Mohicans markets:Markets Await September Meeting

Abstract:In the Asian session on Thursday, September 15, spot gold in the pivoting point 1698.78 further lower, and the primary support focus on 1683.96; spot silver fell below the pivoting point 19.54 after a small rebound, so must pay attention to whether it can return to the pivoting point above; WTI crude oil tested the pivoting point 98.54 after upward approaching the first resistance 89.16; the U.S. dollar index rallied back, erasing most of the intraday.

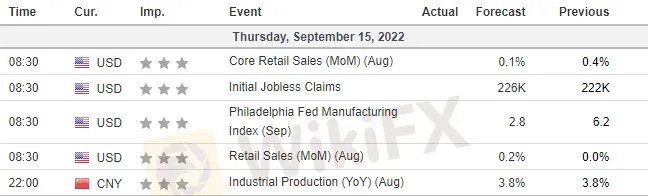

Key Data

Fundamentals overview

In the Asian session on Thursday, September 15, spot gold in the pivoting point 1698.78 further lower, and the primary support focus on 1683.96; spot silver fell below the pivoting point 19.54 after a small rebound, so must pay attention to whether it can return to the pivoting point above; WTI crude oil tested the pivoting point 98.54 after upward approaching the first resistance 89.16; the U.S. dollar index rallied back, erasing most of the intraday. The U.S. dollar index has retreated, erasing most of its intraday gains and approaching its first support at 109.62.

This trading day will be announced the change in the number of U.S. initial jobless claims, the monthly rate of U.S. retail sale in August and the monthly rate of U.S. industrial output in August. Among them, retail sale data is commonly known as “horrible data”, and the market impact is relatively large, so investors need to focus on.

The Mohicans Markets strategy is for reference only and not as investment advice. Please read the terms of the statement at the end of the article carefully. The following strategy was updated at 16:30 on September 15, 2022, Beijing time.

Technical View

ONE · Technical Level · International Gold

1745-1750 Bullish decrease sharply, bearish decrease slightly, resistance area

1735-1740 Bullish increase, bearish unchanged, long target area

1720 Bullish decrease, bearish decrease slightly, resistance

1707-1712, Key resistance area, gold continues to come under pressure below that level

1700 Bullish increase, bearish decrease sharply, long target

1692, Present contention point, confirm break to the downside

1670-1685 Bullish increase, bearish increase sharply, short target area

Technical Analysis

Although the market suspended the irrational sell-off, a few days Asian trading suffered a wave of smash after the continued negative decline, approaching the annual support range. From a larger cycle, gold still faces downside pressure under 1710-1712, and the first target for shorts is the annual support range of 1675-1680.

On the other hand, it is above 1700 that bullish options are relatively positively laid out. It suggests that if gold regains 1700 in the short term, there may be some short term long money coming in. Look up to around 1710-1715 and further break above 1720 to 1735-1740.

Note: The above strategy was updated at 16:00 on September 15. This strategy is a day strategy, please pay attention to the release time of the strategy.

TWO · Technical level · Spot silver

19.9-20, Bullish increase, bearish unchanged, starting point of volume, strong resistance area

19.75 Strong resistance

19.55 Bullish increase sharply, bearish increase, resistance turns into support

18.9-19.2 Rebound key support area

18.3-18.5 Key support area (long cost area)

17.85 Ultimate support

Technical Analysis

Spot silver held steady at 19.25 on Wednesday and then oscillated to the upside, continuing to diverge from gold, once stabilizing above the key resistance at 19.55 in the early trading. However, driven by the decline in gold, it again broke down and support once again turned to focus on 19.2. the level broken will look down to 19 integer level.

In terms of major cycle, although the trend of silver in the past few daysis stronger than gold, the fundamentals do not support the upside. Technically if it can break through the downward trend line suppression since the beginning of June, but also the CPI data. It is expected to attract more bulls to enter the market, looking at the vicinity of 21..

Note: The above strategy was updated at 16:00 on September 15. This strategy is a day strategy, please pay attention to the release time of the strategy.

