Is Fortune Prime Global Legit Broker? Answering concerns: Is this fake or trustworthy broker?

Abstract:When you search "Is Fortune Prime Global legit," you are asking an important question that every trader must answer before putting money into an account. Is this a reliable trading partner or a possible scam designed to take your money? The answer is not a simple yes or no; it is a complex answer that requires a careful, fact-based investigation. While Fortune Prime Global (FPG) operates with regulatory licenses, a concerning number of user complaints and significant red flags raises serious questions about how it actually operates. The difference between its official legitimacy and the real-world experiences of many traders is alarming.

When you search “Is Fortune Prime Global legit,” you are asking an important question that every trader must answer before putting money into an account. Is this a reliable trading partner or a possible scam designed to take your money? The answer is not a simple yes or no; it is a complex answer that requires a careful, fact-based investigation. While Fortune Prime Global (FPG) operates with regulatory licenses, a concerning number of user complaints and significant red flags raises serious questions about how it actually operates. The difference between its official legitimacy and the real-world experiences of many traders is alarming.

This analysis is designed to give you a clear, unbiased picture. We will not tell you what to think; instead, we will present the facts so you can make an informed decision for yourself about whether Fortune Prime Global legit status holds up under scrutiny. To do this, we will:

• Break down the broker's two regulatory licenses and what they mean for your protection.

• Objectively review the trading conditions and products FPG officially offers.

• Take a deep look into the pattern of user-reported complaints, focusing on the most serious allegations.

• Provide a final, data-driven verdict on the risks involved in trading with Fortune Prime Global.

