Datuk Seri Linked to RM8.4 Million Gold Investment Scam Under Police Probe

Abstract:Malaysian police are investigating a gold investment scam that has cheated 37 people out of more than RM8.4 million, with a businessman holding the honorific title ‘Datuk Seri’ believed to be the mastermind.

Malaysian police are investigating a gold investment scam that has cheated 37 people out of more than RM8.4 million, with a businessman holding the honorific ‘Datuk Seri’ believed to be the mastermind.

According to Bukit Aman Commercial Crime Investigation Department (JSJK) director Datuk Rusdi Mohd Isa, police have recorded 40 statements so far, including from three witnesses. The case came to light after the Malaysian International Humanitarian Organisation (MHO) highlighted it, following 43 police reports made nationwide since 2023.

The company behind the scheme claimed to control billions of ringgit in gold and cash held overseas. Investors were told their funds would cover management and activation fees before the gold was sold and high returns paid out.

However, checks showed the company was not registered with the Companies Commission of Malaysia (SSM). Police say the Datuk Seri convinced victims by claiming he was managing the inheritance of a wealthy foreign national. To appear credible, the suspects allegedly produced fake documents carrying forged logos, stamps, and signatures from Bank Negara Malaysia (BNM). These were shown to investors as “proof” of the investments legitimacy.

No investor has received any returns, despite repeated promises. Instead, they were given excuses such as overseas technical problems or missing paperwork.

Police have opened 15 investigation papers under Section 420 of the Penal Code, which deals with cheating and dishonestly inducing the delivery of property. No arrests have been made yet, and the investigation is still ongoing.

Authorities are urging the public to be cautious of investment offers that promise unusually high returns, especially when the companies involved are unregistered and make unverifiable claims about foreign assets.

