The Revenue Center Pro Spreads, leverage, minimum deposit Revealed

Abstract:The Revenue Center Pro, an online trading platform, offers a range of account types. With its maximum leverage of 1:400, traders have the potential to trade with positions significantly larger than their account balance.

| The Revenue Center Pro Review Summary | |

| Registered Country/Region | Saint Vincent and the Grenadines |

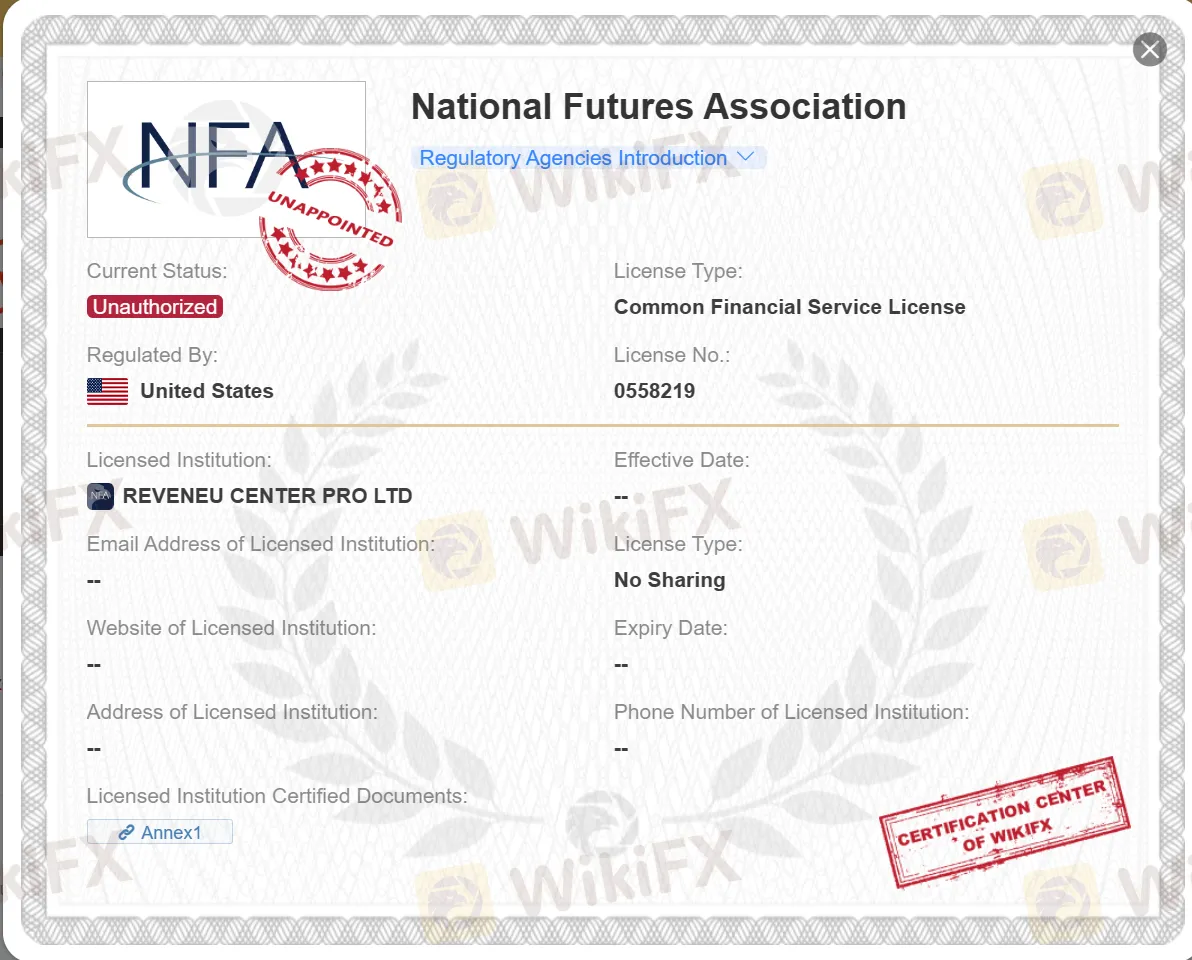

| Regulation | NFA (Unauthorized) |

| Demo Account | Unavailable |

| Trading Products | Forex, cryptos |

| Leverage | 1:400 |

| EUR/ USD Spreads | 0.0 pip (SPECIAL account) |

| Minimum Deposit | $250 |

| Trading Platform | WebTrader |

| Customer Support | Email, support@revenuecenterpro.email |

What is The Revenue Center Pro?

The Revenue Center Pro, an online trading platform, offers a range of account types. With its maximum leverage of 1:400, traders have the potential to trade with positions significantly larger than their account balance.

It is crucial for traders to be aware that The Revenue Center Pro currently does not have valid regulations, which means investing with The Revenue Center Pro carries inherent risks.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

Pros & Cons

| Pros | Cons |

| • Account variety | • Regional restrictions |

| • A range of trading instruments | • NFA (Unauthorized) |

| • No demo accounts | |

| • Limited communication channels |

The Revenue Center Pro Alternative Brokers

There are many alternative brokers to The Revenue Center Pro depending on the specific needs and preferences of the trader. Some popular options include:

Eightcap - A trusted forex and CFD broker that provides traders with competitive spreads, fast trade execution, and a comprehensive suite of trading tools and resources.

