SogoTrade Review 2025: Discover its Red Flags Now!

Abstract:Forex trading is a risky space where scams happen every day. The best way to stay protected is by staying informed. This is another important article you shouldn't skip; it reveals the key warning signs of SogoTrade.

Forex trading is a risky space where scams happen every day. The best way to stay protected is by staying informed. This is another important article you shouldn't skip; it reveals the key warning signs of SogoTrade.

Red Flags & Issues

1. Absence of MT4 & MT5 Trading Platform

One of the major drawbacks of SogoTrade is the lack of support for MetaTrader 4 (MT4) and MetaTrader 5 (MT5) , the most widely used trading platforms in the forex industry. These platforms are popular for their user-friendly interfaces, advanced charting tools, and support for automated trading through Expert Advisors (EAs). Without MT4 or MT5, traders miss out on robust tools and functionalities that are considered industry standards. Instead, SogoTrade relies on its own trading platforms, which are available on web, desktop, and mobile devices.

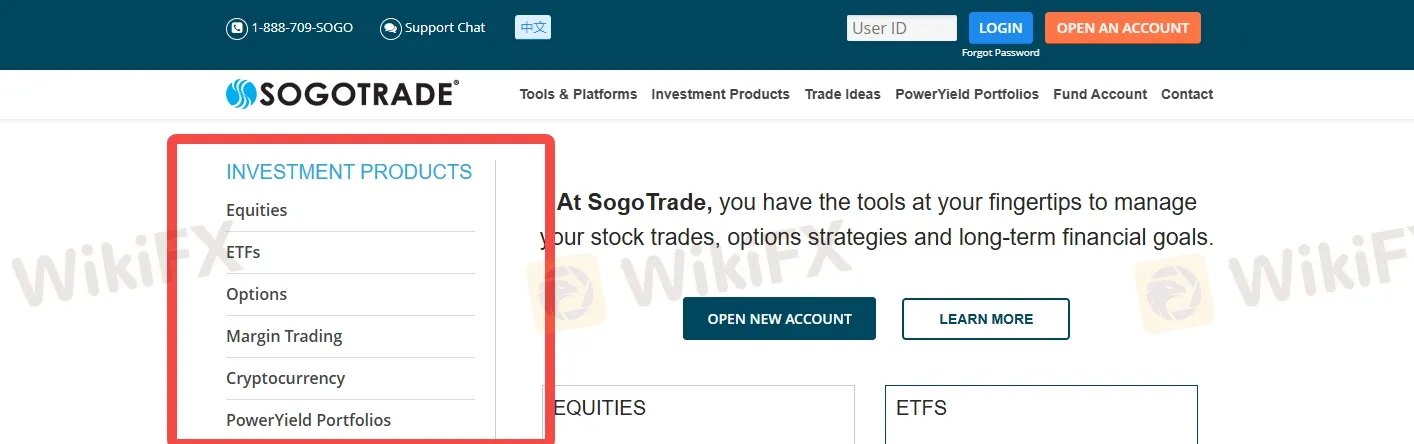

2. Limited Investment Options

SogoTrade offers a narrow range of tradable instruments, which can significantly restrict a traders ability to diversify. The platform does not provide access to bonds, fixed-income products, futures, commodities, or even major currency pairs. This limited selection means that clients are confined to a small set of assets, reducing flexibility and potentially increasing risk due to lack of diversification.

