Mohicans markets:The Dollar Fretted Over Inflation Data and Fed Officials' Remarks Oil Hurt As U.S. Gulf of Mexico Supply Disruption Eases

Abstract:On Friday, August 12, spot gold rose by about $18 after hitting a low of $1,784.79 and broke through the $1,800 mark, finally closing up 0.69% at $1,802.40 per ounce, and spot silver closed up 2.53% to $20.82 an ounce. The U.S. dollar index expanded its gains in European trading, but fell slightly after rising to a daily high of 105.90, and finally closed up 0.51% at 105.67. The 10-year U.S. bond yield hit a high of 2.906% and pared some of its gains to 2.842% .

Financial Events Today

Tonight at 22:50, the Federal Reserve Board of Governors will host the 2022 Summer Workshop with the theme of “Money, Finance, Payments, and Finance”. Federal Reserve Governor Waller delivered an opening speech. Previously, Fed officials, including Governor Waller, said that at the September FOMC meeting, the most likely scenario is to raise interest rates by 75 basis points again, rather than further accelerate the pace of interest rate hikes. Investors need to pay attention to whether Waller will lower his rate hike forecast in September in this speech.

Closed reminder: South Korean, Italian and Indian stock markets will be closed for one day due to holidays.

Global Views - List of Major Markets

On Friday, August 12, spot gold rose by about $18 after hitting a low of $1,784.79 and broke through the $1,800 mark, finally closing up 0.69% at $1,802.40 per ounce, and spot silver closed up 2.53% to $20.82 an ounce. The U.S. dollar index expanded its gains in European trading, but fell slightly after rising to a daily high of 105.90, and finally closed up 0.51% at 105.67. The 10-year U.S. bond yield hit a high of 2.906% and pared some of its gains to 2.842% . In terms of crude oil, both oil prices fell sharply in the pre-US session. WTI crude oil closed down 2.25% at US$91.87 per barrel. Brent crude oil fell again after briefly standing at the US$100 mark, closing down 1.42% at US$97.84. /bucket. U.S. stocks maintained their gains in late trading on Friday. The Dow closed up 1.27%, the S&P 500 rose 1.73%, the Nasdaq closed up 2.09%, and star technology stocks rose in general, Tesla and Micron Technology rose more than 4%, Apple, Amazon rose about 2%. European stocks generally rose. Germany's DAX30 closed up 0.74% at 13,795.85 points. The UK's FTSE 100 closed up 0.47% at 7,500.89 points. The European Stoxx 50 closed up 0.53% at 3,776.81 points. In terms of cryptocurrencies, Bitcoin has risen sharply since the pre-US market on Friday. It once exceeded $25,000 on the weekend, and has now retreated. Ethereum rose with Bitcoin, once rising to a high of $2,031.6, and now it has fallen back and fell below 2,000 Dollar.

Precious Metal

In the early trading hours of Monday, August 15, spot gold fluctuated slightly and was currently trading around US$1,798. Although the 1800 mark suppressed the price of gold most of the time last week, the one-year inflation expectation in the United States fell to a 6-month low. U.S. import prices fell for the first time in seven months. Investors' expectations for a 75 basis point interest rate hike by the Federal Reserve in September fell. U.S. bond yields fell last Friday, helping gold prices finally rise to around the 1800 mark. From a technical point of view, the short-term upward momentum is still there. There is a high probability that the price of gold will break through the resistance of the 1800 mark this week.

From a fundamental point of view, this week will usher in the monthly rate of retail sales in the United States in July, commonly known as “terrorist data”. Currently, the market expects that the monthly rate of retail sales in the United States in July will decrease from a month-on-month increase of 1% in June to a month-on-month increase of 0.1%, or It will intensify the market's worries about an economic recession and is expected to provide further upward momentum for gold prices. In addition, data showed that net long bets on the dollar fell in the latest week. While the percentage of analysts who are bullish and bearish is about the same, the percentage who are bullish has nearly doubled from the previous week, the survey showed.

However, the U.S. stock market rose sharply, and the S&P 500 index hit a new high in more than three months, which slightly suppressed the safe-haven buying demand of gold, focusing on the resistance near the 200-day moving average at 1842.60. In addition, the speeches of most Fed officials are still hawkish, and gold bulls need to be vigilant.

