World Forex-Some important Details about This Broker

Abstract: World Forex was established in 2007 and is registered in Saint Vincent and the Grenadines. It is not regulated by any top-tier organization, but it does provide a wide range of trading services such as forex, commodites, and share CFDs. The platform supports both MT4 and MT5, with leverage up to 1:1000 and a low entrance barrier of only $1.

| World Forex Review Summary | |

| Founded | 2007 |

| Registered Country | Saint Vincent and the Grenadines |

| Regulation | No regulation |

| Market Instruments | Forex, Commodities, Share CFDs |

| Demo Account | ✅ |

| Leverage | Up to 1:1000 |

| Spread | Fixed from 1.8 pips (W-CENT-fix account) |

| Trading Platform | MT4, MT5 |

| Minimum Deposit | $1 |

| Customer Support | Live Chat |

| Russia: 8 800 555-78-99 / +7 495 266 60 77 | |

| UK: +44 204 577 1496 | |

| Email: support@wforex.com | |

World Forex Information

World Forex was established in 2007 and is registered in Saint Vincent and the Grenadines. It is not regulated by any top-tier organization, but it does provide a wide range of trading services such as forex, commodites, and share CFDs. The platform supports both MT4 and MT5, with leverage up to 1:1000 and a low entrance barrier of only $1.

Pros and Cons

| Pros | Cons |

| Very low minimum deposit ($1) | No regulation |

| Live chat support | Withdrawal fees charged |

| MT4 & MT5 supported across all devices | |

| Demo accounts available | |

| Long operational history | |

| Various account choices | |

| Diverse payment options |

Is World Forex Legit?

World Forex is not regulated by any recognized financial authority. While the company claims to have an international financial license, it is not overseen by prominent regulators like the FCA (UK), ASIC (Australia), CySEC (Cyprus), or FINMA (Switzerland).

According to WHOIS records, the domain name vtindex.com was registered on June 12, 2004 and last updated on November 3, 2023. It is now operational and protected, with the following restrictions: client deletion, client renewal, client transfer, and client update are all forbidden.

What Can I Trade on World Forex?

