Yun Shang Hui Xin Limited Review: Is it Trustworthy or Just Another Possible Fraud?

Abstract:Yun Shang Hui Xin Limited Review: Evaluating its trustworthiness amid alleged regulatory irregularities and trader complaints. Delve into its operation details, risks, and safety guidelines.

The world of financial investment can often seem murky and elusive, especially when dealing with numerous investment companies across the globe. Today, we will delve into the workings of one such company, Yun Shang Hui Xin Limited. Are they reliable, or should potential investors be wary? Let's unfold the facts.

Yun Shang Hui Xin Limited: An Overview

When one visits the official website of Yun Shang Hui Xin Limited, one learns that the broker operates in 11 countries, spanning various continents and covering major nations such as Australia, New Zealand, the United States, and China.

However, a significant detail that a trustworthy, regulated broker should readily provide is missing – their headquarters address. It is nowhere to be found on their website. This absence may raise some eyebrows, but let's not jump to conclusions yet.

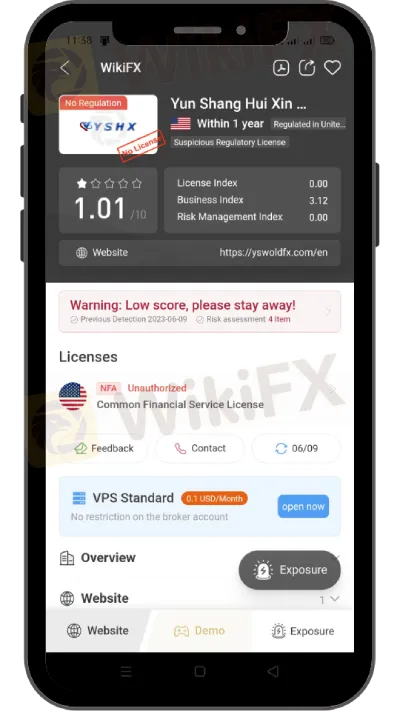

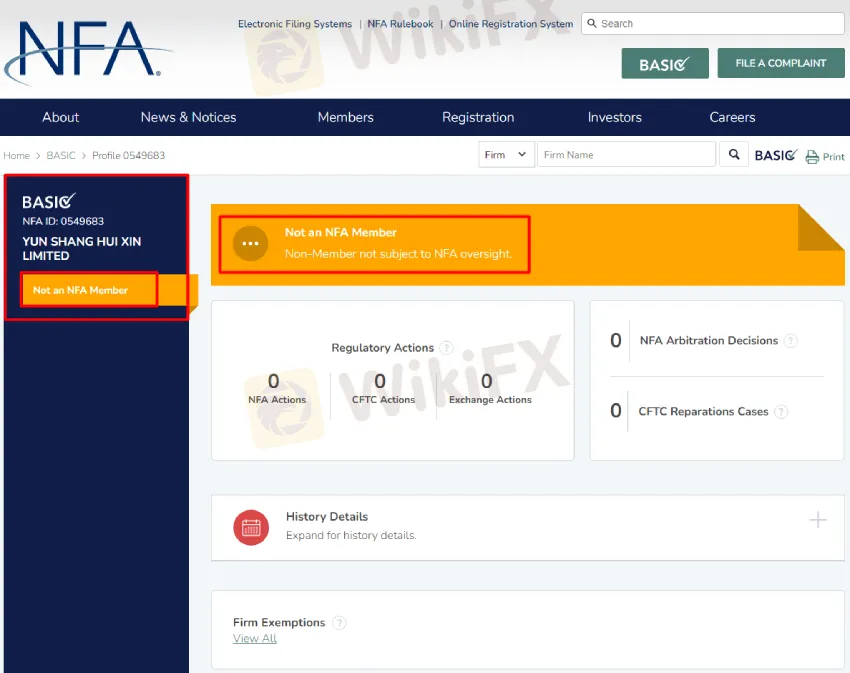

Upon investigation of their regulatory status, they claim to be regulated by the National Futures Association (NFA). Their NFA ID is stated as 0549683. The twist arises when one attempts to verify this claim. Contrary to their assertion, the said broker does not appear to be a member of the NFA. Furthermore, there is no evidence that Yun Shang Hui Xin Limited holds a license to operate as a financial investment company. The information from the WikiFX dealer page corroborates these findings.