CFI Group -A globally regulated STP broker registered in Cyprus that provides its clients with over 13,000 tradable financial instruments.

XGLOBAL Markets - An online forex and CFD broker providing traders with access to a wide range of markets, advanced trading technologies, and competitive trading conditions through its innovative platforms and liquidity network.

Is The Revenue Center Pro Safe or Scam?

United States NFA (license number: 0558219) The regulatory status is abnormal and the official regulatory status is unauthorized. There, the Revenue Center Pro currently has no valid regulation, which means that there is no government or financial authority oversighting their operations.

If you are considering investing with The Revenue Center Pro, it is important to do your research thoroughly and weigh the potential risks against the potential rewards before making a decision. In general, it is recommended to invest with well-regulated brokers to ensure your funds are protected.

Market Instruments

-Forex: The Revenue Center Pro offers a range of forex trading pairs, including USD/ZAR, USD/PLN, NZD/USD, and GBP/HUF.

-Crypto: Explore cryptocurrency options such as Dogecoin against USD and DOGEEUR, as well as ENjin USD, Cosmos USD, ICP/USDT, Aave USD, and Decentraland USD.

-Stocks: The platform provides opportunities to trade stocks such as Beyond Meat, KYFT, Tencent Music Entertainment, Pinterest, American Airlines, TripAdvisor, NIO Inc, US Steel, and Disney.

-Commodities: Trade various commodities like Corn, Wheat, silver spot, Brent Crude Oil, Platinum, Palladium, and Natural Gas.

-Indices: Access different indices including US2000, US500, UK100, Switzerland 20, Japan 20, Japan 225, and US 30 for diversified trading options.

