Hunter TR

Abstract:Hunter TR is a brokerage company based in Malaysia, operating without regulatory oversight. With a maximum leverage of 1:100, it offers a variety of trading platforms catering to different devices, including desktop (Windows), web, and smartphones (iPhone/iOS and Android). Traders have access to a wide range of tradable assets, including major, minor, and exotic currency pairs. The company provides a demo account for practice trading and offers customer support through email. Payment methods accepted by Hunter TR include bank transfer, SticPay, Visa, and Mastercard, providing convenience for funding and withdrawals.

| Aspect | Information |

| Registered Country | Malaysia |

| Company Name | Hunter TR |

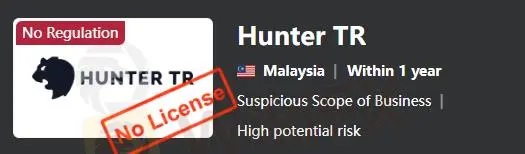

| Regulation | Not regulated |

| Maximum Leverage | 1:100 |

| Trading Platforms | Desktop (Windows) - Windows for cTrader; Web - Web for cTrader; Smartphones (iPhone/iOS) - App Store; Smartphones (Android) - Google Play |

| Tradable Assets | Wide range of currency pairs including major, minor, and exotic pairs |

| Demo Account | Available |

| Customer Support | Email support available |

| Payment Methods | Bank transfer, SticPay, Visa, Mastercard |

Overview of Hunter TR

Hunter TR is a brokerage company based in Malaysia, operating without regulatory oversight. With a maximum leverage of 1:100, it offers a variety of trading platforms catering to different devices, including desktop (Windows), web, and smartphones (iPhone/iOS and Android). Traders have access to a wide range of tradable assets, including major, minor, and exotic currency pairs. The company provides a demo account for practice trading and offers customer support through email. Payment methods accepted by Hunter TR include bank transfer, SticPay, Visa, and Mastercard, providing convenience for funding and withdrawals.

Regulation

Hunter TR operates without regulation as a broker. This absence of oversight might raise concerns regarding investor protection and transparency in its operations. Prior to investing with Hunter TR or any brokerage, it's crucial for individuals to assess the risks associated with dealing with an unregulated entity.

Pros and Cons

Trading with Hunter TR offers various benefits, including a wide range of market instruments for diversification, convenient deposit and withdrawal methods, and accessible customer support channels. However, potential drawbacks include the absence of regulatory oversight and the associated risks, such as limited investor protection and transparency.

| Pros | Cons |

|

|

|

|

|

|

In summary, trading with Hunter TR presents advantages such as diverse market instruments, convenient banking options, and accessible support. However, it's crucial to be aware of the lack of regulatory oversight and associated risks, emphasizing the importance of careful consideration and risk management.