Fundamentals are mostly bullish

[U.S. import prices fell for the first time in seven months, consumer one-year inflation expectations hit the lowest in six months]

[USD net long bets fell to $12.97 billion in the latest week]

[USD fell 0.84% last week]

[U.S. bond yields fall, investors continue to focus on inflation]

[Russia said to attack the Ukrainian army command post, Ukrainian said to repel the Russian army's attack]

Fundamentals are mostly bearish

[Federal Reserve Barkin says it needs to raise interest rates to a restrictive range to keep inflation under control]

[The S&P 500 and the Nasdaq closed higher for the fourth consecutive week]

[Survey: The Reserve Bank of New Zealand is expected to raise interest rates by 50 basis points for the fourth time in a row in August to control high inflation]

On the whole, the price of gold is running at a relatively high level for the time being, the technical signal is biased towards bulls, the expectation of aggressive interest rate hikes by the Federal Reserve has cooled, the geopolitical situation is tense, and worries about economic recession are lingering, and the price of gold tends to rise in shock in the market outlook.

Crude

During the day, we will focus on the press conference held by the State Council Information Office on the operation of the national economy at 10:00.

Bullish Factors Affecting Oil Prices

[U.S. inflation may have peaked in July, boosting U.S. stocks to close higher]

[Russia claims to attack Ukrainian command post, Ukrainian claims to repel Russian attack]

[U. S. illegally crossed the border to transport 89 oil tankers to Iraq]

On the whole, geopolitical tensions still support oil prices, but supply disruptions in the U.S. Gulf of Mexico will ease, and the epidemic further spreads around the world. Concerns about the demand outlook are rising, and oil prices may be bearish in the short-term.

