Pocket Option Scam Alert: Real Trader Complaints

Abstract:Pocket Option scam alert — real traders report blocked withdrawals, fake KYC, slippage, and sudden bans after profits. Read multiple 2025 complaints before you deposit.

Primary Keyword: Pocket Options

Secondary Keywords: Pocket Option withdrawal issues, Pocket Option scam reports 2025, Pocket Option trader complaints, Pocket Option fraud cases, Pocket Option fake verification

Pocket Options has been heavily marketed online as a “high‑tech, fast‑profit” trading platform targeting new crypto and forex traders. Its sleek interface, social trading features, and heavily promoted YouTube and TikTok videos have attracted thousands worldwide. But behind the polished marketing lies a growing wave of warnings from real traders who reported serious withdrawal issues, verification problems, and account freezes throughout 2025.

Reports from several countries—including Spain, Russia, Hong Kong, and Nigeria—show the same disturbing pattern: once users begin making a profit or attempting a withdrawal, their accounts are restricted or banned under vague clauses of the companys “public offer agreement.” These consistent red flags cast serious doubt on the safety and fairness of trading with Pocket Options, especially given its unregulated status and limited transparency.

The Illusion of Easy Money

For many beginners, Pocket Options seems like the perfect shortcut to financial freedom. The ads promise quick profits and make it sound easy to start—even with just $5. The platform looks convincing too, with bright charts, real‑time trades, and an active “trader community” that makes everything feel trustworthy. But as countless Pocket Option scam reports 2025 reveal, that excitement often turns to regret once real money is on the line.

One Colombian investor recounted how a YouTube ad painted a rosy picture of effortless returns. After depositing 100 USDT, he lost everything due to what he described as “clear price slippage.” His message ended with a desperate warning: “Do not deposit.”

Price slippage can occur in normal trading when market volatility causes different execution prices. However, repeated cases of severe slippage within a closed trading ecosystem—where the company controls the price feed—raise concerns about manipulated or opaque pricing, not just technical errors.

Pattern of Manipulation and Withdrawal Freezes

By late 2025, more than a dozen Pocket Option trader complaints highlighted alarming consistency. Heres the pattern repeatedly described:

- Profits trigger sudden “KYC checks.”

When traders attempt to withdraw funds, the platform demands verification, often with changing or unclear document requirements. Even after full compliance, verification is rejected with no clear reason.

- “Technical issues” always disadvantage the trader.

When trades move against the company, instruments reportedly become “disconnected,” or data feeds lag. Users noted significant discrepancies between Pocket Options price quotes and verified sources such as TradingView.

- Support offers endless delays.

Requests for withdrawal can drag on for up to 14 days with ever‑changing excuses—system updates, overloads, or “protocol reviews.”

- Account closure after profit.

Once users push their profits higher or report delays publicly, accounts are blocked for supposed violations of Article 2.9 of the public offer agreement—an intentionally vague clause that gives the company broad grounds to cancel activity it deems “fraudulent.”

In essence, Pocket Option fraud cases show a recurring pattern: let users win small sums, encourage more deposits, then restrict withdrawals once they grow profitable.

Real Trader Testimonies, Real Losses

Spain — October 2025:

A Spanish user documented transactional timestamp discrepancies between their bank and Pocket Options—differences of several minutes that couldnt be explained by time zones. When they demanded trading logs, the company provided incomplete, edited reports. This indicates potential manipulation of user balances after trades.

Russia — September 2025:

A Russian trader lost nearly $3,000 when their account was banned under Article 2.9. The platform cited “fraudulent activity” but provided no evidence. The trader had already submitted a withdrawal request three days prior, which was never processed.

Hong Kong — September 2025:

After growing an account from $600 to $1,400, a trader‘s KYC verification was repeatedly rejected. Soon after pressing for answers, Pocket Options blocked the account entirely. Support accused the user of violating policy clauses, but couldn’t specify which ones.

