Dana -Some important Details about This Broker

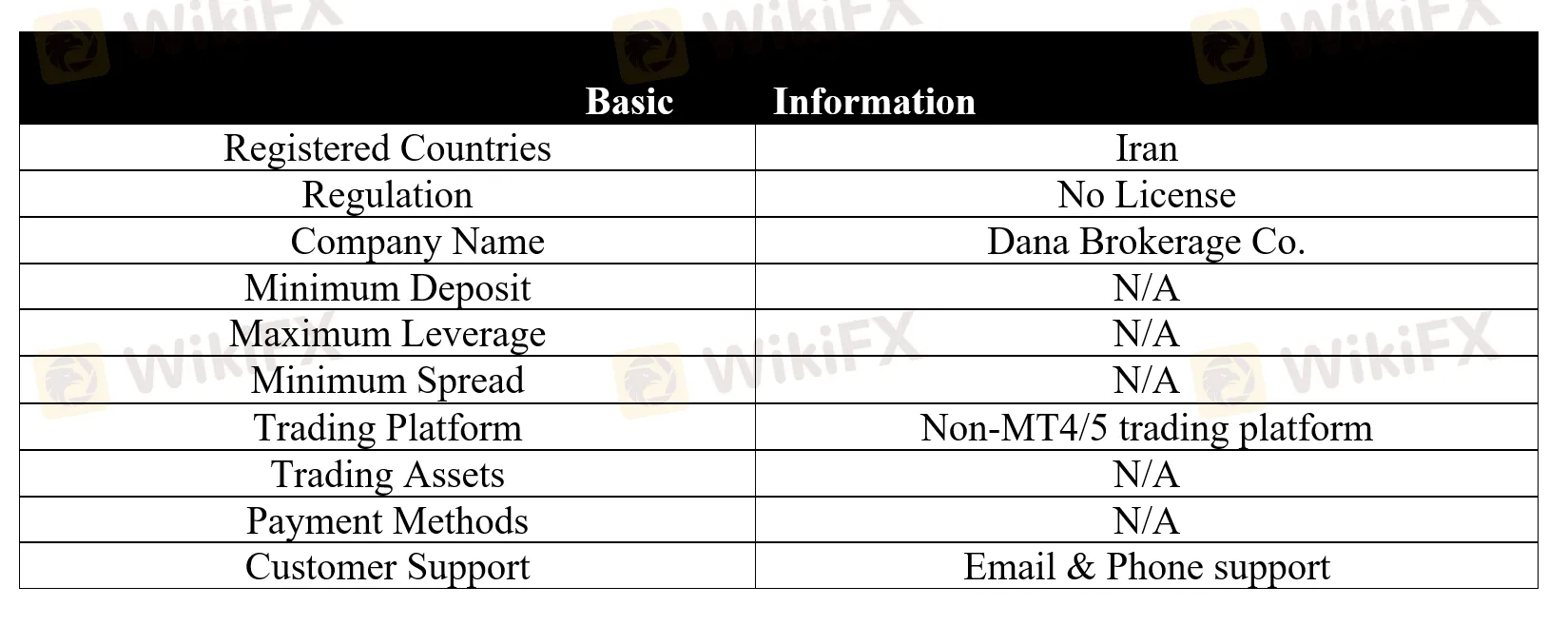

Abstract:Dana Brokerage Co. (short for “Dana”) is an Iran-based brokerage firm founded in 2005, providing clients access to the currency and stock markets.

General Information

Dana Brokerage Co. (short for “Dana”) is an Iran-based brokerage firm founded in 2005, providing clients access to the currency and stock markets.

According to this brokerage firm, Exchange Licenses it holds include the following:

License to operate in Tehran Stock Exchange

OTC license to operate in Iran

Online Trading License

Admission Consultant License

However, there is no official regulatory license showing this broker legally operates.

Market Instruments

With the Dana Brokerage Co. platform, investors can get access to various financial markets, including Foreign Exchange, Stocks, Options, and more.

Trading Channels

Trading the stock market can be done in three ways:

Face to face orders: You can complete the purchase or sales form in the acceptance section and the person in charge of accepting your order informs the traders.

Online Orders: You can register your buying and selling orders through the website of the brokerage without visiting the brokerage in person. After registration, the person in charge of the online reception department informs the traders after seeing these orders.

Online transactions: In both cases mentioned above, you only place orders through traders, but in online transactions, you register purchase and sales orders directly in the core of the transactions, which means you become your own trader.

