MEXEM

Abstract:MEXEM, founded on July 28, 2008, is a Cyprus-based broker regulated by CySEC. It provides access to diverse instruments like stocks, ETFs, and futures, and supports multiple trading platforms. However, it does not offer MT4/MT5 and has limited educational support for beginners.

| MEXEM Review Summary | |

| Founded | 2008 |

| Registered Country/Region | Cyprus |

| Regulation | CySEC, FCA (Revoked) |

| Trading Products | Stocks, Bonds, ETFs, Options, Futures, Warrants, Mutual Funds, Metals |

| Demo Account | / |

| Leverage | / |

| Spread | / |

| Trading Platform | Client Portal, TWS, MEXEM Lite, MEXEM APIs |

| Minimum Deposit | / |

| Customer Support | Contact form |

| Phone: +357-25030447 | |

| Email: info@mexem.com | |

MEXEM Information

MEXEM, founded on July 28, 2008, is a Cyprus-based broker regulated by CySEC. It provides access to diverse instruments like stocks, ETFs, and futures, and supports multiple trading platforms.

Pros and Cons

| Pros | Cons |

| Long operational history | Revoked FCA license |

| Regulated by CYSEC | Commission fees charged |

| Various trading products | Limited educational resources for beginners |

| Free initial withdrawal |

Is MEXEM Legit ?

MEXEM is currently regulated by the Cyprus Securities and Exchange Commission (CySEC) and was previously regulated by the UK Financial Conduct Authority (FCA), but its license has been revoked.

| Regulatory Authority | Regulated by | Regulatory Status | Licensed Entity | License Type | License Number |

| Financial Conduct Authority (FCA) | United Kingdom | Revoked | Mexem Ltd | European Authorized Representative (EEA) | 787270 |

| Cyprus Securities and Exchange Commission (CySEC) | Cyprus | Regulated | Mexem Ltd | Appointed Representative (AR) | 325/17 |

What Can I Trade on MEXEM?

MEXEM offers 8 types of trading instruments: stocks, bonds, ETFs, options, futures, warrants, mutual funds, and metals.

| Tradable Instruments | Supported |

| Stocks | ✔ |

| Bonds | ✔ |

| ETFs | ✔ |

| Options | ✔ |

| Futures | ✔ |

| Warrants | ✔ |

| Mutual funds | ✔ |

| Metals | ✔ |

| Forex | ❌ |

| Other Commodities | ❌ |

| Indices | ❌ |

| Cryptocurrencies | ❌ |

Account Type

Individual Account Types: Individual, Joint, Family Office, Friend & Family

Business and Professional Account Types: Small Business, Advisor, Funding Manager, Proprietary Trading Groups, Hedge & Mutual Fund, Compliance Officers