THREE · Technical Level · US Crude Oil

95 Bullish increase sharply and the stock is large, bearish unchanged, long target

91-92 Bullish increase, bearish decrease, resistance and long target

90 Bullish increase and long dominance, bearish increase, short term long target

88 Bullish decrease, bearish increase, long and short division point

87-87.5 Bullish decrease, bearish increase and short prevails, downside momentum expand

85 Bullish increase, bearish decrease, support and short target

81.5-82.5 Bullish decrease slightly, bearish increase, short target

Technical Analysis

Crude oil stabilized 86.6 support to the upside yesterday, but was stopped near 98.7. On the options side, there are more bearish options bets to the downside in the 86-88 range, and there is quite some contention between long and short stocks near the current price. Expectations of U.S. inventory replenishment may support oil prices, but weak demand will also limit further upside. 90 is the first resistance above crude oil, but there are a number of calls coming in, which, along with their inventory strength, constitute the first long target. If crude oil goes further to the upside, please focus on the 91-91 area, which was strong resistance earlier, but it currently has bulls in to bet on a breakout. At the same time, there are also plenty of bullish options entering at 95 to lay out an upside move.

On the other hand, there is also a need to watch below to see if we can hold 88 support, which is the long-short split. If it loses, downside risk could be exacerbated by a large number of short entries at 87-87.5. 85 is a key support level, with short targets around the recent lows of 81.25-82.5. Note: The above strategy was updated at 16:00 on September 15. This strategy is a day strategy, please pay attention to the release time of the strategy.

FOUR · Technical level · EUR/USD

1.01 bullish decrease, bearish decrease, bull target and resistance

1.005 bullish increase, bearish unchanged, rebound target and resistance

1.00 bullish increase, bearish increase and large stock, first resistance

0.995 bullish increase, bearish decrease, fall back to support

0.99 bullish increase, bearish decrease and large stock, bearish target and support

0.985-0.9875 bullish increase, bearish increase and large stock, short target

Technical Analysis

On Wednesday, Europe and the United States finished higher and fell, but failed to close above the resistance parity. Today's opening continued yesterday's downward trend.

In terms of options, the short action is relatively large compared to the long one, and a large number of new bets are added at the parity, so the rebound resistance still needs to pay attention to the parity position.

However, in the lower range of 0.99-0.995, the bears left the market continuously, while the long funds continued to increase their positions, so the support of Europe and the United States should be paid attention to 0.995;

At the same time, the short bets around 0.99 are intensive, or it will be a short target, and then the next short target will be located at 0.985-0.9875, because the short funds have a large number of entry in this range.

In the upward direction, if it can break above the resistance of 1.00, Europe and the United States may look to the rebound target of 1.005 and the long target of 1.01, and there is resistance at both positions.

Note: The above strategy was updated at 16:00 on September 15th. This strategy is a day strategy, please pay attention to the release time of the strategy.

FIVE · Technical Level · GBPUSD

1.165-1.1675 bullish increase, bearish increase, bulls target

1.16 bullish unchanged, bearish increases slightly and the stock is large, the rebound target and resistance

1.155 bullish unchanged, bearish increase and large stock, first resistance

1.15 bullish unchanged, bearish increases slightly, and the fall target and support

1.145 bullish unchanged, bearish increase and large stock, bear target and support

1.14-1.142 bullish unchanged, bearish increase, next short target

Technical Analysis

The trend of the pound and dollar on Wednesday still followed the dollar, and fell back, failing to test the rebound target of 1.16. Now it has returned to the resistance of 1.155, continuing the decline in the second half of the US session yesterday.

In terms of options, below 1.16, basically only short funds enter the market, there is no new action by longs, and the bets are relatively scarce, and the funds as a whole tend to bet on the fall below 1.16. At present, 1.155 will be the first resistance for the pound and the United States. If it breaks through, it is necessary to pay attention to whether the rebound target of 1.16 can be tested again. This range may be the target for the bulls as new bets start at 1.165-1.1675.

On the downside, 1.15 will be the fall target and support. If it falls below, it may look to the short target of 1.145 and 1.14-1.142. The short chips around 1.145 are dense and need special attention.

Note: The above strategy was updated at 16:00 on September 15th. This strategy is a day strategy, please pay attention to the release time of the strategy.

