ThorFX

Abstract:ThorFX is allegedly an ECN & STP broker registered in China that claims to provide its clients with 145+ assets with leverage up to 1:500 and floating spreads from 0.1 pips on the MT4 for Mac, Windows, iOS, Android and Web Trader and MT5 trading platforms, as well as a choice of four different live account types and 24/7 customer support service.

General Information & Regulation

ThorFX is allegedly an ECN & STP broker registered in China that claims to provide its clients with 145+ assets with leverage up to 1:500 and floating spreads from 0.1 pips on the MT4 for Mac, Windows, iOS, Android and Web Trader and MT5 trading platforms, as well as a choice of four different live account types and 24/7 customer support service. Here is the home page of this brokers official site:

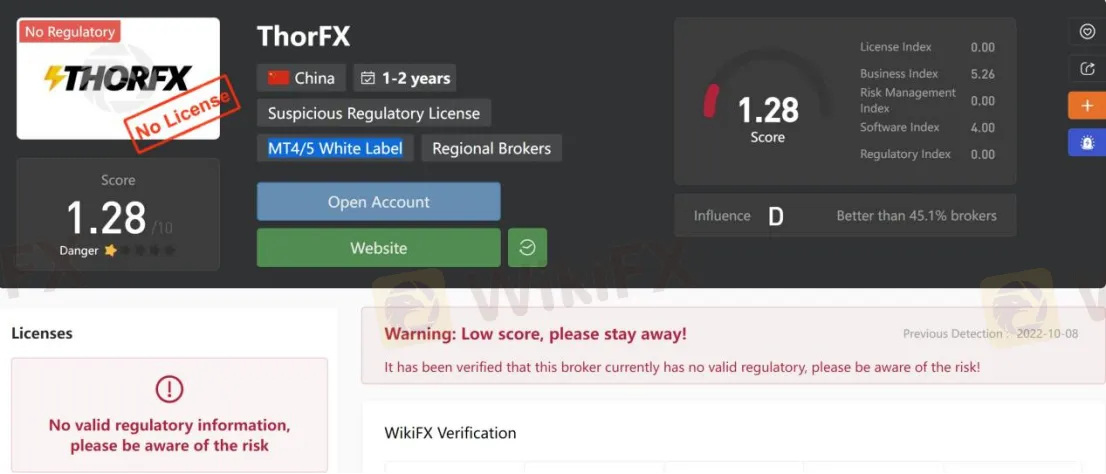

As for regulation, it has been verified that ThorFX does not fall under any valid regulations. That is why its regulatory status on WikiFX is listed as “No License” and receives a relatively low score of 1.28/10. Please be aware of the risk.

