ABX TRADE-Overview of Minimum Deposit, Leverage, Spreads

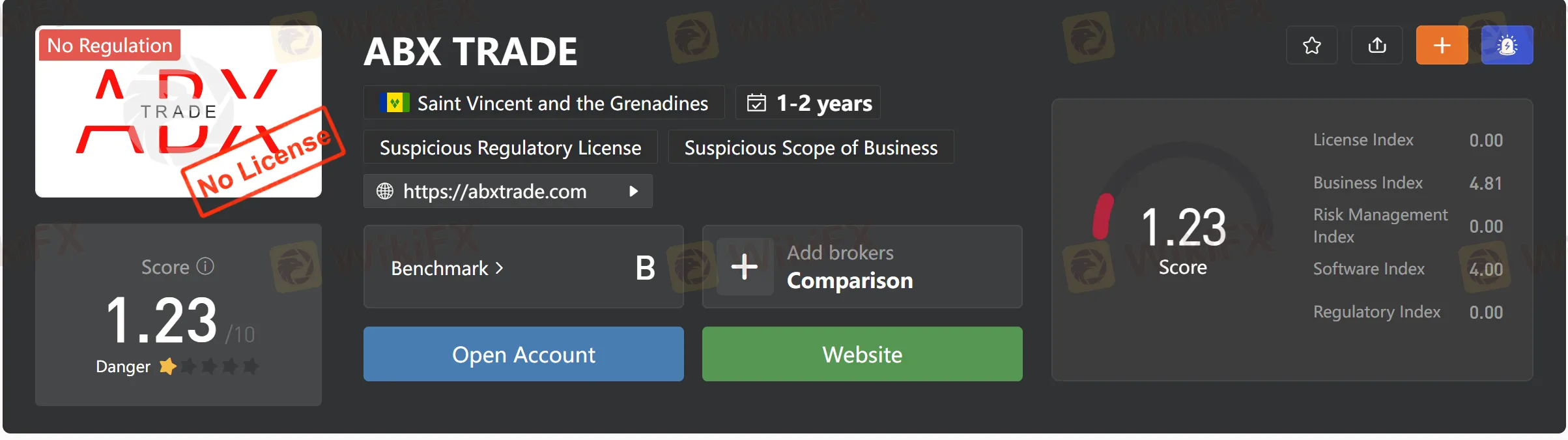

Abstract:ABX TRADE, a trading name of ABX TRADE LLC, is allegedly an international business company incorporated in St. Louis. Vincent & the Grenadines and based in Cambodia in October 2019. The broker presents itself as an STP (Straight-Through-Processing) with NDD (No Dealing Desk) broker, providing trading services both for retail traders and especially for fund managers with a proven track record.

| Aspect | Information |

| Registered Country/Area | Saint Vincent and the Grenadines |

| Founded Year | 1-2 years |

| Company Name | ABX TRADE |

| Regulation | No Regulation |

| Minimum Deposit | $25 (CENT and STANDARD accounts) |

| Maximum Leverage | Up to 1:1000 (CENT and STANDARD accounts), up to 1:200 (ECN account) |

| Spreads | CENT: starting from 2.2 pips, STANDARD: starting from 1.8 pips, ECN: zero pips spread |

| Trading Platforms | MT4 Desktop, MT4 Mobile, MT4 Web Terminal |

| Tradable Assets | Forex, CFDs on shares, futures, indices, commodities |

| Account Types | CENT, STANDARD, ECN |

| Demo Account | Not specified |

| Customer Support | Support hotline, email support, live chat |

| Deposit &Withdrawal Methods | Wire Transfer, Bank Transfer, MasterCared and VISA |

General Information

ABX TRADE, a trading name of ABX TRADE LLC, is allegedly an international business company incorporated in St. Louis. Vincent & the Grenadines and based in Cambodia in October 2019. The broker presents itself as an STP (Straight-Through-Processing) with NDD (No Dealing Desk) broker, providing trading services both for retail traders and especially for fund managers with a proven track record.