Trading Platform

What Dana Brokerage Co. offers is not the MT4 or MT5 trading platform, its proprietary trading platform instead.

Deposit Options

There are three channels for clients to deposit money to the brokerage account to buy securities:

1. Through online access and the instant deposit section (the limit of the deposit amount for daily purchases from each bank care is 50 million Tomans).

2. Direct purchase from a bank account (this method can only be done for Bank Mellat and Bank Saman account holders)

3. You can also deposit funds to the bank accounts of the brokerage through branches or internet Bank.

Two working days after the sales of each share and at your request, the brokerage will deposit the amount of the sales shares into your account.

Educational Resources

Dana Brokerage Co. also provides access to some educational resources, including Stock Exchange, Stock Portfolios, Futures, Options Trading, as well as teaching how to use the option trading system, etc.

Customer Support

Traders with any questions or concerns they may have about their accounts or their trading can reach out to Dana Brokerage Co. through its two branches:

Jordan Branch

Telephone: 021 79408, 02126291522, 02178301000

Address: Tehran, Nelson Mandela Street (Jordan), Kaj Abadi Street, No. 27

Phone: 051370557603

Fax: 05137672291

Address: Mashhad, Janbaz Blvd., Page Complex, Block E 13th Floor, Unit 9

Or you can also follow this company on some social media platforms, such as Linkedin, Instagram, Youtube and Facebook.

Risk Warning

There is a level of danger that comes with trading on the financial markets. As sophisticated instruments, foreign exchange, futures, CFDs, and other financial contracts are typically traded using margin, which significantly increases the inherent risks involved. Therefore, you should consider carefully whether or not this sort of investment activity is right for you.

The information presented in this article is intended solely for reference purposes.

Read more

ECB Set to Cut Rates, But Future Path Uncertain Amid Global Tensions

- ECB expected to cut interest rates on March 6 - Future rate decisions unclear due to ongoing inflation and global trade issues - Markets expect more cuts, but some ECB officials urge caution

Trade245 Review 2025: Live & Demo Accounts, Withdrawals to Explore

Trade345, a young South African broker, has gained some regional popularity, but lacks an established reputation. Trade245 offers access to FX pairs, indices, stocks and commodities CFDs with operation on both MetaTrader 4 and MetaTrader 5. Although this broker only asks for a modest minimum deposit, it does not shine on trading costs. Besides, this broker heavily relies on bonuses to attract new investors and it does not provide trading signals.

T4Trade Review 2025: Live & Demo Accounts, Withdrawal to Explore

T4Trade, established in 2021 and regulated by the FSA in the Seychelles, allows trading on a modest portfolio of over 300 instruments, spanning forex, metals, indices, commodities, futures, and shares, all accessible via the popular MetaTrader 4 and their proprietary WebTrader platforms. Notably, T4Trade offers a zero-commissions pricing model where both floating and fixed spreads are offered on its MetaTrader—flexible leverage up to 1000:1 to increase trading flexibility. T4Trade also introduces a copy trading service called “TradeCopier”, which enables traders who lack experience or time to join in the markets by copying the trades of seasoned professionals.

Quotex Review 2025:Live & Demo Accounts, Withdrawal to Explore

Quotex is an online trading platform specializing in digital options, offering access to various assets, including currencies, commodities, and cryptocurrencies. It operates with a proprietary web-based platform. The platform's user interface, while basic, is generally functional, and the availability of numerous short-term trading options may appeal to those seeking rapid trading opportunities. While it presents a user-friendly interface and a low minimum deposit, it's important to note that the regulatory landscape surrounding Quotex involves offshore registration, which may present different levels of investor protection compared to more strictly regulated financial jurisdictions.

WikiFX Broker

Latest News

Is $CORONA Memecoin a Legit Crypto Investment?

Is Pi Network the Next Big Crypto Opportunity?

Is Linkbex a Scam? SFC Warns of Virtual Asset Fraud in Hong Kong

Donald Trump’s Pro-Crypto Push Boosts PH Markets

5 Best Copy Trading Brokers: You Can Trust in 2025

3 EXCLUSIVE Ramadan Offers That Won’t Last Long! ACT NOW

The Next Crypto Giants: 5 Altcoins to Watch

Japan’s Shift in Crypto Policy and What It Means for Investors

Forex Trading: Scam or Real Opportunity?

The Hidden Tactics Brokers Use to Block Your Withdrawals

Rate Calc