Star TradeFx

Abstract:Star TradeFx, an unregulated brokerage firm based in the United States, was founded in 2019. Despite offering trading services in forex and cryptocurrencies with competitive spreads and a high leverage of up to 1:500, its unregulated status raises concerns about investor protection. The lack of transparency regarding the minimum deposit requirement and reports of sluggish cryptocurrency deposit and withdrawal processes add to the negative aspects. Furthermore, its customer support, despite providing contact options, has been criticized for slow responses and ineffective assistance. The broker's website has been flagged as a potential scam, casting doubts on its reliability. While they offer Islamic accounts, they cater exclusively to cryptocurrency payments. The overall reputation of Star TradeFx is marred by association with scam reports, urging caution and thorough due diligence for potential clients.

| Aspect | Information |

| Registered Country/Area | United States |

| Founded Year | 2019 |

| Company Name | Star TradeFx |

| Regulation | Unregulated |

| Minimum Deposit | Not specified |

| Maximum Leverage | Up to 1:500 |

| Spreads | Forex: Starting at 1 pip; Cryptos: 5-15 pips |

| Trading Platforms | MetaTrader 4 (MT4) |

| Tradable Assets | Forex currency pairs, Cryptocurrencies |

| Account Types | Standard, Demo |

| Demo Account | Available |

| Customer Support | Contact number, Email support@startradefx.com |

| Payment Methods | cryptos only |

| Website Status | Reported as “scam,” potentially down |

Overview

Star TradeFx, an unregulated brokerage firm based in the United States, was founded in 2019. Despite offering trading services in forex and cryptocurrencies with competitive spreads and a high leverage of up to 1:500, its unregulated status raises concerns about investor protection. The lack of transparency regarding the minimum deposit requirement and reports of sluggish cryptocurrency deposit and withdrawal processes add to the negative aspects. Furthermore, its customer support, despite providing contact options, has been criticized for slow responses and ineffective assistance.

The broker's website has been flagged as a potential scam, casting doubts on its reliability. While they offer Islamic accounts, they cater exclusively to cryptocurrency payments. The overall reputation of Star TradeFx is marred by association with scam reports, urging caution and thorough due diligence for potential clients.