Nigeria — July 2025:

Multiple Nigerian users described identical situations: unexplained trade closures, blocked accounts, and denied withdrawals. One claimed their $31 deposit had grown to $3,800 USDT, only to have the funds frozen. Despite passing full verification, support cited “duplicate account violations” and refused payout.

Israel — March 2025:

A user described a more direct approach: “My money was stolen in a professional manner. They force you to trade, then steal your funds under impossible withdrawal conditions.”

The Fake KYC Trap

The Pocket Option fake verification issue deserves attention. Across reports, traders note that Pocket Option often conducts arbitrary KYC rechecks after successful verification or after profit gains. In regulated systems, KYC serves to protect investors. Here, however, traders describe it as a delay tactic designed to frustrate users into either giving up or continuing to trade, thereby losing the rest of their funds.

In many cases, when traders escalate or threaten public complaints, their accounts are suspended under standard “anti‑fraud” clauses. Documentation submitted through official ticket systems disappears, and error messages suddenly appear in withdrawal dashboards.

One key difference between Pocket Options and regulated brokers is the segregation and protection of client funds. On regulated platforms (such as those overseen by CySEC, ASIC, or FCA), client deposits are typically held in custodial accounts separate from the companys operating funds. Pocket Options offers no such clear transparency, making it impossible to know whether user deposits are held in secure, segregated accounts.

2025: A Surge in Global Complaints

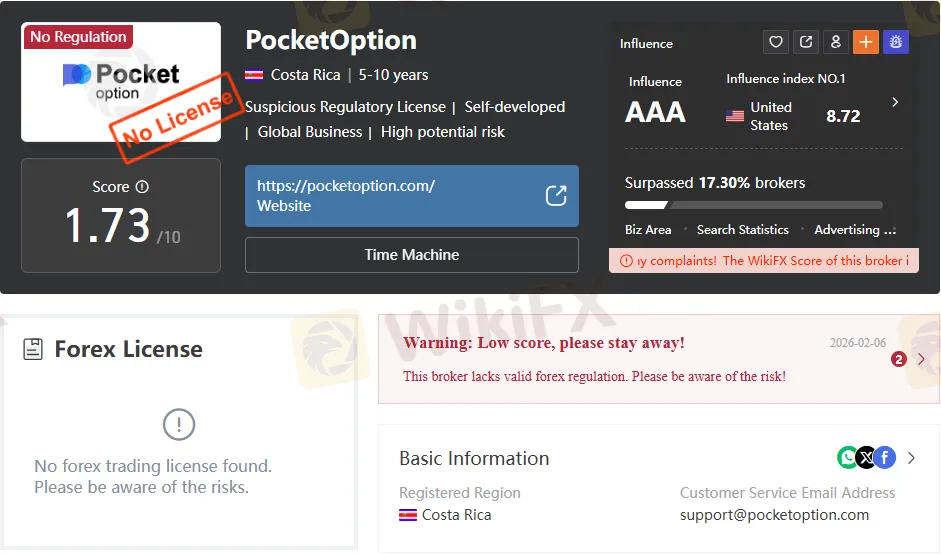

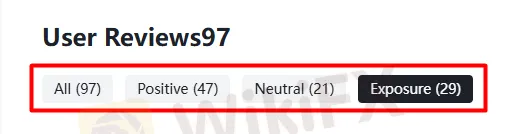

The volume of Pocket Option scam reports surged in 2025, appearing across trading forums, review portals, and consumer‑protection platforms like WikiFX and Trustpilot. The reports spanned over 30 countries, illustrating that the issue isnt isolated but systemic. Many victims share the same timeline: smooth deposits, small wins, account growth, then instant freezing upon withdrawal requests.

These are not isolated misunderstandings. The recurrence of these patterns—slippage, time manipulation, forced KYC resets, and term‑based bans—suggests a coordinated structure that favors the broker over the trader, especially in an unregulated environment.