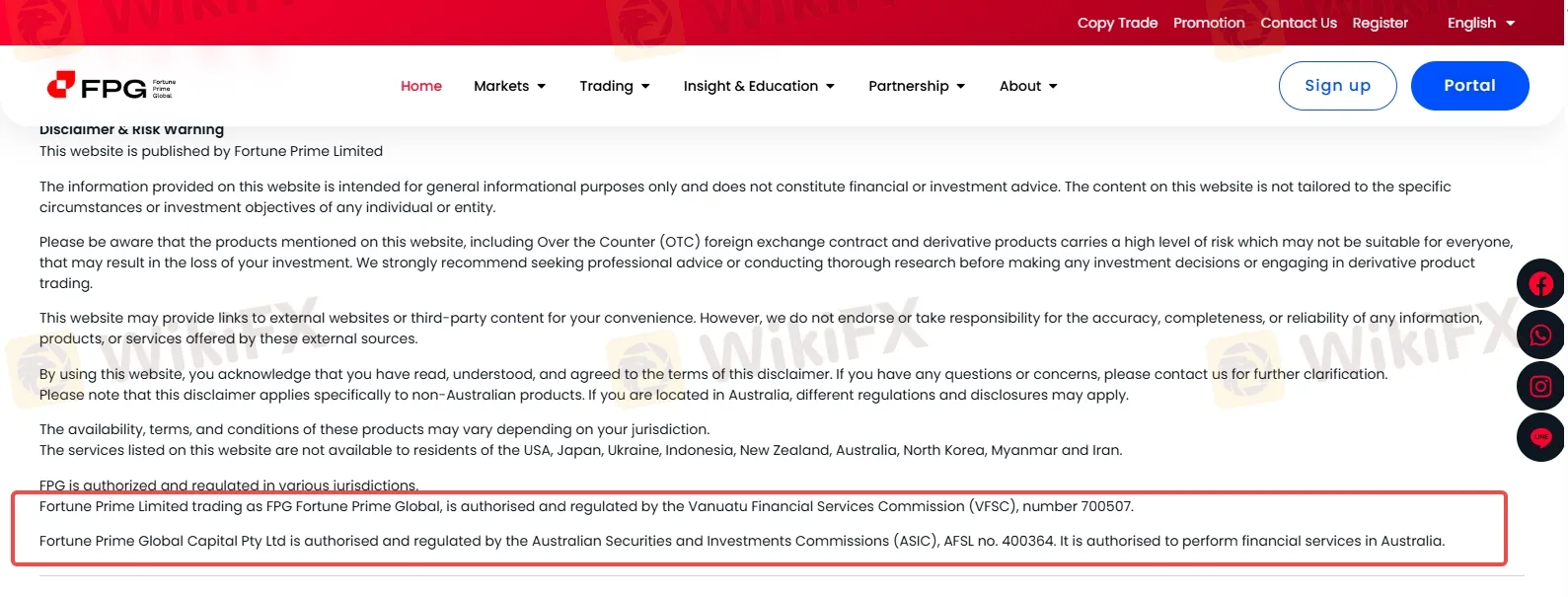

Understanding FPG's Regulatory Status- Is Fortune Prime Global legit?

A broker's regulatory status is the foundation of its legitimacy, but not all licenses offer the same level of protection. This is the most critical point to understand about Fortune Prime Global. The broker operates under two different entities with vastly different levels of oversight. This dual-license structure is a common industry practice, but it places the burden on the trader to know exactly where their funds are being held.

The key difference lies in the quality and enforcement power of the regulator. A top-tier regulator like ASIC provides strong investor protection, including compensation schemes and strict operational guidelines. An offshore regulator like VFSC offers minimal oversight and little to no help for traders who encounter problems.

When assessing whether Fortune Prime Global Legit standing is solid, the answer depends largely on which regulatory entity your trading account falls under. Traders onboarded under ASIC benefit from stronger legal protection, while those registered under the offshore entity assume a higher level of risk.

Here is a breakdown of FPG's two licenses:

| Regulatory Body | Entity Name | License Type | License No. |

| ASIC (Australia) | FORTUNE PRIME GLOBAL CAPITAL PTY LTD | Market Making (MM) | 400364 |

| VFSC (Vanuatu) | FORTUNE PRIME LIMITED | Forex Trading License | 700507 |

The crucial implication here is that your level of safety depends entirely on which entity your account is registered with. While the ASIC license provides a strong appearance of legitimacy, many international clients may be signed up through the Vanuatu (VFSC) entity. An account under VFSC regulation does not benefit from the strict protections offered by ASIC. This means if you run into a dispute, such as the inability to withdraw funds, you have very limited legal and regulatory options for help. When assessing whether Fortune Prime Global Legit status truly applies to your specific situation, the determining factor is which regulatory entity governs your account.

