WM Markets Spreads, leverage, minimum deposit Revealed

Abstract:WM Markets is a global financial trading platform that offers trading services for multiple asset classes, including foreign exchange (Forex), contracts for difference (CFDs), and stocks. It supports trading via MT4, MT5, and mobile applications, and provides a loyalty rewards program, making it suitable for traders of different experience levels.

| WM Markets Review Summary | |

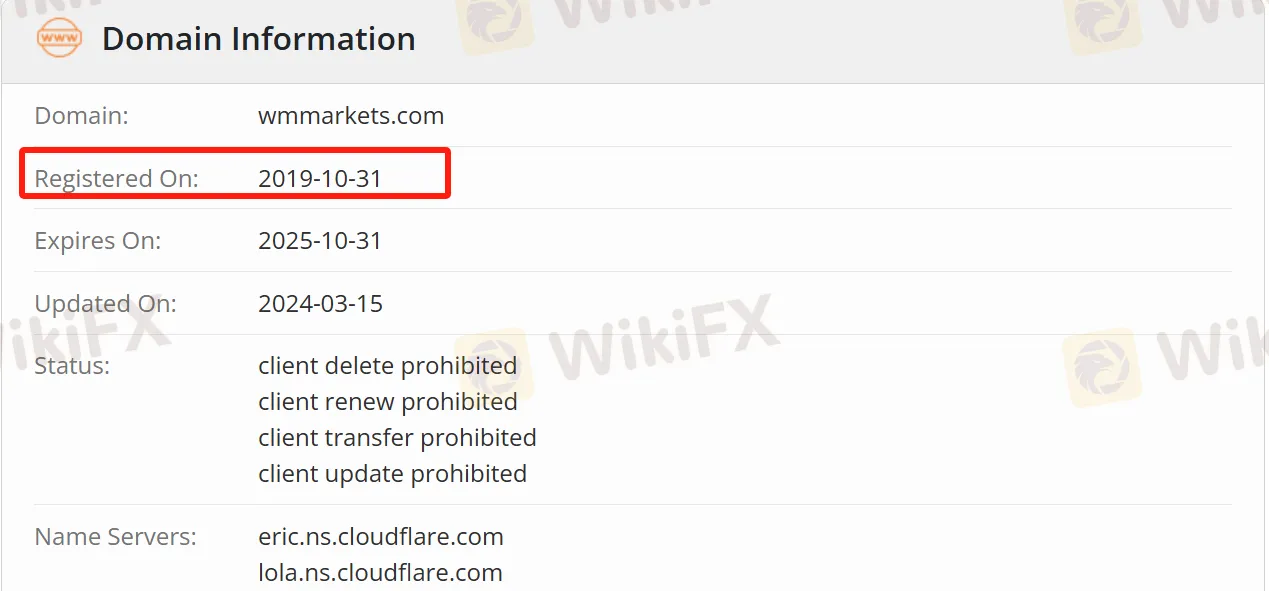

| Founded | 2019-10-31 |

| Registered Country/Region | Comoros |

| Regulation | Unregulated |

| Market Instruments | Forex, Commodities, Stocks, Cryptocurrencies, Indices, ETFs, Energies, and Treasuries |

| Demo Account | ✅ |

| Leverage | Up to 1:1000 |

| Spread | From 0.0 pips |

| Trading Platform | MT5 (Desktop, Mobile, and Web), MT4 (PC, Mac, Android, iOS, Web, Tablet, iPhone, iPad), WM Markets App |

| Min Deposit | $50 |

| Customer Support | support@wmmarkets.com |

| +44 1613940573 | |

| Bonovo Road, Fomboni, Island of Moheli, Comoros Union | |

WM Markets Information

WM Markets is a global financial trading platform that offers trading services for multiple asset classes, including foreign exchange (Forex), contracts for difference (CFDs), and stocks. It supports trading via MT4, MT5, and mobile applications, and provides a loyalty rewards program, making it suitable for traders of different experience levels.

