Mohicans markets:Gold Volatility Narrows Long and Short Competition for Oil Prices Intensifies

Abstract:On Wednesday, September 21, the Fed's interest rate decision will be ushered in this trading day. The market generally expects to raise interest rates by at least 75 basis points, and the expectations are also hawkish. When the US dollar hits a new high, gold prices face further downside risks. But after the Fed's interest rate decision, investors need to beware of the possibility that the bears will leave the market or the Fed's hawks will be less than expected.

Reminder: This article involves the technical analysis of 6 varieties of spot gold, spot silver, U.S. crude oil, EURUSD, GBPUSD, AUDUSD. Starting from the distribution of market chips, the change data of options positions published on the CME official website is superimposed on the average order flow change data of large brokers in the industry to more accurately mark the market trading sentiment in important price ranges.

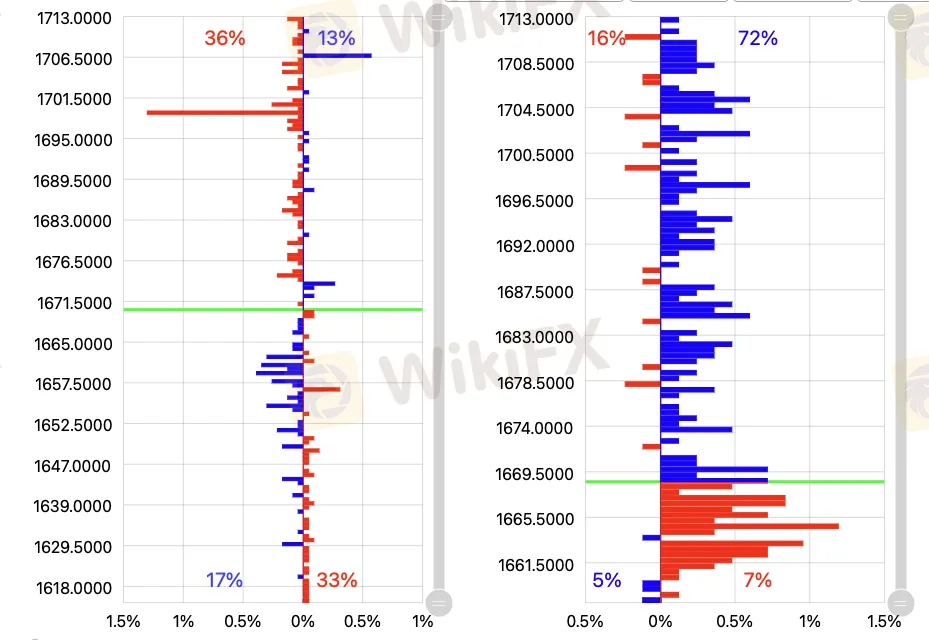

The order flow mainly refers to the following Oder Book data, which is updated every 20 minutes, taking XAUUSD international gold as an example:

The opinions and strategies provided in this article are for reference only. The data are all from large brokers. Please check them according to your needs. They are not investment suggestions. Please read the statement terms at the end of the article carefully.

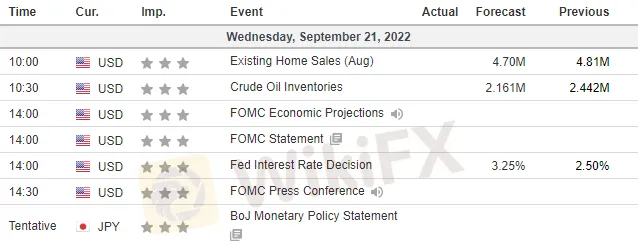

Key Data

Fundamentals Overview

On Wednesday, September 21, the Fed's interest rate decision will be ushered in this trading day. The market generally expects to raise interest rates by at least 75 basis points, and the expectations are also hawkish. When the US dollar hits a new high, gold prices face further downside risks. But after the Fed's interest rate decision, investors need to beware of the possibility that the bears will leave the market or the Fed's hawks will be less than expected.

The U.S. dollar index was higher today ahead of the FOMC meeting, while the euro was slightly lower. Treasury yields have surpassed their immediate resistance and now have more room to rise from here before reversing again. The outcome of the Fed meeting tonight will be very important. It will have to be seen if the Fed outcome triggers a reversal or a further uptick from here. The Dow and DAX have fallen sharply and are likely to remain bearish. The Nikkei is below the 27500 support and has room for further declines in the coming days. Commodities may move sideways for a period of time. Brent and WTI will likely continue to trade sideways between 87.5-95 and 80-90, respectively. The precious metals traded lower as the U.S. dollar index surged ahead of the FOMC meeting.

