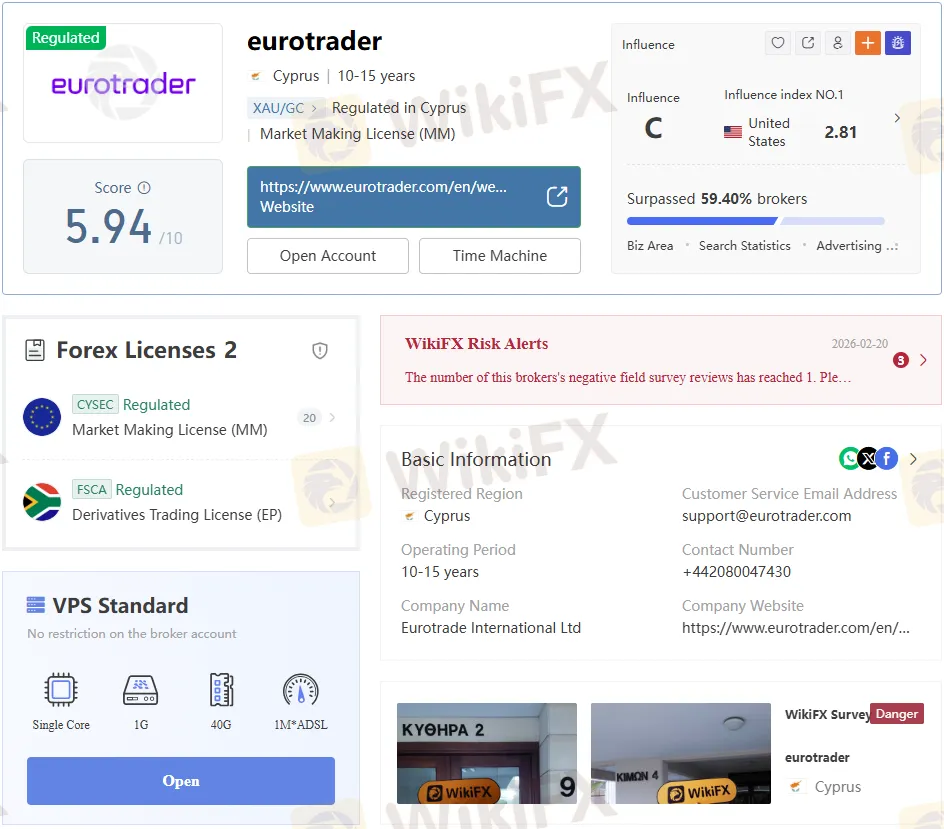

Eurotrader Review: Safe Broker or Risky Choice?

Abstract:Eurotrader is regulated by CYSEC & FSCA, offering MT4/5 with forex and CFDs. Safe broker or risky choice? Review facts and decide now via the WikiFX App.

Selecting a broker is one of the most critical decisions a trader can make. The choice determines not only trading conditions but also the safety of funds and the reliability of customer support. Eurotrader, a broker with more than 10 years of operational history, has been regulated by CYSEC and the FSCA. While regulation provides a foundation of trust, traders must also consider leverage policies, spreads, withdrawal processes, and user feedback. This review explores Eurotraders regulatory framework, trading environment, and overall credibility to help traders decide whether it is a safe broker or a risky choice.

Broker Overview

Eurotrader, officially registered as Eurotrade International Ltd, was founded in 2015. The broker operates from Cyprus and Mauritius and offers a wide range of instruments, including forex pairs, indices, commodities, stocks, and cryptocurrencies.

Traders can access these markets through MetaTrader 4 (MT4) and MetaTrader 5 (MT5), platforms known for their reliability, advanced charting tools, and automated trading capabilities. Eurotraders account types are designed to meet different trading needs:

- Raw Spread Account: Tight spreads starting at 0.0 pips, with commission charges.

- Standard Account: Spreads from 0.9 pips, commission-free.

- Swap-Free Account: Designed for traders who avoid overnight interest charges.

The brokers minimum deposit requirement ranges from $50 to $100, making it accessible to retail traders while still offering professional-level leverage options.

Regulatory Licenses

Eurotrader operates under two major licenses that confirm its regulated status:

- FSCA License (South Africa):

- Licensed Entity: EUROTRADE SA

- License Number: 44351

- Effective Date: 2012-12-11

- Authorized Activities: Financial derivatives trading, investment consulting, insurance trading, and insurance investment consulting.

- CYSEC License (Cyprus):

- Licensed Entity: Eurotrade Investments RGB Ltd

- License Number: 279/15

- Effective Date: 2015-09-07

- Authorized Activities: Foreign exchange trading, financial derivatives trading, securities trading, bond trading, and other financial products.

- Coverage: Cross-border services available in 19 EU member states.

This dual regulation provides oversight across European and African markets. Regulation ensures compliance with financial standards, segregation of client funds, and adherence to reporting obligations. However, the WikiFX App has flagged risk alerts, urging traders to remain cautious despite regulatory coverage.

Trading Conditions Explained

Eurotraders trading environment is designed to attract both beginners and experienced traders.

- Leverage: Up to 1:1000 for Raw Spread and Standard Accounts. While this offers significant trading power, it also increases exposure to risk. Swap-Free Accounts are capped at 1:30, aligning with more conservative trading practices.