Also, ABX TRADE claims to provide its clients with a variety of tradable financial instruments with flexible leverage up to 1:500 and variable spreads from 0.1 pips on the advanced MetaTrader4 trading platform, a choice of three different live account types, as well as PAMM, copy trading service and 24/5 customer support service.

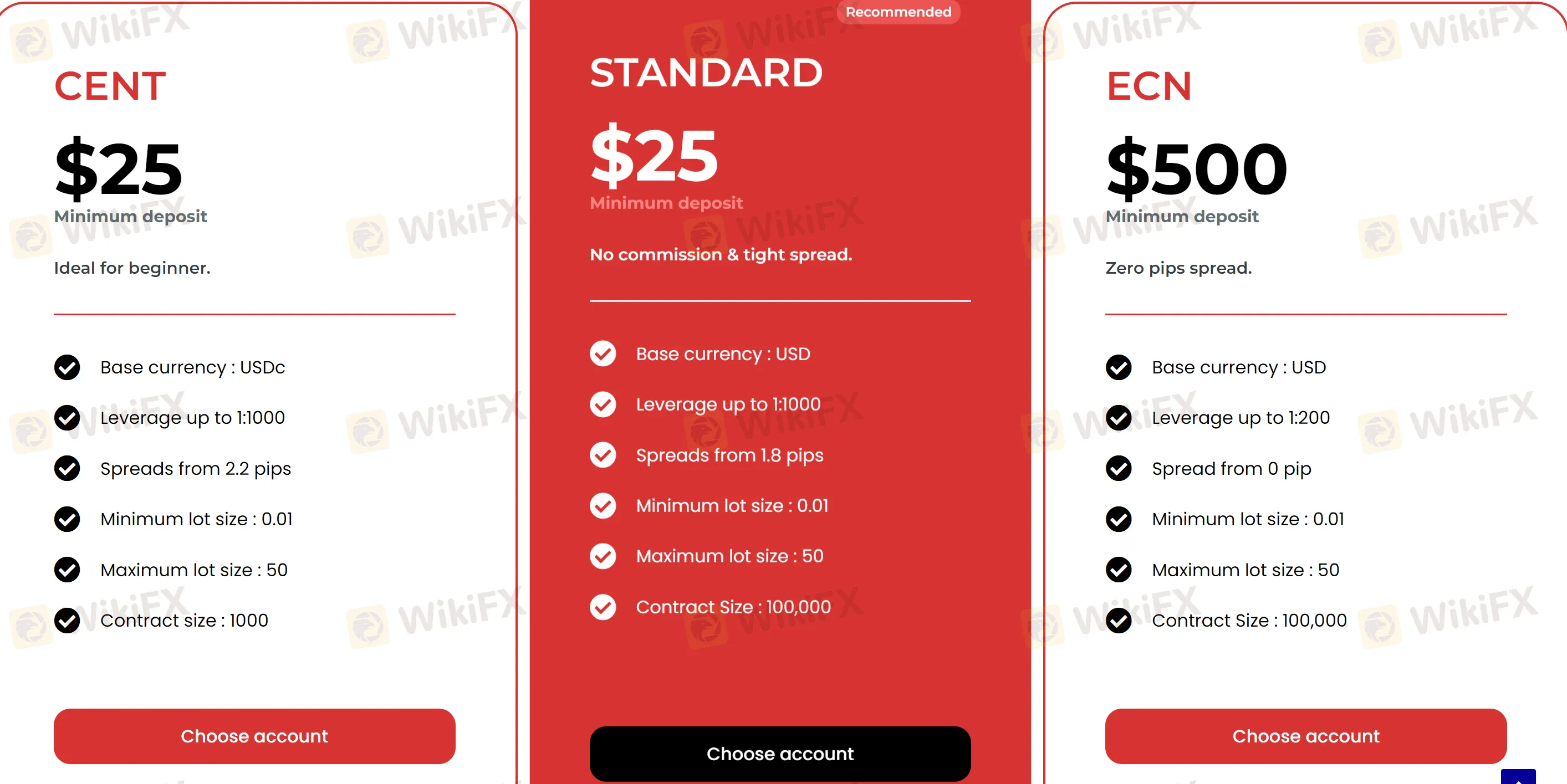

The broker offers three types of accounts: CENT, STANDARD, and ECN. The CENT account is designed for beginners, while the STANDARD and ECN accounts target more experienced traders. Each account type has its own minimum deposit requirement, leverage options, spreads, and commission structures.