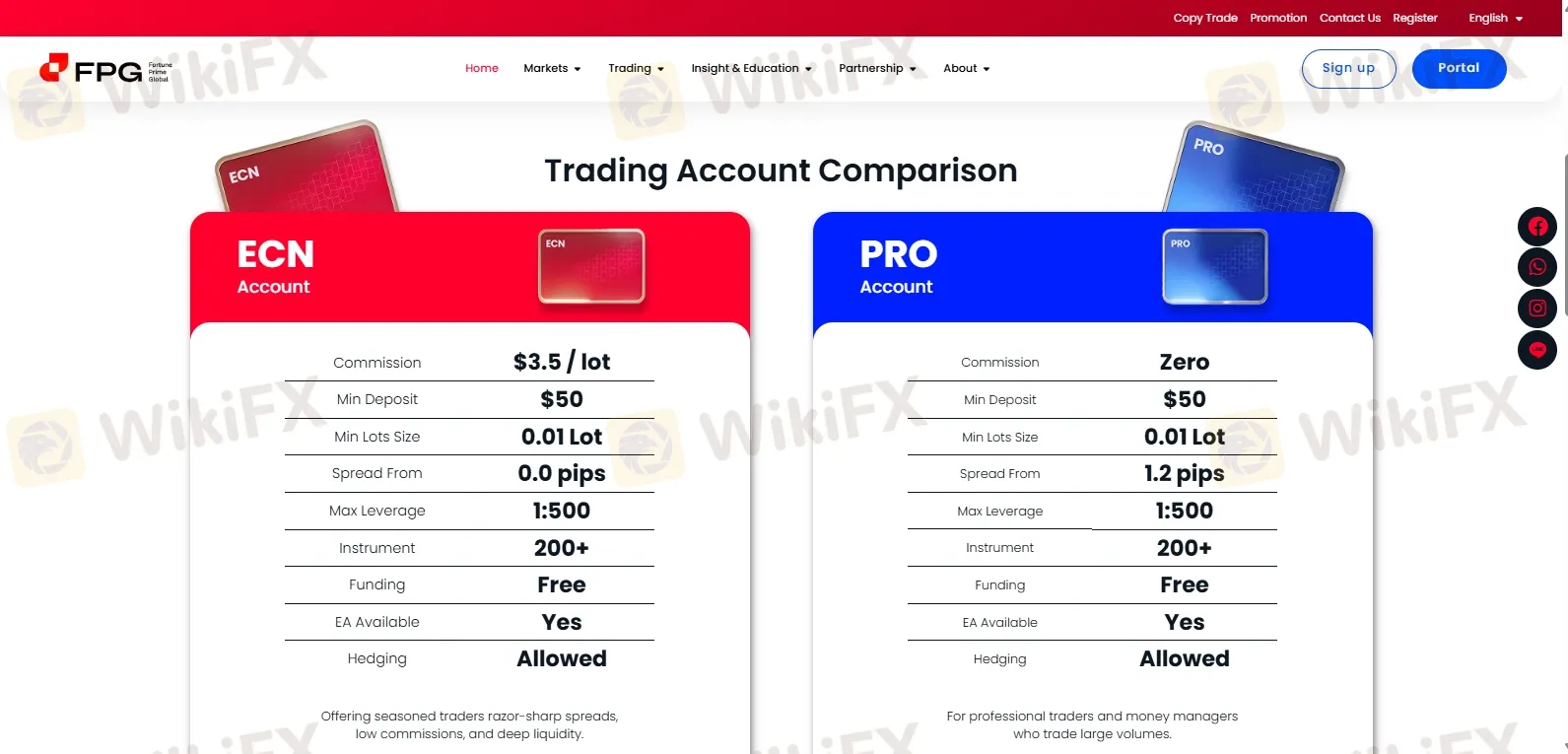

FPG's Advertised Trading Conditions

To understand what draws traders to FPG, we must objectively look at the products and trading conditions it advertises. On paper, Fortune Prime Global presents a competitive offering, catering to different types of traders through its MetaTrader 4 (MT4) and MT5 platforms.

The broker primarily offers two account types, PRO and ECN, with distinct fee structures.

| Account Feature | PRO Account | ECN Account |

| Minimum Deposit | $50 | $100 |

| Spreads | From 1.2 pip | From 0.0 pips |

| Commissions | Zero | From $3.5 per lot, per side |

| Maximum Leverage | Up to 1:500 | Up to 1:500 |

Beyond the account types, FPG's official offerings include several key features:

• Instruments: A broad range of over 100 instruments, including Forex pairs, commodities like gold, global indices, stocks, and cryptocurrencies.

• Platforms: Access to the industry-standard MT4 and MT5 platform for PC, Mac, and mobile, as well as a WebTrader for browser-based access.

• Deposits & Withdrawals: FPG supports multiple payment methods, including Bank Wire, Tether (USDT), China Union Pay, and regional payment systems like Help2Pay and Dragonpay. The broker explicitly claims it charges zero fees for deposits and withdrawals, a point we will revisit later.

• Leverage & Spreads: The availability of high leverage up to 1:500 and raw spreads from 0.0 pips on the ECN account are highly attractive features. However, high leverage is a double-edged sword that significantly amplifies both potential profits and losses.