Foreign Exchange

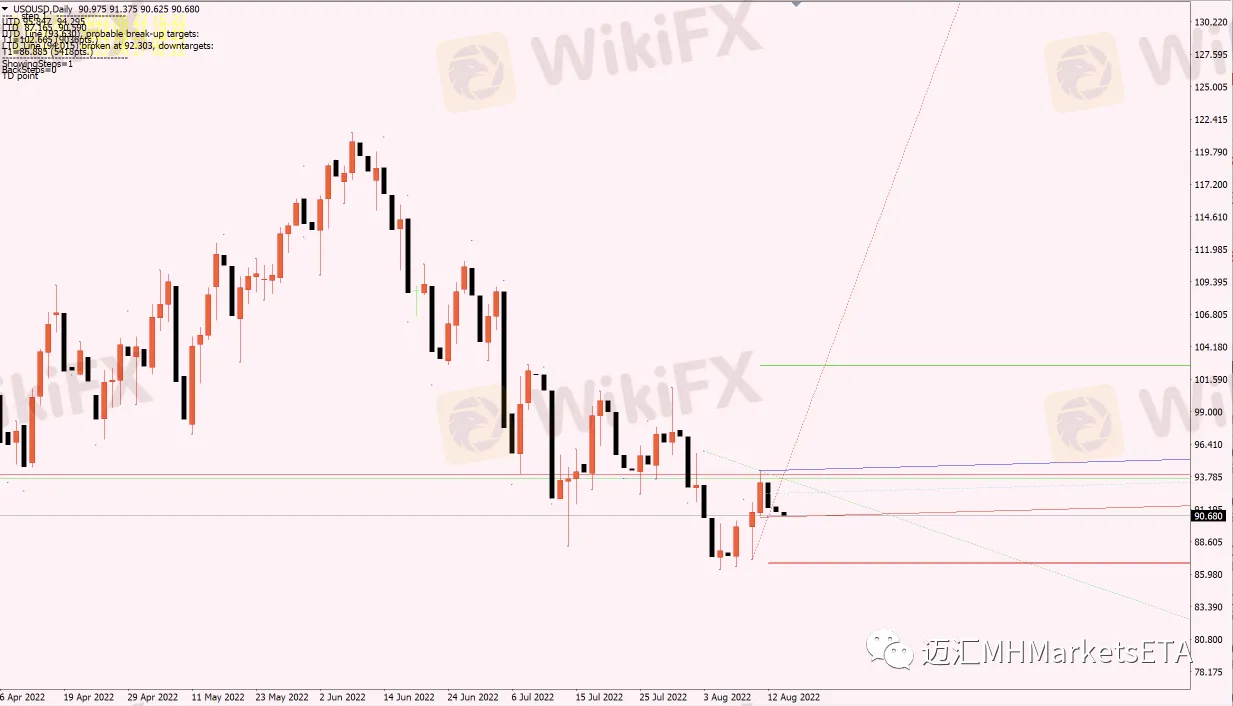

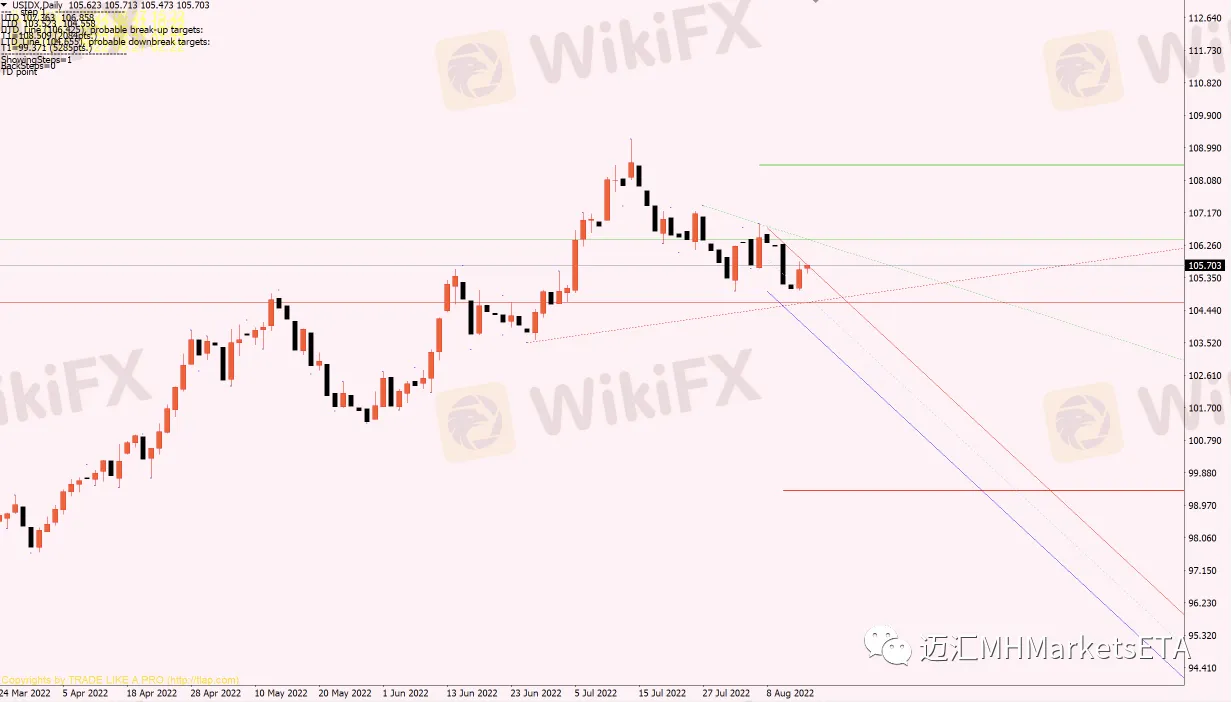

In early Asian trading on August 15, Beijing time, the U.S. dollar index fell slightly to 105.68. The dollar index rebounded on Friday, closing up 0.54% at 105.69. Traders were weighing improving U.S. inflation data against comments from Fed officials. Fed officials have warned that the fight against inflation is far from over.

Data last Wednesday and Thursday showed that two other key inflation indicators, consumer and producer prices, cooled in July, which prompted traders to scale back bets on the Federal Reserve raising interest rates by a third straight 75 basis points at its September meeting.

However, the dollar reversed course after several Fed officials made it clear that they would continue to tighten monetary policy. San Francisco Fed President Daly said on Thursday she was open to the possibility of another 75 basis point rate hike in September to curb excessive inflation.