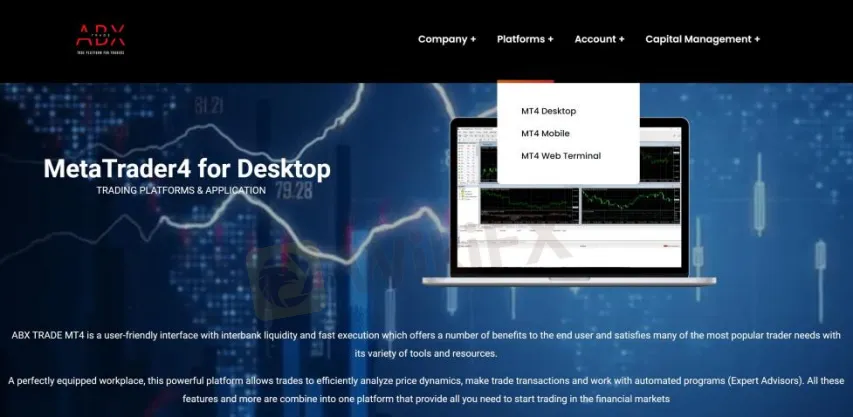

ABX TRADE utilizes the popular MetaTrader 4 (MT4) platform, known for its stability and reliability. Traders can access MT4 through desktop, mobile, and web-based versions, providing flexibility and convenience in executing trades. The platform offers a range of trading tools, including automated trading capabilities, algorithmic strategies, and extensive technical analysis features.

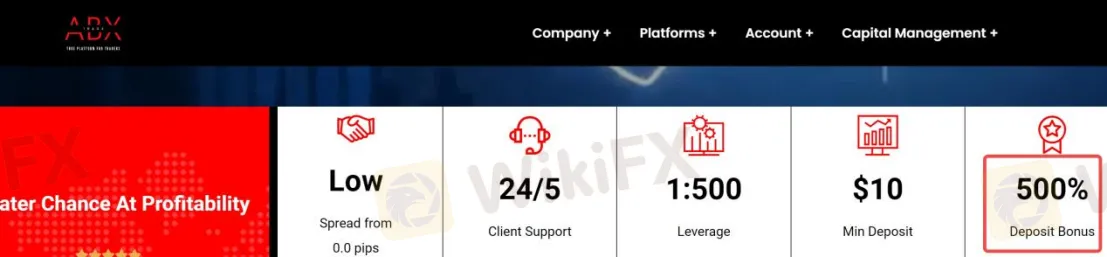

While ABX TRADE highlights bonuses on their website, it is essential to review the associated terms and conditions carefully. Bonuses often come with specific requirements that traders should consider before making any decisions.

Customer support is available through various channels, including a support hotline, email support, and potentially a live chat feature. Traders can seek assistance or address their concerns through these channels.

It is important to note that ABX TRADE lacks valid regulation, which can be a potential risk factor. Traders should exercise caution when dealing with unregulated brokers and consider alternative options that offer a higher level of safety and security.

Here is the home page of this brokers official site:

Pros and Cons

ABX TRADE offers a range of benefits and drawbacks that traders should consider. On the positive side, the broker provides access to various financial markets, including forex, CFDs, futures, indices, and commodities, allowing traders to diversify their portfolios. The availability of different account types, such as CENT, STANDARD, and ECN, caters to traders with different levels of experience. The MetaTrader 4 platform offers stability and reliability, with multiple versions for desktop, mobile, and web-based trading. Additionally, ABX TRADE provides customer support through various channels. However, it's important to note that ABX TRADE lacks valid regulation, which may raise concerns about the safety and security of funds. Potential traders should carefully weigh the pros and cons before making a decision.

