Mohicans markets:MHM Today’s News

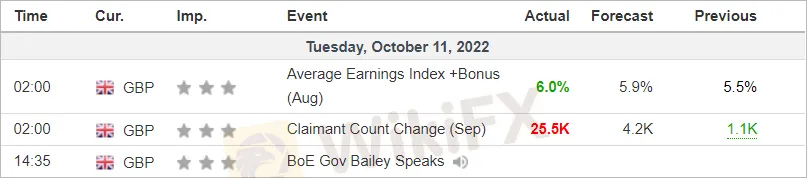

Abstract:On Tuesday, October 11, the dollar index fell below 113 during the day, but after the Bank of England Bailey speech turned up, out of the deep V trend, closing up 0.115% at 113.29. U.S. 10-year Treasury yields on Tuesday Asian trading once touched 4%, as of the close of U.S. stocks, at 3.945%.

![第一篇[英语]](https://wzimg.ruiyin999.cn/fb_article/2022-10-12/638011802158341054/FB638011802158341054_858759.jpg-article598)

In order to further meet the needs of investors for real-time news of the international market and broaden the channels for investors to understand the market, MHMarkets launches heavily “Todays News” to provide investors with real-time market information.

☆ 20:30 The U.S. released the monthly rate of PPI for September, which was expected to be 0.20% and the previous value was -0.10%. The market will take this opportunity to peek at the current state of the U.S. economy and the Feds policy path.

☆ 21:30 ECB President Lagarde will speak. If Lagarde issues a firm inflation-fighting statement with little mention of peripheral Eurozone countries, the yield gap between peripheral country bonds and German government bonds will continue to widen, thus further pulling down the euro.

☆ OPEC releases its monthly report for crude oil market .

☆ The Bank of Englands Financial Policy Committee publishes a summary of comments from its latest meeting.

☆ G20 finance ministers and central bank governors meet until October 13.

Market Overview

-- Source: jin10 & Bloomberg

On Tuesday, October 11, the dollar index fell below 113 during the day, but after the Bank of England Bailey speech turned up, out of the deep V trend, closing up 0.115% at 113.29. U.S. 10-year Treasury yields on Tuesday Asian trading once touched 4%, as of the close of U.S. stocks, at 3.945%.

Spot gold touched $1683.9 per ounce during the day, the U.S. stock market late along with the dollar turned up and turned down and approaching the 1660 mark, which finally closed down 0.1% at $1,666.24 per ounce; spot silver narrowly missed the 19 mark, and closed down 2.54% at $19.15 per ounce.

Crude oil continued to fall due to concerns about the recession and demand outlook, with WTI crude oil falling below $88 per barrel during the day and eventually closing down 2.41% at $88.76 per barrel; Brent crude oil closed down 2.51% at $94.41 per barrel.

The ups and downs of three major U.S. stock indices were inconsistent, with the Dow closing up 0.12%, the Nasdaq closing down 1.1% and the S&P 500 closing down 0.65%. Star technology stocks fell in general, Nifty fell more than 6%, TSMC fell nearly 6%, Alibaba fell nearly 5%, and Tesla fell nearly 3%.

European stocks continued to decline, and Germany‘s DAX30 index closed down 0.43%; FTSE 100 index closed down 1.06%; France’s CAC40 index closed down 0.13%; Europe‘s Stoxx 50 index closed down 0.49%; Spain’s IBEX35 index closed down 0.78%; Italys FTSE MIB index closed down 0.87%.

Hot Spots in the Market

——Source: jin10&Bloomberg

1. On Tuesday, the Bank of England again stepped up its intervention and announced that it would expand the scope of its bond buying operations to include index linked bonds. US Treasury Secretary Yellen said that he had discussed the issue of the bond market with British officials and did not comment on British policies; Don't worry about market liquidity; The US economy will remain resilient; He will not resign as finance minister.

2. Sources said that Saudi Arabia ignored the warning of the United States before OPEC+production reduction.

3. The danger level of terrorism in the vicinity of the Crimea Bridge has been raised to the “yellow” level until October 23.

4. Ukrainian President Zelensky: The G7 Group must respond to Russia's bombing of energy infrastructure and impose strict price ceilings on Russian oil and gas exports.

5. The International Monetary Fund predicts that the global economy will grow by 3.2 percent in 2022.

6. The survey of consumer inflation expectations by the New York Federal Reserve in September showed that the inflation expectations for next year fell from 5.7% to 5.4%, the lowest level since September 2021.

