Hextraprime

Abstract:Hextraprime presents itself as a forex and CFD broker incorporated in Saint Vincent & the Grenadines with registration number 25989 BC 2020. The broker claims to provide its clients with over 1,000 financial instruments with flexible leverage up to 1:5000 and floating spreads from 0.01 pips on the MetaTrader4 PC trading platform, as well as a choice of four different live account types and 24/5 customer support services.

General Information & Regulation

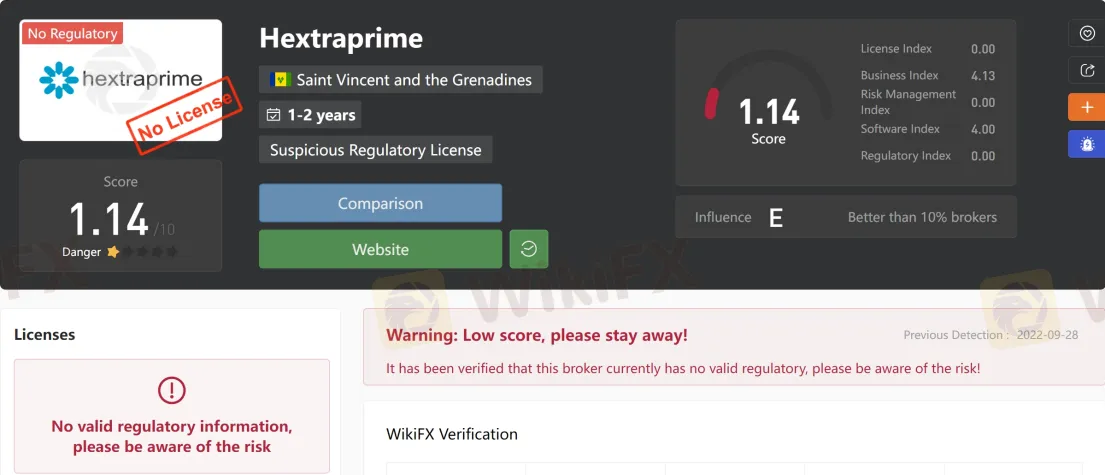

Hextraprime presents itself as a forex and CFD broker incorporated in Saint Vincent & the Grenadines with registration number 25989 BC 2020. The broker claims to provide its clients with over 1,000 financial instruments with flexible leverage up to 1:5000 and floating spreads from 0.01 pips on the MetaTrader4 PC trading platform, as well as a choice of four different live account types and 24/5 customer support services. Here is the home page of this brokers official site:

As for regulation, it has been verified that Hextraprime does not fall under any valid regulations. That is why its regulatory status on WikiFX is listed as “No License” and it receives a relatively low score of 1.14/10. Please be aware of the risk.

Market Instruments

Hextraprime advertises that it offers access to more than 1,000 financial instruments across a range of CFD asset classes, including forex, precious metals and commodities.