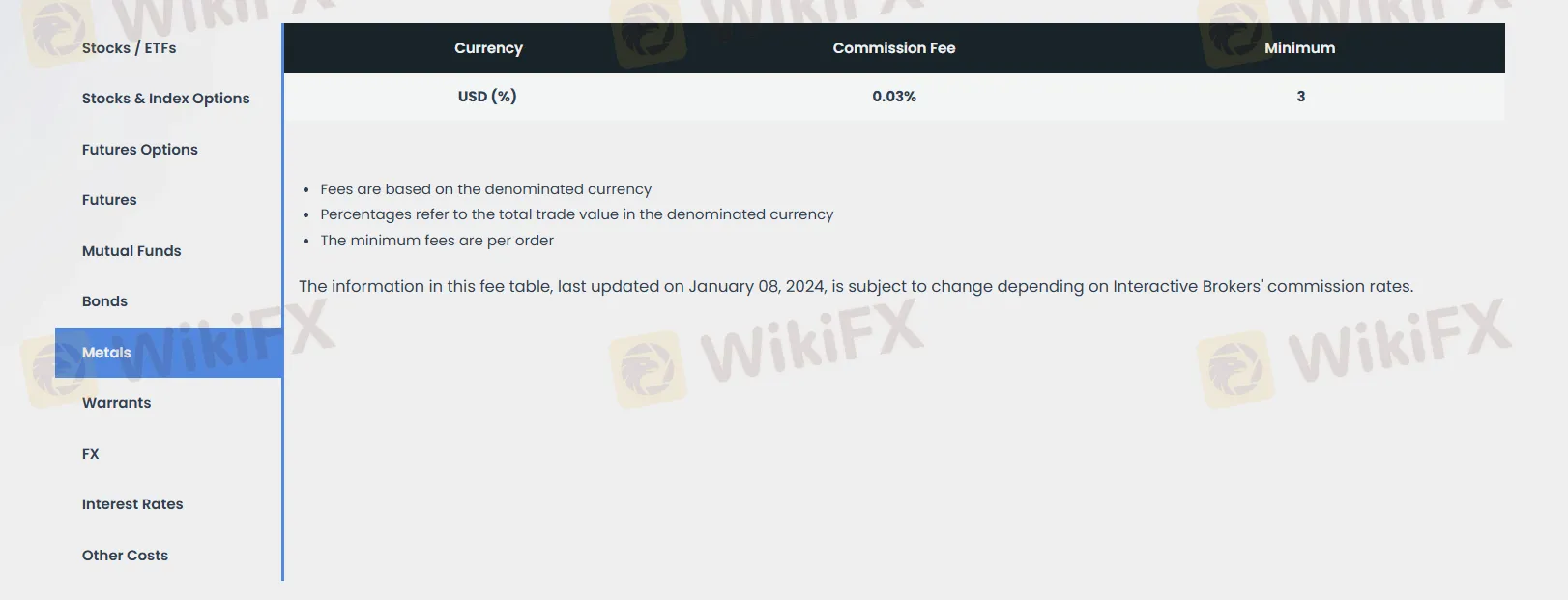

MEXEM Fees

MEXEMs fee structure varies by product. Below is a summary of the main commissions and minimum fees in USD:

| Trading Product | Commission Fee | Minimum Fee |

| Stocks and ETFs | $0.005 per share | $1 |

| Stocks & Index Options | 2 | $2 |

| Futures Options | 4 | $3.50 |

| Futures | 1 | $1 |

| Metals | 0.03% | $3 |

| Bonds | 0.15% | $8 |

| Forex (FX) | 0.005% | $5 |

Trading Platform

MEXEM offers four types of trading platforms.

| Trading Platform | Supported | Available Devices |

| Client Portal | ✔ | Web |

| TWS | ✔ | PC, mobile, watch |

| MEXEM Lite | ✔ | iOS, Android |

| MEXEM APIs | ✔ | Custom, Third-party apps |

Deposit and Withdrawal

For withdrawals, MEXEM offers a free allowance for the first withdrawal. For example, SEPA and wire transfers in the Eurozone are free within 30 days of account activation; after that, they incur fees of €1 and €8 respectively. USD withdrawals are free for the first transaction, then $10 per transaction afterward. GBP withdrawals are also free for the first time, with a £7 fee for each subsequent withdrawal.

Read more

Fake FP Markets Exposure: Allegations of Fund Withdrawal Denials & Trade Manipulation

Did you experience a surprise cancellation of the profits made on the Fake FP Markets trading platform? Did you face more losses than what’s mentioned on your stop-loss order? Did you lose all your capital invested through a supposedly introducing broker? Failed to receive access to the FP Markets withdrawal despite a long delay from the application date? You are not alone! In this Fake FP Markets review article, we have investigated some complaints concerning withdrawal denials and trade manipulation. Read on as we share updates below.

CMTrading Review: Is It Legit or a Scam? Check It Out Now!

Did you experience a difference in the CMTrading withdrawal experience when requesting a small and a large amount? Did the Cyprus-based forex broker accept your requests when the withdrawal amount was small and deny when it was high? Were you told to pay a processing fee that seemed illegitimate in your context? Did the broker scam you by prompting you to deposit more after showing your initial profits? In this CMTrading review article, we have investigated the broker in light of the complaints. Check them out.

Sheer Markets Review: Broker Legit or Not?

CySEC #395/20 regulates Sheer Markets as a Market Maker for MT5 CFDs, but 1:30 leverage, inactivity fees, and the lack of e-wallets raise questions about reliability. Read a neutral review before depositing $/€200.

NinjaTrader Review: Platforms & Risks (2026)

NinjaTrader offers strong futures/forex platforms but faced a $250K NFA fine for AML lapses. Regulated status holds. Read the full 2026 review.

WikiFX Broker

Latest News

Capital.com Review: Is Your Money Locked Inside this Broker?

AssetsFX Regulation: A Complete Guide to Licenses and Trading Risks

ZarVista User Reputation: Looking at Real User Reviews to Check if It's Trustworthy

ZaraVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

S. Africa Energy Gridlock: Glencore Proposal Stalls Amid Regulatory Clash

TP Trader Academy ‘The Axis Event’: Pioneering Trading Education at the Heart of Tech and Data

Is Fortune Prime Global Legit Broker? Answering concerns: Is this fake or trustworthy broker?

Pinnacle Pips Forex Fraud Exposed

Grand Capital Review 2026: Is this Broker Safe?

XSpot Wealth Exposure: Traders Report Withdrawal Denials & Constant Deposit Pressure

Rate Calc