7. In 2022, the FOMC vote committee and Cleveland Federal Reserve Chairman Meister said that the Federal Reserve has not made any progress in reducing inflation and needs to further tighten policies. At present, the biggest policy risk is that the Federal Reserve does not increase interest rates enough.

8. Takeo Kishida said that the Bank of Japan needs to maintain its policy until the wages generally rise, and conveyed support for the current central bank governor, Tomohiko Kuroda, eliminating speculation that the latter may end his term earlier.

Institutional Perspective

—— MHMarkets ETA

1. Deutsche Bank: There is no resistance to the strengthening of the US dollar at present

2. National Australia Bank: do not think that the US dollar has peaked

3. Mitsubishi UFJ: The euro may fall to a level close to 0.90 against the dollar before the end of the year

4. Royal Bank of Canada: As the Bank of England may reduce the expectation of interest rate increase, it is recommended to buy EURGBP

5. Netherlands International: GBPUSD may easily fall below the support level of 1.1

6. Standard Chartered Bank: The slowdown of the US economy will support the Canadian dollar

7. Rabobank: maintain the forecast that the euro will fall to 0.95 against the dollar within one month, and do not rule out the possibility of falling below this level

Risk warning: The margin trading of financial derivatives and other products has high risks, so it is not suitable for all investors. The loss may exceed the initial investment. Please ensure that you fully understand the risks and properly manage your risks. Any opinion, news, research product, analysis, quotation or other information in this article does not constitute the following behavior: (1) In any case, MHM will not provide investment advice or recommendation to clients, nor will it express opinions on whether clients rely on or not to make investment decisions. MHM will never provide investors with trading advice or order trading business through WeChat, QQ or other channels; (2) In any case, any materials, information or other functions provided by MHM to clients through websites, investment platforms, marketing, training activities or other means are general information, which cannot be considered as suitable for clients or suggestions based on clients' personal conditions, and MHM will not bear any responsibility for losses caused by investment based on the above information; Investors should pay attention to the official article logo of MHM and the official channel of the brand, and pay attention to identifying fake websites.

Read more

Mohicans markets:MHM European Market

Spot gold weakened slightly during the Asian session on Thursday (April 6), hitting a two-day low of $2007.89 per ounce and now trading near $2014.15. A series of weak economic data has fueled fears of an impending recession in the US, giving safe-haven support to the dollar. And some dollar shorts took profits, and gold bulls also took profits ahead of Good Friday and the non-farm payrolls data, putting pressure on gold prices.

Mohicans markets:MHM Today News

On Wednesday, as the less-than-expected March "ADP" data and non-manufacturing PMI data fueled market concerns about an economic slowdown and spurred bets that the Federal Reserve could slow interest rate hikes. Spot gold continued to brush a new high since March last year, which was the highest intraday to $2032.13 per ounce, and then retracted most of the day's gains, finally closing up 0.01% at $2020.82 per ounce; spot silver hovered around $25 during the day, finally closing down 0.21% at $2

Mohicans markets:MHM European Market

Spot gold oscillated slightly lower during the Asian session on Tuesday (April 4) and is currently trading around $1980.13 per ounce. The dollar index rebounded mildly after a big drop overnight, putting pressure on gold prices. However, this week will see the non-farm payrolls report, there is no important economic data out on Tuesday, and the market wait-and-see sentiment is getting stronger.

Mohicans markets :MHM Today News

On Monday, in OPEC + members unexpectedly cut production reignited market concerns about long-term inflation and sparked uncertainty about the Fed's response, the dollar index once up to the 103 mark, and then on a "vertical roller coaster", giving back all the gains of the day and once lost 102 mark, finally closed down 0.53% at 102.04; U.S. 10-year Treasury yields rose and then fell, as data showed that the U.S. economy continues to slow, it fell sharply in the U.S. session, and once to a low

WikiFX Broker

Latest News

Is Deriv Safe? A Deep Dive into Regulatory Claims vs. Withdrawal Nightmares

WisunoFX Review 2025: A Complete Look at Costs, Trading Platforms, and Safety

9X Markets Review: Is It Reliable?

IQ Option Review: Real User Experiences

Bessent to propose major overhaul of regulatory body created from financial crisis

Coinlocally Broker Review: Coinlocally Regulation & Real User Complaints Exposed

A Simple Guide to WisunoFX Rules: Understanding Safety and Risks When Trading

The "VIP" Trap: Inside the Algo-Trading Nightmare at Zenstox

Advanced Markets Exposed: Faulty Copy Trading & Execution Failures Cost Traders Dearly

The case for more Fed rate cuts could rest on a 'systematic overcount' of jobs numbers

Rate Calc