Market Instruments

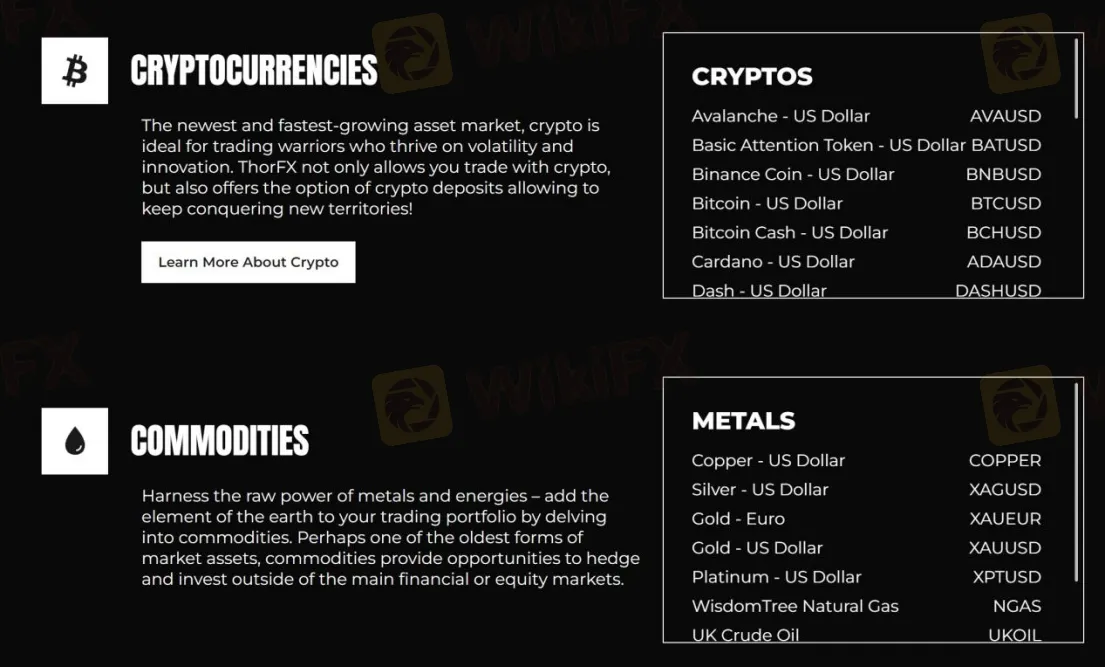

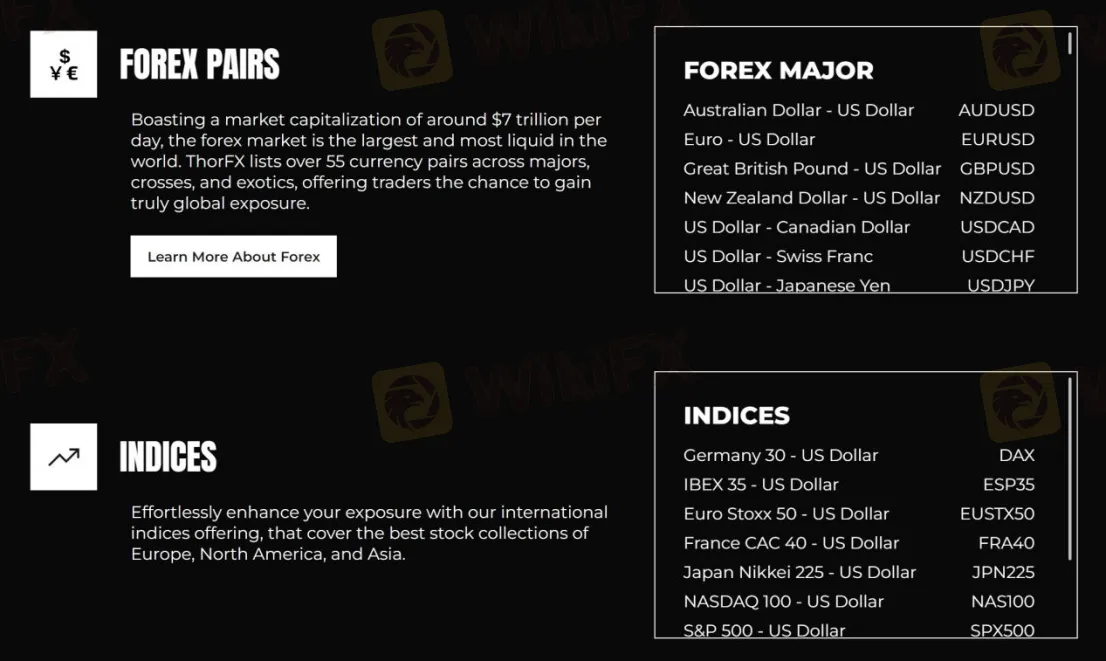

ThorFX advertises that it offers 145+ assets to trade, consisting of cryptocurrencies, commodities (metals/energies), forex pairs, indices and stocks & shares.

