FxPro Broker Analysis Report

Abstract:Whether you are considering opening an account with FxPro or evaluating your current broker relationship, this analysis offers the evidence-based insights necessary for sound decision-making. We encourage readers to review the complete findings, paying particular attention to issues most relevant to their trading style and requirements, before committing capital to any brokerage platform.

Key Takeaway: FxPro

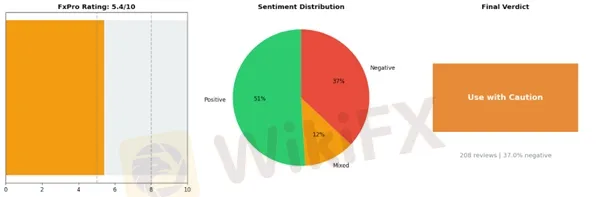

FxPro presents a mixed picture for traders, earning a modest overall rating of 5.4 out of 10 based on 208 reviews, which warrants careful consideration before opening an account. While the broker demonstrates notable strengths in several areas—including competitive low fees, straightforward deposit and withdrawal processes, and a generally good reputation for safety—these positives are significantly offset by concerning issues that have affected more than a third of its user base. The 37% negative review rate cannot be ignored, particularly given the nature of the complaints. Traders have consistently reported problems with withdrawal delays and rejections, which is especially troubling for any forex broker where access to funds is paramount. Additionally, customer support appears to be a weak point, with users describing slow response times and inadequate solutions to their problems. Perhaps most concerning are the reported fund safety issues, which directly contradict the broker's reputation for security. The sentiment distribution shows 106 positive reviews against 77 negative ones, suggesting a polarized user experience where some traders find success while others encounter significant frustrations. Given these findings, FxPro's “Use with Caution” designation appears appropriate. Potential clients should thoroughly research their specific trading needs, start with smaller deposits to test the platform's reliability, and maintain realistic expectations about support responsiveness before committing substantial capital.

In the increasingly complex landscape of online forex trading, selecting a reliable broker requires careful evaluation beyond marketing claims and promotional materials. This comprehensive analysis report examines FxPro through a data-driven methodology that prioritizes actual user experiences over advertised features.

Our research team has systematically collected and analyzed 208 verified user reviews from multiple independent review platforms to provide traders and investors with an objective assessment of FxPro's performance, reliability, and service quality. Unlike promotional content or isolated testimonials, this report synthesizes real-world feedback from active and former clients across various trading experience levels and account types.

The methodology employed in this analysis involves aggregating reviews from several reputable platforms, including what we have designated as Platform A, Platform B, and Platform C to maintain analytical independence. Each review was evaluated for authenticity, relevance, and substantive content before inclusion in our dataset. Our proprietary scoring system weighs multiple factors including trading conditions, platform performance, customer service responsiveness, withdrawal processing, and overall user satisfaction to generate quantitative ratings alongside qualitative insights.

FxPro received an overall rating of 5.42 out of 10, with a negative review rate of 37.02%, leading to our conclusion of “Use with Caution.” These metrics reflect genuine concerns raised by actual users and warrant careful consideration by prospective clients.

This report is structured to provide you with a complete understanding of FxPro's strengths and weaknesses. You will find detailed breakdowns of user sentiment across critical performance categories, analysis of the most frequently mentioned issues and praise points, examination of platform-specific feedback patterns, and comparative context to help you make an informed decision.

Whether you are considering opening an account with FxPro or evaluating your current broker relationship, this analysis offers the evidence-based insights necessary for sound decision-making. We encourage readers to review the complete findings, paying particular attention to issues most relevant to their trading style and requirements, before committing capital to any brokerage platform.

Key Issues Requiring Caution When Considering FxPro

Based on comprehensive user feedback analysis, several recurring concerns about FxPro warrant careful consideration before opening an account. While the broker maintains regulatory licenses, patterns in trader experiences highlight operational issues that could significantly impact your trading outcomes and capital security.