Account Types

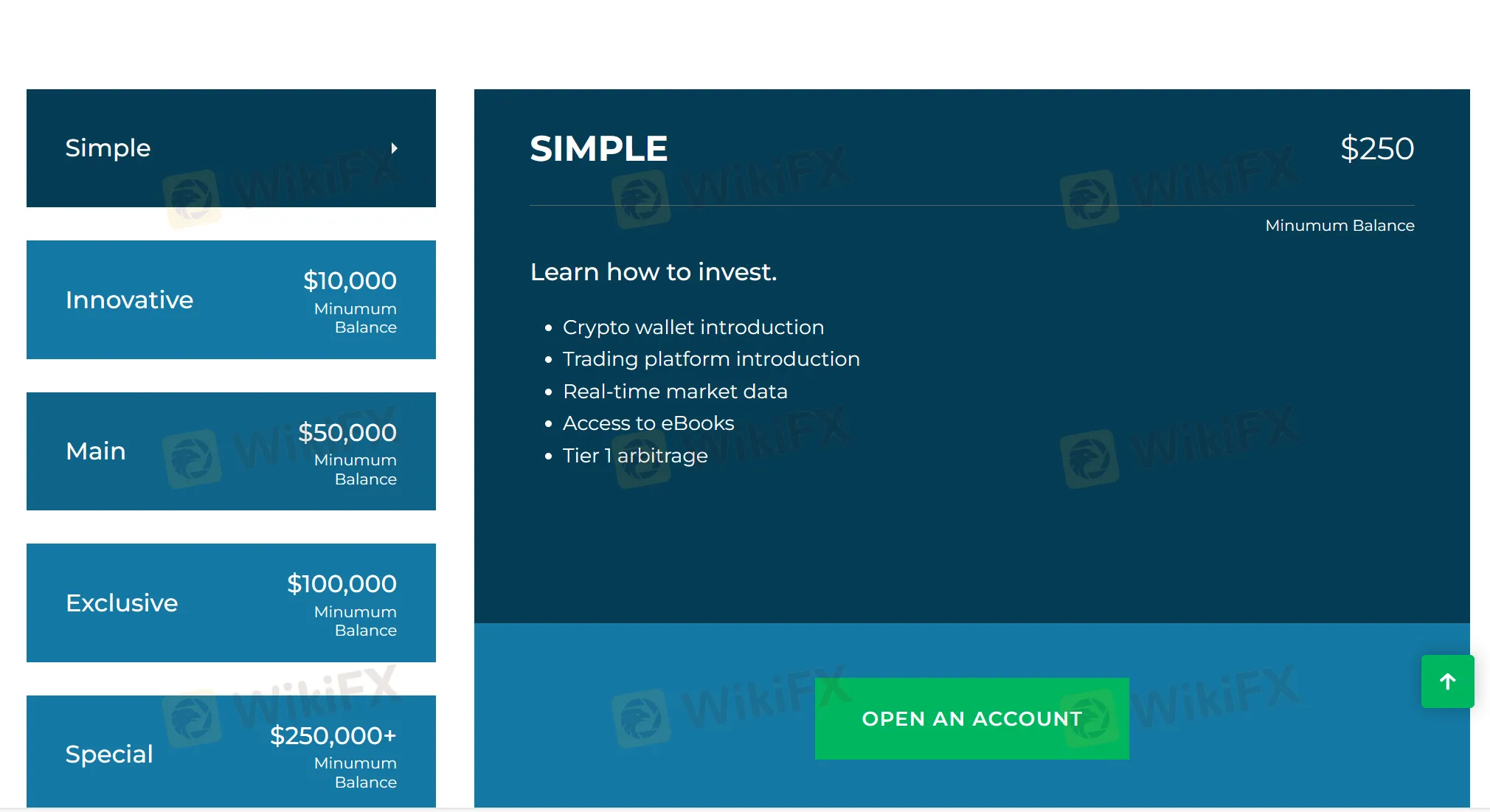

The Revenue Center Pro offers SPECIAL, EXCLUSIVE, MAIN, INNOVATIVE, and SIMPLE accounts with the minimum deposit requirement of $250,000, $100,000, $50,000, $10,000 and $250 respectively.

| Account Type | Minimum Deposit Requirement |

| SPECIAL | $250,000 |

| EXCLUSIVE | $100,000 |

| MAIN | $50,000 |

| INNOVATIVE | $10,000 |

| SIMPLE | $250 |

Leverage

The Revenue Center Pro offers a maximum leverage of 1:400, which means that traders can potentially trade with a position size that is 400 times larger than their actual account balance. Leverage allows traders to gain exposure to larger market positions with a smaller amount of capital.

