MHMarkets:The U.S. dollar fell sharply intraday, non-U.S. currencies and precious metals strengthened, and both bulls and bears of US crude oil were tired!

Abstract:Last Friday (September 8), spot gold prices fell slightly to close at $1,918.65 per ounce. Due to the increasing expectations of the Fed tightening policy, US yields have slightly increased, with precious metals falling sharply last week, silver falling 5%, and gold falling nearly 1%.

Market Overview

Last Friday (September 8), spot gold prices fell slightly to close at $1,918.65 per ounce. Due to the increasing expectations of the Fed tightening policy, US yields have slightly increased, with precious metals falling sharply last week, silver falling 5%, and gold falling nearly 1%. The overall strength of international oil prices has been affected by additional production cuts from Saudi Arabia and Russia. During the week, prices once exceeded their highest level since the beginning of this year, and Brent crude oil and domestic market symbols stood at the levels of $90 and ¥700 per barrel, respectively.

U.S. Treasury yields consolidated their weekly gains last Friday. The 2-year U.S. Treasury yielded 4.99%, while the 5-year and 10-year yields were 4.40% and 4.26%, respectively. All three of these Treasury yields of varying maturities posted modest gains, limiting gold's gains on the day.

Investors are eagerly awaiting the upcoming release of the U.S. August Consumer Price Index (CPI) and Retail Sales data this week in order to continue betting on the Fed's next policy decision. Currently, the market is expecting another 25 basis points (bps) rate hike for the rest of the year, but the market is unsure whether the hike will happen in November or December.

MHMarkets strategy is only for reference and not for investment advice. Please carefully read the statement at the end of the text. The following strategy will be updated at 15:00 on September 11, Beijing time.

| ·Gold XAUUSD· | ||||||

| High Probability Scenario | High throw and low suction in the 1892-1903-1919-1931-1945-1951 range | |||||

| Low Probability Scenario | Chase up and kill down outside the 1892-1903-1919-1931-1945-1951 range | |||||

| ||||||

| ·SilverXAGUSD· | ||||||

| High Probability Scenario | High throw and low suction in the 21.5-22.3-23.1-23.9-24.5-25.3 range | |||||

| Low Probability Scenario | Chase up and kill down outside the 21.5-22.3-23.1-23.9-24.5-25.3 range | |||||

| ||||||

| ·Crude OilUSOUSD· | ||||||

| High Probability Scenario | High throw and low suction in the 80.7-82.3-83.5-85.3-87.3-89.1 range | |||||

| Low Probability Scenario | Chase up and kill down outside the 80.7-82.3-83.5-85.3-87.3-89.1 range | |||||

| ||||||

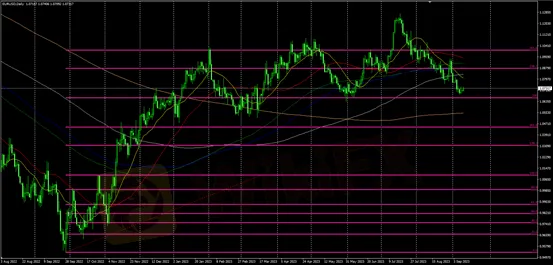

| ·EURUSD· | ||||||

| High Probability Scenario | High throw and low suction in the 1.0570-1.0690-1.0755-1.0830-1.0950 range | |||||

| Low Probability Scenario | Chase up and kill down outside the1.0570-1.0690-1.0755-1.0830-1.0950 range | |||||

| ||||||

| ·GBPUSD· | ||||||

| High Probability Scenario | High throw and low suction in the 1.2250-1.2400-1.2470-1.25460-1.26505-1.27000 range | |||||

| Low Probability Scenario | Chase up and kill down outside the 1.2250-1.2400-1.2470-1.25460-1.26505-1.27000 range | |||||

| ||||||

Read more

MHMarkets:Xung đột Palestine-Israel đã leo thang và vàng đã vượt mốc 2.000 USD.

Hôm thứ Hai (30/10), khi kết thúc Phiên chợ châu Á, Tổng thống Iran Leahy đăng tải trên mạng xã hội cáo buộc Israel "vượt qua ranh giới đỏ" và cảnh báo điều này "có thể buộc mọi người phải hành động".

MHMarkets:The US dollar index rose in the Asian market and was hindered from breaking above yesterday's high. USDJPY trading is cautious due to concerns about the Bank of Japan's intervention in the market.

At the end of the Asian market on Thursday (October 19), the US dollar index rose and was hindered from breaking through yesterday's high.

Mai hui MHmarkets: Ngày 15 tháng 06 năm 2023 – MHMarkets – Quan điểm về thị trường Châu Âu

Giờ Bắc Kinh vào ngày 15 tháng 6 (thứ Năm) thị trường châu Á vào đầu phiên giao dịch, chỉ số đô la giảm nhẹ và hiện đang giao dịch gần 102,99.

WikiFX Broker

Latest News

Gold Fun Corporation Ltd Review: A Deep Dive into Safety and Regulation

Safe-Haven Supercycle: Gold Hits $4,690 as Silver Squeeze Intensifies

Trans-Atlantic Rupture: Markets Brace for Trade War as Trump Issues Greenland Ultimatum

Dollar Softens as Fed Signals Shifts; Warsh Leads Nomination Race

Upway (JRJR) Review: A Deep Dive into Safety and Regulation

Coinbase Banks Push Advances Crypto Rules

China Delivers 5% Growth Target, Yet December Data Reveals Deepening Consumption and Property Cracks

RM668K Gone Overnight: Factory Supervisor Trapped in Fake Investment Scam

Italy’s Consob Blocks Five Unauthorized Investment Websites in New Enforcement Action

Gold Tears Through $4,700 Barrier as Risk Premiums Spike

Rate Calc