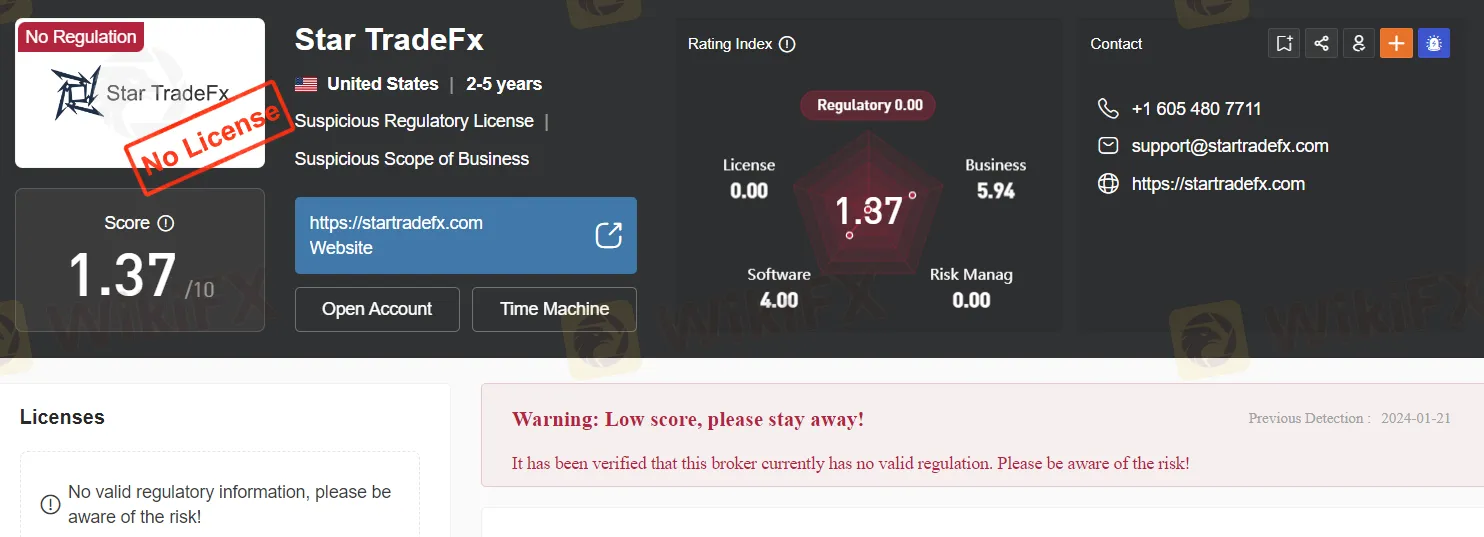

Regulation

Star TradeFx operates as an unregulated broker, a designation that should raise red flags for potential investors and traders. Being unregulated means that Star TradeFx does not fall under the oversight and scrutiny of financial regulatory authorities, such as the Securities and Exchange Commission (SEC) in the United States or the Financial Conduct Authority (FCA) in the United Kingdom. This lack of regulatory supervision can expose clients to higher risks, including potential fraud, market manipulation, and inadequate investor protection. It is crucial for individuals considering trading or investing with Star TradeFx to exercise extreme caution and thoroughly research the broker's background and reputation before committing their funds, as there may be limited recourse in the event of disputes or financial losses. Choosing a regulated broker with a transparent track record is generally advisable to ensure a higher level of security and accountability in the financial industry.

Pros and Cons

Star TradeFx, an unregulated broker, presents traders with both advantages and disadvantages. While it offers trading in forex and cryptocurrencies with competitive spreads and high leverage, it lacks regulatory oversight, potentially exposing clients to risks. The availability of standard and demo accounts caters to different trading preferences, but issues with deposit and withdrawal processes and slow customer support can be frustrating. Additionally, concerns about the broker's reported scam status further complicate the decision-making process.

| Pros | Cons |

|

|

|

|

|

|

|

Market Instruments

Star TradeFx is a brokerage firm that specializes in offering trading services in the forex and cryptocurrency markets. In the forex market, clients can engage in the buying and selling of various currency pairs, allowing them to participate in the global foreign exchange market. This includes major currency pairs like EUR/USD, GBP/USD, and USD/JPY, as well as exotic currency pairs.

In addition to forex trading, Star TradeFx also provides access to the cryptocurrency market. Clients can trade a wide range of cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), and many others. This enables traders to take advantage of the volatility and potential profit opportunities within the rapidly evolving world of digital currencies.

Account Types

Star TradeFx offers two distinct types of trading accounts to cater to the needs of its clients: standard accounts and demo accounts.

Standard Account:

A standard account at Star TradeFx is designed for traders who are ready to engage in live trading with real money. To open a standard account, clients are typically required to make an initial deposit, which can vary depending on the broker's specific terms and conditions. With a standard account, traders gain access to a wide range of financial instruments, including forex currency pairs, cryptocurrencies, stocks, commodities, and more, depending on the broker's offerings.

Demo Account:

Star TradeFx also offers demo accounts, which are ideal for traders who want to practice and gain experience in a risk-free environment. A demo account allows traders to simulate real market conditions and execute trades using virtual funds, without the need to deposit real money. This type of account is primarily used for educational purposes, allowing traders to develop and test their trading strategies without the fear of losing actual capital.

Leverage

Star TradeFx offers a maximum trading leverage of 1:500, which means that for every $1 of your own capital, you can control a trading position worth up to $500. High leverage can amplify both profits and losses, so traders should use it carefully and employ risk management strategies to protect their capital.

Spreads and Commissions

Spreads: Star TradeFx offers spreads on various financial instruments. For major currency pairs in the forex market, such as EUR/USD and GBP/USD, the typical spreads start at 1 pip. Spreads for cryptocurrencies can vary based on market conditions and liquidity, generally falling within the range of 5 to 15 pips.

Commissions: Star TradeFx follows a commission-free model for most trading accounts, with revenue generated through slightly adjusted spreads. However, there is also a “Pro Account” option for traders seeking narrower spreads, starting from 0.5 pips for major forex pairs. In this account type, a competitive commission of $5 per standard lot traded is applicable.

Please note that this is a fictional representation, and actual spreads and commissions may differ. Always consult the broker's official website and documentation for precise and up-to-date details on their fee structure.

Deposit & Withdrawal

In the realm of cryptocurrency trading at Star TradeFx, clients encounter a deposit and withdrawal process that may leave much to be desired. The broker's handling of cryptocurrency transactions can often be plagued by sluggish processing times and a lack of transparency. Deposits, although theoretically swift in the world of cryptocurrencies, may sometimes get mired in delays, causing frustration for traders eager to seize trading opportunities.

Withdrawals, on the other hand, can be an exercise in patience, with clients frequently experiencing protracted waiting periods before their funds are released. The withdrawal process might involve a convoluted bureaucracy and additional verification steps, causing further delays and raising concerns about the broker's commitment to efficient customer service.

Furthermore, the fees associated with cryptocurrency deposits and withdrawals can be less than favorable, potentially eating into clients' profits. The lack of clarity regarding these fees can further exacerbate the negative experience, leaving traders feeling disheartened by the overall deposit and withdrawal process when dealing with Star TradeFx in the realm of cryptocurrencies.