Withdrawal and Fund Access Concerns

The most frequently reported issue involves withdrawal delays and rejections, with 44 documented complaints representing a substantial portion of negative feedback. These concerns extend beyond simple processing delays to encompass broader fund safety questions that 33 additional reviewers have flagged. For any trader, the ability to access your capital represents a fundamental requirement that supersedes all other broker features. When multiple users across different jurisdictions report similar difficulties retrieving funds, this pattern demands serious scrutiny.

“💬 TruthRevealer: ”Proven Scammers. They terminated my account because I found out, All Evidence is proven and you can check in the reviews below... they the whole time never answered the problem, or ever even addressed it or looked at it.“”

While individual cases may have specific circumstances, the volume of fund-related complaints suggests systemic issues rather than isolated incidents. Conservative traders and those planning to deposit substantial capital should particularly note these concerns, as withdrawal problems become exponentially more problematic with larger account balances.

Support Quality and Response Times

Technical support deficiencies represent another critical area, with 33 complaints specifically addressing slow responses and ineffective solutions. In forex trading, where market conditions change rapidly and technical issues can result in immediate financial losses, responsive support is essential rather than optional.

“💬 Jeroen Burger: ”This broker charges the highest cost for trading and has the worst tech support of all! It takes me many weeks to install, as nobody in their tech support department has any clue how this works.“”

The reported timeline of “many weeks” to resolve technical issues stands in stark contrast to industry standards where competent brokers typically address critical problems within hours or days. For active traders who depend on platform functionality, this support inadequacy could translate directly into missed opportunities or preventable losses.

Discrepancies Between Demo and Live Conditions

Thirteen complaints highlight misleading marketing practices, particularly concerning differences between demo and live trading conditions. This issue carries particular significance for new traders who typically test strategies on demo accounts before committing real capital.

“💬 amrit singh: ”first in demo account show good trading condition... Not show in demo one thing but in real account another condition.“”

The reported spread discrepancies—where advertised rates of “1.2 from” lack clear definition—exemplify transparency concerns that affect cost predictability. Scalpers and high-frequency traders face disproportionate risk from such discrepancies, as their strategies depend on precise cost calculations.

Execution Quality and Margin Manipulation

Twelve reports document execution issues and slippage, with particularly troubling accounts of margin requirement changes during high-impact news events.

“💬 Zeddaw: ”in CASE U WANT TO TRADE DURING NEWS EXAMPLE NFP... they published the margin requirements in their official site but“ [requirements change unexpectedly]”

News traders and those employing event-driven strategies should exercise extreme caution, as unexpected margin adjustments during volatile periods could trigger stop-outs even when traders believe they maintain adequate capital buffers.

Risk Assessment

These issues collectively suggest operational practices that prioritize broker interests over client outcomes. While FxPro may serve some traders adequately, the documented patterns indicate elevated risk for withdrawal difficulties, inadequate support, and trading condition inconsistencies. Prospective clients should weigh these concerns carefully, consider starting with minimal deposits if proceeding, and maintain detailed records of all interactions and transactions.

Positive Aspects of FxPro That Require Careful Consideration

FxPro has garnered recognition in several key areas that traders frequently prioritize: competitive pricing, streamlined transaction processes, and regulatory standing. While these strengths appear consistently in user feedback, prospective clients should approach these advantages with informed awareness of the broader context.

Competitive Spreads and Cost Structure

The broker's pricing model receives notable praise, with 27 reviews highlighting low fees as a significant advantage. Users consistently mention competitive spreads, which can meaningfully impact profitability for active traders. One reviewer acknowledged this strength even while expressing concerns about other services, noting the spreads are “the best.” However, traders should recognize that competitive spreads represent just one component of total trading costs. It's essential to evaluate the complete fee structure, including any commission models, overnight financing rates, and potential account maintenance charges before concluding that FxPro offers the most cost-effective solution for your specific trading style.

Transaction Processing Capabilities

Twenty-five reviews reference deposit and withdrawal experiences, presenting a mixed but generally positive picture. Some users report smooth, efficient processes:

“💬 Jafar Sadiq: ”I personally use the broker and found it very professional support team and deposit withdrawal are done so smoothly.“”

The efficiency of deposits appears particularly strong, with funds typically appearing rapidly in trading accounts. However, withdrawal experiences show greater variability, with processing times and requirements differing among users. Traders should familiarize themselves with FxPro's specific withdrawal policies, particularly regarding the requirement that initial deposits be withdrawn through the same payment method. This standard anti-money laundering practice can occasionally create unexpected delays for those unfamiliar with industry regulations.