Here's a table summarizing the pros and cons of ABX TRADE:

| Pros | Cons |

| Access to diverse financial markets | Lack of valid regulation, potential risk |

| Multiple account types available | Potential concerns about safety and security |

| Stable and reliable MT4 platform | |

| Various customer support channels |

Is ABX TRADE Legit?

ABX TRADE lacks valid regulation, and it is essential to be aware of the associated risks. This means that ABX TRADE does not fall under any valid regulations, indicating a potential lack of oversight and investor protection. Traders should exercise caution when engaging with an unregulated broker, as it may pose higher risks to their investments. It is advisable to thoroughly research and consider regulated alternatives to ensure a higher level of safety and security for trading activities.

Market Instruments

ABX TRADE provides traders with a diverse selection of market instruments across various financial markets. They offer access to forex, allowing traders to engage in currency trading and take advantage of fluctuations in exchange rates. Additionally, ABX TRADE offers contracts for difference (CFDs) on shares, enabling traders to speculate on the price movements of individual company stocks without owning the underlying asset.

Traders can also trade CFDs on futures, which are contracts based on the anticipated future value of commodities or financial instruments. This allows traders to participate in the price movements of commodities such as oil, gold, or agricultural products, as well as financial instruments like bonds or interest rates.

Furthermore, ABX TRADE provides CFDs on indices, which are representative portfolios of stocks from specific markets or sectors. Traders can take positions on the overall performance of an index, allowing them to capitalize on the market movements of a specific group of stocks.

By offering a wide range of market instruments, ABX TRADE aims to cater to the diverse trading preferences and strategies of their clients, providing opportunities to participate in various financial markets and potentially profit from price fluctuations.

Pros and Cons

| Pros | Cons |

| Diverse selection of market instruments across multiple financial markets | No specific information provided |

| Access to forex for currency trading | No charts provided |

| Availability of CFDs on shares for speculating on stock price movements | |

| Trading CFDs on futures for participating in commodity and financial instrument markets | |

| CFDs on indices allow traders to take positions on overall market performance |

Account Type

ABX Trade offers three different account types: CENT, STANDARD, and ECN.

CENT: The CENT account is designed for beginners and requires a minimum deposit of $25. It is an ideal account type for those who are just starting out in trading. The base currency for this account is USDc (USD cents). The leverage available for this account is up to 1:1000, allowing traders to amplify their positions. Spreads start from 2.2 pips, which refers to the difference between the bid and ask price. The minimum lot size is 0.01, and the maximum lot size is 50. The contract size is 1000 units. Traders can choose this account if they are new to trading and want to start with a small deposit.

STANDARD: The STANDARD account offered by ABX Trade also requires a minimum deposit of $25. This account type does not charge any commission and offers tight spreads. The base currency for the STANDARD account is USD. Like the CENT account, it offers leverage up to 1:1000, allowing traders to trade larger positions than their account balance. The spreads for this account start from 1.8 pips, which can be advantageous for traders looking for competitive pricing. The minimum and maximum lot sizes are the same as the CENT account, which are 0.01 and 50 respectively. However, the contract size for this account is 100,000 units. Traders who prefer no commissions and tight spreads can choose the STANDARD account.

ECN: For more experienced traders, ABX Trade offers the ECN account. This account type requires a higher minimum deposit of $500. The base currency is USD, and the leverage available is up to 1:200. The most notable feature of the ECN account is the zero pips spread, which means there is no difference between the bid and ask prices. This can be highly beneficial for traders looking for direct market access and tight pricing. The minimum and maximum lot sizes for the ECN account are the same as the previous accounts, 0.01 and 50. The contract size is also 100,000 units, providing traders with ample trading opportunities. Traders who prioritize low spreads and direct market access can opt for the ECN account.

Pros and Cons

| Pros | Cons |

| CENT account for beginners | Higher minimum deposit for ECN account |

| No commissions for STANDARD account | Zero spread only available in ECN account |

| Direct market access in ECN account | Limited customization options for account features |

How to open an account?