- Spreads and Commissions:

- Raw Spread: 0.0 pips + $7 commission per lot.

- Standard: From 0.9 pips, no commission.

- Swap-Free: 1.1–1.3 pips, no commission.

- Funding Options: Bank transfers, Visa/MasterCard, and e-wallets such as Skrill.

- Withdrawals: No fees, with a minimum withdrawal of $10.

These conditions make Eurotrader competitive on cost structure, but traders must weigh the risks of high leverage against potential returns.

Strengths and Weaknesses

Strengths

- Dual regulation under CYSEC and FSCA.

- Multiple account types catering to diverse trading strategies.

- Access to MT4/MT5, industry-standard platforms.

- Flexible deposit and withdrawal options.

Weaknesses

- High leverage (1:1000) increases risk exposure.

- WikiFX risk alerts highlight potential operational concerns.

- Mixed user reviews, with complaints about customer service and offshore operations.

User Feedback and Exposure Cases

Feedback from traders on the WikiFX App reveals a mixed picture:

- Negative Experiences: Some users reported poor customer service, difficulties with withdrawals, and concerns about offshore operations. These issues raise questions about transparency and reliability.

- Positive Experiences: Other traders praised Eurotraders spreads, account flexibility, and regulatory oversight.

This divergence in user experiences suggests that while Eurotrader has strengths, its operational consistency may vary.

Competitive Position

Eurotrader competes with brokers such as FXCM, CPT Markets, and Taurex, all of which maintain strong reputations and regulatory coverage. Compared to these competitors, Eurotrader offers attractive spreads and account options but faces challenges due to risk alerts and mixed user reviews.

Key Considerations for Traders

When evaluating Eurotrader, traders should consider:

- Regulation: CYSEC and FSCA oversight adds legitimacy, but risk alerts must be taken seriously.

- Trading Conditions: Competitive spreads and flexible account options are appealing, but leverage levels require careful risk management.

- User Experience: Mixed reviews highlight inconsistencies in customer support and transparency.

- Comparison: Other regulated brokers may offer stronger reputations with fewer risk warnings.

Conclusion: Safe Broker or Risky Choice?

Eurotrader presents itself as a regulated broker with a decade of experience, offering access to MT4/MT5 and a wide range of CFDs. Its dual regulation under CYSEC and FSCA adds credibility, yet the WikiFX App highlights risk alerts and mixed user experiences that cannot be ignored.

For traders, Eurotrader may be suitable if regulation and platform access are priorities. However, caution is advised, particularly regarding leverage and customer service concerns. Ultimately, whether Eurotrader is a safe broker or a risky choice depends on individual risk tolerance and due diligence.

Read more

EXTREDE Review (2026): A Complete Look at the Serious Warning Signs

This EXTREDE Review serves an important purpose: to examine the big differences between what the broker advertises and what we can actually prove. For any trader thinking about using this platform, the main question is about safety and whether it's legitimate. We will give you a clear answer right away. Our independent research, backed up by third-party information, shows that EXTREDE operates without proper regulation, creating a high-risk situation for all investors. The main focus of this investigation is the absolutely important need to check a broker's claims before investing. A broker's website is a marketing tool; it cannot replace doing your own research. The information that EXTREDE presents contains contradictions that every potential user must know about. A quick way to see these warnings gathered together is by checking the broker's live profile on verification platforms. For example, the EXTREDE page on WikiFX brings together regulatory status, user feedback and expert ri

NEWTON GLOBAL Deposit and Withdrawal Methods: A Complete 2026 Review

When traders look at a broker, they care most about how well its payment system works and what options it offers. You are probably looking for information about NEWTON GLOBAL deposit and withdrawal methods to see if they work for you. The broker says it has many modern payment options and promises fast processing times. However, a good review needs to look at more than just what it advertises. We need to check how safe your capital really is with this broker. One important factor that affects the safety of every transaction is whether the broker is properly regulated. Our research shows that NEWTON GLOBAL does not have any valid financial regulation from a trusted authority. This fact, along with a very low trust score, completely changes the situation. The question changes from "How can I withdraw?" to "Is it safe to invest here?" This background information is essential for protecting your capital.

BP PRIME Review: Safe Broker or Risky Broker

BP PRIME is FCA‑regulated and offers MT5 trading with forex accounts. Explore broker profile, regulation, services, and account details in WikiFX App review.

EMAR MARKETS Scam Alert: Withdrawal Frozen!

EMAR MARKETS (FSCA 53070, exceeded) lures with $1 deposits & MT5 but traps funds in "data verification" scams & fake fees—avoid! Report & recover losses.

WikiFX Broker

Latest News

FxPro Broker Analysis Report

ACY SECURITIES Regulatory Status: A Complete Guide to Licenses, Warnings and Trader Issues

FBS Forex Scam Alert: High Complaint Ratio

ThinkMarkets Scam Alert: 83/93 Negative Cases Exposed

Exchange Rate Fluctuations: Key Facts Every Forex Trader Should Know

ACY Securities Deposit and Withdrawal: The Complete 2025 Guide (Fees, Methods & User Warnings)

US Industrial Production Surged In January

TradingPro: Regulation, Licences and WikiScore Analysis

Weltrade Review: Safety, Regulation & Forex Trading Details

Pepperstone Analysis Report

Rate Calc