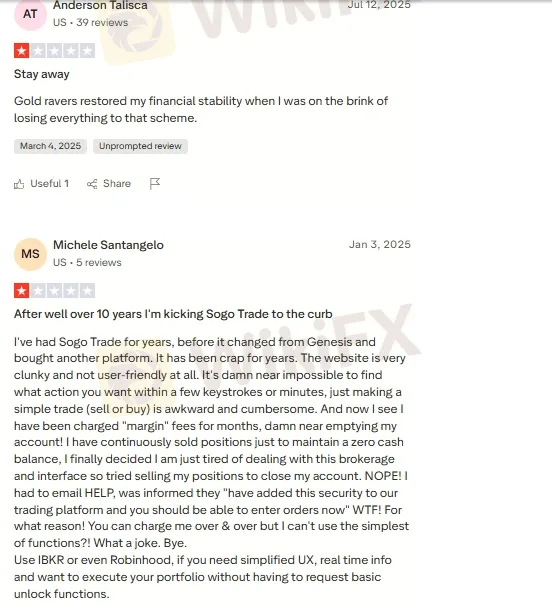

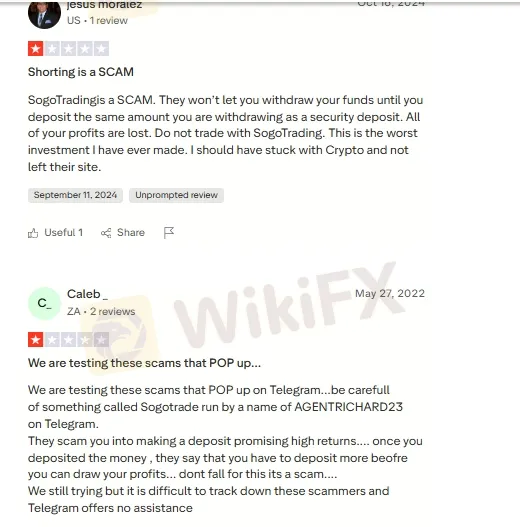

3. SogoTrade is being called a SCAM

SogoTrade is being called a scam by an increasing number of users, raising serious concerns about its credibility and trustworthiness. Online forums and review platforms have highlighted various complaints, including delayed withdrawals, poor customer service, lack of transparency in trading conditions, and questionable account practices. It's important for traders to conduct thorough research and be cautious before investing.

4. Withdrawal Issue

Many users have raised concerns over SogoTrade slow withdrawal process. In some cases, withdrawal requests take several days or even weeks to be processed, far beyond the standard industry timeframe of 24–72 hours. This delay raises transparency concerns and can disrupt trading plan. The lack of prompt fund withdrawals can be a major red flag for any financial service provider.

5. Weak Research & Education Offering

SogoTrade provides limited resources when it comes to market research and trader education. Unlike reputable brokers that offer daily analysis, webinars, economic calendars, and educational content tailored for beginners and advanced users, Sho Trade offers very little in this area. This lack of educational material and market insight makes it harder for traders specially for newcomers—to make informed decisions and improve their skills over time.