To open an account with ABX ACCOUNT, follow these steps:

1. Create Your Account: Begin by visiting the ABX ACCOUNT website and locating the account registration section. Enter your personal details, including your username, first name, last name, IC or passport number, email address, contact phone number, and the name of the introducer if applicable. Make sure to review and agree to the terms and conditions before proceeding.

2. Verify: After completing the registration process, you will need to verify your account. ABX ACCOUNT may require you to provide additional documentation to confirm your identity. This may include submitting scanned or photographed copies of your identification documents such as your IC (Identity Card) or passport. Follow the instructions provided by ABX ACCOUNT to complete the verification process.

3. Fund: Once your account is successfully registered and verified, you can proceed to fund your account. ABX ACCOUNT will provide you with various payment methods to deposit funds. Choose the payment method that is most convenient for you and follow the instructions provided to transfer the desired amount. Be aware of any minimum deposit requirements specified by ABX ACCOUNT.

4. Trade: Once your account is funded, you can start trading. Log in to your ABX ACCOUNT using your username and password. Familiarize yourself with the trading platform and the available trading instruments. ABX ACCOUNT may offer a variety of financial products such as stocks, commodities, or currencies. Select the instrument you wish to trade, analyze the market, and execute your trades according to your trading strategy.

It is important to note that the account opening process and specific requirements may vary, and it is recommended to visit the official ABX ACCOUNT website or contact their customer support for detailed instructions and assistance throughout the account opening process.

Leverage

Traders holding different account types can enjoy different maximum leverage ratios. Clients on the Standard or Cent account can enjoy the maximum leverage of 1:500, while the ECN account clients can experience leverage of 1:200. It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

Spreads & Commissions

ABX TRADE offers different account types with varying spreads and commissions. The CENT and STANDARD accounts are COMMISSION-FREE, meaning there are no additional charges per trade. The spreads for these accounts start from 2.2 pips for the CENT account and 1.8 pips for the STANDARD account. This indicates the difference between the bid and ask prices of trading instruments.

On the other hand, the ECN account has a commission of $2 per lot traded. However, in return, traders benefit from a zero-pip spread, which means there is no difference between the bid and ask prices. The ECN account offers tighter spreads, starting from 0.1 pips.

It is important to note that spreads and commissions can vary based on market conditions, volatility, and the specific trading instruments being traded. Traders should also be aware that while tighter spreads can potentially reduce trading costs, commissions can add to the overall cost of trading. It is advisable for traders to consider their trading strategies, account types, and associated costs when choosing the most suitable option for their trading needs.

Trading Platform Available

ABX TRADE offers multiple trading platforms for its clients. The available platforms include MT4 Desktop, MT4 Mobile, and MT4 Web Terminal. It is also recommended to use either MT4 or MT5 for trading purposes. MetaTrader 4 (MT4) is particularly praised by forex traders for its stability and reliability, making it one of the most popular forex trading platforms in the industry.

MT4 provides a range of sophisticated trading tools that can enhance the trading experience. Traders can utilize Expert Advisors (EAs) for automated trading, Algo trading for executing algorithmic strategies, and access to complex indicators for technical analysis. Additionally, the platform offers a strategy tester feature, allowing traders to backtest their trading strategies and evaluate their performance.

One notable advantage of using MT4 is the vast selection of trading apps available on the Metatrader marketplace. With over 10,000 trading apps to choose from, traders have the opportunity to enhance their trading performance by utilizing various tools, indicators, and plugins developed by third-party providers.

Furthermore, ABX TRADE offers mobile trading options. Traders can access the MT4 and MT5 platforms on their iOS and Android devices, allowing them to trade from anywhere and at any time.

Deposit & Withdrawal

ABX TRADE offers deposit and withdrawal options primarily through Wire Transfer, Bank Transfer, MasterCared and VISA.The minimum initial deposit requirement is stated to be only $10, allowing traders to start with a relatively small amount. However, it is important to note that the specific details regarding the minimum withdrawal amount are not provided.

