Luckystar-Overview of Minimum Deposit, Leverage

Abstract:Luckystar is a forex trading platform registered in China that offers trading services in the forex market. It provides traders with leverage up to 1:100 and a minimum deposit requirement of $300. However, Luckystar's official site is currently not functional. Furthermore, it operates without regulation.

NOTE: Luckystars official site - https://www.luckystarfx.com/home.html is currently not functional. Therefore, we could only gather relevant information from the Internet to present a rough picture of this broker.

| Luckystar Review Summary | |

| Registered Country/Region | China |

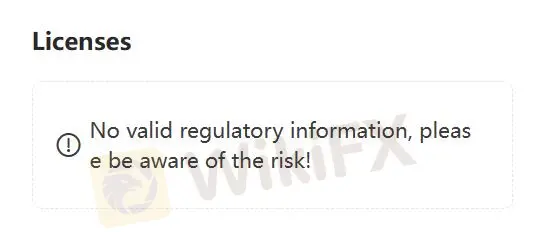

| Regulation | No Regulation |

| Market Instruments | Forex |

| Leverage | Up to 1:100 |

| Minimum Deposit | $300 |

| Customer Support | Email: info@luckystarfx.com |

What is Luckystar?

Luckystar is a forex trading platform registered in China that offers trading services in the forex market. It provides traders with leverage up to 1:100 and a minimum deposit requirement of $300. However, Luckystar's official site is currently not functional. Furthermore, it operates without regulation.

Pros & Cons

| Pros | Cons |

| N/A |

|

|

|

|

Cons:

Lack of regulation: Luckystar operates without regulation, which impacts the platform's reliability and safety.

Non-functional website: The official website of Luckystar is currently not functional, which indicates issues with the platform's operation or legitimacy.

Limited information: Due to the lack of a functional website, there is limited information available about Luckystar, making it difficult for traders to make informed decisions.

Is Luckystar Safe or Scam?

The safety and legitimacy of Luckystar are uncertain due to its lack of regulation and the non-functional official website. Regulation in forex trading helps protect you from unfair practices and ensures the platform operates according to certain standards. Without regulation, you have little recourse if something goes wrong. Additionally, the non-functional website raises serious doubts about the legitimacy and stability of the platform.

Market Instruments

Luckystar specializes in providing trading services for the forex market. This means that users have the opportunity to trade a wide range of currency pairs. Forex trading involves the buying and selling of currencies to make a profit from the fluctuations in exchange rates.

Account Types

Luckystar offers three types of trading accounts with varying minimum deposit requirements.

Micro Account: The minimum deposit for a Micro Account is $300. This account type is suitable for traders who are new to forex trading or prefer to trade in smaller amounts.

Mini Account: The minimum deposit for a Mini Account is $1500. This account type is designed for traders who have some experience in forex trading and are looking to trade in slightly larger amounts.

Standard Account: The minimum deposit for a Standard Account is $3000. This account type is suitable for more experienced traders who are looking to trade in larger amounts.

Leverage

Luckystar offers leverage up to 1:100 for traders. Leverage allows traders to control larger positions with a relatively small amount of capital. While leverage can amplify profits, it also increases the risk of losses, as traders are effectively borrowing funds to increase their trading position.

Customer Service

Luckystar provides customer service through email at info@luckystarfx.com. You can reach out to customer support for assistance with account-related queries, technical issues, and other trading-related matters.

Conclusion

Luckystar presents itself as a forex trading platform, but significant red flags make it a risky option. The biggest concern is the lack of regulation. Regulation protects traders and ensures the platform operates fairly. Another major red flag is the non-functional website. This raises serious doubts about the platform's legitimacy and stability. The recommended course of action is to avoid Luckystar and look for a well-regulated forex broker with a transparent and functional website.

Frequently Asked Questions (FAQs)

Q: Is Luckystar regulated?

A: No, Luckystar operates without regulation.

Q: What is the minimum deposit for a Luckystar account?

A: $300.

Q: What leverage does Luckystar offer?

A: Luckystar offers leverage up to 1:100.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

Read more

Capital.com Shifts to Regional Leadership as CEO Kypros Zoumidou Steps Down

Capital.com transitions to a regional leadership model as Kypros Zoumidou steps down, promoting Christoforos Soutzis as CEO of its Cyprus operations.

eToro Launches Global-Edge Smart Portfolio: A Balanced Approach to Growth and Stability

Online trading platform eToro has recently unveiled its latest investment offering—the Global-Edge Smart Portfolio. This new addition to eToro’s extensive portfolio options provides investors with a balanced approach to investing by combining global stocks and bonds, tailored for those looking for growth and stability.

Something You Need to Know About SogoTrade

Have you ever heard of a broker named SogoTrade? In this article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information.

Webull Introduces 24/5 Overnight Trading to Extend U.S. Market Access

Webull has announced the launch of a new 24/5 Overnight Trading feature for U.S. users, developed in partnership with Blue Ocean ATS. This feature allows Webull’s clients to trade stocks and ETFs outside traditional market hours, from 8:00 pm to 4:00 am ET, Sunday through Thursday.

WikiFX Broker

Latest News

ATFX Expands LATAM Presence with New Mexico Office

CySEC Warns against Public Review Websites

Former Alameda Executives Hand Over Assets in FTX Creditor Recovery Effort

Tradeweb and TSE Partnership Enhances Access to Japanese ETFs

JUST Finance and UBX Launch Multi-Currency Stablecoin Exchange

XM Revamps Website with Sleek Design and App Focus

Global Shift in Cryptocurrency Taxation: Italy and Denmark Chart New Paths

Webull Introduces 24/5 Overnight Trading to Extend U.S. Market Access

TradingView & Mexico’s Uni. Partnership, to Enhance Financial Education

Something You Need to Know About SogoTrade

Rate Calc