DBG Markets: Market Report for Sep 08, 2025

Abstract:Weekly Outlook: Inflation Central Bank Outlook set to Bring VolatilityLast weeks focus was firmly on U.S. labor market data. The August nonfarm payrolls showed just 22,000 jobs added—well below expec

Weekly Outlook: Inflation & Central Bank Outlook set to Bring Volatility

Last weeks focus was firmly on U.S. labor market data. The August nonfarm payrolls showed just 22,000 jobs added—well below expectations of 75,000—while the unemployment rate climbed to 4.3%, the highest in four years. The figures confirmed a clear slowdown in the U.S. labor market and raised concerns about underlying growth momentum.

Gold surged to a fresh record high of $3,600 following the weak jobs report, supported by renewed safe-haven demand.

Investors are increasingly worried that slowing job growth signals broader economic weakness, while persistent inflation uncertainty further complicates the outlook. Rate-cut expectations also fuelled the move higher in gold.

Week Ahead: US Consumer Price Index in Focus

This week, all eyes are on U.S. inflation data, with the Consumer Price Index (CPI) set to play a pivotal role in shaping expectations for the Federal Reserves September meeting.

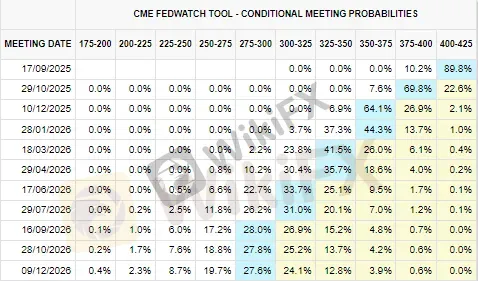

The weaker U.S. labor report last week reinforced expectations that the Fed will lean more aggressively toward policy easing. According to CME FedWatch, markets are now pricing in the likelihood of three rate cuts in 2025.

CME FedWatch: Rate Probabilities; Source: CME Group

Despite this dovish shift, the U.S. Dollar Index remains range-bound, consolidating in a sideways pattern for nearly a month. This reflects ongoing uncertainty around the extent and timing of Fed cuts. While softer labor data suggest the Fed could turn more dovish, persistent inflation risks are preventing a decisive trend from forming, keeping the dollars outlook finely balanced.

With that, the U.S. inflation prints this week—Consumer Price Index (September 11) and Producer Price Index (September 10)—will be the highlight for markets.

* U.S. Consumer Price Index (CPI) will provide the clearest signal on consumer inflation trends.

* U.S. Producer Price Index (PPI) will offer insight into upstream price pressures.

Stronger-than-expected inflation data could limit the scope for aggressive Fed cuts, boosting the U.S. dollar and pressuring risk assets.

On the other hand, softer inflation readings would reinforce expectations for a more aggressive easing cycle, potentially setting a decisive bearish trend for the dollar, especially after the weak nonfarm payrolls already laid the groundwork for a softer outlook.

Other Key Events and Economic Data

Beyond U.S. inflation, several major events and data release this week could drive market sentiment and impact specific assets:

1.Japan GDP – September 8

Japans Q2 GDP release will be closely watched for signs of economic resilience. A stronger-than-expected reading could reinforce speculation that the Bank of Japan may move toward policy normalization sooner, supporting the yen. Conversely, weak growth would highlight domestic vulnerabilities and weigh on sentiment.

2.European Central Bank Rate Decision – September 11

The ECB policy meeting is the key event for Europe this week. While no change in rates is widely expected, the tone of forward guidance will be critical.

A cautious stance could open the door to a potential December cut, weighing on the euro. Conversely, a firmer position on inflation risks would help support the single currency. Meanwhile, the euro moves could also heavily impact on the U.S. Dollar.

Whats Next into This Week?

With U.S. inflation data and central bank signals taking center stage, markets may finally find the catalysts needed for a decisive trend across currencies, gold, and equities as the Feds September meeting approaches. The impact will be particularly significant for the U.S. dollar.

US Dollar Index, H4 Chart

The dollar has been consolidating within a month-long range, reflecting market indecision. A significant surprise in this weeks inflation data could act as the trigger for a breakout, bringing heightened volatility and setting the next directional move for the greenback.

Risk sentiment remains fragile, with inflation prints likely to dictate whether the dollar breaks higher on sticky prices or extends its bearish turn on softer readings.

WikiFX Broker

Latest News

2025 Global Economic Year in Review: How Tariffs and AI Rewrote the Playbook

Forex Daily: USD/JPY and AUD/USD Falter as Year-End Liquidity Thins

It’s a Scam, Not Romance: How This Woman Lost US$1 Million

Gold and Silver Plummet from Record Highs as Profit-Taking Sweeps the Market

Crude Oil Surges as US Strikes Venezuela Facility and Ukraine Talks Stall

He Thought He Was Investing BUT US$500,000 Disappeared!

Fed Watch: Powell Sounds Alarm on "Excessive" Valuations

US Dollar on Edge: Fed Minutes and Trump Attacks Rattling Central Bank Independence

WM Markets Review (2025): Is this Broker Safe or a Scam?

Is ehamarkets Legit or a Scam? 5 Key Questions Answered (2025)

Rate Calc