The broker states that there are no fees charged for deposits or withdrawals made via the Local Bank method. This can be beneficial for traders as they can avoid additional charges when funding their account or withdrawing their profits.

When it comes to processing withdrawal requests, ABX TRADE mentions that it typically takes 1-3 working days. This indicates that the broker strives to process withdrawal requests promptly, allowing traders to access their funds within a reasonable time frame.

It is worth noting that the information provided is based on the given description, and it is always recommended to refer to the official ABX TRADE website or contact their customer support for the most accurate and up-to-date information regarding deposit and withdrawal methods, fees, and processing times.

Pros and Cons

| Pros | Cons |

| Minimum initial deposit requirement of $10 | Lack of specific details about minimum withdrawal amount |

| No fees charged for deposits and withdrawals |

Bonuses

On the home page of ABX TRADEs website, the broker claims to offer a 500% deposit bonus, yet no more information is specified. In any case, you should be very cautious if you receive a bonus. First of all, bonuses aren't client funds, they're company funds, and fulfilling the heavy requirements that are usually attached to them can prove a very daunting and difficult task. Remember that brokers who are regulated and legitimate do not offer bonuses to their clients.

Pros and Cons

| Pros | Cons |

| Potential for increased trading capital | Lack of transparency regarding bonus details |

| Additional incentives for new clients | Stringent requirements and conditions |

| Loyalty bonuses for existing clients | Bonuses may distract from the overall trading strategy |

| Bonuses may be associated with withdrawal restrictions |

Customer Support

ABX TRADE provides customer support through various channels to assist clients with their inquiries and provide necessary information. Here are the available customer support options provided by ABX TRADE:

1. Support Hotline: Clients can contact ABX TRADE's support team through their hotline at +60386552745. This phone number can be used to seek assistance, ask questions, or address any concerns related to their products or services.

2. Email Support: Clients can also reach out to ABX TRADE's support team by sending an email to support@abxtrade.com. This email address allows clients to communicate their queries or concerns and receive a response from the support team.

3. Live Chat Support: ABX TRADE offers live chat support, which provides real-time assistance and immediate responses to clients' questions or issues. The live chat feature is likely available on the ABX TRADE website, allowing clients to interact with a support representative through text-based messaging.

Conclusion:

In conclusion, ABX TRADE offers a wide range of market instruments, including forex, CFDs on shares, futures, indices, and commodities, providing traders with opportunities to participate in various financial markets. The broker offers different account types to cater to traders with varying experience levels, along with leverage options and competitive spreads. Additionally, ABX TRADE provides multiple trading platforms, including the popular MT4, for trading. However, it is important to approach bonuses with caution and carefully review the associated terms and conditions. Furthermore, while ABX TRADE offers customer support through various channels, the lack of detailed information on their website regarding deposit and withdrawal requirements may be a disadvantage. Overall, ABX TRADE presents a legitimate trading option with a diverse range of instruments, but prospective traders should conduct thorough research and consider their individual needs and preferences before engaging with the broker.

FAQs

Q: What are the available account types at ABX TRADE?

A: ABX TRADE offers three account types: CENT, STANDARD, and ECN. Each account type has its own minimum deposit requirement, leverage options, spreads, and commission structures, catering to different trading preferences and experience levels.

Q: How can I open an account with ABX TRADE?

A: To open an account with ABX TRADE, you need to complete the registration process by providing your personal details, verify your account, fund it, and then you can start trading. The specific steps and requirements may vary, so it's advisable to visit the official ABX TRADE website or contact their customer support for detailed instructions.

Q: What leverage options are available at ABX TRADE?

A: The maximum leverage offered by ABX TRADE depends on the account type. The CENT and STANDARD accounts offer leverage up to 1:1000, while the ECN account provides leverage up to 1:200. Traders should use leverage responsibly and be aware of the associated risks.

Q: What are the spreads and commissions at ABX TRADE?

A: The spreads and commissions at ABX TRADE vary depending on the account type. The CENT and STANDARD accounts have no commission and spreads starting from 1.8 pips and 2.2 pips, respectively. The ECN account charges a commission of $2 per lot traded but offers spreads starting from 0.1 pips.