Account Types

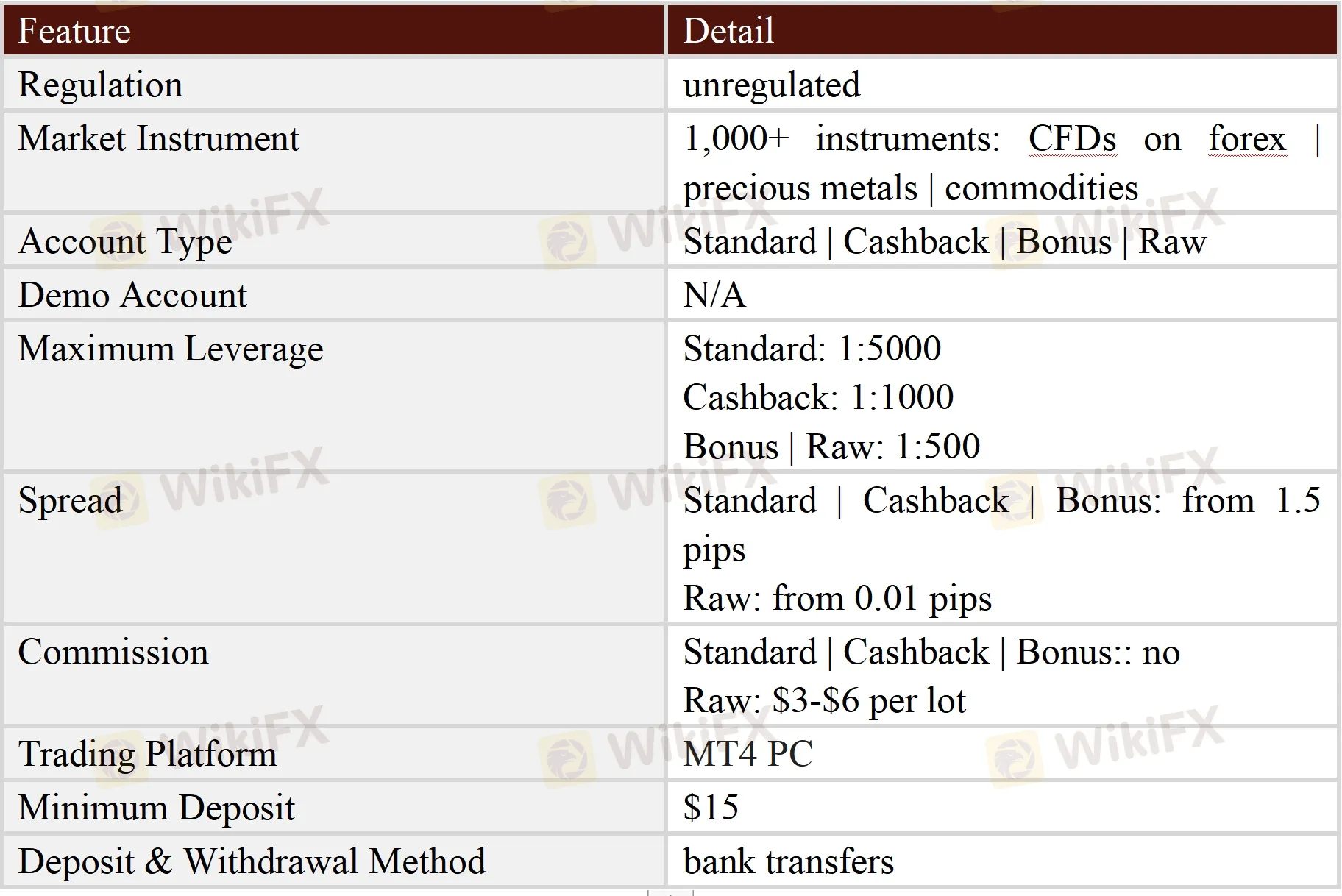

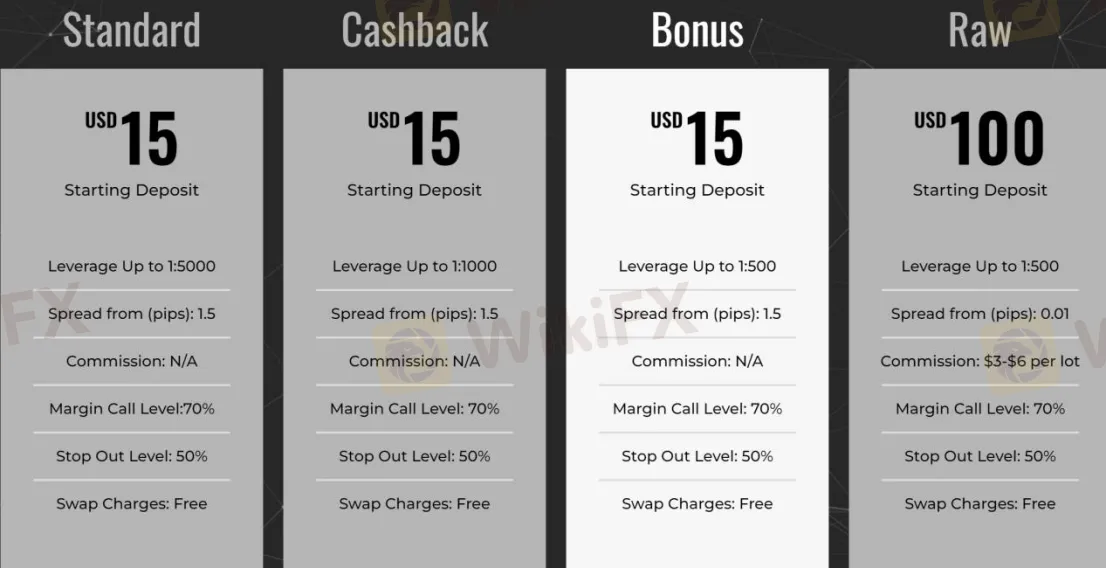

Hextraprime claims to offer four types of trading accounts, namely Standard, Cashback, Bonus and Raw. The minimum initial deposit amount is $15 to open Standard, Cashback and Bonus accounts, while the Raw account has a much higher minimum initial capital requirement of $100.

Leverage

Traders holding different account types can enjoy different maximum leverage ratios. Clients on the Standard account can enjoy the maximum leverage of 1:5000, the Cashback account has a leverage of 1:1000, while the Bonus and Raw account members can experience leverage of 1:500. It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

Spreads & Commissions

Hextraprime claims that different account types have different spreads and commissions. Specifically, the spread starts from 1.5 pips on the Standard, Cashback and Bonus accounts, while from 0.01 pips on the Raw account. As for commissions, there is no commission on the Standard, Cashback and Bonus account, while the Raw account holders have to pay a commission of $3-$6 per lot.

Trading Platform Available

The platform available for trading at Hextraprime is the industry-standard MetaTrader4 PC. In any case, we recommend using MT4 or MT5 for your trading platform. Forex traders praise MetaTrader's stability and trustworthiness as the most popular forex trading platform. Expert Advisors, Algo trading, Complex indicators, and Strategy testers are some of the sophisticated trading tools available on this platform. There are currently 10,000+ trading apps available on the Metatrader marketplace that traders can use to improve their performance. By using the right mobile terminals, including iOS and Android devices, you can trade from anywhere and at any time through MT4 and MT5.

Deposit & Withdrawal

From the logos shown at the foot of the home page on Hextraprimes official website, we found that this broker seems to accept payments via bank transfers. The minimum initial deposit requirement is said to be only $15, while there is no mention of what the minimum withdrawal amount is. There is no deposit fee charged.