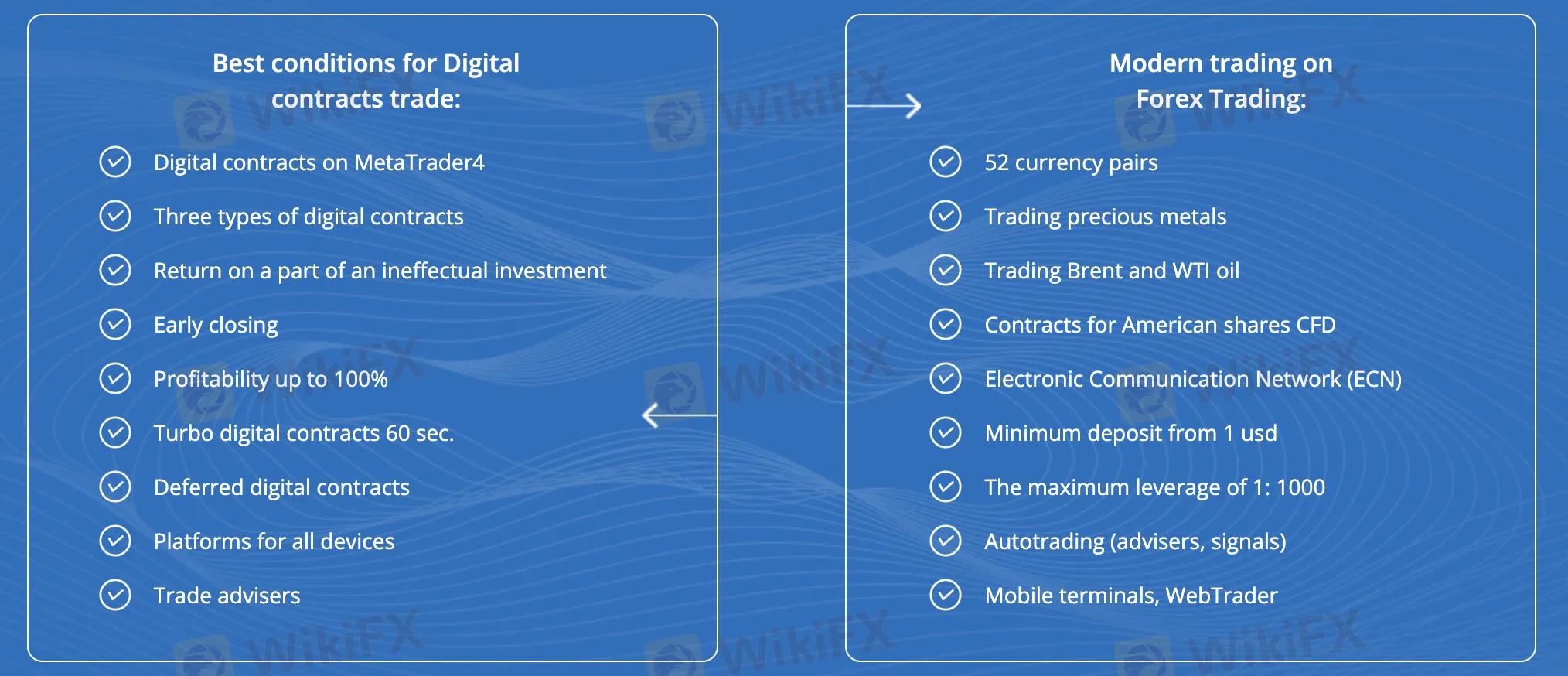

52 currency pairs, key commodities, and CFDs on U.S. stocks are just a few of the many tradable products that World currency offers. Additionally, it allows digital contracts that have features like turbo options and early closing.

| Instrument Type | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Share CFDs | ✔ |

| Indices | ❌ |

| Cryptos | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Account Type

World Forex provides six types of actual trading accounts and fully functional demo accounts. Two of the accounts (W-CENT and W-PROFI) provide swap-free choices for traders who want to avoid overnight interest payments. All accounts feature MetaTrader 4/5, mobile/web trading, and require a minimum deposit of $1, with leverage up to 1:1000.

| Account Type | Trading Platform | Accepted Currency | Spread | Leverage | Swap-Free | Minimum Deposit | Commission | Trading Instruments |

| W-CENT-fix | MT4/MT5 | USD/EUR cents | Fixed from 1.8 pips | 1:33 – 1:1000 | ✔ | $1 | 0 | Forex, CFDs, metals, oil |

| W-CENT | Floating from 0.6 pips | ✔ | Forex, metals, oil | |||||

| W-PROFI-fix | USD/RUR/EUR | Fixed from 1.8 pips | ✔ | Forex, CFDs, metals, oil | ||||

| W-PROFI | Floating from 0.6 pips | ✔ | Forex, metals, oil | |||||

| W-CRYPTO | USD/RUR | Floating from 0 pip | 1:1 – 1:25 | ❌ | 0.50% | Cryptos (17 assets) | ||

| W-DIGITAL | MT4 | USD/RUR/EUR | Fixed from 1.8 pips | – | ❌ | 40% early close fee | Digital contracts (Forex, metals, oil) |

Leverage

World Forex provides leverage of up to 1:1000, allowing traders to manage larger amounts with a little initial commitment. This can greatly increase prospective gains and losses.

World Forex Fees

Compared to industry standards, World Forex has usually modest fees. Most account types lack trading commissions, close spreads, and inactivity fees. For some accounts, swap-free choices take the place of conventional swap fees with fixed overnight costs.

Spreads & Commissions

| Account Type | Spread Type | Spread | Commission |

| W-CENT-fix | Fixed | From 1.8 pips | 0 |

| W-CENT | Floating | From 0.6 pips | |

| W-PROFI-fix | Fixed | From 1.8 pips | |

| W-PROFI | Floating | From 0.6 pips | |

| W-CRYPTO | Floating | From 0.0 pips | 0.5% fee |

| W-DIGITAL | Fixed (Digital only) | From 1.8 pips | 40% early close fee (digital only) |

Swap Rates

Standard accounts use market-based swap rates depending on the instrument and position size. Swap-Free Accounts (W-CENT, W-PROFI) replace swaps with a fixed overnight fee, which is payable daily at 00:00 server time. Traditional swaps are not used in cryptocurrency or digital accounts.