Account Types

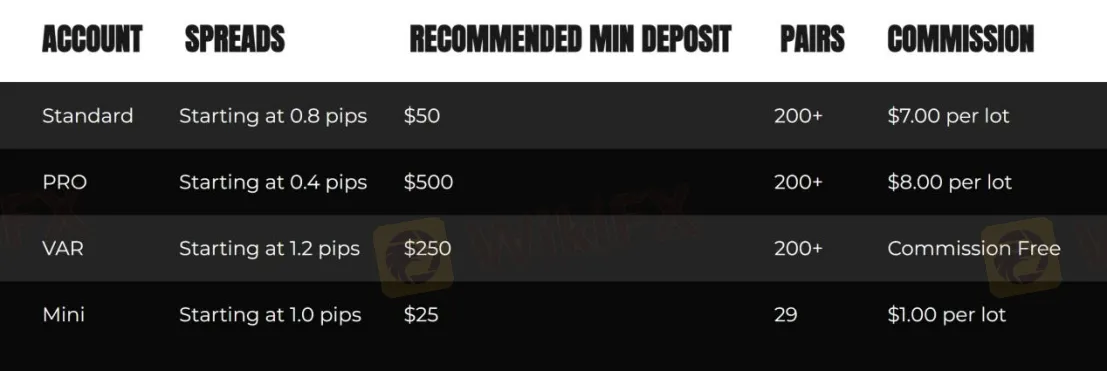

Apart from demo accounts, ThorFX claims to offer four types of trading accounts - Standard, PRO, VAR and Mini, with minimum initial deposit requirements of $50, $500, $250 and $25 respectively.

Leverage

The leverage provided by ThorFX is capped at 1:500. It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

Spreads & Commissions

ThorFX claims to offer raw spreads from 0.1 pips. As for commissions, clients on different account types will be charged different commissions. For example, the commission on the Standard, PRO, VAR and Mini accounts is $7 per lot, $8 per lot, free and $1 per lot respectively.

Trading Platform Available

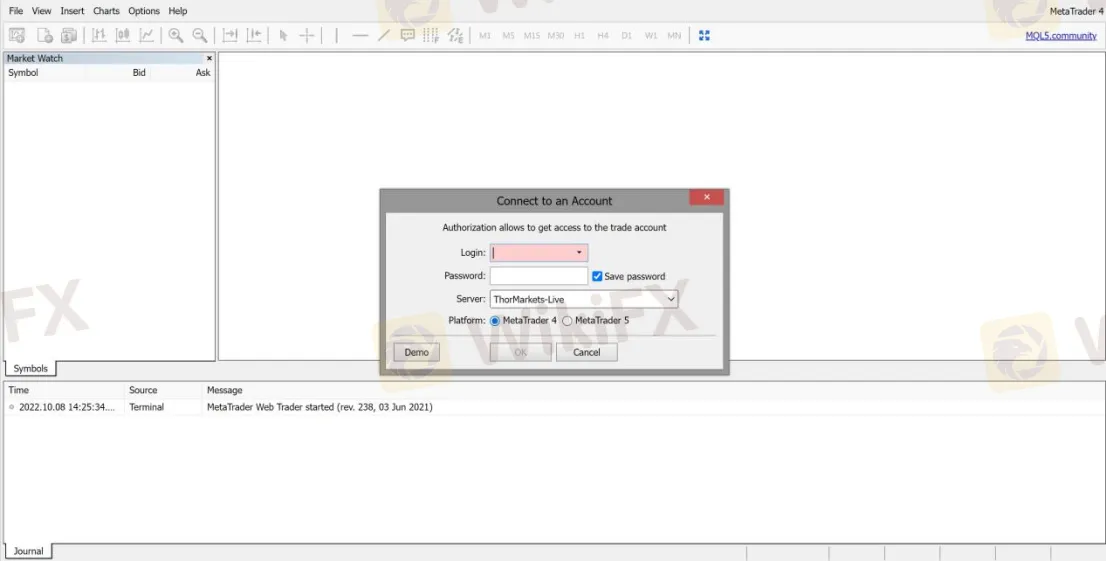

Platforms available for trading at ThorFX are MT4 for Mac, Windows, iOS, Android and Web Trader, as well as MT5. In any case, we recommend using MT4 or MT5 for your trading platform. Forex traders praise MetaTrader's stability and trustworthiness as the most popular forex trading platform. Expert Advisors, Algo trading, Complex indicators, and Strategy testers are some of the sophisticated trading tools available on this platform. There are currently 10,000+ trading apps available on the Metatrader marketplace that traders can use to improve their performance. By using the right mobile terminals, including iOS and Android devices, you can trade from anywhere and at any time through MT4 and MT5.

