shares, ETFs and indices |

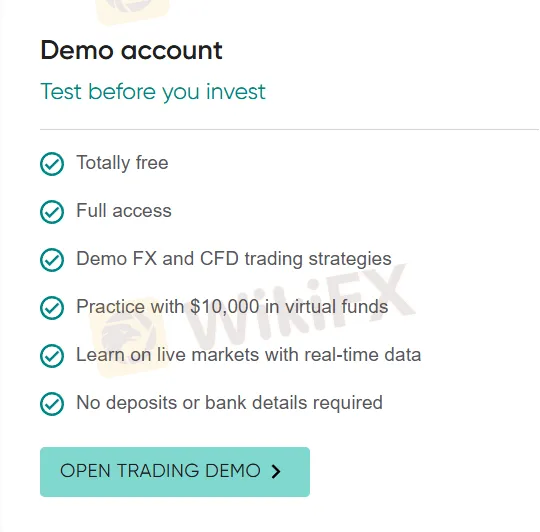

| Demo Account | ✅(valid 90 days, $10,000 virtual funds) |

| Leverage | Up to 1:2000 |

| Spread | Average 1.4 pips (Standard account) |

| Trading Platform | MT4, MT5 |

| Min Deposit | $0 |

| Customer Support | 24/6 live chat |

| Linkedin: https://www.linkedin.cn/incareer/company/equiti/ | |

| YouTube: https://www.youtube.com/channel/UCMfRYPE2cJ7XuclSbIsDgIg | |

| Instagram: https://instagram.com/equitisc/ | |

| Twitter: https://twitter.com/Equiti_en | |

| Facebook: https://www.facebook.com/EquitiSC/ | |

Equiti, a trading name of Equiti Brokerage (Seychelles) Limited is a company incorporated with limited liability under the laws of the Republic of Seychelles, under registration number 8428558-1, with its registered address at First Floor, Marina House, Eden Island, Republic of Seychelles. The broker presents itself as a global provider of bespoke Forex and CFD liquidity for professional and ECP clients. It claims to provide its clients with the industry-standard MT4 and MT5 trading platforms.

| Pros | Cons |

| Regulated by CySEC | Offshore FSA license |

| Various trading instruments | No 24/7 customer support |

| No minimum deposit | |

| High leverage | |

| Demo accounts offered | |

| MT4/5 supported |

Strong business ethics and regulatory compliance are at the core of everything.

Equiti is licensed & regulated by Cyprus Securities and Exchange Commission (CySEC) - Cyprus, Equiti Global Markets Ltd License No. 415/22;

Offshore regulated by the Financial Conduct Authority (FCA) – UK, Equiti Capital UK Limited License FRN. 528328;