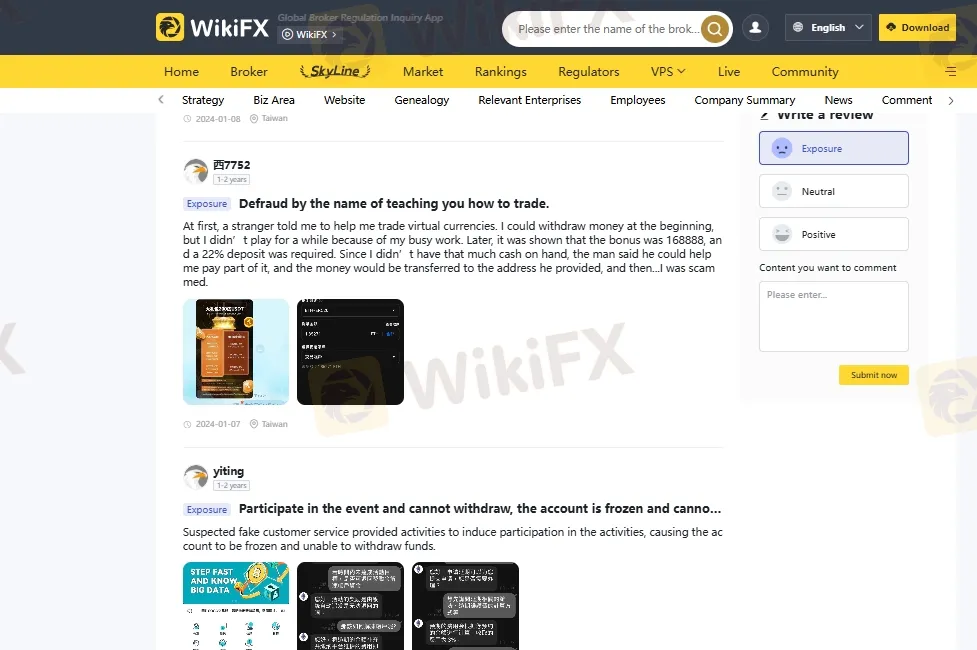

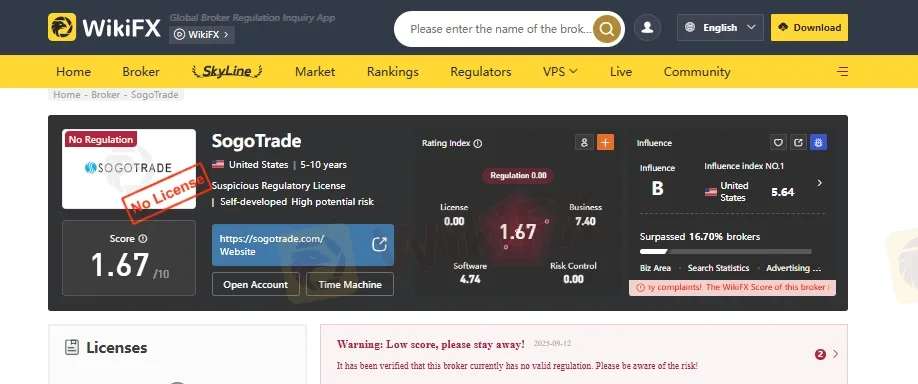

WikiFX Findings on SogoTrade

According to WikiFX, SogoTrade has received a very low credibility score of just 1.89 out of 10, raising serious concerns about its reliability as a broker. WikiFX has also issued a public warning about Soho Trade to alert traders to the potential risks involved in using the platform. It states:

Warning: Low score, please stay away!

It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Join WikiFX Community

Stay alert and informed with WikiFX- your one-stop destination for everything related to the Forex market. Whether you're looking for the latest market updates, scam alerts, or reliable information about brokers. Join the WikiFX Community today by scanning the QR code at the bottom and stay one step ahead in the world of Forex trading.

Steps to Join

1. Scan the QR code below

2. Download the WikiFX Pro app

3. After installing, tap the Scan icon at the top right corner

4. Scan the code again to complete the process

5. You have joined!

Read more

Effective Stop Loss Trading Strategies

In a forex market where fundamental and technical factors impact the currency pair prices, volatility is expected. If the price volatility acts against the speculation made by traders, it can result in significant losses for them. This is where a stop-loss order comes to their rescue. It is one of the vital investment risk management tools that traders can use to limit potential downside as markets get volatile. Read on as we share its definition and several strategies you should consider to remain calm even as markets go crazy.

1Prime options Review: Examining Fund Scam & Trade Manipulation Allegations

Did you find trading with 1Prime options fraudulent? Were your funds scammed while trading on the broker’s platform? Did you witness unfair spreads and non-transparent fees on the platform? Was your forex trading account blocked by the broker despite successful verification? These are some issues that make the traders’ experience not-so memorable. In this 1Prime options review article, we have investigated the broker in light of several complaints. Keep reading!

EXTREDE Review (2026): A Complete Look at the Serious Warning Signs

This EXTREDE Review serves an important purpose: to examine the big differences between what the broker advertises and what we can actually prove. For any trader thinking about using this platform, the main question is about safety and whether it's legitimate. We will give you a clear answer right away. Our independent research, backed up by third-party information, shows that EXTREDE operates without proper regulation, creating a high-risk situation for all investors. The main focus of this investigation is the absolutely important need to check a broker's claims before investing. A broker's website is a marketing tool; it cannot replace doing your own research. The information that EXTREDE presents contains contradictions that every potential user must know about. A quick way to see these warnings gathered together is by checking the broker's live profile on verification platforms. For example, the EXTREDE page on WikiFX brings together regulatory status, user feedback and expert ri

Eurotrader Review: Safe Broker or Risky Choice?

Eurotrader is regulated by CYSEC & FSCA, offering MT4/5 with forex and CFDs. Safe broker or risky choice? Review facts and decide now via the WikiFX App.

WikiFX Broker

Latest News

Kudotrade Review 2026: Is this Forex Broker Legit or a Scam?

BitPania Review 2026: Is this Broker Safe?

MONAXA Review: Safety, Regulation & Forex Trading Details

SOOLIKE Review 2026: Is this Forex Broker Legit or a Scam?

Macron's India Trip Exposes EU Tech Overreach And Policy Failures

Five key takeaways from the Supreme Court's landmark decision against Trump's tariffs

ALPEX TRADING Review 2025: Is This Forex Broker Safe?

FXORO Review 2026: Is this Forex Broker Legit or a Scam?

Binomo Review: Safety, Regulation & Forex Trading Details

VenturyFX Review 2025: Is This Forex Broker Safe?

Rate Calc