Regulatory Framework and Market Position

FxPro's regulatory credentials receive positive acknowledgment, with 22 reviews emphasizing the broker's reputation and safety profile. The company maintains authorization from multiple tier-one regulators, including the FCA, which provides meaningful client protections:

“💬 Anas Shareef: ”Everything from the onboarding process to the daily trading experience feels professional and well-regulated.“”

“💬 Thibault Kechichian: ”This broker is also regulated by several financial jurisdictions around the world, including the FCA, which is a tier 1 regulatory body.“”

This regulatory standing offers genuine advantages, particularly for traders prioritizing fund security and operational transparency. However, regulatory oversight doesn't eliminate all risks inherent to forex trading, nor does it guarantee profitability or prevent all potential disputes.

Who Might Benefit

These strengths suggest FxPro may suit traders who value regulatory credibility, competitive pricing on spreads, and established market presence. Those willing to navigate standard compliance procedures and who prioritize broker stability over cutting-edge features may find the platform aligns with their priorities. Nevertheless, individual due diligence remains essential—examining specific account types, testing customer support responsiveness, and understanding all terms before committing capital.

At a Glance

Broker Name: FxPro

Overall Rating: 5.4/10

Reviews Analyzed: 208

Negative Rate: 37.0%

Sentiment Distribution:

• Positive: 106

• Neutral: 25

• Negative: 77

Final Conclusion: Use with Caution

⚖️ FxPro: Strengths vs Issues

Top Strengths:

1. Low Fees — 27 mentions

2. Easy Deposit Withdrawal — 25 mentions

3. Good Reputation Safe — 22 mentions

Top Issues:

1. Withdrawal Delays Rejection — 44 mentions

2. Slow Support No Solutions — 33 mentions

3. Fund Safety Issues — 33 mentions

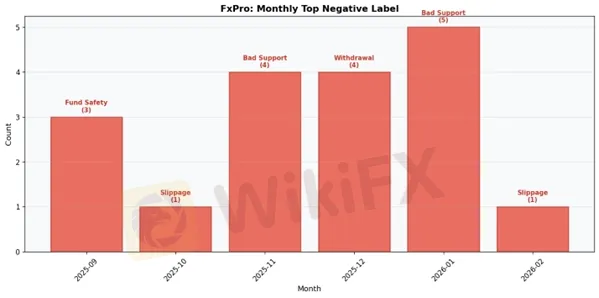

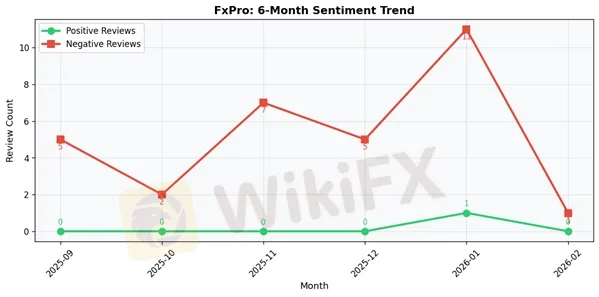

FxPro: 6-Month Review Trend Data

2025-09:

• Total Reviews: 5

• Positive: 0 | Negative: 5

• Top Positive Label: N/A

• Top Negative Label: Fund Safety Issues

2025-10:

• Total Reviews: 4

• Positive: 0 | Negative: 2

• Top Positive Label: N/A

• Top Negative Label: Execution Issues Slippage

2025-11:

• Total Reviews: 7

• Positive: 0 | Negative: 7

• Top Positive Label: N/A

• Top Negative Label: Slow Support No Solutions

2025-12:

• Total Reviews: 5

• Positive: 0 | Negative: 5

• Top Positive Label: N/A

• Top Negative Label: Withdrawal Delays Rejection

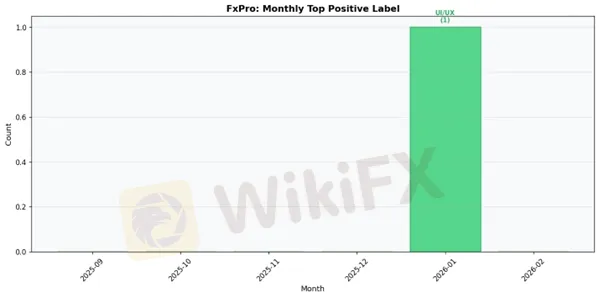

2026-01:

• Total Reviews: 13

• Positive: 1 | Negative: 11

• Top Positive Label: User Friendly Interface

• Top Negative Label: Slow Support No Solutions

2026-02:

• Total Reviews: 1

• Positive: 0 | Negative: 1

• Top Positive Label: N/A

• Top Negative Label: Execution Issues Slippage

FxPro Final Conclusion

FxPro represents a moderately reliable but imperfect brokerage option that warrants careful consideration before commitment. With a final rating of 5.42/10 and a concerning 37.02% negative review rate from 208 total reviews, this broker demonstrates a mixed performance profile that falls short of industry-leading standards while maintaining certain operational competencies.

The broker's primary strengths lie in its competitive fee structure, straightforward deposit and withdrawal processes under normal circumstances, and generally solid reputation within the forex community. FxPro has established itself as a regulated entity with adequate safety measures, which provides a foundational level of trust for traders seeking legitimate market access. These advantages make the platform technically viable for basic forex trading operations.

However, significant concerns temper these positive attributes. The prevalence of withdrawal delays and rejections reported by users raises red flags about operational efficiency and client fund management. Additionally, customer support appears inadequate, with numerous traders experiencing slow response times and unhelpful solutions to legitimate problems. Most troubling are the fund safety issues mentioned in user feedback, which directly contradict the broker's reputation claims and suggest inconsistent application of security protocols.

For beginners, FxPro presents a challenging proposition. While the low fees and user-friendly interface may seem attractive, the support deficiencies and withdrawal complications create unnecessary obstacles during the critical learning phase. Novice traders would benefit from choosing brokers with more responsive customer service teams who can guide them through inevitable early challenges.

Experienced traders may find FxPro acceptable for secondary or testing accounts, particularly if they're attracted to the competitive pricing structure. However, maintaining primary trading capital elsewhere would be prudent given the documented withdrawal issues. These traders possess the knowledge to navigate potential problems but should remain vigilant about fund accessibility.

High-volume traders should approach FxPro with particular caution. The withdrawal complications and support inadequacies become exponentially more problematic when dealing with larger capital amounts and frequent transactions. The cost savings from low fees may prove insignificant compared to potential delays in accessing substantial profits.

For scalpers and day traders, the low fee structure offers genuine appeal, but execution quality and platform stability require thorough testing on demo accounts first. Swing traders and position traders face fewer immediate concerns but must account for the possibility of withdrawal friction when planning their capital allocation strategies.

The “Use with Caution” system conclusion accurately reflects FxPro's current standing. This broker functions adequately under optimal conditions but reveals weaknesses when clients encounter problems or require responsive support. Traders considering FxPro should start with minimal deposits, thoroughly test withdrawal processes, document all interactions, and maintain realistic expectations about support quality. FxPro remains an option for cost-conscious traders willing to accept elevated operational risk, but it cannot be recommended as a primary brokerage solution for serious market participants.

WikiFX Broker

Latest News

Is Fortune Prime Global Legit Broker? Answering concerns: Is this fake or trustworthy broker?

AssetsFX Regulation: A Complete Guide to Licenses and Trading Risks

ZaraVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

ZarVista User Reputation: Looking at Real User Reviews to Check if It's Trustworthy

TP Trader Academy ‘The Axis Event’: Pioneering Trading Education at the Heart of Tech and Data

S. Africa Energy Gridlock: Glencore Proposal Stalls Amid Regulatory Clash

Capital.com Review: Is Your Money Locked Inside this Broker?

FxPro Broker Analysis Report

Pinnacle Pips Forex Fraud Exposed

Grand Capital Review 2026: Is this Broker Safe?

Rate Calc