EMD Forex -Overview of Minimum Deposit, Leverage, Spreads

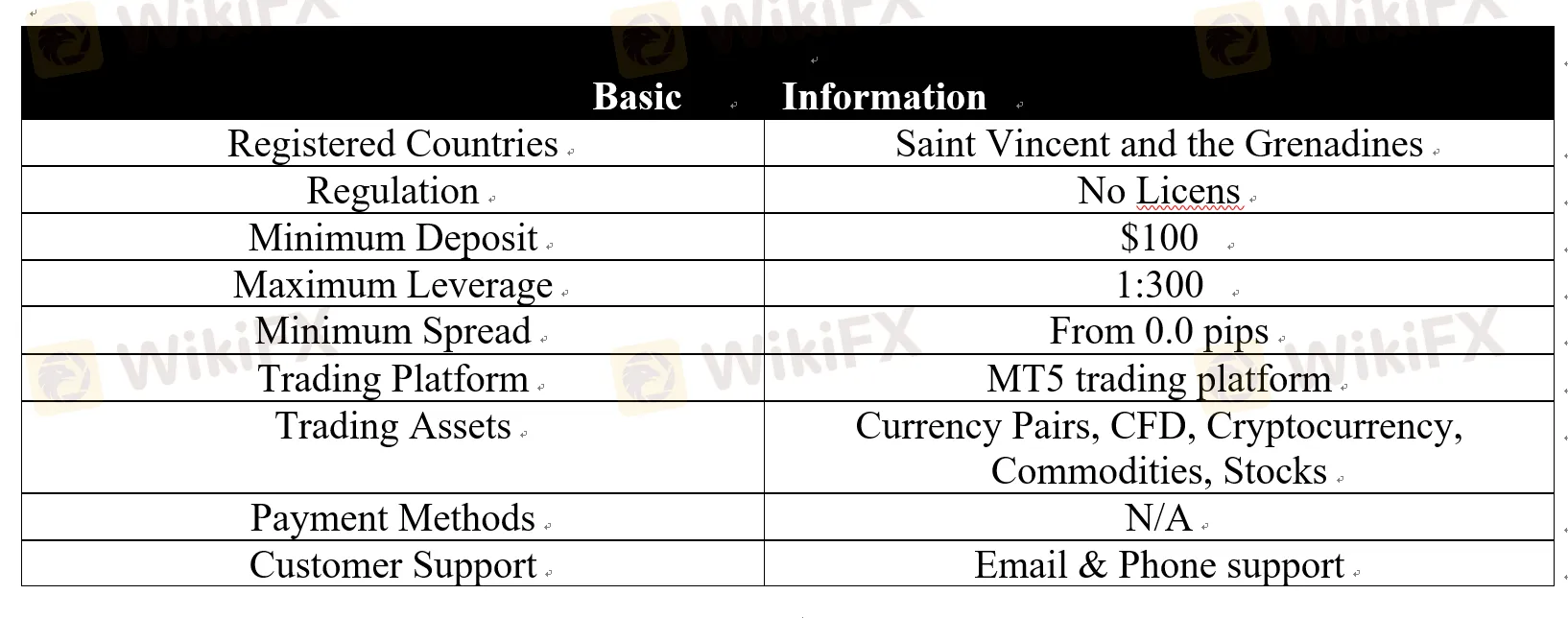

Abstract:Registered in Saint Vincent and the Grenadines, EMD Forex is an online forex broker offering a series of trading instruments, including currency pairs, commodities, index, stocks, as well as digital pairs. With EMD Forex, investors have the flexibility to choose from three trading accounts, and the maximum leverage that can be used is up to 1:300.

General Information

Registered in Saint Vincent and the Grenadines, EMD Forex is an online forex broker offering a series of trading instruments, including currency pairs, commodities, index, stocks, as well as digital pairs. With EMD Forex, investors have the flexibility to choose from three trading accounts, and the maximum leverage that can be used is up to 1:300.

Market Instruments

EMD Forex offers its clients access to various trading instruments, including 70 currency pairs, all commodities, gold and silver, platinum, as well as 50 cryptocurrencies.

Account Types

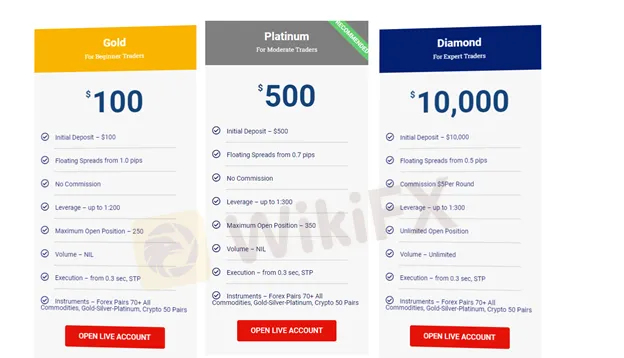

EMD Forex provides a total of three types of trading accounts to suit its clients different trading needs, including Gold, Platinum and Diamond accounts.

The Gold account is suitable for Gold account, and to open this account, an initial deposit of $100 is enough.

The Platinum account is suitable for moderate traders, and this account asks for an initial deposit of $500.