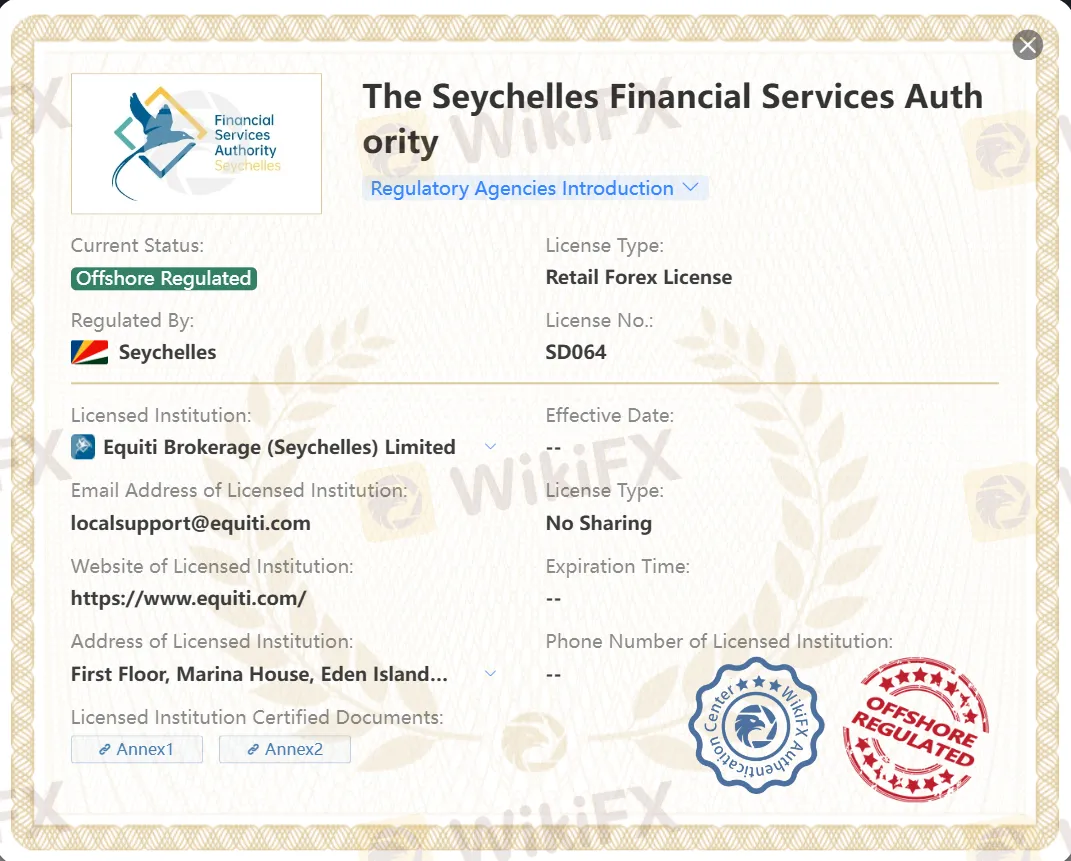

And it holds a suspicious clone license from the Financial Services Authority (FSA) – Seychelles, Equiti Brokerage (Seychelles) Ltd License No. SD 064.

| Regulated Country | Regulator | Regulatory Status | Regulated Entity | License Type | License Number |

| Cyprus Securities and Exchange Commission (CySEC) | Regulated | Equiti Global Markets Ltd | Straight Through Processing (STP) | 415/22 |

| Seychelles Financial Services Authority (FSA) | Offshore Regulated | Equiti Brokerage (Seychelles) Limited | Retail Forex License | SD064 |

| Financial Conduct Authority (FCA) | Suspicious Clone | Equiti Capital UK Limited | Institution Forex License | 528328 |

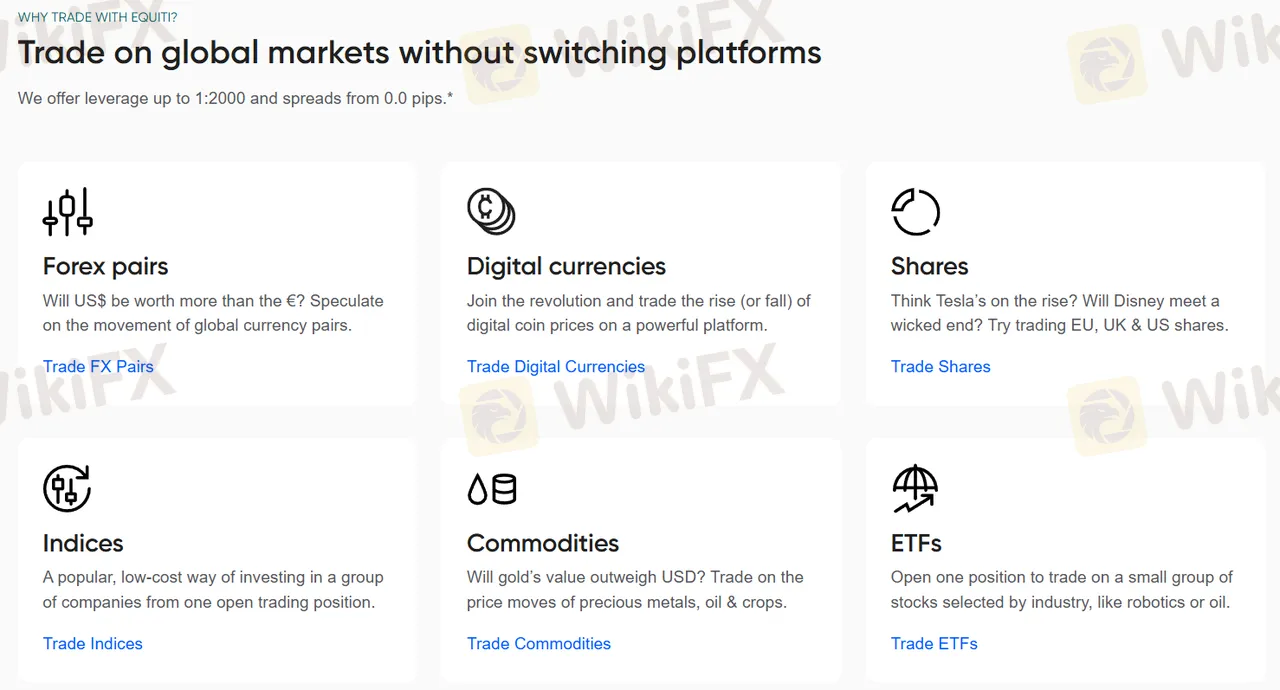

Equiti advertises that it is a forex & CFD Liquidity provider that offers some tradable products such as Forex pairs, Shares, Commodities, Indices, ETFs and Cryptocurrencies.

