Investeria -Some Important Details about This Broker

Abstract:Established in 2011, Investeria is based in India and provides e-IPO, mutual fund, and broking services. Although it offers platforms and tools designed to meet a variety of trading requirements, it is not regulated by national or international authorities.

| Investeria Review Summary | |

| Founded | 2011 |

| Registered Country/Region | India |

| Regulation | Not regulated |

| Products and services | Broking, Mutual Funds, e-IPO |

| Demo Account | / |

| Leverage | / |

| Spread | / |

| Trading Platform | XTS Base Setup, XTS Updates, XTS Utility/Tools, XTS Remote Setup |

| Min Deposit | / |

| Customer Support | Email: compliance@investeria.in |

| Phone: +91 7949199817 | |

| Address: 1003, Ruby Crescent Business Boulevard, Ashok Chakrawarthy Road, Above Axis Bank, Kandivali East, Mumbai, Maharashtra, India, 400101 | |

Investeria Information

Established in 2011, Investeria is based in India and provides e-IPO, mutual fund, and broking services. Although it offers platforms and tools designed to meet a variety of trading requirements, it is not regulated by national or international authorities.

Pros and Cons

| Pros | Cons |

| Wide range of financial services | Not regulated |

| Desktop-based trading tools | Limited information on fees |

| Multiple customer service channels |

Is Investeria Legit?

Investeria is not regulated in India, where it is registered, and it does not hold any licenses from reputable regulatory agencies such as the FCA (UK), ASIC (Australia), or any recognised foreign authorities.