The Diamond account is designed for an Expert Traders, and traders who want to try out this account need to fund at least $10,000.

Aside from live trading accounts, demo accounts are also available with the EMD Forex platform for newcomers to get a feel of this platform and practice their trading skills.

Leverage

When it comes to leverage, EMD Forex permits traders to use leverage of up to 1:300, which is significantly higher than the levels regarded appropriate by many regulators.

As leverage can also cause serious fund losses, it is important for inexperienced traders to choose the proper amount that they feel most at ease.

Spreads

Like many other forex brokers, spreads and commission are determined by trading accounts you are holding on the EMD Forex platform. The Gold and Platinum account offers a commission-free trading environment, with spreads from 1.0 pips, and 0.7 pips, respectively. The Diamond account charges both spreads and commissions, with floating spreads from 0.5 pips, and a commission of $5 per lot is charged.

Trading Platform

EMD Forex provides its clients access to the leading MT5 trading platform and some features and functionalities of the MT5 trading platform include the following:

User friendly and high-customized

Multiple technical indicators, and robust charting tools

Free EA hosting capabilities

Web and mobile trading support

Payment Methods

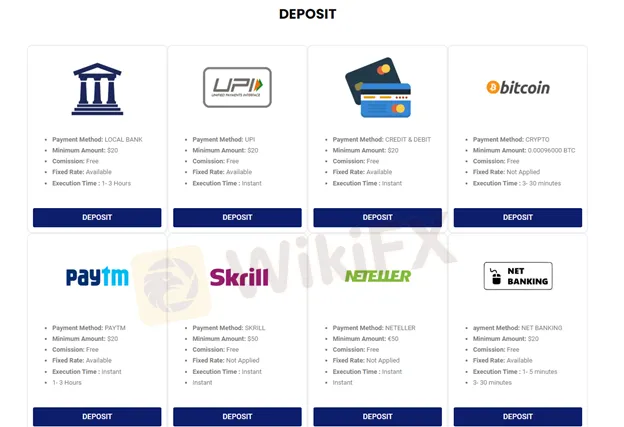

The minimum initial deposit required to invest with this broker varies depending on payment methods. EMD Forex allows its clients to make a deposit through Local Bank, UPI, Credit/Debit Cards, Crypto, PayTM, Skrill, Neteller, Netbanking.

Withdrawal

The minimum withdrawal amount also varies depending on payment methods. And EMD Forex allows its clients to make a withdrawal through Local Bank, Bitcoin, Skrill and Neteller.

Customer Support

Traders can reach out to EMD Forex about any questions or concerns they may have about their accounts or their trading through the following methods:

Online Communication

Email: support@emdforex.com

Address 1: Premier Business Centre, 10t h Floor, Sterling Tower, 14 Poudriere Street, Port Louis, Mauritius

Address 2: Suite 305, Griffith Corporate Centre, Beachmont, Kingston, St. Vincent And The Grenadines

Or you can follow this brokerage house on some social media platforms, such as Facebook, Instagram, Twitter, Youtube, Linkedin and whatsapp.

Risk Warning

There is a level of danger that comes with trading on the financial markets. As sophisticated instruments, foreign exchange, futures, CFDs, and other financial contracts are typically traded using margin, which significantly increases the inherent risks involved. Therefore, you should consider carefully whether or not this sort of investment activity is right for you.

The information presented in this article is intended solely for reference purposes.

Read more

HTFX Broker Reviews: Withdrawal Complaints Rise Explained

HTFX broker faces mounting scam complaints over withdrawal delays and unprocessed funds. Learn about user experiences, regulation, and red flags before trading.

WikiFX Launches Safepedia Lounge Today: Co-Building a Forex Safety Knowledge Community with Users

As a globally leading forex information service platform, WikiFX is pleased to announce the upcoming official launch of its new initiative – the “WikiFX Safepedia Lounge”. This platform aims to create an authoritative, trustworthy, and open forex knowledge community for investors through high-quality content and expert interaction.

EC Markets Posts Record 2024 Earnings as Global Expansion Accelerates

EC Markets’ 2024 revenue nearly doubles year-on-year, fueled by global growth, new regulatory licenses, and diversified income streams in forex and CFD brokerage.

Is MTrading Licensed or Operating Illegally?

MTrading broker review: Unregulated status, high-risk leverage, mixed user feedback, scam warnings, and essential red flags for traders seeking safety and transparency.

WikiFX Broker

Latest News

Malaysia SC’s Toughest Ad Ban: What It Means for Forex

WikiFX Interview “The Role of KOLs and Educators: Guiding Investors Through Uncertainty”

No Hidden Fees, No Custody Risks – InstaXchange Sets a New Standard for Crypto Exchanges

EC Markets Posts Record 2024 Earnings as Global Expansion Accelerates

Jim Cramer flips the playbook on the S&P 500

Goldman Sachs reboots jobs forecast before Friday's unemployment report

Trump finalizes Japan trade deal with 15% tariffs as Ishiba faces discontent from within party

【WikiEXPO Global Expert Interviews】 Cleopatra Kitti: A Foresight on Cross-Border Regulation

Is MTrading Licensed or Operating Illegally?

Cyprus ICF Ejects Four Firms After CySEC Licence Revocations

Rate Calc