EXON Markets

Abstract:EXON Markets is allegedly a suspicious regulated forex and CFD broker registered in Vanuatu since 2017 that claims to provide its clients with over 200 tradable financial instruments with the default leverage of 50:1 and floating spreads from 0.5 pips on the MT5 iOS, Android, Web and Desktop trading platforms, as well as a choice of seven different live account types.

General Information & Regulation

EXON Markets is allegedly a suspicious regulated forex and CFD broker registered in Vanuatu since 2017 that claims to provide its clients with over 200 tradable financial instruments with the default leverage of 50:1 and floating spreads from 0.5 pips on the MT5 iOS, Android, Web and Desktop trading platforms, as well as a choice of seven different live account types. Here is the home page of this brokers official site:

As for regulation, EXON Markets says it is regulated by the (VFSC) Vanuatu Financial Services Commission. But in reality, it has been verified that the broker does not fall under any valid regulations. That is why its regulatory status on WikiFX is listed as “No License” and it receives a relatively low score of 1.28/10. Please be aware of the risk.

Market Instruments

EXON Markets advertises that it offers access to more than 200 trading instruments in financial markets, including 140+ forex currency pairs, commodities, oil, cryptocurrencies, indices, stocks and CFDs.

Account Types

Apart from demo accounts with a balance of $10,000, EXON Markets claims to offer seven types of trading accounts, namely Standard, Bronze, Silver, Gold, Platinum, Premium and VIP, as well as Islamic accounts. The minimum initial deposit amount is extremely high-$500 for the Standard account, while the other six live account types have much higher minimum initial capital requirements of $1,000, $3,000, $5,000, $10,000, $25,000 and $50,000 respectively. In comparison, licensed brokers allow setting up a starter account with a minimum deposit of $100 or even less. Note that demo trading accounts are limited to 1 month and after this period, the demo account will be deactivated.

Leverage

EXON Markets website states that the default leverage for forex transactions is 50:1. It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

Spreads & Commissions

EXON Markets claims that the spread starts from 0.5 pips and commission is free of charge.

Trading Platform Available

Platforms available for trading at EXON Markets are MT5 iOS, Android, Web and Desktop. In any case, we recommend using MT4 or MT5 for your trading platform. Forex traders praise MetaTrader's stability and trustworthiness as the most popular forex trading platform. Expert Advisors, Algo trading, Complex indicators, and Strategy testers are some of the sophisticated trading tools available on this platform. There are currently 10,000+ trading apps available on the Metatrader marketplace that traders can use to improve their performance. By using the right mobile terminals, including iOS and Android devices, you can trade from anywhere and at any time through MT4 and MT5.