Deposit & Withdrawal

ThorFX says to accept deposits and withdrawals via credit/debit cards and cryptocurrencies. The minimum initial deposit requirement is said to be only $10, while there is no mention of what the minimum withdrawal amount is.

Bonuses

ThorFX claims to offer a deposit bonus of up to 20%. In any case, you should be very cautious if you receive a bonus. First of all, bonuses aren't client funds, they're company funds, and fulfilling the heavy requirements that are usually attached to them can prove a very daunting and difficult task. Remember that brokers who are regulated and legitimate do not offer bonuses to their clients.

Customer Support

ThorFX‘s customer support can be reached by live chat or request a callback. You can follow this broker on social networks such as Telegram, Twitter, Facebook and Instagram. However, this broker doesn’t disclose other more direct contact information like telephone numbers or the company address that most brokers offer.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

Read more

Tag Markets Exposed: Withdrawal Issues, Inflated Spreads & Market Manipulation Concerns

Did you encounter the sudden disappearance of Tag Markets’ MT5 one-click button? Did it result in wiping out your forex trading account balance? Does the broker disallow you profit withdrawals? Do you frequently witness price mismatches on the Tag Markets login? Has this piled on your capital losses? These experiences sum up the below-standard forex trading journey many traders have had with the broker. Some of them discussed such experiences while sharing the Tag Markets review. Take a look!

Exnova Exposed: Reports of Failed Deposits & Withheld Withdrawals from Traders

Does your deposit amount fail to reflect in your Exnova forex trading account? Does the same thing happen even when withdrawing? Does the Exnova bonus lure lead to a NIL account balance? Has the broker terminated your account without any explanation? These trading issues have become synonymous with traders here. Some traders have openly criticized the broker on several review platforms online. In this Exnova review article, we have highlighted the miserable forex trading experiences.

FXCM Broker ASIC Stop Order Halts CFD Sales

FXCM Broker ASIC Stop Order blocks new CFD trading for retail clients in Australia due to TMD flaws. Explore FXCM Broker CFD Trading Ban Australia impacts, retail client restrictions, and next steps for traders.

FortuixAgent Review: A Tale of Account Restrictions & Withdrawal Denials

Has your FortuixAgent app for forex trading been restricted? Does the broker not allow you to withdraw your initial deposits? Does the UK-based forex broker demand payment out of your earnings to allow withdrawals? These issues refuse to leave traders, as they come out expressing their frustration on broker review platforms. In this Fortuixagent review article, we have shared many complaints made against the broker.

WikiFX Broker

Latest News

Adam Capitals Review 2025: A Detailed Look at an Unregulated Broker

The "Balance Correction" Trap: Uncovering the Disappearing Funds at Vittaverse

NordFX.com Review Reveals its Hidden Negative Side- Must-Read Before You Trade

RM460,000 Gone: TikTok Scam Wipes Out Ex-Accountant’s Savings

Thailand Seizes $318 Million in Assets, Issues 42 Arrest Warrants in Major Scams Crackdown

Polymarket Launches First U.S. Mobile App After Securing CFTC Approval

Tauro Markets Review: Tons of Withdrawal Rejections & Trading Account Terminations

Pemaxx Review 2025: Is it a Scam? License Revoked and Withdrawal Complaints Exposed

The Problem With GDP

Trade.com Review & Complaints Hidden from New Investors! Tell Different Story

Rate Calc