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| MetaTrader 4 (MT4) | ✔ | Windows, Mac, Android, iPhone/iPad, Linux | Beginners |

| MetaTrader 5 (MT5) | ✔ | Windows, Mac, Android, iPhone/iPad, Linux | Experienced traders |

Deposit and Withdrawal

World Forex does not charge any deposit fees for most methods, but withdrawal costs do apply and vary depending on the payment method. Depending on the method used, the minimum deposit amount can be as low as $1.

| Payment Method | Transfer Currency | Minimum Deposit | Deposit Fee | Withdrawal Fee | Deposit Time | Withdrawal Time |

| VISA/MasterCard | USD, EUR | 30 USD/EUR | 0 | 4% + 5 USD/EUR | Instant | 30 minutes |

| Sberbank Online | RUB | 1 USD or equivalent | 2.5% + 50 RUB | Up to 24 hours | ||

| Tinkoff Bank | ||||||

| Alfa-Click | Instant | |||||

| Promsvyazbank | ||||||

| Russky Standart | ||||||

| Payeer | 10 RUB | 1% | ||||

| Perfect Money | RUB, USD, EUR | 1 USD or equivalent | 3.80% | |||

| ADVcash | 1.50% | |||||

| Dash | Dash | Varies by provider | Up to 6 hours | |||

| Apple Pay | RUB, USD, EUR | 300 RUB | 2.5% + 50 RUB | Instant | ||

| Google Pay | RUB | |||||

| Wire Transfer | RUB, USD, EUR, KZT | 200 USD or equivalent | Bank fees apply | Depends on receiving bank | Up to 5 days |

Read more

TAG MARKETS Review 2026: Allegations of Withdrawal Denials & Trading Glitches

Did your good trading experience with TAG MARKETS reverse when applied for fund withdrawals at the Mauritius-based forex broker? Besides withdrawal denials, did you also witness account blocks or deletions by the broker? Did the broker’s customer support team fail to provide you a proper reason for these trading activities? Have you also witnessed glitches on deposit bonus? These allegations have only grown further in 2026. Read on as we share these allegations in this TAG MARKETS review article.

MYFX Markets: Is it Legit or a Scam? This Review Will Tell You the Answer!

Is your trading experience with MYFX markets full of fund withdrawal denials despite repeated communications with its customer support team? Has the broker deleted all your profits? Did the broker accuse you of false trading strategy implementation while deleting your profits? There have been many such instances reported by traders against these activities online. In this MYFX Markets review article, we have shared some complaints. Take a look!

Exfor Exposure: Investigating Alleged Withdrawal Denials, Illegitimate Account Closure & More

Exfor, a Malaysia-based forex broker, has allegedly been the centre of attention for all the wrong reasons. These include long-pending withdrawal denials, no communication or assistance from the broker’s customer support team, manipulated pricing upon a withdrawal request by the trader, and account blowups due to bonus-related issues. It’s the traders who allegedly bear the brunt of all these suspicious trading activities. A lot of them have criticized it on broker review platforms. We have highlighted some of their complaints in this Exfor review article. Take a look!

Axiory Exposed: Low WikiFX Score & Trader Complaints!

Axiory WikiFX score 1.5: Active Belize FSC license (no FX authorization), multiple complaints. Reports show withdrawal/support issues. Traders beware.

WikiFX Broker

Latest News

Understanding Dbinvesting Deposit and Withdrawal: What Traders Should Know

TradeEU Global Review 2026: Is this Forex Broker Legit or a Scam?

Emerging Markets: South African Fiscal Strains in Focus Amid Calls for SOE Reform

China Economic Watch: PMI Divergence and "Two Sessions" Signal Structural Shift

Is Tradier a trustworthy broker? A Tradier review and licensing overview based on WikiFX data.

Oil Spikes 9% and Shipping Rates Soar as Middle East Logistics Fracture

AssetsFX Review 2026: Is this Broker Safe?

Fed Beige Book: Stagflation Risks Rise as Growth Stalls While Prices Stick

Asia Market Volatility: KOSPI Stages Historic 12% Rebound as Capital Flows Pivot

Evest Broker Review: Regulated, but Complaints Persist

Rate Calc