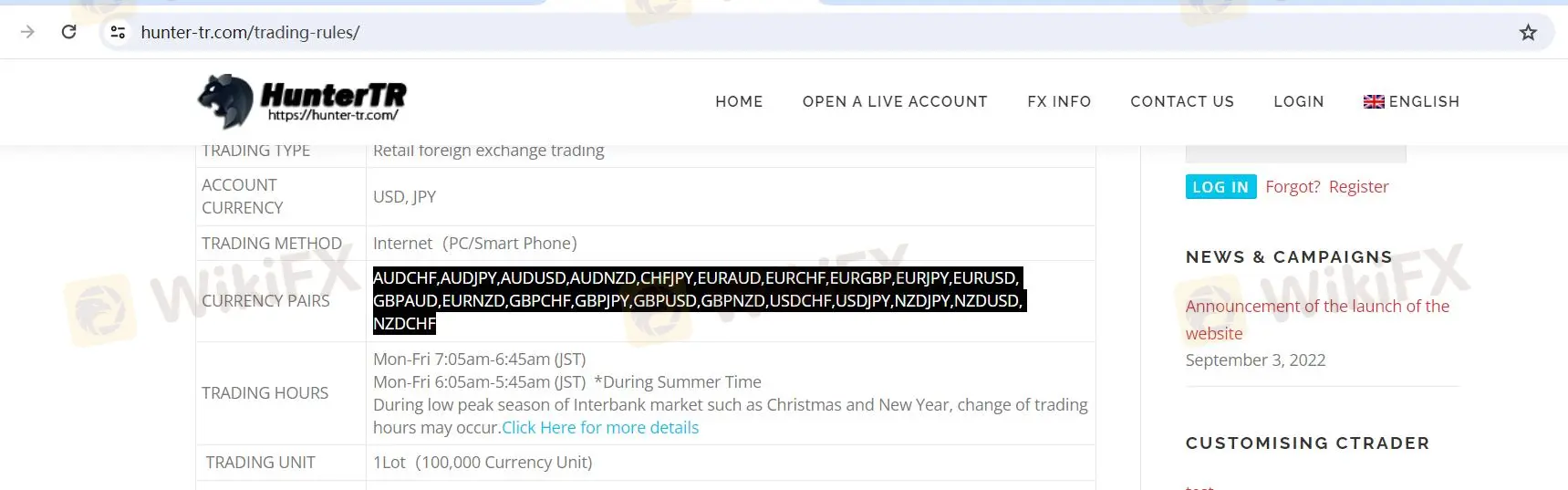

Market Instruments

The market instruments offered by Hunter TR cover a wide range of currency pairs, including major, minor, and exotic pairs. These instruments allow traders to speculate on the exchange rates between different currencies, providing opportunities for diversification and risk management strategies. From commonly traded pairs like EUR/USD and GBP/USD to less common ones like AUD/NZD and NZD/CHF, Hunter TR's offerings cater to various trading preferences and strategies. However, it's essential for traders to conduct thorough research and analysis before engaging in trading activities with any specific currency pair to mitigate potential risks.

Leverage

Hunter TR offers a maximum trading leverage of 1:100. This leverage ratio allows traders to control larger positions in the market with a smaller amount of capital. While higher leverage can amplify potential profits, it also increases the risk of significant losses, as fluctuations in the market can quickly erode the trader's account balance. Therefore, it's crucial for traders to exercise caution and employ risk management strategies when trading with leverage to protect their capital.

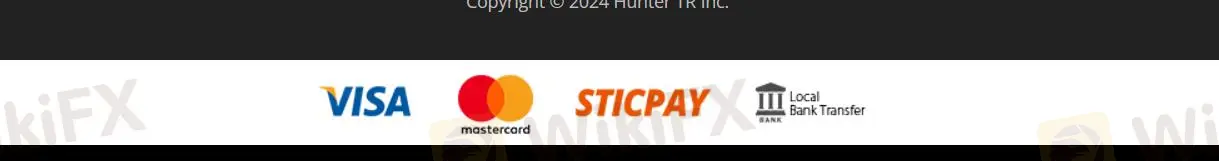

Deposit & Withdrawal

Hunter TR offers a range of deposit and withdrawal methods, including bank transfer, SticPay, Visa, and Mastercard. These options provide flexibility for clients to fund their trading accounts securely and conveniently. Deposits can be made via bank transfer or through digital payment solutions like SticPay, while Visa and Mastercard offer additional convenience through credit and debit card transactions. Withdrawals are typically processed using the same method as deposits, ensuring a straightforward experience for clients managing their funds. It's advisable for traders to review any associated fees and processing times for each method before initiating transactions.