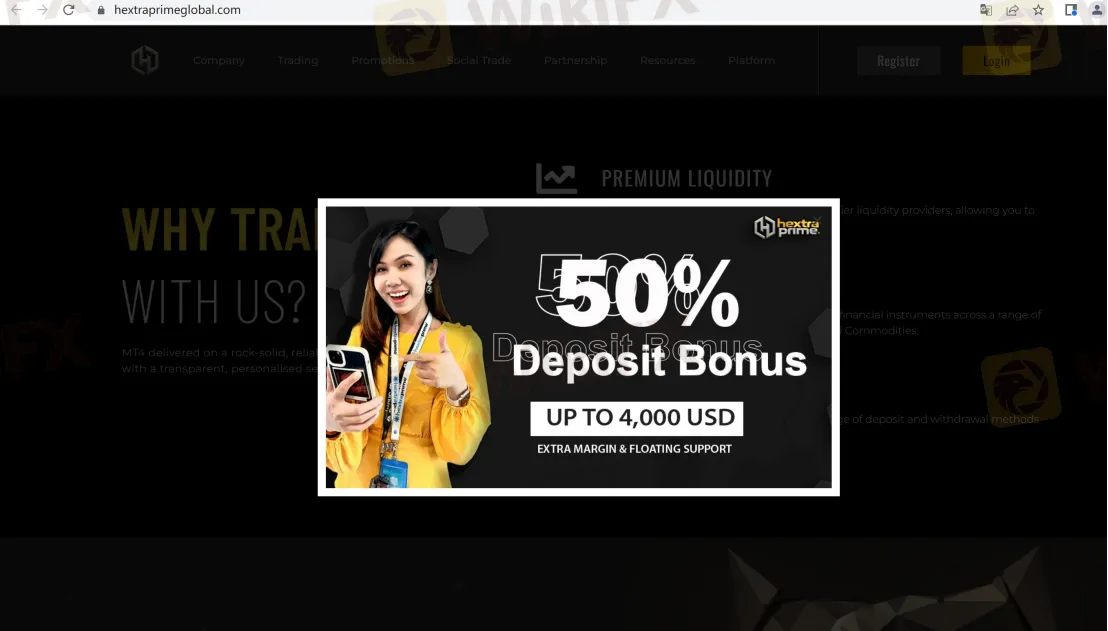

Bonuses

Hextraprime claims to offer a 50% deposit bonus which is up to $4,000. In any case, you should be very cautious if you receive a bonus. First of all, bonuses aren't client funds, they're company funds, and fulfilling the heavy requirements that are usually attached to them can prove a very daunting and difficult task. Remember that brokers who are regulated and legitimate do not offer bonuses to their clients.

Customer Support

Hextraprime‘s customer support can be reached by email: support@hextraprime.com. Company address: Suite 305, Griffith Corporate Centre, 1510, Beachmont, Kingstown, Saint Vincent and the Grenadines. However, this broker doesn’t disclose other more direct contact information like telephone numbers that most brokers offer.

Risk Warning

Online trading involves a significant level of risk and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

Read more

TAG MARKETS Review 2026: Allegations of Withdrawal Denials & Trading Glitches

Did your good trading experience with TAG MARKETS reverse when applied for fund withdrawals at the Mauritius-based forex broker? Besides withdrawal denials, did you also witness account blocks or deletions by the broker? Did the broker’s customer support team fail to provide you a proper reason for these trading activities? Have you also witnessed glitches on deposit bonus? These allegations have only grown further in 2026. Read on as we share these allegations in this TAG MARKETS review article.

MYFX Markets: Is it Legit or a Scam? This Review Will Tell You the Answer!

Is your trading experience with MYFX markets full of fund withdrawal denials despite repeated communications with its customer support team? Has the broker deleted all your profits? Did the broker accuse you of false trading strategy implementation while deleting your profits? There have been many such instances reported by traders against these activities online. In this MYFX Markets review article, we have shared some complaints. Take a look!

Exfor Exposure: Investigating Alleged Withdrawal Denials, Illegitimate Account Closure & More

Exfor, a Malaysia-based forex broker, has allegedly been the centre of attention for all the wrong reasons. These include long-pending withdrawal denials, no communication or assistance from the broker’s customer support team, manipulated pricing upon a withdrawal request by the trader, and account blowups due to bonus-related issues. It’s the traders who allegedly bear the brunt of all these suspicious trading activities. A lot of them have criticized it on broker review platforms. We have highlighted some of their complaints in this Exfor review article. Take a look!

Axiory Exposed: Low WikiFX Score & Trader Complaints!

Axiory WikiFX score 1.5: Active Belize FSC license (no FX authorization), multiple complaints. Reports show withdrawal/support issues. Traders beware.

WikiFX Broker

Latest News

Understanding Dbinvesting Deposit and Withdrawal: What Traders Should Know

TradeEU Global Review 2026: Is this Forex Broker Legit or a Scam?

Emerging Markets: South African Fiscal Strains in Focus Amid Calls for SOE Reform

China Economic Watch: PMI Divergence and "Two Sessions" Signal Structural Shift

Is Tradier a trustworthy broker? A Tradier review and licensing overview based on WikiFX data.

Oil Spikes 9% and Shipping Rates Soar as Middle East Logistics Fracture

AssetsFX Review 2026: Is this Broker Safe?

Fed Beige Book: Stagflation Risks Rise as Growth Stalls While Prices Stick

Asia Market Volatility: KOSPI Stages Historic 12% Rebound as Capital Flows Pivot

Evest Broker Review: Regulated, but Complaints Persist

Rate Calc