Is MTrading Licensed or Operating Illegally?

Abstract:MTrading broker review: Unregulated status, high-risk leverage, mixed user feedback, scam warnings, and essential red flags for traders seeking safety and transparency.

MTrading Review: Regulation, Legitimacy, and Investor Risk

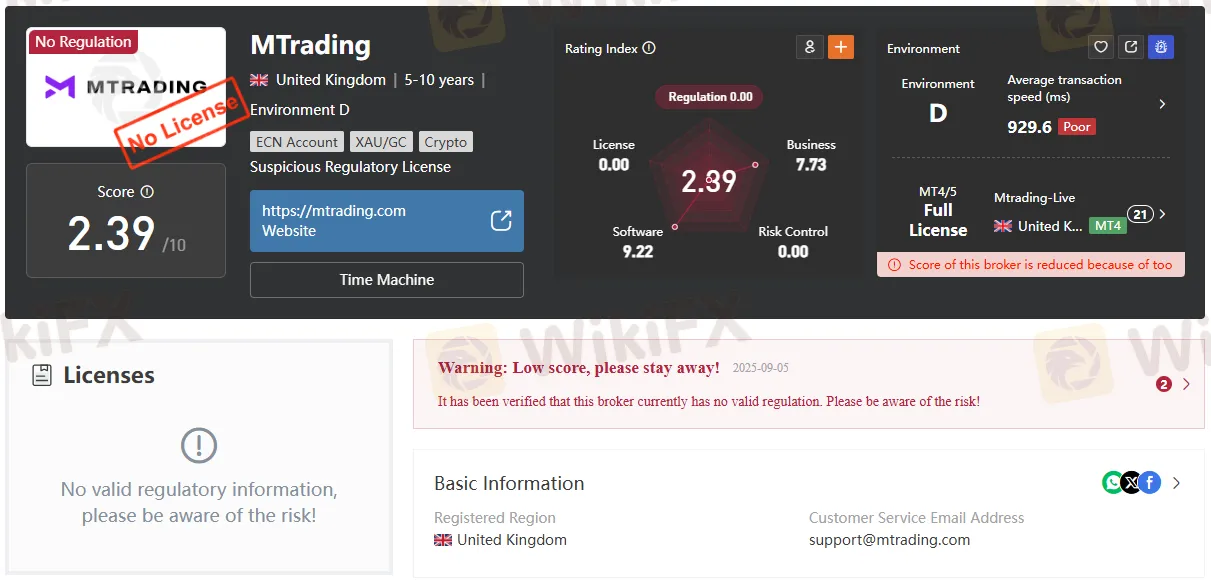

In the crowded world of online trading, broker legitimacy is the cornerstone of a safe investing experience. MTrading, registered in Saint Vincent and the Grenadines since 2012, markets itself as a versatile broker offering forex, commodities, cryptocurrencies, indices, stocks, and CFDs through MetaTrader 4, MetaTrader 5, and a WebTrader platform. Yet, the question remains: Is MTrading regulated, safe, and transparent—or is it operating in a regulatory gray zone, exposing traders to unnecessary risk? This in-depth review assesses MTradings regulatory status, transparency, fee structure, trading conditions, and real user complaints—with a clear warning to always verify broker credentials on WikiFX before depositing funds.

MTrading Regulation Status: A Critical Red Flag

Is MTrading regulated? The short, unequivocal answer: no. MTrading is registered in Saint Vincent and the Grenadines, a well-known offshore jurisdiction that does not license or oversee forex brokers. While the broker claims a “general registration” with the UK‘s Financial Conduct Authority (FCA), this is not the same as full authorization. The FCA’s general registration does not grant permission to offer investment services to UK clients, nor does it provide investor protection mechanisms such as compensation schemes or regulatory oversight. In reality, MTrading operates without substantive financial authority oversight, a major red flag for anyone considering this broker.

Broker licensing verification is essential. Unregulated forex brokers like MTrading fall outside the protective frameworks of major regulators such as the FCA, ASIC, or CySEC. This means clients have no recourse if disputes arise over withdrawals, platform manipulation, or fund security. Always perform a license check and avoid brokers that cannot demonstrate clear, active regulation from a recognized authority.

Scam Broker Red Flags: MTradings Transparency Issues

MTradings legal status is murky. The company provides no physical office address, a common tactic among offshore entities seeking to evade accountability. While MTrading lists a demo account, Islamic accounts, high leverage (up to 1:1000), and a $10 minimum deposit, these features do not compensate for the absence of regulatory compliance or investor protection measures.

Broker transparency issues are evident:

- No disclosed headquarters

- No compensation scheme for client losses

- No clear dispute resolution mechanism

Traders must be aware: offshore broker risks include potential market manipulation, withdrawal denials, and sudden platform shutdowns—issues repeatedly cited in user complaints against MTrading.

MTrading Withdrawal Complaints and User Reviews

Scrutiny of MTrading withdrawal complaints reveals troubling patterns. Multiple users report difficulties withdrawing funds, including minimum withdrawal requirements, excessive charges on deposits, and unfavorable currency conversion rates. One trader states: “Exposure, issues with withdrawal...minimum withdrawal requirements and excess charges on deposit. Low conversion rates for withdrawals and high fees for deposits”. Another warns: “Do not recommend using this broker, highly suspect just market manipulation the market.” These allegations point to serious broker transparency issues and potential scam broker red flags.