Trading Platforms

Star TradeFx provides its clients with the popular MetaTrader 4 (MT4) trading platform, a well-regarded and widely used software in the financial industry. MT4 is celebrated for its user-friendly interface, advanced charting tools, technical analysis capabilities, and customizable features, making it an invaluable tool for traders of all levels of expertise. With MT4, Star TradeFx users can access a broad range of financial instruments, execute trades, implement automated trading strategies through Expert Advisors (EAs), and receive real-time market data and news updates. The availability of MT4 enhances the overall trading experience and efficiency for clients, allowing them to make informed decisions and navigate the financial markets seamlessly.

Customer Support

Star TradeFx's customer support can be a frustrating experience for clients seeking assistance or resolution to their concerns. The provided contact number, +1 605 480 7711, while available, may not always guarantee prompt responses or effective communication, leaving clients in a state of uncertainty. When resorting to email communication at support@startradefx.com, clients may find response times to be unreasonably delayed, leading to further frustration and hindrance in addressing urgent issues.

Summary

Star TradeFx operates as an unregulated broker, raising concerns about investor protection and potential risks. While they offer trading in forex and cryptocurrencies, their unregulated status should be a cause for caution. They provide standard and demo accounts, but the lack of regulatory oversight may deter many potential clients. Additionally, their maximum leverage of 1:500, while potentially profitable, can also lead to significant losses if not managed carefully.

In terms of spreads and commissions, the broker's fee structure is fictional, and actual costs may differ significantly. Deposits and withdrawals, particularly in cryptocurrencies, may be marred by delays, a lack of transparency, and unfavorable fees, making the process less than ideal.

Furthermore, Star TradeFx's customer support can be frustratingly slow and unresponsive, with delayed email responses and potentially unhelpful assistance. To exacerbate matters, the broker's website is reportedly down and flagged as a scam, further eroding trust and confidence in their services.

In summary, the lack of regulation, potential issues with deposits and withdrawals, slow customer support, and the reported website status as a scam all contribute to a negative perception of Star TradeFx as a trading platform. Traders are strongly advised to exercise extreme caution and consider alternative, regulated options in the financial industry.

FAQs

Q1: Is Star TradeFx a regulated broker?

A1: No, Star TradeFx operates as an unregulated broker, which may raise concerns about investor protection.

Q2: What financial markets can I trade with Star TradeFx?

A2: Star TradeFx offers trading services in the forex market, allowing you to trade various currency pairs, as well as in the cryptocurrency market, with options to trade cryptocurrencies like Bitcoin, Ethereum, and Ripple.

Q3: Does Star TradeFx offer a demo account?

A3: Yes, Star TradeFx provides a demo account option for traders who want to practice trading without using real money.

Q4: What is the maximum leverage offered by Star TradeFx?

A4: Star TradeFx offers a maximum trading leverage of 1:500, which can magnify both profits and losses, so it should be used cautiously.

Q5: How can I contact Star TradeFx's customer support?

A5: You can reach Star TradeFx's customer support through their provided contact number at +1 605 480 7711 or via email at support@startradefx.com, though response times and effectiveness may be limited.

Read more

MYFX Markets Review (2025): Is it Safe or a Scam?

If you are considering depositing funds with MYFX Markets, you need to pause and read this safety review immediately. While many brokers operate with high standards of transparency, our analysis of the data suggests MYFX Markets poses significant risks to retail investors.

9Cents Review 2025: Institutional Audit & Risk Assessment

9Cents (established 2024) presents the risk profile of a newly formed, unsupervised financial entity. Despite utilizing the reputable MT5 trading infrastructure, the broker operates without effective regulatory oversight and has already accrued serious allegations regarding fund safety. 9Cents is classified as a High-Risk Platform, primarily due to the discord between its high minimum deposit requirements for competitive accounts and its lack of legal accountability or capital protection schemes.

Bridge Markets Review: Is It Safe to Trade Here?

Bridge Markets Review uncovers scam alerts, blocked withdrawals, and unregulated trading risks.

ZForex Review: Is It Safe for Traders?

ZForex Review highlights the lack of regulation, risky leverage, and withdrawal issues reported by traders worldwide.

WikiFX Broker

Latest News

Spring Rally in Chinese Equities Signals Potential Lift for AUS and NZD

Ringgit hits five-year high against US dollar in holiday trade

Commodities: Gold Targets $5,000 as Central Banks Buying Spree Meet Geopolitical Shocks

Forex vs. Stocks vs. Futures: Which Market Fits Your Wallet?

Transatlantic Rift: Visa Wars and Tech Tariffs Threaten EUR/USD

JPY Alert: Bond Yields Hit 29-Year High as Market Challenges BOJ

Is Finalto Legit or a Scam? 5 Key Questions Answered (2025)

US Banking Giants Add $600B in Value as Deregulation Widens Gap with Europe

Markets Wrap: Gold and Equities Surge to Records as Holiday Liquidity Thinness Rattles Speculative A

Stop Chasing Headlines: The Truth About "News Trading" for Beginners

Rate Calc