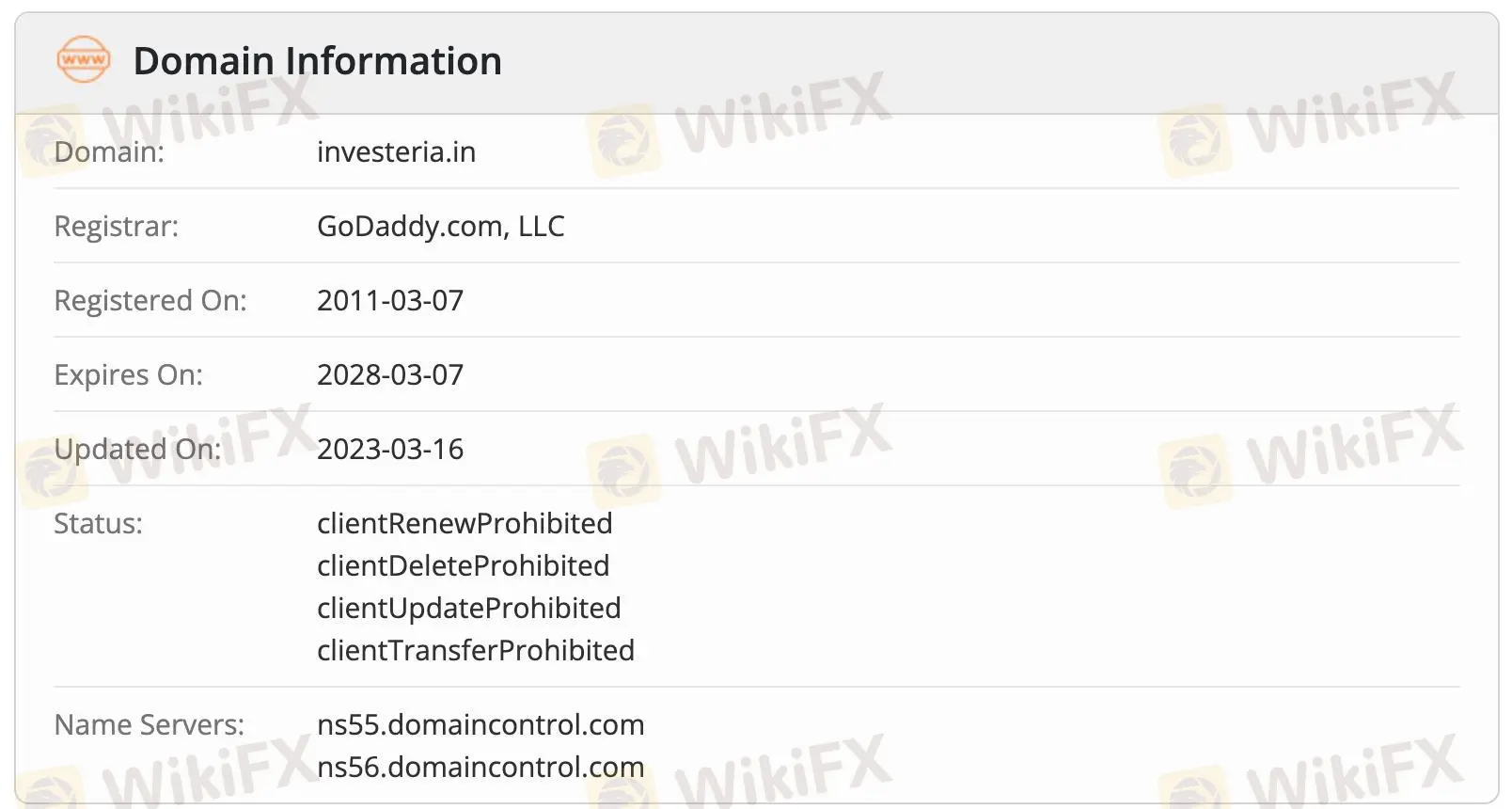

Although its domain (investeria.in) is operational with limitations and was registered on March 7, 2011, its absence of licensing raises serious questions regarding its legality.

What Can I Trade on Investeria?

Both individual and institutional investors can take advantage of the financial products and services that Investeria provides, such as mutual funds, broking, and e-IPO services.

Trading Platform

Investeria's trading platforms cater primarily to desktop users, providing tools and remote setups for diverse trading needs.

| Trading Platform | Supported | Available Devices | Suitable for what kind of traders |

| XTS Base Setup | ✔ | Windows (Desktop) | Beginners and professionals |

| XTS Updates | ✔ | Windows (Desktop) | All users for software updates |

| XTS Utility/Tools | ✔ | Windows (Desktop) | Advanced traders for tools |

| XTS Remote Setup | ✔ | Windows (Desktop, Remote Access) | Remote and flexible traders |

Read more

WikiFX Alert: Three Well-Known Brokers Targeted by Impersonation Websites

WikiFX issues a warning over unlicensed trading sites posing as established brokers, highlighting the lack of regulatory safeguards and growing risks of fraud and investor losses.

Pocket Option Scam Alert: Real Trader Complaints

Pocket Option scam alert — real traders report blocked withdrawals, fake KYC, slippage, and sudden bans after profits. Read multiple 2025 complaints before you deposit.

Beware Weltrade: Scam Reports Surge in One Month

Weltrade scam surge in August 2025: traders report fake prices, slippage manipulation, and delayed withdrawals. Protect your funds and think twice before trading.

PU Prime Launches “The Grind” to Empower Traders

Discover PU Prime’s new campaign, “The Grind,” and learn how trading discipline builds long-term success. Watch and start your trading journey today!

WikiFX Broker

Latest News

GmtFX Flagged for Operating Without Authorisation as Regulatory and Risk Signals Mount

TradeEU Review: Safety, Regulation & Forex Trading Details

Metals Massacre: Silver Plunges 40% on Margin Hikes; Gold Rejects $5,000

Emerging Markets: NGO Capital Injection Highlights NGN Liquidity Flows

CAD Outlook: Historic Drop in Student Enrollment Signals Demographic Drag

Resource Sentiment Dampened as Rio Tinto-Glencore Merger Talks Implode

NNPC and Edo State agree on New 10,000 bpd Refinery Project

Italian Regulator Moves to Block Seven Unauthorised Investment Websites

The RM47,000 Lesson: Experienced Investor Falls for WhatsApp Investment Scam

Jetafx Review 2026: A Trader's Warning on Regulation and High-Risk Signals

Rate Calc