ZForex Review: Is It Safe for Traders?

Abstract:ZForex Review highlights the lack of regulation, risky leverage, and withdrawal issues reported by traders worldwide.

ZForex Review Overview

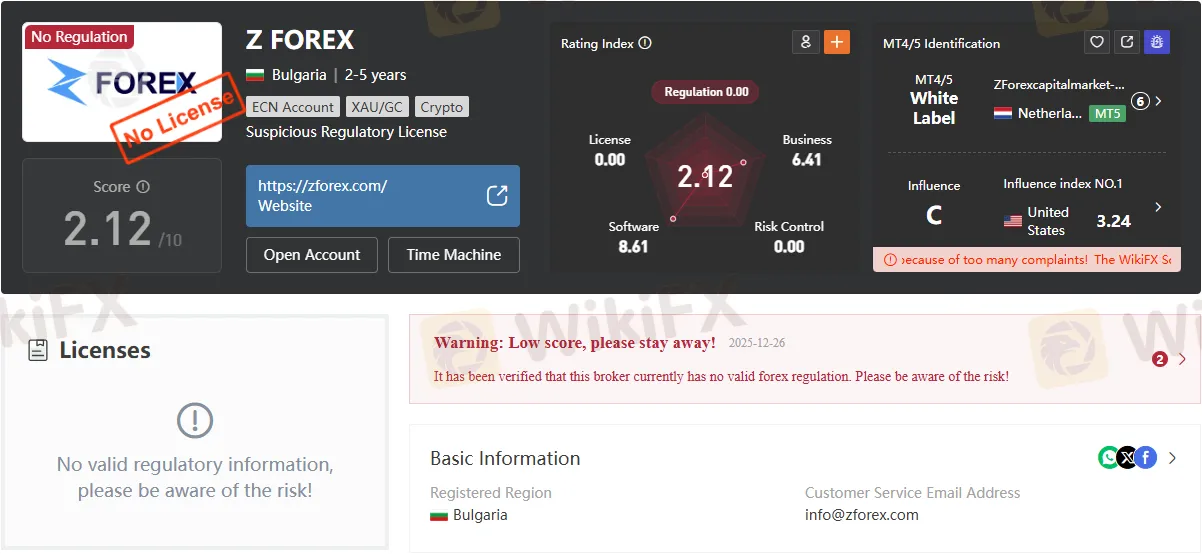

ZForex, founded in 2006 and registered in Bulgaria, presents itself as a multi-asset broker offering forex, stocks, indices, commodities, metals, and cryptocurrencies. Despite its longevity in the market, the broker operates without valid regulatory oversight, a fact confirmed by multiple independent sources. This absence of regulation raises immediate red flags for traders concerned about transparency, fund safety, and dispute resolution.

The brokers official domains include zforex.com and zglobaltrade.com, with servers hosted in the United States and the United Kingdom. While ZForex promotes advanced trading platforms such as MetaTrader 5 (MT5) and cTrader, its operational framework is undermined by questionable licensing claims and a WikiFX score of just 2.12/10, signaling high risk.

Regulation and Licensing Concerns

The most pressing issue in this ZForex Review is the brokers unregulated status. According to WikiFX data “No valid regulatory information, please be aware of the risk!” Traders should note that ZForex has been flagged for suspicious regulatory licenses and operates without oversight from any recognized financial authority.

- Registered Country: Bulgaria

- Regulation: None

- WikiFX Score: 2.12/10

- Risk Control Index: 3.24

In contrast, reputable competitors such as XTB or IG Markets hold licenses from tier-one regulators like the FCA (UK) or CySEC (Cyprus), offering far greater investor protection. ZForexs lack of regulation means clients have no recourse in cases of fraud, withdrawal disputes, or platform manipulation.