Dealer Page: https://www.wikifx.com/en/dealer/1183515535.html

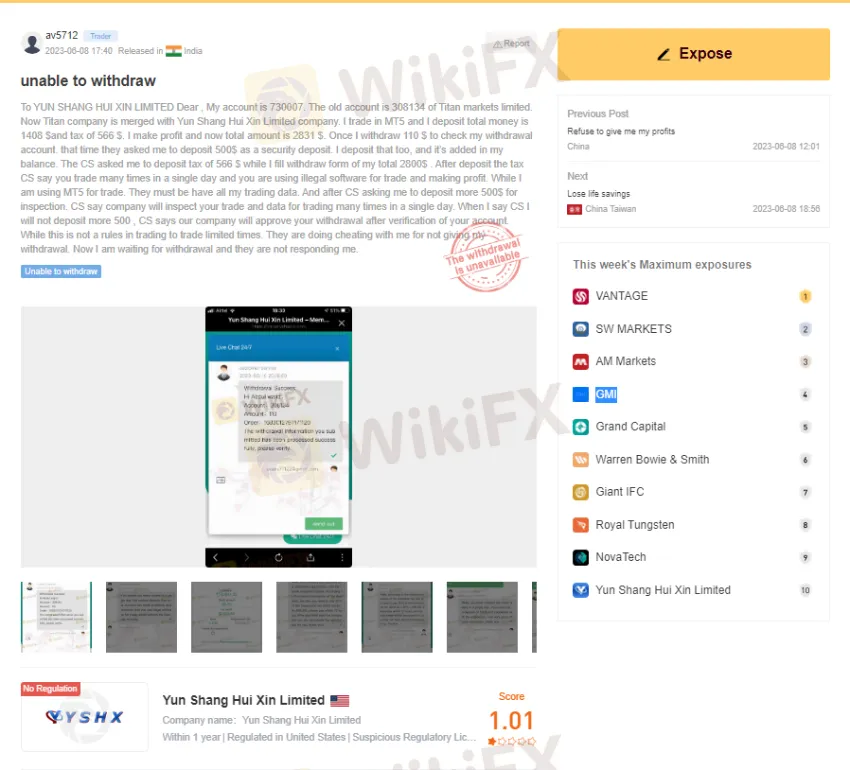

Trader Complaints Against Yun Shang Hui Xin Limited

Disturbingly, a number of complaints have been voiced against Yun Shang Hui Xin Limited by traders. This factor further fuels the flame of skepticism regarding the company's reliability.

For more details, one can examine the specific complaints at the link below:

Exposure Link: https://www.wikifx.com/en/exposure/exposure/1183515535.html

Awareness and Vigilance

Taking into account the aforementioned details about Yun Shang Hui Xin Limited, one must tread carefully. Investing with an entity having no clear regulatory status, much like Yun Shang Hui Xin Limited, could potentially lead to a total loss of invested capital.

The worst part? If such a dire situation occurs, reclaiming your hard-earned money might be an uphill task. However, there is some solace in knowing that WikiFX Support diligently works to aid scammed victims in retrieving their funds from fraudulent brokers.

Conclusion

Given the lack of transparency, absence of regulatory status, and volume of trader complaints, it is advisable to exercise extreme caution when considering an investment with Yun Shang Hui Xin Limited.

To stay updated on the latest news about various brokers, consider downloading and installing the WikiFX App on your smartphone. The App offers timely updates and can be a handy tool for potential investors.

Download the App: https://social1.onelink.me/QgET/px2b7i8n

The world of financial investment is not always clear-cut, but with proper information and alertness, one can minimize risks and maximize potential profits. Remember, in the realm of finance, knowledge is your best weapon.

Read more

Lirunex Joins Financial Commission, Boosts Trader Protection

Lirunex joins the Financial Commission, offering traders €20,000 protection per claim. A multi-asset broker regulated by CySEC, LFSA, and MED.

Why Your Forex Trades Are Always Losing

There is no guaranteed way to win in forex trading, but why do so many people still fail?

Capital.com Review 2025: Trading Account & Withdrawal to Explore

Despite its relative youth, the Cyprus-registered online broker Capital.com has garnered respectable attention from a large number of retail and professional investors since its 2016 launch. Capital.com is a frontrunner among low-cost trading products; it allows individual and institutional investors to trade contracts for difference (CFDs) on three thousand markets, including Forex, Stocks, Commodities, Indices, Cryptocurrencies, and more. Impressively, Capital.com is on board with ESG investments as well. You can begin trading CFDs on the Capital.com platform with as little as $20. You can trade CFDs on this platform without paying any commissions; the only fees involved are the spreads. This broker offers a wide range of platforms, including mobile apps, a desktop trading app, an API from Capital.com, Tradingview, and MetaTrader 4. Among Capital.com's many distinguishing features is the wealth of educational content and high-quality research it offers its users. The platform's Marke

BaFin Unveils Report: The 6 Biggest Risks You Need to Know

BaFin’s latest annual risk report highlights multiple challenges for the financial sector in 2025. While the financial system remained stable in 2024, global economic fluctuations, geopolitical tensions, digitalization, and sustainability concerns demand stronger risk management. The report examines six core risks facing Germany’s financial system and three major trends shaping the industry’s future.

WikiFX Broker

Latest News

Robinhood Halts Super Bowl Betting Contracts After CFTC Request

3-Day Online Scam Trap: Victims Lose $200K—Don't Be Next!

Japan's January PMI has been released, investors need to pay attention to these points!

Investment Scam on Telegram: How a Woman Lost Over RM65,000

Spotting Red Flags: The Ultimate Guide to Dodging WhatsApp & Telegram Stock Scams

WikiFX Review: Why so many complaints against QUOTEX?

Trans X Markets: Licensed Broker or a Scam?

Carmaker Kia becomes latest global firm to face tax trouble in India

Judge halts Trump\s government worker buyout plan: US media

BaFin Unveils Report: The 6 Biggest Risks You Need to Know

Rate Calc