Deposit & Withdrawal

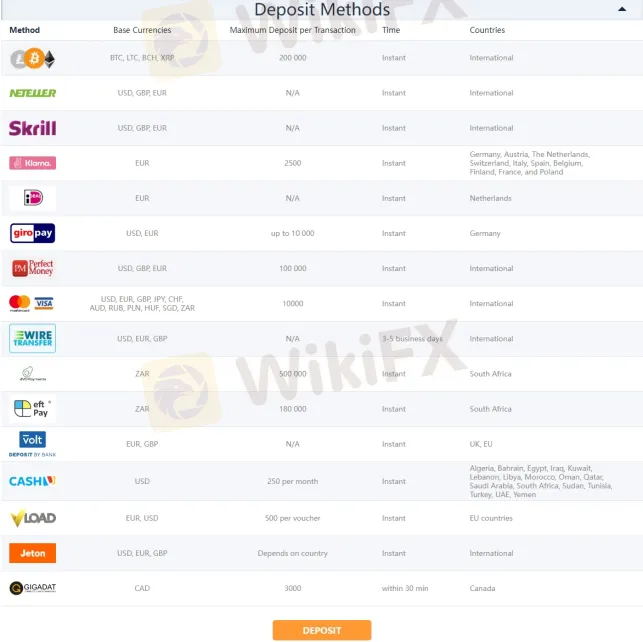

EXON Markets says to accept deposits via cryptocurrencies, Neteller, Skrill, Klarna, iDEAL, giropay, Perfect Money, Visa, MasterCard, Wire Transfer, AVOPayments, eft Pay, Volt, CASH, LOAD, Jeton and GIGADAT, while the withdrawal methods are except iDEAL, Volt, CASH and GIGADAT. The minimum initial deposit requirement is said to be $500, while there is no mention of what the minimum withdrawal amount is. The maximum deposit and withdrawal amounts differ depending on the methods. The broker also says that there is no deposit fee charged.

As for the processing time of deposit and withdrawal requests, Wire Transfer deposits require 3-5 business days to be processed, GIGADAT deposit requests are said to be processed within 30 minutes, while other deposits are instant. Withdrawals take a minimum of 3-5 business days upon completion of compliance requirements. For wire transfers, it may require more time.

Customer Support

EXON Markets customer support can be reached Mon-Fri 8:00-24:00 (GMT+3) by telephone: +1 (469) 251 0018, email: support@exonmarkets.com or live chat. You can also follow this broker on social networks such as WhatsApp, Twitter, Facebook, Instagram, YouTube and LinkedIn. Company address: Rue De Paris, Port-Vila, Vanuatu.

Risk Warning

Online trading involves a significant level of risk and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

Read more

NaFa Markets Regulation: A Deep Dive Investigation Exposing a Major Scam

WARNING: Do not put any money into NaFa Markets. Our research shows it has all the signs of a clever financial scam. This platform lies about its legal status and uses tricks that are the same as fake investment schemes designed to steal your funds. When people search for information about NaFa Markets regulation, they need to know the truth: it is fake and made up.

Is NaFa Markets Legit? A Complete Investigation

Our research into NaFa Markets gives us a clear and urgent answer. For anyone asking, "Is NaFa Markets legit?", the answer is definitely no. This platform shows all the typical signs of a fake operation created to steal funds from people who don't know better. We strongly recommend that all traders stay completely away from this platform.

Capitalix Review: Revealing the Latest Fund Scam Allegations Against the Broker

Has Capitalix imposed a fine on your trading inactivity? Did you still lose your capital despite paying the fine amount? Have you had multiple instances of fund scams at Capitalix? Does your forex trading account balance often become negative? Failed to receive a response to the Capitalix withdrawal application? Did you face a prolonged drawdown issue on the broker’s trading platform? You are not alone! Many traders have reported these issues on broker review platforms such as WikiFX. We have uncovered all these alleged trading activities in this Capitalix review article. Take a look!

UFX Partners Review: Traders Allege Fund Scams and Withdrawal Issues

UFX Partners, a UK-based forex broker, has been flagged by many traders as a scam forex broker. Frequent reports of profit deletions, withdrawal blocks, and alleged fund scams are trending on several broker review platforms. Some traders reportedly lost all of their life savings due to the broker’s illegitimate trading activities. In this UFX Partners review article, we have highlighted numerous allegations against the broker. Read on!

WikiFX Broker

Latest News

Is Forex Still Worth It in 2026? Global Central Banks Are Splitting

JPY Volatility Ahead: PM Takaichi Calls Snap Election Amid Rate Hike Speculation

China Holds Rates Steady After Hitting 5% Growth Target, Easing Expected in Q1

The Fed on Trial: Markets Brace for Supreme Court Showdown Over Central Bank Independence

Trade War 2.0: Trump’s Greenland Ultimatum Rattles Transatlantic Alliance

Euro Stabilizes as France Forces 2026 Budget; Bond Spreads Narrow

JPY Volatility Spikes as PM Takaichi Calls Snap Election and Fiscal Gamble

AI in Medicine: Diagnostics, Privacy, and Ethical Challenges

TSMC Earnings Confirm AI "Supercycle," But Capacity Wall Looms

China Macro: Liquidity Trap Signals Persist Despite Credit Bump

Rate Calc