Trading Platforms

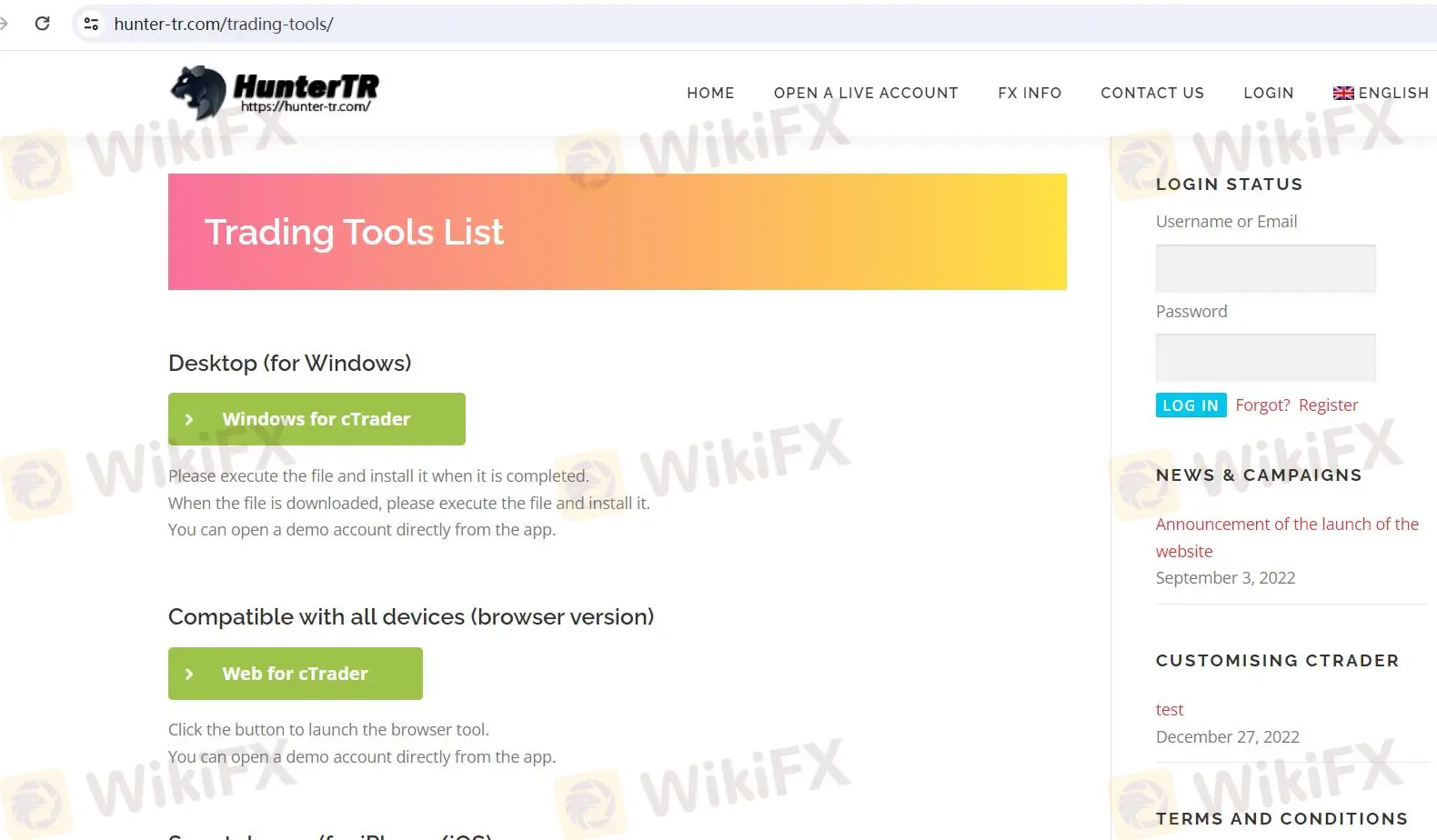

Hunter TR offers a variety of trading platforms tailored to different devices:

Desktop (Windows):

Windows for cTrader: A robust desktop platform designed for Windows users, offering advanced trading tools and features. Users can easily install the application and open demo accounts directly within the platform.

Compatible with all devices (Browser Version):

Web for cTrader: A web-based platform accessible from any device with a web browser. No downloads are required, providing convenient access to trading tools and features without installation hassle. Users can open demo accounts directly from the web platform.

Smartphones (iPhone/iOS):

Download on the App Store: Dedicated iOS app available on the App Store, offering a seamless trading experience optimized for iPhone and iOS devices. Traders can download the app and open demo accounts directly within it.

Smartphones (Android):

Get it on Google Play: Dedicated Android app available on Google Play, providing a user-friendly trading experience on Android devices. Traders can download the app from Google Play and open demo accounts directly within it.

These platforms cater to the diverse needs of traders, offering flexibility, accessibility, and a comprehensive set of trading tools to enhance the trading experience across different devices.

Customer Support

Hunter TR offers accessible customer support channels to assist clients with their inquiries and concerns. Clients can reach out to the support team via email, providing their name, email address, subject, and optional message for more personalized assistance. This allows for efficient communication and resolution of issues or questions that clients may have regarding their accounts, trading platforms, or other related matters. The submission feature ensures that inquiries are promptly directed to the appropriate department for timely response and support, enhancing overall client satisfaction and user experience.