What Traders Can Learn

For traders tempted by Pocket Options marketing or influencer endorsements, consider the following red flags before funding any account:

- Unregulated operations: Pocket Options is registered in Costa Rica and lacks licenses from top-tier regulators, including the FCA (UK), CySEC (EU), and ASIC (Australia).

- Limited corporate transparency: Ownership details are vague, and the company operates largely through offshore‑style registration.

- Social‑media PR masking as credibility: Paid YouTube tutorials and testimonials often disguise themselves as genuine reviews.

- Opaque pricing and execution: Trade outcomes are generated internally, meaning your “market” exists only inside their database.

Anyone discovering these traits in a platform should treat them as immediate warning signs.

The Shift to Safer Platforms

Many former users report switching to verified exchanges like Binance or Bybit, only to realize too late that unregulated binary‑style sites operate outside the reach of enforceable laws. One Colombian trader expressed his pain clearly: “When I switched to Binance and its alpha points, that‘s when it hurts the most. These people took advantage of the fact that I didn’t know anything.”

Although major exchanges also impose complex KYC checks, their processes are transparent, standardized, and backed by stronger oversight. The contrast underscores the difference between regulated friction and fraud‑like obstacles.

Final Warning: Think Before You Deposit

The growing body of Pocket Option trader complaints paints a clear picture: a platform exploiting unregulated loopholes while hiding behind vague service agreements. Withdrawals are delayed until traders give up. Profitable accounts are banned under loosely defined “violations.” Support offers little real accountability.

Before depositing a single dollar into Pocket Options, investors must pause and read the 2025 testimonies. The stories span continents but converge on one truth: Pocket Options structure benefits the company far more than the trader.

Dont be misled by flashy ads or social‑media influencers proclaiming fast wealth. In practice, Pocket Options has become a global case study in digital‑era financial risk, where the absence of strong regulation makes it easier for users to lose money with little recourse.

If you value your capital, keep your distance—and always verify regulation and fund‑protection practices before trading.

Read more

Beware Weltrade: Scam Reports Surge in One Month

Weltrade scam surge in August 2025: traders report fake prices, slippage manipulation, and delayed withdrawals. Protect your funds and think twice before trading.

PU Prime Launches “The Grind” to Empower Traders

Discover PU Prime’s new campaign, “The Grind,” and learn how trading discipline builds long-term success. Watch and start your trading journey today!

IG Adopts AI to Strengthen UK Marketing Compliance

IG boosts FCA compliance by integrating Adclear’s AI tools. Learn how automation accelerates marketing approvals and ensures regulatory accuracy.

ZarVista Regulatory Status: A Deep Look into Licenses and High-Risk Warnings

A close look at ZarVista's regulatory status shows major red flags that mark it as a high-risk broker for traders. This analysis goes beyond the company's marketing materials to examine the real substance of its licenses, business structure, and operating history. The main issues we will explore include its dependence on weak offshore regulation, a large number of serious user complaints, and worrying details about its corporate identity. It is also important to note that ZarVista previously operated under the name Zara FX, a detail that provides important background to its history. This article aims to deliver a complete, evidence-based breakdown of the ZarVista license framework and its real-world effects, helping traders understand the serious risks involved before investing.

WikiFX Broker

Latest News

White House-Backed Firm Secures Strategic Stake in Glencore’s DRC Assets

Commodities Wrap: Oil Sinks on Geopolitical Optimism, Gold Defies Dollar Strength

USD/ZAR Analysis: Rand Tests 16.00 Resilience Amid Commodity Rebound

New Year, New Rewards | Year of the Horse Gifts Now 30% OFF

Fed’s Hidden Constraint: Why Monetary Tightening is Hitting Stability Limits

Global FX: Yen Volatility Spikes as US-India Trade Defrosts

ZarVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

Gold's Historic Volatility: Liquidation Crash Meets Geopolitical Deadlock

Treasury Yields Surge as Refunding Expectations Dash; Warsh 'Hawk' Factor Looms

The Warsh Dilemma: Why the New Fed Nominee Puts Fiscal Plans at Risk

Rate Calc