| Tradable Instruments | Supported |

| FX pairs | ✔ |

| Indices | ✔ |

| Commodities | ✔ |

| Digital currencies | ✔ |

| Shares | ✔ |

| ETFs | ✔ |

| Bonds | ❌ |

| Options | ❌ |

| Mutual Funds | ❌ |

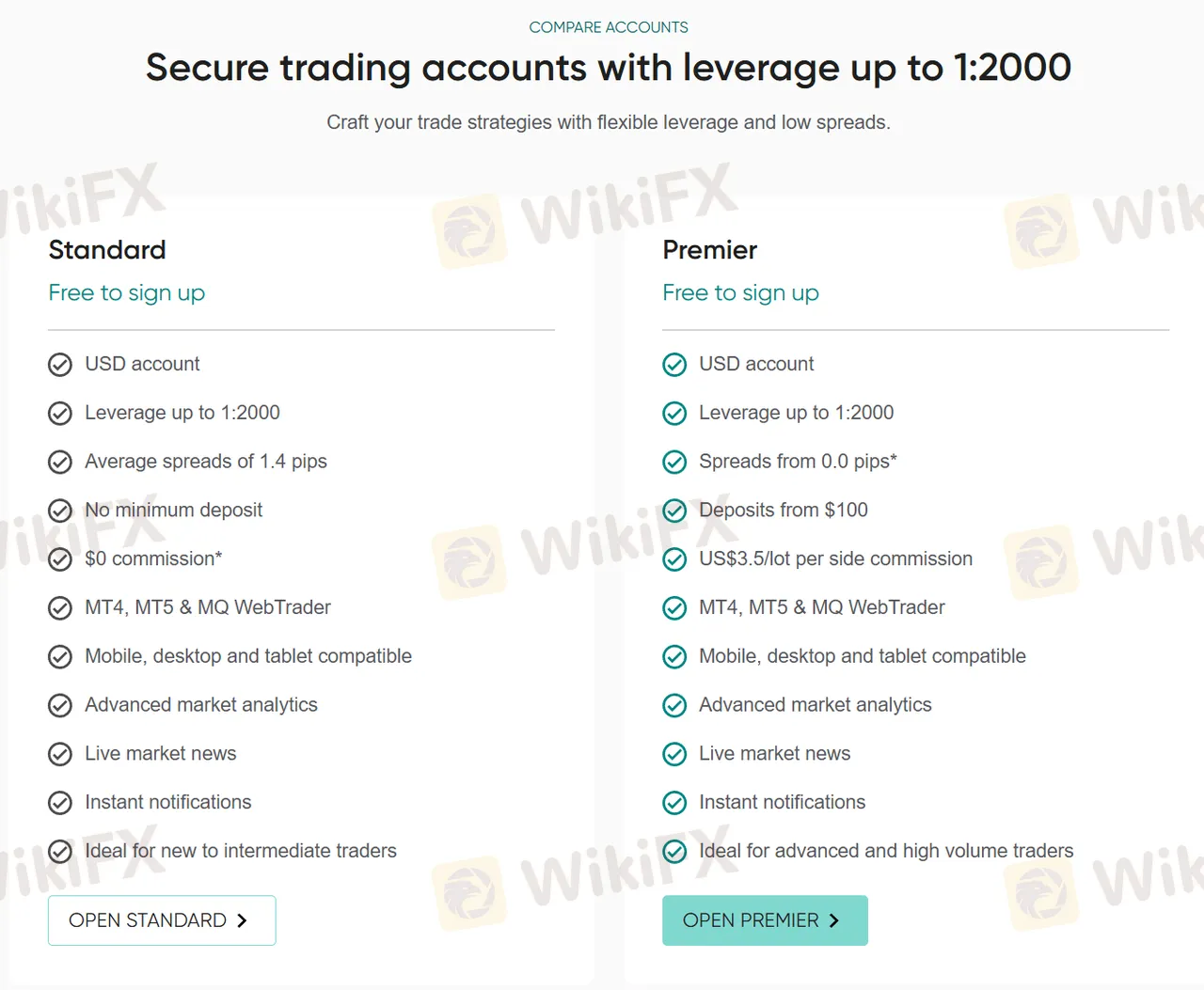

Equiti offers two distinct trading account options, Standard and Premier.

The Standard Account is ideal for new to intermediate traders. It offers a high leverage of up to 1:2000 and average spreads of 1.4 pips. There is no minimum deposit requirement, making it accessible for beginners or those looking to test the platform with minimal financial commitment. This account also boasts $0 commission on trades, supports trading via MT4, MT5, and MQ WebTrader platforms, and is compatible across mobile, desktop, and tablet devices. Traders can benefit from advanced market analytics, live market news, and instant notifications.