GBP/USD closed down 0.52% on Friday at 1.2134. UK GDP fell 0.1% quarter-on-quarter in the second quarter, the first contraction since the coronavirus lockdown in early 2021, but the contraction was smaller than market expectations of 0.2%.

The euro closed down 0.59% against the dollar on Friday at 1.0256. Prices in France rose 6.8 percent in July from a year earlier, while inflation in Spain was 10.8 percent, the highest since 1984, data showed. The euro is under pressure as Europe struggles with the war in Ukraine, Europe's search for non-Russian energy sources and a lack of rain battering the German economy.

NZD/USD closed up 0.36% on Friday at 0.6452. At 10:00 on August 17, Beijing time, the Reserve Bank of New Zealand will announce its interest rate decision. Expectations of a rate hike by the New Zealand Federal Reserve boosted the New Zealand dollar's performance.

Things to watch on Monday: Federal Reserve Board of Governors hosts 2022 Summer Workshop on “Money, Finance, Payments and Finance” with opening remarks by Fed Governor Waller.

International News

1. On Friday, the preliminary reading of the U.S. University of Michigan consumer confidence index in August recorded a reading of 55.1, higher than the expected 52.5. Joanne Hsu, director of consumer surveys at the University of Michigan, said that all components of the expected index have improved, especially for low- and middle-income consumers who are particularly sensitive to inflation. The economic outlook for the year ahead rose sharply, slightly above the average for the second quarter of 2022.

2. According to CNN, CBS and other media reports, according to the search warrant and list of search items released by the US Federal Court on the afternoon of the 12th local time, the US Federal Bureau of Investigation is investigating the alleged involvement of former President Trump of three federal charges. Trump, who faces up to 10 years in prison if convicted, asked the FBI on Sunday to return documents confiscated at Mar-a-Lago, the report said.

3. The domestic flight disruption problem that has lasted for more than a week is still fermenting. According to a report by Fox Business Channel on the 12th, American Airlines reproduced a large-scale flight disruption that day, with more than 1,000 flights being delayed or cancelled in a single day. Data from flight tracking website FlightAware shows that as of 10:00 a.m. ET on the 12th, more than 1,000 flights in and out of the United States or within the United States were delayed, and more than 100 flights were cancelled.

4. The Ukrainian State News Agency reported on the 12th that Ukrainian President Volodymyr Zelensky had submitted two draft bills to the Ukrainian Verkhovna Rada (Parliament) on the extension of the wartime state and the general mobilization order. These two bills will be issued on August 23. maturity. In addition, the adviser to the Chief of the Office of the President of Ukraine said on the 13th that Ukraine has no intention to resume talks with Moscow. At present, the dialogue between Ukraine and Russia is limited to resolving the exchange of prisoners and the remains of the deceased.

5. On the 13th local time, Zaporozhye local officials said that Ukraine's Ener Godar and Zaporozhye nuclear power plants were once again attacked by Ukrainian militants. He cited eyewitness sources as saying that explosions could be heard in the city, and that shells were suspected of falling on the banks of the Dnieper River and near the nuclear power plant. At present, the Kakhovka hydropower plant said it had shut down a turbine due to continued attacks.

6. U.S. Energy Secretary Granholm said U.S. gasoline prices fell below $4 a gallon for the first time since March and should fall further. Barring an unforeseen “global event”, the forecast will remain normal, Granholm said.

7. Gazprom has increased gas supplies to Hungary through the Turkstream pipeline, a Hungarian foreign ministry official said on Saturday. EU member Hungary has maintained a pragmatic relationship with Moscow since the outbreak of the Russia-Ukraine conflict, straining relations with some EU states that want a tougher stance. According to the subsequent agreement, Gazprom started to increase gas deliveries to Hungary on Friday, the Hungarian state secretary at the foreign ministry said. In addition, Rosneft confirmed that it had paid Ukraine in full the transit fee for August, and resumed oil shipments to the Czech Republic after Ukraine confirmed receipt of the transit fee.

8. The Saudi Aramco CEO said on Sunday that if needed, Saudi Aramco can produce oil at maximum capacity, and continued investment in the oil industry is necessary, and Saudi Aramco can increase production to 12 million barrels per day at any time the Saudi government requires .

