03/11 Market report

Abstract:XAUUSD / USOIL / Dow Jones Index USA30 / EURUSD

【XAUUSD】

The all-time high of gold 2075USD per ounce was in August 2020 and the previous few days had a high of 2069USD per ounce. The price difference between the two is not much. The all-time high in 2020 was because the outbreak of the epidemic affected the global economy. This time in 2022, it was mainly because of the war between Russia and Ukraine that triggered the world's economic sanctions on Russia. With the war between Russia and Ukraine still going on and although it has been negotiated four times, the situation is still likely to escalate. The officials negotiating between the two sides have become larger.

Gold's daily technical line also began to enter contradictions with the Alligator gold cross and KD death cross. From the challenge of the swing highs to a pull-back near 2000USD per ounce, it then began to oscillate around that region. Gold has a strong buying strength, but there is also some selling pressure. It will be difficult to see the clear direction in the short period of time.

XAUUSD – D1

Resistance point 1: 2020.00 / Resistance point 2: 2050.00 / Resistance point 3: 2080.00

Support point 1: 1980.00/ Support point 2: 1950.00/ Support point 3: 1920.00

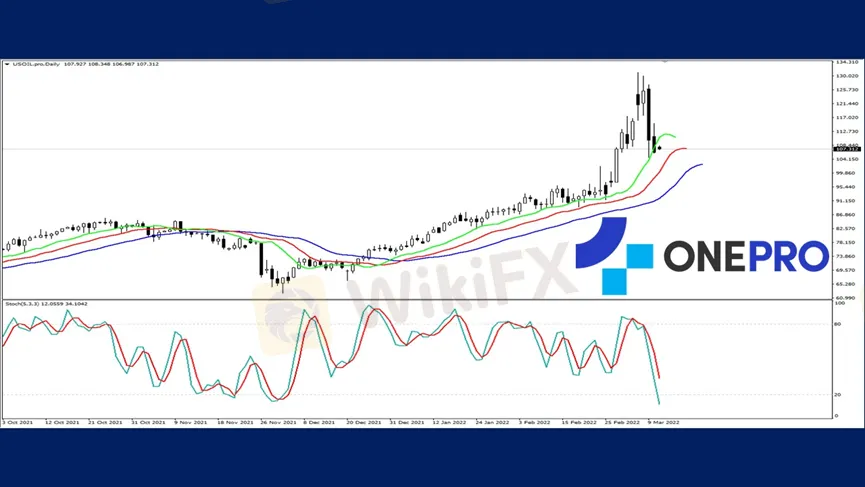

【USOIL】

Russian President Putin stated in the government meeting that Russia has the obligation to fully fulfil the contract energy. This news is coupled with a statement by the Iraqi minister that OPEC+ members are actively achieving a balance between supply and demand to ensure market stability. With the strong support of the producers of these crude oils, the oil's rise has been temporarily suppressed and it returned to between 100USD and 110USD per barrel. Market analysts at Morgan Stanley believe that the market has not yet reflected the actual price of crude oil and if affected by the embargo and we may see a price of 150USD per barrel in the future.

At this stage, crude oil moving average began to narrow at the opening. KD is also slowly entering a lower figure. The actual market supply and demand have not been balanced and so it is not easy to return to the normal crude oil price.

USOIL – D1

Resistance point 1: 108.500 / Resistance point 2: 110.500 / Resistance point 3: 113.800

Support point 1: 105.200/ Support point 2: 103.500/ Support point 3: 102.800

【Dow Jones Index USA30】

The U.S. CPI index of 7.9% in February was the biggest increase in 40 years. This is even higher than the 7.5% increase in January. The impact of the war between Russia and Ukraine has not yet been calculated, and it is noticeable how quickly the consumer's price has risen. The next thing to note would be on US Federal Reserve interest rate hike in March. As it nears to the date of the interest rate hike, the pattern of the Dow Jones Index is becoming more and more obvious.

From the perspective of the technical line, the Alligator of the Dow Jones Index Daily line is a death cross while the KD is a gold cross. The international situation is unstable. Investors will be waiting for the next catalyst at the US dollar interest rate decision for a momentum to put in some trades.

USA30 –D1

Resistance point 1: 33200 / Resistance point 2: 33500 / Resistance point 3: 34800

Support point 1: 32800/ Support point 2: 32500/ Support point 3: 32200

【EURUSD】

The European Union announced an expansion of sanctions against Russia and increased the blacklist of 160 people by locking in the crypto assets of some individuals as well as put restrictions on the maritime sector. On the other hand, the ECB's decision on the re-interest rate was not moved. However, due to concerns that the possible impact of inflation could be far greater than the war between Ukraine and Russia, the Asset Purchase Program for the Emergency Pandemic (PEPP) was scheduled to end in March and the Asset Acquisition Program (APP) to take place in April, May and June. This is considered to be the beginning of the paving of interest rate increases.

From the euro's daily technical chart, alligator is a death cross and KD is a gold cross. The two different technical line charts are not consistent as the current stage of the euro's buying and selling force on both sides keep constantly changing. However, the current price of the euro is also relatively low in recent years. It will be good to wait for a clear direction.

EURUSD – D1

Resistance point 1: 1.10200 / Resistance point 2: 1.10500 / Resistance point 3: 1.10800

Support point 1: 1.09500/ Support point 2: 1.09200/ Support point 3: 1.09000

OnePro Special Analyst

Buy or sell or copy trade crypto CFDs atwww.oneproglobal.com

The foregoing is a personal opinion only and does not represent any opinion of OnePro Global, nor is there any guarantee of reliability, accuracy or originality in the foregoing.

Forex and CFD trading may pose a risk to your invested capital.

Before making an investment decision, investors should consider their own circumstances to assess the risks of investment products. If necessary, consult a professional investment advisor.

www.oneproglobal.com

Read more

WikiFX Broker

Latest News

If you haven't noticed yet, the crypto market is in free fall, but why?

Renewable Grid Integration: Economics and Technology

Gold Rally Validated as Miners Forecast Doubled Earnings

US Labor Market 'Noise' vs. Reality; Trump Trade Agenda Looms Over Outlook

Emerging Markets: Nigeria's Debt Market Valuation Hits N99.3 Trillion

JPY In Focus: Takaichi Wins Snap Election to Become Japan's First Female Leader

Amaraa Capital Scam Alert: Forex Fraud Exposure

Vebson Scam Exposure: Forex Withdrawal Failures & Fake Regulation Warning

EGM Securities Review: Investigating Multiple Withdrawal-related Complaints

Galileo FX Exposure: Allegations of Fund Losses Due to Trading Bot-related Issues

Rate Calc