The Premier Account, on the other hand, is tailored for advanced and high volume traders. It provides the same high leverage of up to 1:2000 but with tighter spreads starting from 0.0 pips. This account requires a minimum deposit of $100 and charges a commission of $3.5 per lot per side. Like the Standard Account, it supports MT4, MT5, and MQ WebTrader platforms and is fully compatible with mobile, desktop, and tablet devices. Premier account holders also enjoy advanced market analytics, live updates on market news, and instant notifications.

| Feature | Standard Account | Premier Account |

| Signup Fee | ❌ | ❌ |

| Minimum Deposit | $0 | $100 |

| Leverage | Up to 1:2000 | Up to 1:2000 |

| Spread | Average 1.4 pips | From 0.0 pips |

| Commission | ❌ | $3.5 per lot per side |

| Ideal for | New to intermediate traders | Advanced and high volume traders |

Equiti offers a free demo trading account that allows traders to practice strategies using simulated funds on the MT5 platform. Traders can open up to three demo accounts, each valid for 90 days, and reset their virtual balance to $10,000 anytime via the Client Portal.

Demo accounts expire after 90 days of inactivity. To transition from a demo to a live trading account, users need to register for a live account on the Equiti Portal, verify their email, and make an initial deposit. This setup enables both new and experienced traders to test trading strategies risk-free before engaging in live markets.

Equiti offers a leverage of up to 1:2000 for both the Standard and the Premier account, which is quite high.

Equiti provides traders the trading platform including MT4 and MT5. Traders can trade CFDs in forex, shares, indices, commodities and ETFs on MT4. All markets are available on MT5.

Both MT4 and MT5 always coincide with the NY close, which means during ‘daylight savings’, it will operate on GMT+3, and in Winter on GMT+2, unless a specific closure has been announced on ‘market holiday hours’. Traders can explore MT5 cost-free by opening a demo account.

Traders can deposit and withdraw funds into Equiti trading account with credit cards, eWallets, bank transfers, local solutions and crypto wallets. Equiti claims that all clients' money is safely held in segregated bank accounts under FSA rules and will never be used by any other means.

| Options | Payment Method | Accepted Currencies | Deposit Fee | Withdrawal Fee | Deposit Time | Withdrawal Time |

| Credit Cards | Mastercard, VISA | USD, JOD | ❌ | ❌ | Instant | 1-2 working days |

| e-Wallets | Local or international bank wire transfer | USD, GBP, EUR, AED, SAR, JOD, JPY, AUD, BHD, BWP, BGN, CAD, CHF, CNY, CZK, DKK, GHS, HKD, HRK, HUF, KES, KWD, MUR, MXN, NZD, NOK, OMR, PNL, QAR, RON, RUB, SEK, SGD, THB, TND, TRY, UGX, ZAR | ❌ | USD$30 | 1-5 working days | 1-3 working days |

| Bank Transfers | Neteller | USD, BRL, EUR, GBP, AED, COP, MXN | ❌ | 1% up to USD$30 | Instant | 1-2 working days |

| SKRILL | USD, GBP, EUR, AED, BRL, COP, SAR | |||||

| Local Solutions | Cash Payments, Mobile money, Online Wire Transfers, QR Code Payments | Various | Solution dependent | |||

| Crypto Wallets | Crypto wallets | USDT, BTC, ETH and many more | ❌ | ❌ | Instant | 1 working day |

Equiti regulation includes CySEC, Cyprus, FCA UK, and FSA Seychelles. Review broker accounts, leverage, and platforms.

WikiFX

WikiFX

They trade for weeks, sometimes months. They follow the market, execute their strategy, and watch their account balance grow. Then, without warning, it's all gone. Not from a bad trade, but from a decision made by the broker. Their profits are confiscated, their principal is wiped, and their account is locked. This is the alarming reality dozens of traders have reported to WikiFX about their experiences with Equiti, painting a picture of a platform where success can be punished without explanation. In the last three months alone, WikiFX has been flooded with 11 new complaints against Equiti, each one echoing a similar, disturbing story. The central theme? Traders who manage to generate profits find themselves abruptly accused of “improper trading” or “abuse,” a vague justification used to seize their funds and sever communication. The evidence submitted by these users points to a deeply concerning pattern that every potential trader in Africa must be aware of.

WikiFX

WikiFX

Equiti faces mounting scam allegations, including withdrawals blocked and fund deductions, despite mixed regulatory claims and office verifications.

WikiFX

WikiFX

When selecting a broker, understanding its regulatory standing is an important part of assessing overall reliability. For traders seeking to protect their capital, ensuring that a platform operates under recognised and stringent oversight can make all the difference. Keep reading to learn more about Equiti and its licenses.

WikiFX

WikiFX

More

User comment

18

CommentsWrite a review

2025-12-17 08:38

2025-12-17 08:38

2025-12-16 23:06

2025-12-16 23:06