Conclusion

In conclusion, while Hunter TR offers a diverse range of market instruments and convenient trading platforms across various devices, it's essential to consider the absence of regulatory oversight as a potential risk factor. Traders should approach investing with caution and conduct thorough research to mitigate associated risks. Additionally, the availability of accessible customer support channels underscores the broker's commitment to assisting clients. However, it's crucial for traders to remain vigilant and adhere to proper risk management practices to safeguard their capital and enhance their trading experience.

FAQs

Q1: Is Hunter TR regulated?

A1: No, Hunter TR operates without regulation as a broker.

Q2: What leverage does Hunter TR offer?

A2: Hunter TR offers a maximum trading leverage of 1:100.

Q3: What deposit methods does Hunter TR support?

A3: Hunter TR supports deposit methods such as bank transfer, SticPay, Visa, and Mastercard.

Q4: What trading platforms does Hunter TR provide?

A4: Hunter TR offers trading platforms for desktop (Windows), web (browser version), iPhone/iOS, and Android devices.

Q5: How can I contact Hunter TR's customer support?

A5: You can contact Hunter TR's customer support team via email for assistance with inquiries and concerns.

Risk Warning

Online trading carries substantial risk, potentially leading to the total loss of invested funds. It may not be appropriate for all traders or investors. It's crucial to fully comprehend the associated risks before engaging in trading activities. Additionally, the content of this review is subject to change, reflecting updates in the company's services and policies. The review's creation date is also relevant, as information could have become outdated. Readers should confirm the latest information with the company prior to making any investment decisions. The responsibility for utilizing the information provided herein lies exclusively with the reader.

Read more

Mazi Finance Scam Exposure: A Warning to Indian Traders

Latest India Mazi Finance scam: Failed XAUUSD execution despite margin, costing $675—fake “insufficient balance” excuse. Protect funds, read the full report now!

Pemaxx Review: Fund Scams & No Withdrawals, Say Traders

Does Pemaxx prevent you from withdrawing funds once you make profits? Has the Mauritius-based forex broker disabled your trading account upon your withdrawal request? Do you fail to withdraw funds despite meeting the trading lot requirements? These scam-like trading activities have allegedly become a part of the broker’s operation, as many traders have complained about them online. In this Pemaxx review article, we have highlighted their comments against the forex broker. Keep reading!

Fortune Prime Global Exposure: Withdrawal Denials & Profit Cancellations Frustrate Traders

Did Fortune Prime Global deduct all your profits by accusing you of market manipulation? Are you struggling to access withdrawals for months? Has the forex broker disabled your forex trading account upon the withdrawal application? Does the broker stipulate tax payments as a condition for fund withdrawals? You are not alone! In this Fortune Prime Global review article, we have highlighted these complaints. Read on!

UNIGLOBEMARKET Analysis Report

UNIGLOBEMARKET presents a mixed picture that demands careful consideration from prospective traders, earning an overall rating of 5.5 out of 10 with a "Use with Caution" designation. Based on 55 trader reviews, the broker shows a concerning 40% negative rate, though it's worth noting that positive reviews still outnumber negative ones with 31 favorable assessments compared to 22 unfavorable ones. Read on for an insightful review.

WikiFX Broker

Latest News

New AI laws to arrest deepfakes

Global Macro: Real Wage Growth Expected to Return by 2026

XAU/USD: Gold Rally Signals 'Paradigm Shift' as Middle East Tensions Simmer

MONAXA Review 2026: Comprehensive Safety Assessment

BoC Preview: Macklem to Hold at 2.25% Amidst Trade Anxiety

Fed Holds Rates as Political Storm Intensifies; Trump to Name New Chair Imminently

Meta and Samsung Fuel AI Capex Boom, Keeping Risk Sentiment Alive

Gold Smashes $5,600 Record on Shutdown Fears; Analysts Flash Crash Warning for Silver

FxPro Enhances MetaTrader 5 Execution with New LD4 Cross-Connect

Fed Holds Rates Amidst Political Siege; Dollar Sinks to Four-Year Lows

Rate Calc