9. An Iranian tanker detained after a U.S. crackdown on Iranian crude exports will soon return to Iran with its shipments of oil, which may eventually help the release of two Greek ships. In addition, Iran is evaluating the “final text” of the Iran deal proposed by the EU, which is “acceptable” on the premise of ensuring that key demands are met. The price premium is $9.5/barrel.

10. Reuters reported on Aug. 14 that the U.S. Bureau of Land Management will suspend oil and gas leases on 2.2 million acres of public lands in Colorado under a settlement, as environmental groups say its current management plan does not account for climate impacts . The agreement, filed in Colorado federal court last Thursday, requires the government to conduct a new environmental analysis of the climate impacts of oil and gas leases on public lands in southwestern Colorado.

11. Last Friday, the Rhine Rhine water level dropped to 40 centimeters in the critical navigable reach, and according to German government data, it is expected to drop to 30 centimeters in the Kaub reach by Monday, and in Further declines followed in the following days. If shipping conditions on the Rhine deteriorate, Germany said it would prioritise rail transport of energy necessities.

12. Germany will limit the heating of public buildings in winter to save natural gas supplies as Russia reduces gas supplies to Europe, German Economy Minister Habeck said on Friday. In addition to hospitals and other parts of the social system, public buildings will be heated to a maximum temperature of 19°C.

13. According to calculations by the Financial Times, rising inflation and interest rates will push up debt servicing costs and social welfare spending in the UK by more than £50bn ($60.7bn) over the next financial year.

14. According to the US Wall Street Journal website, the global population is expected to exceed 8 billion later this year, and the United Nations expects it to be November 15. Since the global population first crossed the 3 billion mark in the 1960s, it will take more than a decade to cross each new billion-population milestone, and a situation of 9 billion or even 10 billion is bound to emerge.

15. India's central bank deputy governor Patra said that the US Treasury told India that an Indian ship took oil from a Russian tanker on the high seas and brought it to India for refining and loading.

Institutional Currency Viewpoint

1. HSBC: The Fed's policy shift is not imminent, the dollar may remain strong

①The dollar is unlikely to remain weak because it is too early to expect the Fed to change its tightening policy. HSBC analysts said in a research note that the market's reaction to the Fed's July meeting on interest rates and lower-than-expected U.S. inflation data last Wednesday showed a premature rush to price in the Fed's policy shift, leading to a rise in risk appetite, Higher equities, lower rate expectations and a weaker dollar.

②However, several Fed policymakers recently dismissed speculation of a shift in monetary policy. More evidence of a slowdown in core inflation is needed for the Fed to ease the intensity of its tightening policy, not to mention the expected rate cut in mid-2023.

2. MUFG: Dollar sell-off unlikely to last

①Mitsubishi UFJ analysts suggest shorting EUR/USD near 1.029 with a target of 0.9900 and a stop loss of 1.0540, as the situation in Europe has brought uncertainty to the euro, and market participants may begin to expect the Fed to further tighten monetary policy . Given the still high level of uncertainty about Europe's near-term growth prospects due to declining natural gas supplies, we are skeptical of the scope for further growth. As far as the dollar is concerned, the sell-off will not last, and it is too early to think the Fed will adjust its stance now, as the CPI data shows that the Fed is determined to further tighten policy significantly before signaling the market to change its stance, US stocks rebounded May strengthen the Fed's determination to raise interest rates aggressively.

②The Jackson Hole annual meeting may be used to show the Fed's resolve, and the market may soon price in more tightening policy for the rest of the year.

3. Commerzbank cuts EUR/USD down

①Commerzbank said in a report to clients that it has lowered its forecast for the euro against the US dollar, because it now expects a recession in the euro area to be the base scenario, which was previously considered a “risk scenario”.

②The bank expects the euro to fall to $0.98 in December and not recover until later in 2023.

4. ING: Rising gas prices in Europe could hit the euro

①The rise in European natural gas prices last week caused the terms of trade in the euro zone to fall to the worst level in the year, which is obviously unfavorable to the euro.