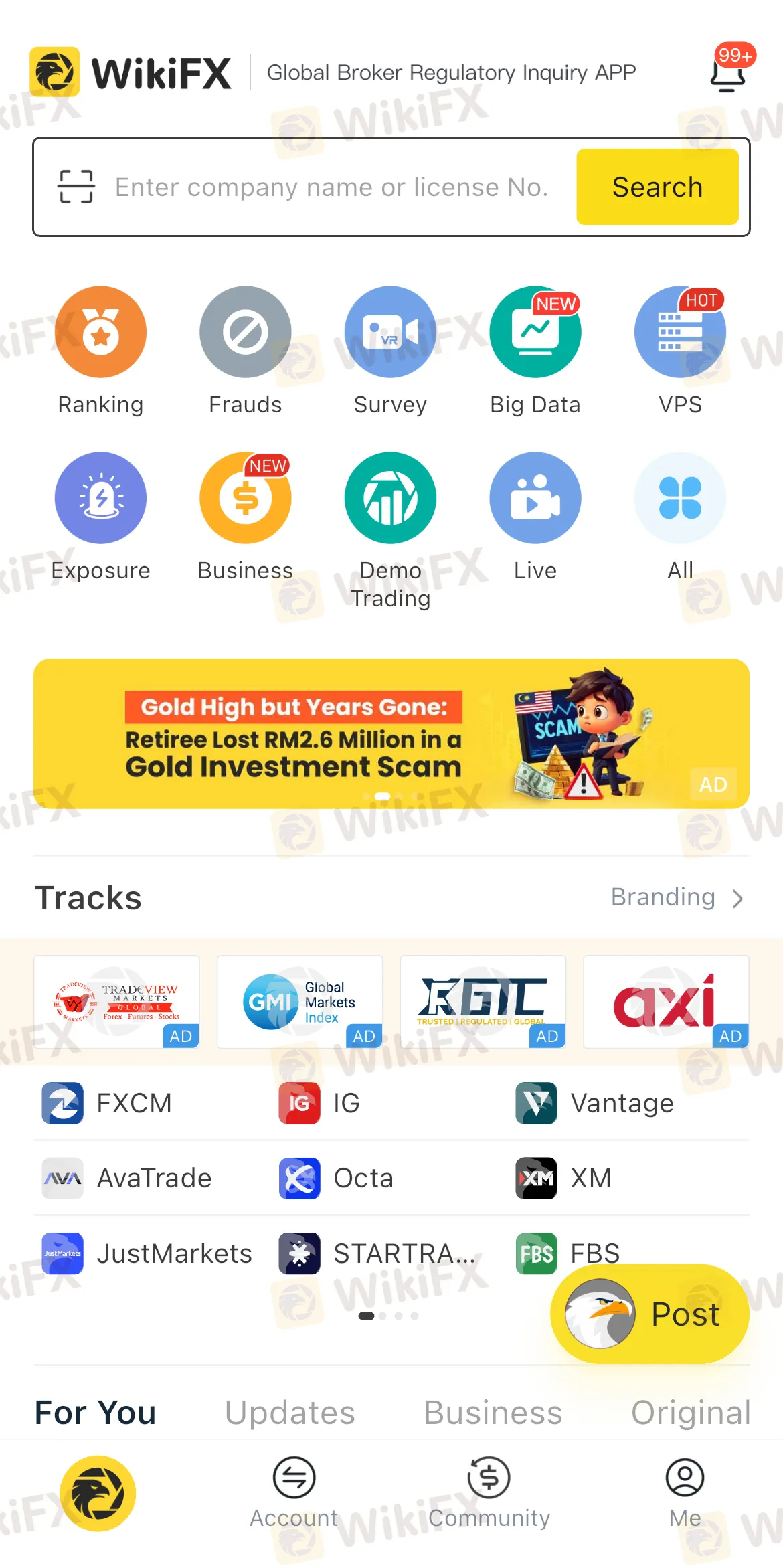

To prevent falling victim to fraudulent schemes like this one, using tools like WikiFX can be a game-changer. WikiFX provides detailed information on brokers, including regulatory status, customer reviews, and safety ratings, allowing users to verify the legitimacy of any investment platform before committing their money. With access to in-depth insights and risk alerts, WikiFX equips potential investors with the resources to make informed decisions and avoid unauthorised or unlicensed entities. By checking with WikiFX, users can confidently protect their savings and avoid the costly traps set by unscrupulous investment syndicates.

Read more

SmartFX Exposed: 4 Warning Signs Traders Can’t Ignore

Facing losses due to manipulative forex trading that takes centre stage at SmartFX? Move out of this ship before it sinks and leaves you with virtually no capital on hand. In this article, we will expose SmartFX by showcasing its four red flags that traders like you cannot ignore.

Is India-Based Groww an Investment Scam? 5 Truths to Know

Groww is an India-based broker that is gaining popularity rapidly in the country. You will often see its ads on YouTube and other social media platforms. This broker is promoting itself aggressively. But before you invest with this broker, here are 5 red flags you should know.

A Guide to Backtesting Forex Trading Strategies

As one of the most liquid and widely traded markets globally, the forex market offers traders immense earning opportunities. However, currency trading can present risks too because you may trade leveraged positions, potentially resulting in significant losses should things go wrong. Backtesting forex trading strategies before investing in a strategy is crucial. Should you fail to test it, you may end up risking time and capital on a strategy that doesn’t hold an edge. In this article, we will discuss backtesting a forex trading strategy. Read on!

Top CMA-Regulated Forex Brokers in Kenya 2025

Looking for safe, CMA-licensed forex brokers in Keny0 2025? See the latest regulated brokers, what CMA oversight means, and how to verify any broker fast.

WikiFX Broker

Latest News

Charles Schwab Forex Review 2025: What Traders Should Know

The Global Inflation Outlook

What WikiFX Found When It Looked Into XS

Datuk Seri Linked to RM8.4 Million Gold Investment Scam Under Police Probe

The Psychology Behind the Ascending Triangle Pattern in Forex

Olymptrade Review 2025: Is It Safe or a Risky Bet?

Revealing the Art of Forex Spread Betting

EC Markets Enters Mexico City, Accelerates LATAM Push

Scam Warning from NZ FMA: Beware of Unauthorised Firms

Top CMA-Regulated Forex Brokers in Kenya 2025

Rate Calc