These advertised conditions seem appealing and in line with industry standards. However, a broker's true value is not what it promises on its website, but whether it honors those promises, especially when it comes to the security and accessibility of client funds. This is critical when evaluating whether Fortune Prime Global legit status can be trusted.

Analyzing The Fortune Prime Global Scam Allegations

This section directly addresses the core of the user's fear: is Fortune Prime Global a scam? Based on the available data, there is a clear and disturbing pattern of serious complaints. WikiFX, a global broker regulatory inquiry app, has issued a stark warning on FPG's profile: “The WikiFX Score of this broker is reduced because of too many complaints!” As of early 2025, there are 16 exposure reports filed against the broker, which is a significant number.

These are not minor complaints about platform glitches or slippage. The allegations form a consistent narrative of withdrawal denial, profit confiscation, and tactics commonly associated with fraudulent operations. We have categorized the most severe complaints below, raising serious doubts about Fortune Prime Global Legit claims.

Overwhelming Withdrawal Problems

The most common and alarming red flag is the sheer volume of users reporting they cannot withdraw their money. This is the ultimate test of a broker's legitimacy, and FPG fails it repeatedly according to these user accounts.

Traders from multiple countries describe a similar, frustrating experience. One user from the United States stated plainly, “I've been trying to withdraw and I can't. I went through support and no help at all!” Another reported, “They keep on rejecting my withdrawals and I don't know what exactly the issue is.” For others, the process is dragged out indefinitely. An investor who made a profit of $2,554 from a $500 deposit reported their withdrawal application “keeps showing pending review.”

A particularly worrying cluster of complaints comes from South Korean traders, with multiple users in early 2025 reporting that “No withdrawals have been made for 5 months.” One trader specified that no withdrawals have been processed since November 2023, turning a once-trusted broker into a source of distress. These repeated issues strongly challenge the perception that Fortune Prime Global Legit operations are reliable.

Accusations of Profit Cancellation

Perhaps the most damning evidence comes from traders who were profitable, only to have their earnings and accounts confiscated. This suggests a business model that cannot tolerate winning clients.

One shocking case involves a trader from Singapore who invested $60,000 and, through careful trading, grew their account to $142,510. When they attempted to withdraw their profits, FPG allegedly disabled their trading account and backend access. The broker sent an email claiming the account was closed for investigation due to “suspected market manipulation.” The trader rightly questioned how a $60,000 account could manipulate the highly liquid global gold market on a platform with a market-making license. Ultimately, the broker only allowed the withdrawal of the initial principal, effectively confiscating over $82,000 in legitimate profits. The trader noted, “This is not how a professional financial platform should act! FPG Fortune Prime Global's behavior is tantamount to depriving me of my legitimate earnings.”

This was not an isolated incident. Another user reported a similar experience: “I was accused of 'market manipulation' by FPG after I made a profit, and my capital and profit were all wiped out.”

Frozen Accounts and Unexpected Fees

Another classic red flag for a scam operation is the practice of freezing funds and demanding additional payments to release them. One trader from the United Kingdom reported investing a substantial amount (393,364 USDT), only to have the funds frozen. The broker allegedly claimed the user's “credit score has fell” and demanded a payment of “1500usdt to up my credit limit” to unlock the funds. This tactic is a form of financial coercion designed to extract more money from a victim who is desperate to recover their initial investment.

This was not an isolated incident. Another user reported a similar experience: “I was accused of 'market manipulation' by FPG after I made a profit, and my capital and profit were all wiped out.” Such reports severely undermine claims of Fortune Prime Global legit operations.

These reports form a disturbing pattern. To understand the full scope of these risks and read the detailed accounts from affected traders, we strongly recommend reviewing them directly on the [Fortune Prime Global's WikiFX exposure pagehttps://www.wikifx.com/en/dealer/1636217011.html.

Are There Positive Experiences?

To maintain an objective perspective, it is important to acknowledge that not all feedback for Fortune Prime Global is negative. A number of users have reported positive experiences, which contributes to the complexity of a final judgment. If the broker were an outright scam for every single client, it would likely not have survived for 10-15 years.