Trading Instruments and Platforms

ZForex claims to provide access to a wide range of instruments:

- Forex pairs

- Stocks

- Indices

- Commodities

- Metals

- Cryptocurrencies

- Bonds, options, funds, ETFs

The broker supports MetaTrader 5 (MT5) and cTrader, both recognized platforms in the industry. However, it reveals that ZForex operates white-label servers, which often lack the stability and technical support of fully licensed MT4/MT5 providers. Average execution speed is listed at 184 ms, but without regulatory audits, these figures remain unverifiable.

Account Types and Fees

ZForex offers three live accounts alongside a demo option:

| Account Type | Minimum Deposit | Leverage | Commission | Spread |

| Standard | $10 | 1:1000 | $0 | 1.2 pips |

| ECN | $10 | 1:1000 | $7 Forex / $15 Metals | From 0 pips |

| Swap-Free | $2,500 | 1:500 | $10 Forex / $15 Metals | 0.7 pips |

- Leverage: Up to 1:1000, with dynamic adjustments based on equity tiers.

- Margin Call: 100%

- Stop Out: 30% (50% for Swap-Free accounts)

While the low minimum deposit of $10 may attract beginners, the extremely high leverage exposes traders to significant risk. Competitor brokers typically cap leverage at 1:30 (EU) or 1:50 (US), aligning with regulatory standards to protect retail investors.

Deposits and Withdrawals

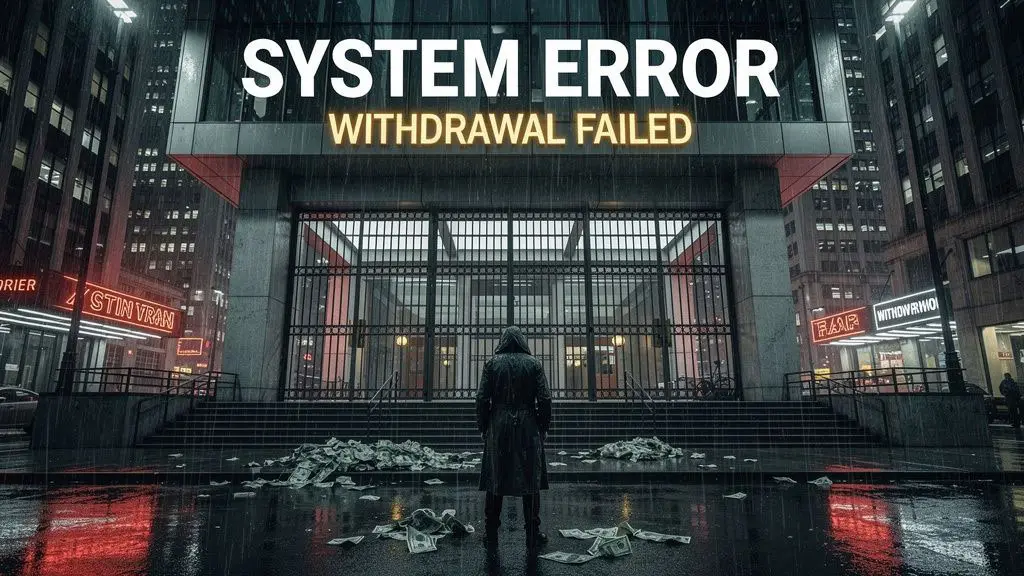

The broker advertises same-day withdrawals and multiple payment methods, including credit cards, wire transfers, e-wallets (SticPay, Jeton, Fasapay), and cryptocurrencies. However, user reports series of claims:

- Case 1: A trader reported ZForex withheld $4,000, marking withdrawals as “pending” indefinitely.

- Case 2: Another user stated $3,200 in withdrawals were deducted without explanation.

- Case 3: A Hong Kong-based trader claimed withdrawals had been on hold since October 2024, with accusations of “abuse” used as a pretext to deny payouts.

These cases highlight a pattern of withdrawal issues, undermining ZForexs credibility. By comparison, regulated brokers are required to segregate client funds and process withdrawals transparently.

