Financo-innovation markets--Overview of Minimum Deposit, Leverage, Spreads

Abstract:Financo-innovation markets presents itself as a multi-regulated global forex and shares broker authorized by FCA, ASIC & FSCA and founded in 2013. It claims to provide its clients with the industry-standard MetaTrader4 and MetaTrader5 trading platforms, leverage up to 1:500, low spreads from 0.2 pips on a variety of tradable assets, as well as a choice of three different account types and 24/7 customer support service.

General Information & Regulation

Financo-innovation markets presents itself as a multi-regulated global forex and shares broker authorized by FCA, ASIC & FSCA and founded in 2013. It claims to provide its clients with the industry-standard MetaTrader4 and MetaTrader5 trading platforms, leverage up to 1:500, low spreads from 0.2 pips on a variety of tradable assets, as well as a choice of three different account types and 24/7 customer support service.

Market Instruments

Financo-innovation markets advertises that it is a multi-asset platform with more than 40,000 trading instruments in financial markets, including forex, stocks, cryptocurrencies and real estate.

Account Types

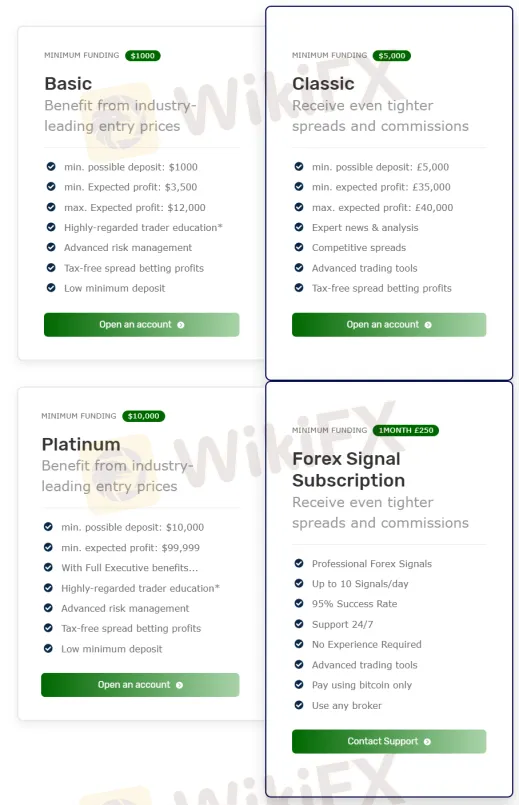

There are three live trading accounts offered by Financo-innovation, namely Basic, Classic and Platinum. Opening a Basic account requires the minimum initial deposit amount of $3,000, while the other two account types with the much higher minimum initial capital requirements of £5,000 and $10,000 respectively. The broker also offers a Forex Signal Subscription package, which requires £250 monthly and traders on this type of package can receive tighter spreads and commissions.

Leverage

The maximum leverage ratio provided by Financo-innovation is much higher than most brokers, up to 1:500. Bear in mind that leverage can magnify gains as well as losses, inexperienced traders are not advised to use too high leverage.

Spreads & Commissions

According to the information displayed on Financo-innovations official website, the spread for forex is as low as 0.2 pips and the commission for stocks starts from £3. More details can be seen in the below screenshot.

Trading Platform Available

When it comes to trading platforms available, Financo-innovation says to give traders the world‘s most trusted and popular MeatTrader4 and MetaTrader5 trading platforms, available on the desktop and mobile terminals, yet we found the broker didn’t exist in the MT4/5 White List. Anyway, we suggest you use MT4 and MT5 which are known as the most successful, efficient, and competent forex trading software. The MT4 offers an intuitive and user-friendly interface, advanced charting and analysis tools, as well as copy and auto-trade options. While the MT5 features real-time quotes, financial news, forex & stock charts, technical analysis and online trading. With the MT4 or MT5 mobile app, trading can be done from anywhere and at any time through the right mobile terminals.

Deposit & Withdrawal

Financo-innovation claims to only accept credit/debit card and bank wire transfers, as well as the cryptocurrency of Bitcoin as its available payment methods. However, from the logos shown at the foot of the home page on its official website, we found that this broker seems to work with Visa, MasterCard, Skrill, PayPal and Neteller, yet we cannot be sure if these payment options are all available. The minimum deposit in BTC (Bitcoin)is said to be £50, while the minimum initial deposit requirement to open an account is $1,000. There are no fees for deposits via either credit/debit cards or wire transfers. When deposits or withdraws with Bitcoin, the broker will not charge a fee, however, there is a standard networking fee of 0.0005 BTC when allocating funds through the Blockchain network. If you send funds from Bitcoin, the funds will credit when they reach 6 confirmations and will take up to 6 hours.

Customer Support

Financo-innovation markets‘ customer support can be reached by telephone: +18134363070, email: support@financo-innovationmarkets.online, live chat or send messages online to get in touch. Besides, you can also follow this broker on some social media platforms like ·YouTube, Facebook, Instagram and Twitter. However, this broker doesn’t disclose other more direct contact information like the company address that most brokers offer.

Read more

Best Binary Options Indicators: Enhance Your Trading Strategy

Binary options trading involves predicting whether an asset's price will rise or fall within a specific timeframe. Unlike traditional investing, more specifically, binary options demand rapid decisions due to fixed expiry times (e.g., 60 seconds to 1 hour). For instance, speculating if EUR/USD will be above 1.0800 in the next five minutes. Success yields a fixed payout, while failure results in the loss of invested capital. Binary indicators distill complex market data—price action, volume, volatility—into actionable signals tailored for short-term trades. Indicators act as a compass, guiding traders to trends, reversals, and optimal entry points, thus enabling traders to detect market shifts for higher-probability decisions.

Baazex Review: Is it safe to invest in it?

Baazex is a relatively new broker registered in the United Arab Emirates, with an operating history of between 2 to 5 years. Despite its claims of offering over 1500 trading instruments—from foreign exchange pairs like EUR/USD, GBP/USD, and AUD/JPY, to major stocks including Apple, Meta, Disney, LVMH, and Tesla; as well as commodities (oil, gold, silver, coffee), indices, cryptocurrencies, and futures—investors should be aware of some critical risks.

New African Currency Marketplace to Boost Cross-Border Trade

PAPSS is piloting an African currency marketplace to improve cross-border commerce, helping businesses exchange local currencies directly across the continent.

Forex BackTesting: Pros and Cons | Best Free Backtesting Software to Explore

Imagine you're driving from New York City to Philadelphia and want to know if your route is optimal, then you take two steps: Firstly, you gather the traffic records in the past five years, including traffic patterns, historic weather conditions, and holiday congestion records. Second, you run simulations of your proposed road to see if it is most efficient and fuel-saving before an actual trip.

WikiFX Broker

Latest News

Indian Watchdog Approves Coinbase Registration in India

SILEGX: Is This a New Scammer on the Block?

How Can Fintech Help You Make Money?

Good News for Nigeria's Stock Market: Big Gains for Investors!

IIFL Capital Faces SEBI's Regulatory Warning

Why Is OKX Crypto Exchange Under EU Probe After Bybit $1.5B Heist?

Gold Trading Insights: Prepare for Moves Above $2,900 Post-CPI

The ‘Boom-S’ Scam: How a Simple Click Led to RM46,534 in Losses

Royal Forex’s CySEC License Revoked: Can It Still Operate Legally?

Trump vs. Powell: The Showdown That Will Shape Global Markets

Rate Calc