The themes from positive reviews generally include:

• Platform Stability: Some users praise the platform for being stable and free of price manipulation, with one user contrasting it favorably against other brokers.

• Fast Transactions: A few traders report “fast deposits and withdrawals” and no fees, which directly contradicts the overwhelming number of withdrawal complaints.

• Good Service: Positive mentions of “great support,” “competitive spreads,” and “fast order execution” also appear.

This presents a critical question: Why is there such a stark difference in user experiences? The discrepancy is too wide to be a matter of random chance. We can hypothesize several potential reasons. Are the positive experiences limited to traders with small accounts or those who have not attempted to withdraw significant profits? Does the quality of service depend on the client's country of origin? Most importantly, could the difference be tied to the regulatory entity? It is plausible that clients under the ASIC-regulated entity receive better treatment, while those onboarded through the VFSC offshore entity are exposed to the severe issues detailed in the complaints.

While some users report good service, the severity and nature of the negative complaints—particularly those involving large sums and profit confiscation—cannot be ignored. A comprehensive view, including all positive and negative feedback, is essential for a complete picture and is available on the [full WikiFX profile for Fortune Prime Global-https://www.wikifx.com/en/dealer/1636217011.html

Our Final Verdict

Fortune Prime Global exists in a gray area. It is a technically regulated broker, holding a prestigious Tier-1 license from ASIC. On paper, these credentials support the claim that Fortune Prime Global Legit status is valid. However, the broker is also the subject of severe and numerous allegations that are classic hallmarks of a fraudulent operation, particularly regarding the denial of withdrawals and confiscation of profits. The positive on-paper credentials clash violently with the negative real-world experiences of a significant number of its clients, raising serious doubts about whether Fortune Prime Global Legit protections can be fully relied upon. For a clear summary, we have created a final “Legitimacy Scorecard.”

| Factor | Assessment | Key Finding |

| Regulation | Mixed | Holds a strong ASIC license, but also uses a high-risk offshore VFSC license, creating a two-tiered system of protection for clients. |

| User Reviews | Overwhelmingly Negative | A high volume of severe complaints regarding withdrawal failures and arbitrary profit confiscation points to systemic issues. |

| Trading Conditions | Fair | Offers competitive conditions on paper, but this is rendered irrelevant if the broker fails to honor withdrawals and profits. |

Based on this evidence, while FPG is not an entirely unregulated entity, it operates with a very high-risk profile. The consistent pattern of complaints, especially from profitable traders, suggests a substantial danger that you may be unable to access your funds. A broker's primary duty is to safeguard client funds and honor its financial obligations. When a broker is widely accused of failing this fundamental duty, the term “legit” becomes highly questionable.

We strongly advise extreme caution. The risk of encountering the severe issues detailed in the user exposure reports appears to be unacceptably high.

Before you consider depositing any funds, the most critical step is to verify the latest information yourself. The WikiFX score and detailed complaints are non-negotiable data points for your safety. We urge you to visit the [official Fortune Prime Global page on WikiFXhttps://www.wikifx.com/en/dealer/1636217011.html to check for any new alerts and review all evidence firsthand.

WikiFX Broker

Latest News

Kraken Review 2025: Is This Forex Broker Safe?

IQ Option Review: The High-Stakes Game of Withholding Trader Capital

AssetsFX Regulation: A Complete Guide to Licenses and Trading Risks

Grand Capital Review 2026: Is this Broker Safe?

MultiBank Group Review: A Regulatory Titan or a Master of Liquidation?

ZarVista User Reputation: Looking at Real User Reviews to Check if It's Trustworthy

ZaraVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

Pinnacle Pips Forex Fraud Exposed

S. Africa Energy Gridlock: Glencore Proposal Stalls Amid Regulatory Clash

TP Trader Academy ‘The Axis Event’: Pioneering Trading Education at the Heart of Tech and Data

Rate Calc