ICM Brokers-Overview of Minimum Deposit, Spreads & Leverage

Abstract:ICM Brokers, established in 2009, is a broker registered in the Marshall Islands that provides CFD trading on forex, commodities, indices, stocks, and cryptocurrency. While the broker offers MetaTrader 4 platforms and a 20-day sample account, there is no regulatory monitoring or transparency about fee structures.

| ICM Brokers Review Summary | |

| Founded | 2009 |

| Registered Region | Marshall Islands |

| Regulation | No regulation |

| Market Instruments | Forex, Commodities, Indices, Stocks, Cryptos (all as CFDs) |

| Demo Account | ✅ |

| Leverage | Up to 1:400 (Standard/Prime), |

| Up to 1:5 (Crypto) | |

| Spread (EUR/USD) | From 2 pips (Standard account, fixed) |

| Trading Platform | MT4 Windows, MT4 WebTerminal, MT4 Mobile, MT4 MultiTerminal |

| Minimum Deposit | $50 |

| Customer Support | Live Chat |

| Phone: +1-539-207-9177 | |

| Email: info@icmbrokers.com | |

ICM Brokers Information

ICM Brokers, established in 2009, is a broker registered in the Marshall Islands that provides CFD trading on forex, commodities, indices, stocks, and cryptocurrency. While the broker offers MetaTrader 4 platforms and a 20-day sample account, there is no regulatory monitoring or transparency about fee structures.

Pros and Cons

| Pros | Cons |

| Wide range of tradable instruments | Not regulation |

| Offers MetaTrader 4 across all major devices | High spreads on Standard account |

| Supports multiple live accounts and demo access | No Islamic account |

Is ICM Brokers Legit?

ICM Brokers is not a regulated brokerage. It is registered in the Marshall Islands, a country that lacks a recognized financial regulatory authority for forex or brokerage services.