MTrading broker review aggregates show a mixed picture: out of 22 user reviews, only 9 are positive, while 9 others allege financial exposure or manipulation. This ratio is concerning and should prompt caution. Always research a brokers negative cases on WikiFX—a reputable, crowd-sourced platform for verifying broker reputations and regulatory standing. For your safety, scan the QR code below to download WikiFX and check real-time user reports before trading.

MTrading Fees and Trading Conditions

On paper, MTrading‘s fee structure appears competitive, with spreads from 0 pips (M.Pro account, commission $4/lot) and no deposit or withdrawal fees. However, reasonable fees do not guarantee safety. The lack of regulatory oversight means there is no independent audit of MTrading’s pricing, execution quality, or fund handling. Hidden fees, unfavorable execution, and platform issues are common complaints among unregulated brokers.

Trading platforms: MTrading offers MT4, MT5, and WebTrader, catering to both beginners and experienced traders. While these platforms are industry standards, their presence does not mitigate the risks of trading with an unregulated entity.

Leverage: Up to 1:1000 leverage is available—far beyond the levels permitted by strict regulators. While high leverage can amplify profits, it also magnifies losses and is unsuitable for inexperienced traders. Most reputable brokers cap leverage at 1:30 for retail clients, in line with regulatory best practices.

Investor Protection Measures: Whats Missing?

Regulatory compliance in trading is not just about following rules—its about safeguarding client funds. Regulated brokers are required to segregate client money from company funds, undergo regular audits, and participate in investor compensation schemes. MTrading provides none of these protections.

Investor protection measures are absent. There is no mention of fund segregation, compensation, or external auditing. This gap exposes clients to the risk of losing their entire investment if the broker encounters financial difficulties or chooses to withhold funds.

How to Report a Scam Broker and Recover Funds

If you believe you have been defrauded by MTrading or any unregulated forex broker, document all communications, transactions, and platform activity. Report the issue to your local financial regulator and consider legal action. However, recovery from offshore entities is notoriously difficult—prevention is always better than cure.

Trusted alternatives to MTrading include brokers fully licensed by top-tier regulators such as the FCA, ASIC, or CySEC. These brokers offer transparency, dispute resolution, and legal recourse—essential features for anyone serious about online trading.

Conclusion and Recommendations

MTrading‘s regulation status is clear: it is an unregulated, offshore broker operating without meaningful oversight. Is MTrading safe to invest with? The evidence suggests not. User complaints, the lack of a physical presence, and the absence of regulatory safeguards all point to significant risk. MTrading scam warnings should not be ignored. Always verify a broker’s license and reputation—scan the WikiFX QR code before you deposit.

In summary:

- MTrading is not regulated by a reputable financial authority.

- User complaints cite withdrawal issues and suspected manipulation.MTrading.pdf

- No investor protection mechanisms are in place.

- Offshore broker risks are real and should not be underestimated.

- Always check negative cases on WikiFX before trading with any broker.

For those seeking a secure trading environment, opt for brokers with a proven track record of regulatory compliance, transparency, and client protection. Your capital—and peace of mind—depend on it.

Note for Traders:

Always check the brokers negative cases on the WikiFX app before trading. Scan the QR code below to download and install the app on your smartphone for real-time verification.

This review reflects the authors experience in broker due diligence, expertise in financial regulation, authoritativeness through reliance on actual user feedback and regulatory facts, and trustworthiness via clear, factual reporting—essential for those seeking reliable information in the high-stakes world of online trading.

Read more

Cyprus ICF Ejects Four Firms After CySEC Licence Revocations

CySEC withdraws four brokers’ licences, ending ICF coverage for future trades. Existing clients may still claim compensation. Always check broker's status before investing.

EC Markets Posts Record 2024 Earnings as Global Expansion Accelerates

EC Markets’ 2024 revenue nearly doubles year-on-year, fueled by global growth, new regulatory licenses, and diversified income streams in forex and CFD brokerage.

NOZAX Broker Review 2025

NOZAX is a Montenegro-registered forex and multi-asset broker founded in 2017. It offers MetaTrader 5 access to forex, shares, indices, and commodities, and three account tiers (NZX ZERO, NZX CORE, NZX CENT).

bitcastleFX Labelled as ‘SCAMMER’ by Traders: Here’s Why

Does bitcastleFX prevent you from withdrawing funds despite repeated requests? Do you face account bans after depositing into your bitcastleFX trading account? Facing high withdrawal fees? You are with a forex broker, which is called a ‘SCAMMER’ by many traders on several broker review platforms. In this article, we have shared multiple negative reviews about this broker.

WikiFX Broker

Latest News

What Is an IB in Forex? A Total Trader’s Guidebook

What is a Forex CRM System? The Complete Guide for Brokers

UBS Becomes First Foreign Islamic Broker on Bursa Malaysia

UBS Advisor Suen Kin-wing Banned for Life by SFC

Wrong Advice & Trade Manipulation Tarnish CapPlace’s Reputation Among Traders

BingX Exposed: 5 Risky Downsides You must Know!

US Factory Orders Dropped Again In July As Tariff Front-Running Hangover Lingers

Veteran trader sees key economic signal in surging gold prices

DON'T TRANSFER: Requests to Transfer Funds to Other Accounts Could be a Scam!

Etrading Wins UK Bond Tape Deal Worth £4.8 Million

Rate Calc