Pros and Cons

| Pros | Cons |

| Multiple trading instruments | Unregulated |

| Spreads as low as 0.0 pips (Forex) | Opaque cryptocurrency leverage |

| $0 commission (stocks and ETFs) | Missing account types |

| MT4 and MT5 available |

Is WM Markets Legit?

In fact, WM Markets is not regulated, and the WM Markets website does not clearly disclose specific regulatory authorities (such as FCA, ASIC, etc.) and license information.

What Can I Trade on WM Markets?

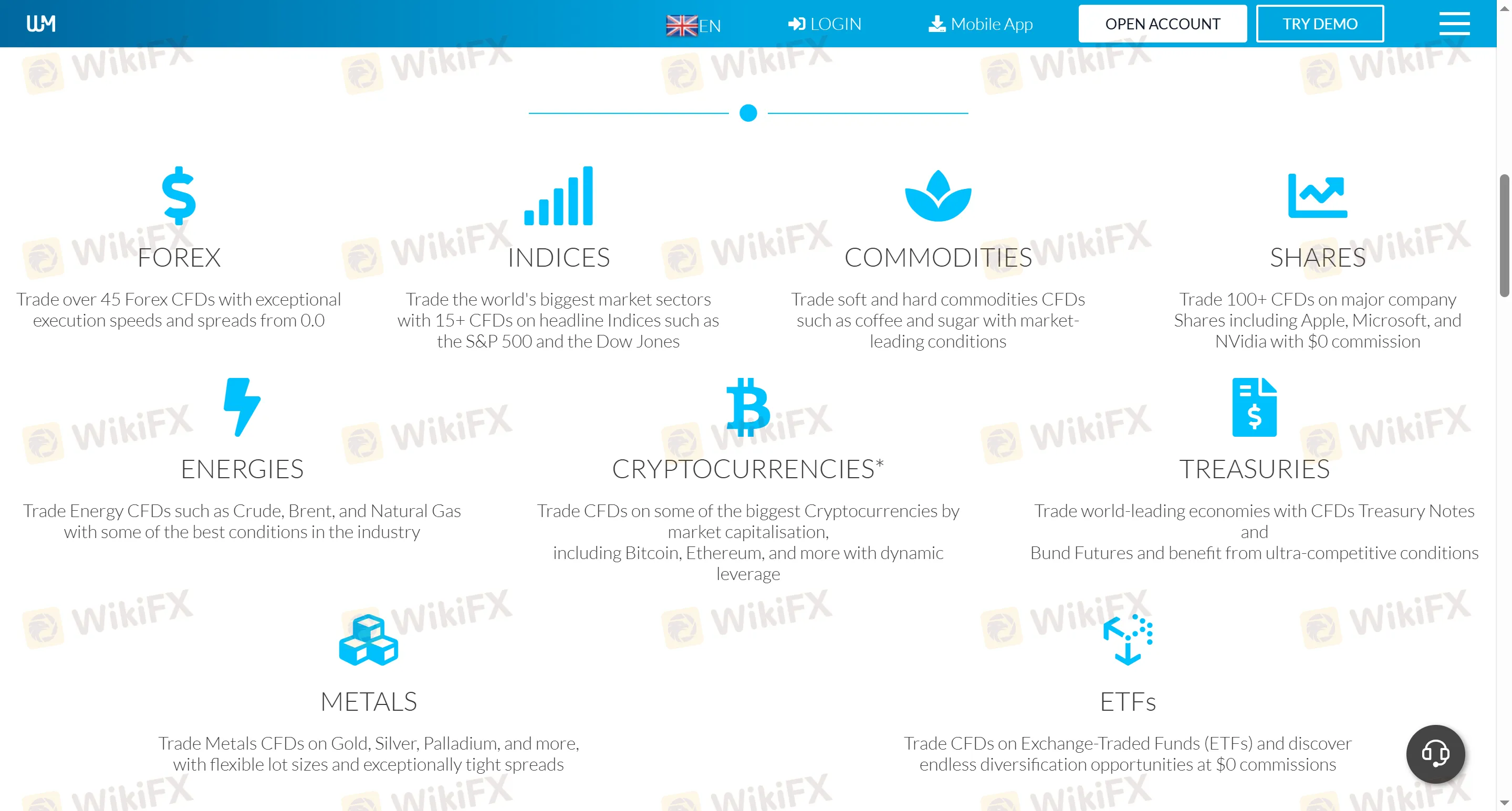

The platform supports trading of multiple asset classes (all traded as CFDs), such as forex, indices, stocks, commodities, energies, cryptocurrencies, treasuries, and ETFs. Specific products include:

Over 45 currency pairs, such as AUDUSD and EURUSD.

15+ major global indices, such as the S&P 500 and Dow Jones Industrial Average.

100+ popular stocks, such as Apple, Microsoft, and NVIDIA.

Soft commodities like coffee and sugar, and precious metals like gold and silver.

Energies include crude oil (Brent, WTI) and natural gas.

Leading cryptocurrencies like Bitcoin and Ethereum.

U.S. Treasury futures, German Bund futures, and exchange-traded funds (ETFs) with $0 commission to support diversified investing.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Stocks | ✔ |

| Cryptocurrencies | ✔ |

| Indices | ✔ |

| ETFs | ✔ |

| Energies | ✔ |

| Treasuries | ✔ |

Account Type

The VIP ZERO account is specially tailored for high-net-worth individuals. The WM Markets VIP ZERO account is suitable for holders of ZERO MT4 and ZERO MT5 trading accounts. The Prime account is more suitable for beginners.

| Account Type | Zero | Prime |

| Suitable for | Forex pros | Beginner traders |

| Minimum Deposit | $1000 | $50 |