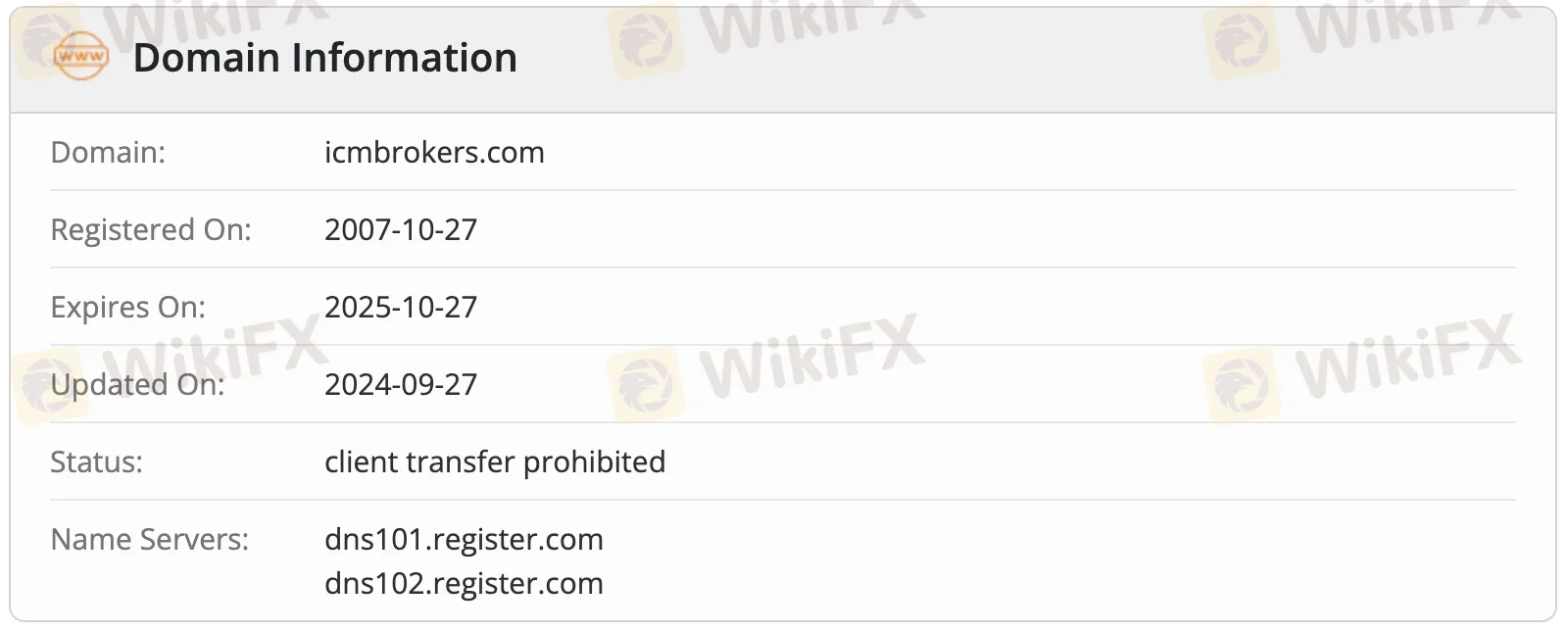

Its domain, icmbrokers.com, was registered on October 27, 2007, and is still live with transfer restrictions in place. Despite being online for some years, it operates without governmental monitoring, posing a significant risk to investors.

What Can I Trade on ICM Brokers?

| Tradable Instrument | Supported |

| Forex | ✔ |

| CFDs | ✔ |

| Commodities | ✔ |

| Indices | ✔ |

| Stocks | ✔ |

| Cryptos | ✔ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Account Types

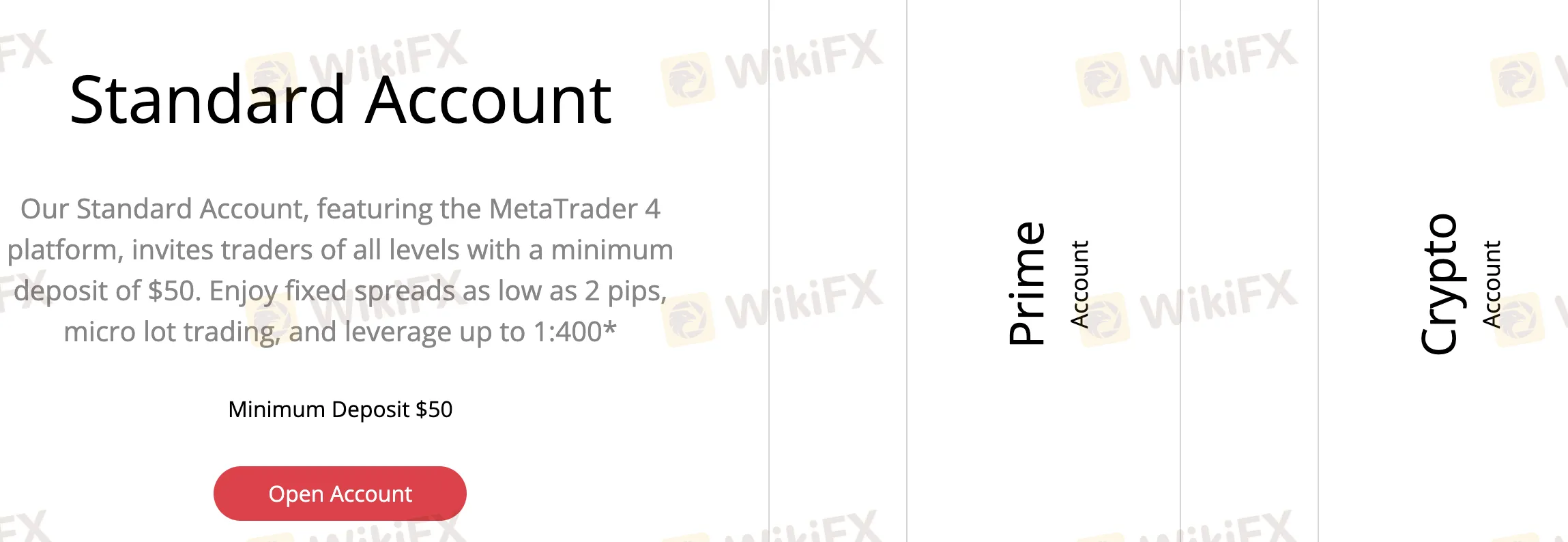

ICM Brokers provides three live account options and one demo account. It does not mention any Islamic accounts.