However, it's important to note that while high leverage can bring the potential for higher returns, it also amplifies the risks involved in trading. Traders should exercise caution and carefully consider their risk tolerance and trading strategy before utilizing high leverage.

Spreads & Commissions

The Revenue Center Pro offers spreads ranging from 1.6 pips for the Simple and Innovative accounts, 1.5 pips for the Main account, 0.5 pips for the Exclusive account, and 0.0 pips for the Special account. However, commission details are not specified on the webiste.

| Account Type | Spread Range | Commission |

| SPECIAL | From 0.0 pips | N/A |

| EXCLUSIVE | From 0.5 pips | |

| MAIN | From 1.5 pips | |

| INNOVATIVE | From 1.6 pips | |

| SIMPLE | From 1.6 pips |

Trading Platforms

The Revenue Center Pro is a trading platform that provides accessibility through its Web Trader interface. This means that users can conveniently access and trade on the platform directly through their web browser, without the need for any additional software downloads or installations.

The Web Trader interface typically offers a user-friendly trading environment with various tools and features for executing trades, analyzing market data, and managing positions. It allows traders to access their trading accounts and make trades from any device with an internet connection, making it convenient for users who prefer browser-based trading platforms.

Deposits & Withdrawals

The Revenue Center Pro provides a restricted set of payment methods for deposits, including Credit/Debit cards,e-wallets ( (APM, EFT)) and wire transfers.

| Deposit time | Withdrawal time | Price | |

| Bank wire | 2-5 business days | 5-10 business days | $25+ |

| Credit card | Instant | 24 hours | Free |

Customer Service

Customers can visit their office or get in touch with customer service line using the information provided below:

Email: support@revenuecenterpro.email

The Revenue Center Pro offers online messaging as part of their trading platform. This allows traders to communicate with customer support or other traders directly through the platform. Online messaging can be a convenient way to get real-time assistance or to engage in discussions with fellow traders.

Conclusion

In conclusion, it is important to note that The Revenue Center Pro currently has no valid regulation, as indicated by an abnormal regulatory status and an unauthorized official regulatory status.

The factor, combined with the limited payment methods offered and high minimum deposit requirements, highlight the importance of conducting thorough due diligence and exercising caution when considering investing with The Revenue Center Pro.

Frequently Asked Questions (FAQs)

| Q 1: | Is The Revenue Center Pro regulated? |

| A 1: | No. It has been verified that this broker currently has no valid regulation. |

| Q 2: | How can I contact the customer support team at The Revenue Center Pro? |

| A 2: | You can contact via email, support@revenuecenterpro.email. |

| Q 3: | Does The Revenue Center Pro offer demo accounts? |

| A 3: | No. |

| Q 4: | What is the minimum deposit for The Revenue Center Pro? |

| A 4: | The minimum initial deposit to open an account is $250. |

| Q 5: | At The Revenue Center Pro, are there any regional restrictions for traders? |

| A 5: | Yes. They are unable to accept traders who are residents of The United States, Cuba, Democratic People's Republic of Korea (North Korea), Iran, and Syria. |

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

Latest News

Yen in Peril: Wall Street Eyes 160 as Structural Outflows Persist

RM238,000 Lost to a Fake Stock Scheme | Don't Be The Next Victim!

FX Markets: Dollar Holds Firm at 98.00; Euro and Kiwi Breach Key Technical Levels

“Elites’ View in Arab Region” Event Successfully Concludes

Bond Markets Signal 'Hawkish' Risk: The Era of Cheap Money is Officially Over

FP Markets Marks 20 Years of Global Trading

GivTrade Secures UAE SCA Category 5 Licence

Is 9X markets Legit or a Scam? 5 Key Questions Answered (2025)

Common Questions About GLOBAL GOLD & CURRENCY CORPORATION: Safety, Fees, and Risks (2025)

What Is a Liquid Broker and How Does It Work?

Rate Calc