The Mohicans Markets strategy is for reference only and not as investment advice. Please read the terms of the statement at the end of the article carefully. The following strategy was updated at 15:30 on September 19, 2022, Beijing time.

Technical Point of View

CME Group options layout changes:

1725 Bullish increase sharply, bearish unchanged, second target for bulls

1700 Bullish increase, bearish decrease, first target and resistance for bulls

1680 Bullish slightly reduced, bearish increased sharply, key resistance

1665 Bullish slightly reduced, bearish increased, short-term resistance

1660 Bullish increase, bearish equal amount decreases and the stock is large, intraday support

1650 Bullish increase, bearish increase sharply, bears first target

1630 Bullish unchanged, bearish increase sharply, support level

1610 Bullish unchanged, bearish increase and bears dominate, the second target of bears

Order flow key point labeling (spot price):

1708-1710 Strong resistance (There is a certain resistance during 1700)

1693-1695 Bears defensive position, breakout stabilization will weaken bears confidence

1681 The starting and falling points of heavy volume, short-term competition for key positions

1668-1670 Below this position will face shock downward pressure

1660 M top neckline support, below the first look down

1654-16571643 Short target

Technical Analysis

In the early hours of Thursday, the Federal Reserve's interest rate decision is about to come. In the face of huge uncertainty, funds have slowed down the progress of betting, and only a small amount of positions have been added to key positions such as 1680 and 1650. It is expected that the US market will still fluctuate within a narrow range. 1660-1680 option action is limited, only 1667 has some resistance.

In terms of funds, 1682 added 297 put options, consolidating the position of this key resistance. Once it breaks through, it is expected to test 1702, which is also the first target of bulls. Only after stabilization can we have a chance to look at the second target of 1727.

Below the current price, the differences between long and short positions are mainly concentrated at 1650, where put options have increased by 231 lots, the first target of the bears, and the broken position may look at 1630-1610 in turn.

Note: The above strategy was updated at 15:00 on September 21. This strategy is a day strategy, please pay attention to the release time of the strategy.

Changes in CME Group's options layout (December futures prices):

20 Bullish increase, bearish unchanged, bulls target and resistance

19.50 Bullish decrease, bearish increase, key resistance

19.25 Bullish increase slightly, bearish unchanged, first support

19 Bullish unchanged, bearish sharply reduced, key support

18.8 Bullish unchanged, bearish increased, support level

18.50 Bullish reduction, bearish reduction, previous bear target

Order flow key point labeling (spot price):

19.89 CPI data shows the ups and downs, strong resistance

19.56-19.67 Secondary resistance

19.15 Short-term long-short demarcation, at this level, focus on the risk of continued downside

18.8-18.98 Support zone

18.3-18.5 Key support zone (bulls cost zone)

17.85-18 Ultimate support

Technical Analysis

Under the stabilization of gold and silver prices, the gold-silver ratio has rebounded temporarily, but the silver ETF has continued to inflow in the past week. Compared with the outflow of gold, the inflow of funds will bring certain support to the silver price.

There was little change in options as a whole yesterday, especially in the vicinity of the current price, there was little action in options. Among them, 19.25 was dominated by stock funds, and the competition between long and short positions was fierce, becoming the first support in the day. Below this, it may test the key intraday support of the 19 mark, which is also a key level of order flow. Above the current price, although the price was repeatedly blocked at 19.5, the bulls left the market weakly, suggesting that some funds are still betting on a breakthrough. Once it stabilizes at 19.5, it may challenge the early bullish target of 20.

Note: The above strategy was updated at 15:00 on September 21. This strategy is a day strategy, please pay attention to the release time of the strategy.

CME Group options layout changes:

88 Bullish increase sharply, bearish decrease, and upward momentum expands

87 Bullish increase sharply, bearish increase slightly, bulls and bears compete for points

86 Bullish decrease, bearish increase, resistance level

85 Bullish increase, bearish increase, first resistance

82.5-83 Bullish reduce, bearish equal reduction, bearish target

80 Bullish decrease, bearish increase sharply, bearish target

Key points of the order flow are marked:

89 Strong resistance

88 Resistance

86-86.4 The first resistance

84.4 -84.8 Short-term resistance

83 The first support during the day, continue to look down at 82 around

81.7-82.13 Key support range

80-81 Early short target, look down at around 78

Technical Analysis

Crude oil continued to fluctuate in a wide range, and bulls and bears still entered the market one after another to bet on both ends. As the interest rate decision is approaching, options chips near the current price increase, and the competition between long and short positions intensifies, and the fluctuation of crude oil may gradually converge.