Pros and Cons

Pros:

- Wide range of trading instruments

- MT5 and cTrader platforms supported

- Low minimum deposit ($10)

- Multiple contact channels (live chat, phone, email, social media)

Cons:

- Unregulated broker with suspicious licensing claims

- High leverage (up to 1:1000) increases risk exposure

- Documented withdrawal disputes and complaints

- Commission fees on ECN and Swap-Free accounts

- Regional restrictions (USA, Turkey, Iran, DPRK, Myanmar)

Domain and Transparency Check

- Primary Domains: zforex.com, zglobaltrade.com

- IP Hosting: United States (23.106.37.153), United Kingdom (104.21.89.108)

- Company Address: Sofia, Bulgaria, Olimpiyska str., SiteGround, Sofia Park, fl. 4, No: 2, post code: 1756

Despite listing a Bulgarian address, the brokers lack of regulatory registration in Bulgaria or the EU raises transparency concerns. Competitors like RaiseFX or Assexmarkets provide verifiable licensing details, which ZForex fails to match.

User Complaints and Exposure Cases

Based on the reported cases recieved, 59 user reviews, with multiple exposures highlighting serious issues:

- Funds withheld despite evidence provided by clients.

- Accounts closed after withdrawal requests.

- Accusations of abuse without proof, used to deny payouts.

These cases align with common warning signs of unregulated brokers: delayed withdrawals, lack of communication, and arbitrary account closures.

Bottom Line: Should Traders Trust ZForex?

This ZForex Review underscores a broker operating outside regulatory frameworks, with a history of withdrawal disputes and unverified licensing claims. While the platform offers attractive features such as MT5 support, diverse instruments, and low entry deposits, these benefits are overshadowed by serious risks.

Traders seeking security and transparency should consider regulated alternatives. Brokers licensed by authorities such as the FCA, ASIC, or CySEC provide far stronger safeguards, including fund segregation, compensation schemes, and audited operations. ZForex, by contrast, remains a high-risk choice with limited accountability.

Final Verdict: ZForex is not safe for traders. The lack of regulation, risky leverage, and repeated withdrawal complaints make it unsuitable for anyone prioritizing fund security and fair trading conditions.

Read more

Bridge Markets Review: Is It Safe to Trade Here?

Bridge Markets Review uncovers scam alerts, blocked withdrawals, and unregulated trading risks.

Capitalix: The ‘Burn and Ransom’ Trap Hiding Behind a Seychelles Shell

It starts with a phone call—often aggressive, always persistent. A "personal manager" promises to guide you through the complexities of the market, asking for a modest $200 deposit. But according to sixteen separate reports from victims across Latin America, Europe, and the Middle East, that initial deposit is just the entry fee to a financial hostage situation.

WikiFX Deep Dive Review: Is dbinvesting Safe?

If you are thinking about trading with dbinvesting, you need to be very careful. At WikiFX, we analyze brokers based on facts, licenses, and trader feedback.

BitPania Review 2025: Safety, Features, and Reliability

BitPania is a relatively new brokerage established in 2024 and registered in Saint Lucia. The platform markets itself as a digital trading solution offering multiple account types and support for automated trading (EAs). However, potential investors should approach with significant caution. Currently, BitPania holds a WikiFX Score of 1.20, a very low rating that reflects its lack of regulatory oversight and recent user complaints regarding withdrawals.

WikiFX Broker

Latest News

China’s Export Resilience: A Structural Pivot Towards the 'Global South'

Silver Smashes $70: Is the "Forced Central Bank Buying" Thesis Playing Out?

JPY Forecast: Japan Raises Debt Cost Assumption to 30-Year High

Copper Smashes $12,000 Barrier in Commodity Super-Cycle Surge

Trump Intensifies Fed Pressure as Strong GDP Complicates Rate Cut Path

Credit Suisse Hit With $7.1M Fine Over Supervisory Failures

Brokers or Prop Firms, or both...

Trading.com Launches Zero-Commission Investment Account

Quotex Review 2025: Safety, Features, and Reliability

Government Officer Lost RM12,000 to Non-Existent Forex Scheme

Rate Calc