Q: How can I deposit and withdraw funds with ABX TRADE?

A: ABX TRADE primarily offers Bank Transfer as a deposit and withdrawal method. The minimum initial deposit requirement is stated to be $10, but specific details regarding the minimum withdrawal amount are not provided. It is recommended to visit the official ABX TRADE website or contact their customer support for more information.

Q: What trading platforms does ABX TRADE offer?

A: ABX TRADE provides access to popular trading platforms such as MT4 Desktop, MT4 Mobile, and MT4 Web Terminal. These platforms offer a range of features, tools, and indicators to assist traders in their trading activities. It is advisable to refer to the official ABX TRADE website or contact their customer support for specific platform details and requirements.

Q: Does ABX TRADE offer bonuses?

A: ABX TRADE advertises various bonuses, such as deposit bonuses and loyalty bonuses, on their website. It is important to carefully review the terms and conditions associated with these bonuses before considering them, as they often come with specific requirements and conditions.

Q: How can I contact ABX TRADE's customer support?

A: ABX TRADE offers customer support through a support hotline at +60386552745 and email support at support@abxtrade.com. They may also provide a live chat support feature on their website for real-time assistance.

Risk Warning

Online trading involves a significant level of risk and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

Read more

Is NEWTON GLOBAL Safe or a Scam? A Deep Look at User Reviews & NEWTON GLOBAL Complaints

When you look up information about a financial broker, you have one main worry: Is my capital safe? For NEWTON GLOBAL, the facts point to a clear answer. After looking at its regulatory status, user feedback and how transparent it is, NEWTON GLOBAL presents a very high risk to all traders. This conclusion isn't based on opinion, but on real data collected by platforms designed to protect investors. The main problems—no valid regulation and a pattern of serious user complaints—show major warning signs that can't be ignored. A broker's reputation depends on two things: regulatory oversight and positive user experiences. As we will show, NEWTON GLOBAL fails badly on both. We encourage traders to always check information on independent platforms. You can see the full data we are analyzing on the official WikiFX page for NEWTON GLOBAL. This article will break down its regulatory standing, look at real user complaints, and give you a clear verdict to help you make an informed decision.

Fidelity Exposure: Examining the Latest User Reviews on Withdrawal Denials & Trade Manipulation

Fidelity Investments has been grabbing attention of late for negative reasons. These include complaints concerning withdrawals, account closure without notice, technical glitches in trade order processing, and inept customer support service. As the complaints continue to grow, we prepared a Fidelity review article showcasing some of them. Read on as we share details.

ICE FX Review: Are Traders Raising Red Flags Over Withdrawal Fees & Regulation Status?

Does ICE FX ask you to pay taxes for fund withdrawal access? Were you made to pay a hefty fee on a verification failure? Does the broker deliberately cancel your profitable trades? Have you failed to receive assistance from the ICE FX customer support team on your fund deposit and withdrawal queries? These issues have become common for its traders. Many of them have highlighted these issues online. In this ICE FX review article, we have investigated some of their complaints. Read on as we dive deep.

Phyntex Markets Forex Scam: $58K Blocked After $50K

Phyntex Markets forex scam: $50K withdrawal approved, $58K blocked on “toxic trading.” Unregulated Comoros broker scams Malaysian traders. Read exposure & protect funds!

WikiFX Broker

Latest News

FxPro Broker Analysis Report

ACY SECURITIES Regulatory Status: A Complete Guide to Licenses, Warnings and Trader Issues

FBS Forex Scam Alert: High Complaint Ratio

ThinkMarkets Scam Alert: 83/93 Negative Cases Exposed

Exchange Rate Fluctuations: Key Facts Every Forex Trader Should Know

ACY Securities Deposit and Withdrawal: The Complete 2025 Guide (Fees, Methods & User Warnings)

US Industrial Production Surged In January

TradingPro: Regulation, Licences and WikiScore Analysis

Weltrade Review: Safety, Regulation & Forex Trading Details

Pepperstone Analysis Report

Rate Calc