SIX · Technical level · AUD/USD

0.695 bullish increase, bearish unchanged but large stock, resistance level

0.685 bullish increase, bearish increase, bulls target and resistance

0.68 bullish increase, put options remain unchanged but the stock is large, long and short are competing for points

0.675 bullish increase, bearish increase sharply, long-short dividing point

0.67 bullish unchanged, bearish unchanged but the stock is large, short target

0.655 bullish unchanged, bearish increase, bearish target

Technical Analysis

The Australian dollar has been less volatile in the past two days, and the options market has not moved significantly. The long and short stock of 0.68 is not small, and there may be competition. If Australia dollar and dollar go up, they may further test the 0.685 resistance. The bears have a stock advantage at this point, but there are 226 call options betting on the upside, and it is necessary to pay attention to whether there are signs of the expansion of the upward movement in Australia and the United States.

But at the same time, 0.675 is the dividing point between long and short positions, and the bullish support below is weak, and Australia dollar and dollar still have downside risks. The short targets are 0.7, 0.66 and 0.655.

Note: The above strategy was updated at 16:00 on September 15th. This strategy is a day strategy, please pay attention to the release time of the strategy.

Disclaimer

Disclaimer: The information contained in this material is for general advice only. It does not take into account your investment goals, financial situation or special needs. Every effort has been made to ensure the accuracy of the information as of the date of publication. MHMarkets makes no warranties or representations about this material. The examples in this material are for illustration only. To the extent permitted by law, MHMarkets and its employees shall not be liable for any loss or damage arising in any way, including negligence, from any information provided or omitted from this material. The features of MHMarkets products, including applicable fees and charges, are outlined in the Product Disclosure Statements available on the MHMarkets website. Derivatives can be risky; losses can exceed your initial payment. MHMarkets recommends that you seek independent advice.

Mohicans Markets, (abbreviation: MHMarkets or MHM, Chinese name: Maihui), Australian Financial Services License No. 001296777.

Read more

Mohicans markets:European Market

On Monday, October 10, during the Asian session, spot gold shock slightly down, and is currently trading near $ 1686 per ounce. Last Friday's better-than-market-expected U.S. non-farm payrolls report for September reinforced expectations that the Federal Reserve will raise interest rates sharply, and the dollar and U.S. bond yields surged and recorded three consecutive positive days, causing gold prices to weaken sharply.

Mohicans markets:Hitting Exhibition| See the Grand Occasion of Dubai Exhibition!

Focus on the industry highlight event, and explore the new future of trading. MHMarkets, the world's leading currency and CFD broker, is committed to providing better trading services to global traders and expanding its international markets.

Mohicans markets :MHM Today’s News

On Thursday, spot gold first fell and then rose. The US market once rose to a high of $1,664.78, and finally closed up 0.04% at $1,660.57 per ounce; spot silver finally closed down 0.34% at $18.82 per ounce.

Mohicans markets:Daily European Market Viewpoint

On Thursday, September 29, during the Asia-Europe period, spot gold fluctuated slightly and was currently trading around $1,652.26 an ounce. U.S. crude oil fluctuated in a narrow range and is currently trading around $81.63 a barrel, holding on to its sharp overnight gains.

WikiFX Broker

Latest News

FINRA Fines Cetera $1.1 Million Over Compliance Lapses

FINRA Fines Cetera $1.1 Million Over Compliance Lapses

Upway (JRJR) Review: A Deep Dive into Safety and Regulation

Coinbase Banks Push Advances Crypto Rules

RM668K Gone Overnight: Factory Supervisor Trapped in Fake Investment Scam

Dollar Softens as Fed Signals Shifts; Warsh Leads Nomination Race

Safe-Haven Supercycle: Gold Hits $4,690 as Silver Squeeze Intensifies

Trans-Atlantic Rupture: Markets Brace for Trade War as Trump Issues Greenland Ultimatum

China Delivers 5% Growth Target, Yet December Data Reveals Deepening Consumption and Property Cracks

Italy’s Consob Blocks Five Unauthorized Investment Websites in New Enforcement Action

Rate Calc