GFX-Some important Details about This Broker

Abstract:GFXRoyal is an offshore forex broker registered in Marshall Islands, offering currency trading services for both retail and professional traders. GFX claims that it offers five trading accounts for traders to choose from.

Note: GFX's official website - https://www.gfxroyal.com/ is currently inaccessible normally.

| GFX Review Summary | |

| Founded | 2019 |

| Registered Country/Region | Marshall Islands |

| Regulation | No regulation |

| Market Instruments | Currency pairs, CFDs on indices, commodities, stocks, and cryptocurrencies |

| Demo Account | / |

| Leverage | Up to 1:5 (cryptocurrency) |

| Spread | 6.2 pips (Explorer Account) |

| Trading Platform | Web Trader |

| Min Deposit | $500 |

| Customer Support | Emai: support@gfxroyal.com |

GFXRoyal is an offshore forex broker registered in Marshall Islands, offering currency trading services for both retail and professional traders. GFX claims that it offers five trading accounts for traders to choose from.

GFXRoyal says that it is the trading name of GFX Finance who belongs to CAPITTAL LETTER GMBH, German Investment Firm Incorporation: HRB242418, 23/07/18.

Please note that this brokerage is not subject to any regulatory authorities, please be aware of the risk.

Pros and Cons

| Pros | Cons |

| Diverse tradable assets | Inaccessible website |

| Various accounts choices | Lack of regulation |

| Wide spreads | |

| No MT4 or MT5 | |

| High minimum deposit | |

| Limited payment options | |

| Inactivity fee charged | |

| Only email support |

Is GFX Legit?

No, it is not regulated by the financial services regulatory authority in Marshall Islands, which means that the company lacks regulation from its registration site. Besides, AMF, a French regulatory authority issued a warning notice about this company. Therefore, please be aware of the potential risks!

What Can I Trade on GFX?

GFX offers several types of products, including currency pairs, CFDs on indices, commodities, stocks, and cryptocurrencies.

| Tradable Instruments | Supported |

| Currency Pairs | ✔ |

| CFDs | ✔ |

| Indices | ✔ |

| Commodities | ✔ |

| Stocks | ✔ |

| Cryptocurrencies | ✔ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Leverage

Trading on cryptocurrencies can use leverage up to 1:5, while leverage for other particular instruments is not mentioned.

Account Type

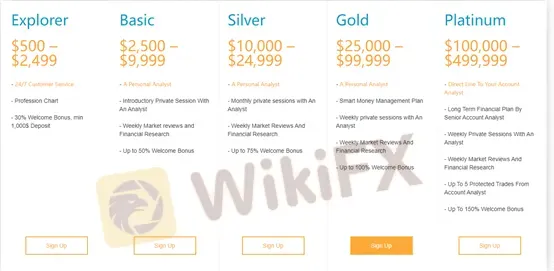

GFX provides 5 types of accounts, including Explorer, Basic, Silver, Gold, and Platinum.

| Account Type | Min Deposit | Max Deposit |

| Explorer | $500 | $,2499 |

| Basic | $2,500 | $9,999 |

| Silver | $10,000 | $24,999 |

| Gold | $25,000 | $99,999 |

| Platinum | $100,000 | $499,999 |

Trading Platform

GFX uses a web-based platform, and it does not support MT4 or MT5.

| Trading Platform | Supported | Available Devices | Suitable for |

| Web Trader | ✔ | Web | / |

| MT4 | ❌ | / | Beginners |

| MT5 | ❌ | / | Experienced traders |

Deposit and Withdrawal

GFX supports 3 types of payment options, including Wire Transfer, Vload, and Cashier. However, other details such as the processing time and fees are not clear.

Fees

If a trader did not login and trade from his account within three months, then his account will be subject to a deduction of 10% each month.

Read more

Lost Money, Shattered Confidence! Crypto Trader Asks How to Cope After Nearly $270,000 Portfolio Wip

Summary: A real post from a member of the Bitcoin Thai Community struck a chord this December — a crypto trader shared that he lost nearly 10 million Thai baht (about $270,000) trading futures. What began as quick gains spiraled into a complete account wipeout due to high leverage, frequent trading, and repeated top-ups fueled by overconfidence. This painful experience illustrates a timeless trading lesson: markets don’t ruin people — emotions and lack of discipline do.

ForexDana Exposure: Do Traders Witness Fund Scams & Deposit Credit Failures?

Did your deposited amount fail to reflect in the ForexDana forex trading account? Failed to receive an adequate response from the broker’s customer support officials? Do you think that it is a clone firm that cheats traders? Were you fascinated by the profit shown on the trading platform, but could not withdraw funds? Have you been lured into trading by a deposit bonus that does not work in real-time? In this ForexDana review article, we have investigated some complaints against the broker.

SOLIDARY P R I M E Review: Reported Fund Scams & Poor Customer Support

Have you witnessed a complete fund scam experience when trading with SOLIDARY PRIME? Did you have a PAMM account that disappeared suddenly on the broker’s trading platform? Is the SOLIDARY PRIME customer support team inept in handling your trading queries? Did the broker deceive you on binary options? These complaints are showing up on broker review platforms. In this SOLIDARY PRIME review article, we have investigated some of the complaints against the broker. Take a look!

DBInvesting Forex Scams: User Exposure and Reviews

DBInvesting Forex scams exposed: offshore regulation, fake offices, and withdrawal issues. Read the full scam report now.

WikiFX Broker

Latest News

FINRA Fines Cetera $1.1 Million Over Compliance Lapses

FINRA Fines Cetera $1.1 Million Over Compliance Lapses

Upway (JRJR) Review: A Deep Dive into Safety and Regulation

Coinbase Banks Push Advances Crypto Rules

RM668K Gone Overnight: Factory Supervisor Trapped in Fake Investment Scam

Dollar Softens as Fed Signals Shifts; Warsh Leads Nomination Race

Safe-Haven Supercycle: Gold Hits $4,690 as Silver Squeeze Intensifies

Trans-Atlantic Rupture: Markets Brace for Trade War as Trump Issues Greenland Ultimatum

China Delivers 5% Growth Target, Yet December Data Reveals Deepening Consumption and Property Cracks

Italy’s Consob Blocks Five Unauthorized Investment Websites in New Enforcement Action

Rate Calc