84.7 Although there are many bulls in stock, bears still have the upper hand, suppressing oil prices. Bulls and bears are fighting at 86.7, need to continue to break above to see the recovery of crude oil's upward momentum

On the other hand, below 82.2-82.7 is the first bearish target, below and then down to see 80. Overall, there is still strong resistance above crude oil. The 10-day and 20-day moving averages form strong suppression at 85.7 and 87.7. Short-term crude oil may still be dominated by shocks. The change in risk sentiment brought about by the interest rate decision tonight may indirectly disturb the oil market, but the market is still dominated by supply and demand.

Note: The above strategy was updated at 15:00 on September 21. This strategy is a day strategy, please pay attention to the release time of the strategy.

CME Group options layout changes:

1.0075-1.01 Bullish increase, bearish decrease slightly, long target and resistance

1.005 Bullish increase, bearish unchanged, rebound target and resistance

1.00 Bullish unchanged, bearish increase and the stock is large, strong resistance

0.995 Bullish unchanged, bearish decrease sharply, falling back to support

0.9875-0.99 Bullish decrease slightly, bearish increase and the stock is large, short target

0.98 Bullish unchanged, bearish increase and the stock is large, next short target

Technical Analysis

The euro continued to fall since the European session on Tuesday, falling below parity and continuing yesterday's decline after today's opening earnings, but is still above the support level of 0.995. The options distribution shows that long funds are mainly leaving the market above 1.01, which is not too optimistic about a significant rebound in EURUSD. Short money, on the other hand, is adding large bets in the range 0.98-0.99, probably waiting for hawkish expectations from the Fed tonight.

On the downside, there is a large amount of short money leaving around 0.995, which will be the first support for EURUSD to fall back. If it is broken, it perhaps will look to the short target 0.9875-0.99 and 0.98, and these two target positions bearish money chips dense; as for the upper parity, due to the addition of many bearish options, it will be a rally resistance level. If it is broken, it perhaps will look to the rally target 1.005 and 1.0075-1.01, which need to pay attention to 1.005 there is some resistance.

Note: The above strategy was updated at 15:00 on September 21. This strategy is a day strategy, please pay attention to the release time of the strategy.

CME Group options layout changes:

1.15 Bullish increase, bearish unchanged, next long target

1.145 Bullish increase, bearish slightly decrease but the stock is large, long target and resistance

1.14 Bullish unchanged, bearish slightly decrease, resistance weaken

1.135 Bullish unchanged, bearish unchanged but the stock is large, retreat target and support

1.13 Bullish unchanged, bearish slightly decrease, support

1.125 Bullish unchanged, bearish unchanged but the stock is large, short target

Technical Analysis

The GBPUSD trend followed the USD and continued to fall since the European session, before gaining support above 1.135 and maintaining a narrow range of oscillation at the opening today.

The options distribution shows that the long and short sides are basically laid out above 1.14. If it rises above the resistance at 1.14, GBPUSD may look to long targets at 1.145 and 1.15, but also need to pay attention to the existence of resistance near 1.145.

On the downside, 1.135 short money chips are dense and will be a pullback target cum support. And then 1.13 bearish options are seen leaving the market and will be the next support. If they both break down, it maybe look for a short target at 1.1250.

Note: The above strategy was updated at 15:00 on September 21. This strategy is a day strategy, please pay attention to the release time of the strategy.

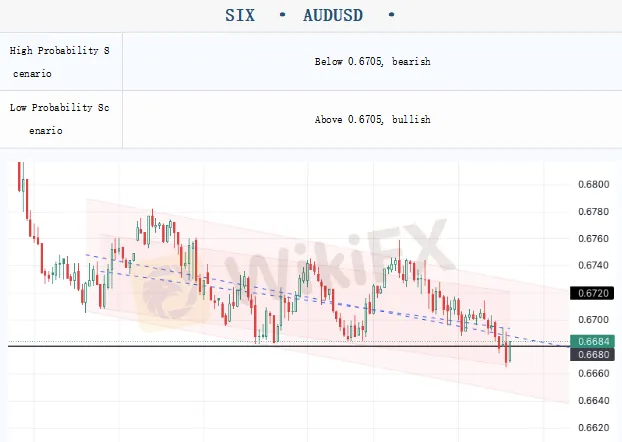

CME Group options layout changes:

0.69 Bullish slightly increase, bearish unchanged but the stock is large, long target

0.685 Bullish slightly increase but the stock is large, bearish slightly decrease but the stock is large, long and short contention points

0.68 Bullish slightly increase but the stock is large, bearish decrease and stock is large, resistance level

0.675 Bullish slightly increase and the stock is large, bearish slightly decrease and large stock, first resistance

0.67 Bullish increase, bearish unchanged and the stock is large, breakout alert for risk of downward momentum

0.655 Bullish unchanged, bearish unchanged and the stock is large, short target

Technical Analysis

Market sentiment is leaning toward wait-and-see, with no significant options action, but the previous stock of larger pips still poses an impact on the market. Intraday attention is still focused on the 0.667 neighborhood. The AUDUSD is currently on its third test and has previously had relatively strong buying support after hitting this level. However, options have a number of bearish option bets on 0.67 and there is strong short squeeze. From the oscillating market so far on the 14th, AUDUSD has shown a pivot down. The shorts still have a strong grip on the market and need to be wary of downside risks. The upper resistance is at 0.675 and 0.68, and the short target below is at 0.655.

Note: The above strategy was updated at 15:00 on September 21. This strategy is a day strategy, please pay attention to the release time of the strategy.

Statement | Disclaimer

Disclaimer: The information contained in this material is for general advice only. It does not take into account your investment goals, financial situation or special needs. Mohicans Markets has made every effort to ensure the accuracy of the information as of the date of publication. Mohicans Markets makes no warranties or representations regarding this material. The examples in this material are for illustration only. To the extent permitted by law, Mohicans Markets and its employees shall not be liable for any loss or damage arising in any way, including negligence, from any information provided or omitted from this material.The features of Mohicans Markets products, including applicable fees and charges, are outlined in the product disclosure statements available on the Mohicans Markets website and should be considered before deciding to deal with these products. Derivatives can be risky and losses can exceed your initial payment. Mohicans Markets recommends that you seek independent advice.

Mohicans Markets, (Abbreviation: MHMarkets or MHM, Chinese name: Mai hui), Australian Financial Services License No. 001296777.

Read more

Mohicans markets:European Market

On Monday, October 10, during the Asian session, spot gold shock slightly down, and is currently trading near $ 1686 per ounce. Last Friday's better-than-market-expected U.S. non-farm payrolls report for September reinforced expectations that the Federal Reserve will raise interest rates sharply, and the dollar and U.S. bond yields surged and recorded three consecutive positive days, causing gold prices to weaken sharply.

Mohicans markets:Hitting Exhibition| See the Grand Occasion of Dubai Exhibition!

Focus on the industry highlight event, and explore the new future of trading. MHMarkets, the world's leading currency and CFD broker, is committed to providing better trading services to global traders and expanding its international markets.

Mohicans markets :MHM Today’s News

On Thursday, spot gold first fell and then rose. The US market once rose to a high of $1,664.78, and finally closed up 0.04% at $1,660.57 per ounce; spot silver finally closed down 0.34% at $18.82 per ounce.

Mohicans markets:Daily European Market Viewpoint

On Thursday, September 29, during the Asia-Europe period, spot gold fluctuated slightly and was currently trading around $1,652.26 an ounce. U.S. crude oil fluctuated in a narrow range and is currently trading around $81.63 a barrel, holding on to its sharp overnight gains.

WikiFX Broker

Latest News

If you haven't noticed yet, the crypto market is in free fall, but why?

Emerging Markets: Nigeria's Debt Market Valuation Hits N99.3 Trillion

SkyLine Guide 2026 Thailand — Official Launch of the Judge Panel Formation!

JRJR Review: The Anatomy of a Hong Kong Liquidity Trap

South Africa Macro: Mining Policy Risks Cloud GNU Economic Optimism

JPY In Focus: Takaichi Wins Snap Election to Become Japan's First Female Leader

Vebson Scam Exposure: Forex Withdrawal Failures & Fake Regulation Warning

Amaraa Capital Scam Alert: Forex Fraud Exposure

Galileo FX Exposure: Allegations of Fund Losses Due to Trading Bot-related Issues

EGM Securities Review: Investigating Multiple Withdrawal-related Complaints

Rate Calc