| Spreads from | 0.0 pips | 1.0 pips |

| Max Leverage | 1:1000 | 1:1000 |

| Commission | $8 (Forex & Metals CFDs/Round Lot) | $8 (Crypto CFDs/Round Lot) |

| $0 (all other CFDs) | $0 (all other CFDs) | |

| Islamic / SWAP Free | NOT available | Available |

| Negative Balance Protection | Yes | Yes |

| Training provided | No | Yes |

| Stop Out Level | 20% | 20% |

| Margin Call Level | 100% | 100% |

WM Markets Fees

Different markets have different fee requirements for trading. For example, the spread for foreign exchange can be as low as 0.0 pips (such as AUDUSD), and there is a $0 commission for stock and ETF trading.

Trading Platform

Traders can experience automated trading (EA) and multi-account management functions through the MT5 desktop, mobile, and web versions. In addition, the platform also offers the WM Markets App, designed specifically for mobile trading, including copy trading.

Latest News

Geopolitical Risk Premium Rising: Russia Warns on Arms Treaty as Trump Pushes Ukraine Land Deal

Emerging Markets: West Africa Projected for 4.4% Growth Amid Reforms

US Crisis Deepens: Government Shutdown Odds Hit 78% Amid Winter Paralysis and Fed Feud

Market Perception: 'SA Inc' Under Review

Gold Breaches $5,100 as 'De-Dollarization' and Tariff Wars Crush the Greenback

Geopolitical Risk Premium Rising: Russia Warns on Arms Treaty as Trump Pushes Ukraine Land Deal

Solitaire PRIME Regulatory Status: Understanding Their Licenses and Company Information

APAC Outlook: 'Takaichi Trade' Returns to Tokyo; RBA Hike Bets Propel Aussie Dollar

US Crisis Deepens: Government Shutdown Odds Hit 78% Amid Winter Paralysis and Fed Feud

China Industrial Profits Turn Positive; Yen Falters on Fiscal Woes

Rate Calc