The Standard and Prime accounts are for general traders of various skill levels, and the Crypto account is for crypto-focused traders.

A demo account is available, with a free trial period of 20 days.

| Account Type | Minimum Deposit | Leverage | Spread | Suitable for |

| Standard Account | $50 | Up to 1:400 | Fixed, from 2 pips | All-level traders |

| Prime Account | Market, from 1.2 pips | Intermediate & experienced | ||

| Crypto Account | $1,000 | Up to 1:5 | Market (Crypto only) | Crypto-focused, higher capital |

Leverage

ICM Brokers provides leverage of up to 1:400 on Standard and Prime accounts, and 1:5 on Crypto accounts. High leverage enables greater bets with less cash, but it also raises the danger of significant losses.

ICM Brokers Fees

ICM Brokers' fees are generally comparable to industry standards, while spreads on the Standard account are somewhat high.

| Account Type | Spread | Commission |

| Standard | Fixed, from 2 pips | ❌ |

| Prime | Market, from 1.2 pips | ❌ |

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 Windows | ✔ | Windows PCs | All traders; supports EAs & analysis |

| MT4 WebTerminal | ✔ | All browsers (Web-based) | Traders who prefer no software installation |

| MT4 Mobile | ✔ | iOS & Android devices | Traders who trade on the go |

| MT4 MultiTerminal | ✔ | Windows PCs | Managers handling multiple accounts |

| MT5 | ❌ | / | Experienced traders |

Read more

Exnova Exposed: Reports of Failed Deposits & Withheld Withdrawals from Traders

Does your deposit amount fail to reflect in your Exnova forex trading account? Does the same thing happen even when withdrawing? Does the Exnova bonus lure lead to a NIL account balance? Has the broker terminated your account without any explanation? These trading issues have become synonymous with traders here. Some traders have openly criticized the broker on several review platforms online. In this Exnova review article, we have highlighted the miserable forex trading experiences.

FXCM Broker ASIC Stop Order Halts CFD Sales

FXCM Broker ASIC Stop Order blocks new CFD trading for retail clients in Australia due to TMD flaws. Explore FXCM Broker CFD Trading Ban Australia impacts, retail client restrictions, and next steps for traders.

FortuixAgent Review: A Tale of Account Restrictions & Withdrawal Denials

Has your FortuixAgent app for forex trading been restricted? Does the broker not allow you to withdraw your initial deposits? Does the UK-based forex broker demand payment out of your earnings to allow withdrawals? These issues refuse to leave traders, as they come out expressing their frustration on broker review platforms. In this Fortuixagent review article, we have shared many complaints made against the broker.

Is Tiger Brokers Regulated? Investor Protection Guide

Tiger Brokers offers regulated trading in US, HK, SG stocks & futures. SFC-approved in HK (BMU940), FMA in NZ. No min deposit, competitive fees.

WikiFX Broker

Latest News

Identity Theft in FX: FCA Flags New 'Clone' Broker Mimicking Fortrade

Oron Limited Regulation: A Complete 2025 Review of Its License and Safety

The Problem With GDP

Polymarket Launches First U.S. Mobile App After Securing CFTC Approval

Thailand Seizes $318 Million in Assets, Issues 42 Arrest Warrants in Major Scams Crackdown

RM460,000 Gone: TikTok Scam Wipes Out Ex-Accountant’s Savings

The "Balance Correction" Trap: Uncovering the Disappearing Funds at Vittaverse

Adam Capitals Review 2025: A Detailed Look at an Unregulated Broker

NordFX.com Review Reveals its Hidden Negative Side- Must-Read Before You Trade

Tauro Markets Review: Tons of Withdrawal Rejections & Trading Account Terminations

Rate Calc