②Chris Turner, an analyst at ING, said in a research report that as European gas prices continue to rise slightly, the European gas industry will definitely become more worried. Rising costs are certain, but winter rationing may still be a bigger threat. FX markets have been watching for changes in terms of trade, which have been “very negative” for the euro zone this year, negatively impacting industry revenues.

5. ING said it will not chase the euro against the pound

ING analysts said: “The euro against the pound is slightly stronger than expected and may rise to around 0.8485 pounds. But considering the challenges facing the European continent, it will not chase the euro against the pound. ”

6. HSBC: It is expected that the European Central Bank will stop raising interest rates after this year, and raise interest rates by 50 basis points in September

①The European Central Bank will stop raising interest rates after the end of 2022, when recession and easing price pressures in the euro area will prevent monetary policy from tightening. HSBC economists led by Simon Wells said a cut in Russian gas supplies and the resulting surge in energy costs would push up inflation, which is expected to peak at 10% in October. A squeeze on household income will make a recession “or inevitable”;

②By the first quarter of next year, as the impact of our forecast recession becomes more apparent, inflation begins to fall, and the ECB is no longer expected to raise interest rates in 2023. It will raise rates by 50 basis points in September, possibly by a further 75 basis points, and then by 25 basis points in October and December.

Statement | Disclaimer

Disclaimer: The information contained in this material is for general advice only. It does not take into account your investment goals, financial situation or special needs. Mohicans Markets has made every effort to ensure the accuracy of the information as of the date of publication. Mohicans Markets makes no warranties or representations regarding this material. The examples in this material are for illustration only. To the extent permitted by law, Mohicans Markets and its employees shall not be liable for any loss or damage arising in any way, including negligence, from any information provided or omitted from this material.The features of Mohicans Markets products, including applicable fees and charges, are outlined in the product disclosure statements available on the Mohicans Markets website and should be considered before deciding to deal with these products. Derivatives can be risky and losses can exceed your initial payment. Mohicans Markets recommends that you seek independent advice.

Mohicans Markets, (Abbreviation: MHMarkets or MHM, Chinese name: Mai hui), Australian Financial Services License No. 001296777.

Read more

Mohicans markets:European Market

On Monday, October 10, during the Asian session, spot gold shock slightly down, and is currently trading near $ 1686 per ounce. Last Friday's better-than-market-expected U.S. non-farm payrolls report for September reinforced expectations that the Federal Reserve will raise interest rates sharply, and the dollar and U.S. bond yields surged and recorded three consecutive positive days, causing gold prices to weaken sharply.

Mohicans markets:Hitting Exhibition| See the Grand Occasion of Dubai Exhibition!

Focus on the industry highlight event, and explore the new future of trading. MHMarkets, the world's leading currency and CFD broker, is committed to providing better trading services to global traders and expanding its international markets.

Mohicans markets :MHM Today’s News

On Thursday, spot gold first fell and then rose. The US market once rose to a high of $1,664.78, and finally closed up 0.04% at $1,660.57 per ounce; spot silver finally closed down 0.34% at $18.82 per ounce.

Mohicans markets:Daily European Market Viewpoint

On Thursday, September 29, during the Asia-Europe period, spot gold fluctuated slightly and was currently trading around $1,652.26 an ounce. U.S. crude oil fluctuated in a narrow range and is currently trading around $81.63 a barrel, holding on to its sharp overnight gains.

WikiFX Broker

Latest News

If you haven't noticed yet, the crypto market is in free fall, but why?

Emerging Markets: Nigeria's Debt Market Valuation Hits N99.3 Trillion

JPY In Focus: Takaichi Wins Snap Election to Become Japan's First Female Leader

Amaraa Capital Scam Alert: Forex Fraud Exposure

Vebson Scam Exposure: Forex Withdrawal Failures & Fake Regulation Warning

EGM Securities Review: Investigating Multiple Withdrawal-related Complaints

Galileo FX Exposure: Allegations of Fund Losses Due to Trading Bot-related Issues

Fed Balance Sheet Mechanics: The Silent Risk to Liquidity

Gold Eclipses $5,070 as China Treasury Shift Hammers the Dollar

SkyLine Guide 2026 Thailand — Official Launch of the Judge Panel Formation!

Rate Calc