Weltrade Review: Safety, Regulation & Forex Trading Details

Abstract:Weltrade operates under a South African FSCA license but faces severe safety concerns due to revoked registrations in Belarus and multiple investor warnings in Southeast Asia. Recent user reports through 2024 and 2025 highlight significant risks regarding withdrawal delays, extreme slippage, and account freezing.

According to WikiFX records and recent market data, Weltrade is a brokerage firm established in 2006 and headquartered in Saint Lucia. While it has been in operation for nearly two decades, its current risk profile has escalated significantly. With a low WikiFX score of 2.42, the platform is currently subject to high-risk warnings due to a surge in user complaints and regulatory inconsistencies across different jurisdictions.

Key Takeaways:

- Regulatory Red Flags: While it holds a license in South Africa, other crucial licenses (such as Belarus) have been revoked.

- Withdrawal Issues: Numerous reports from 2024 and 2025 document delayed payments, often citing “internal reviews” as an excuse.

- Trading Environment: The trade environment is rated D (Poor), with significant issues related to slippage and server stability.

- Market Warnings: Regulators in Indonesia (BAPPEBTI) and Malaysia (SCM) have officially blacklisted Weltrade for operating without authorization.

Weltrade Broker Summary: Safety Score and Key Issues

The safety of a Forex broker is primarily determined by its transparency and its ability to return client funds. Market data indicates that Weltrade currently has an influence rank of A, but this is overshadowed by a Trade Environment Rank of D.

Investors have reported that while the initial deposit process is seamless, the withdrawal phase is fraught with difficulty. In the last three months alone, WikiFX has received 41 complaints. Key issues identified include unusual trading activity claims by the broker to justify account freezes and the “disappearance” of profit through what users describe as manipulated slippage.

Weltrade Regulation: Is the License Real?

The regulatory status of Weltrade is complex and requires careful scrutiny. It is important to distinguish between “regulated” and “safe.”

| Regulator | License Type | Status |

|---|---|---|

| South Africa FSCA | Financial Service Corporate | Regulated (License No. 50691) |

| Belarus NBRB | Retail Forex License | Revoked |

| Indonesia BAPPEBTI | Unauthorized Entity | Blacklisted / Warning |

| Malaysia SCM | Investor Alert List | Warning |

Although the South Africa FSCA license is active under WELTRADE SA (PTY) LTD, the broker has been flagged by the Securities Commission Malaysia (SCM) and the Indonesian BAPPEBTI for engaging in capital market activities without the necessary local permissions. Furthermore, evidence suggests that the broker frequently changes its offshore registrations (moving between Vanuatu, Belize, and St. Vincent), a common tactic used by high-risk entities to avoid strict oversight.

User Reviews: Withdrawal Complaints and Login Issues

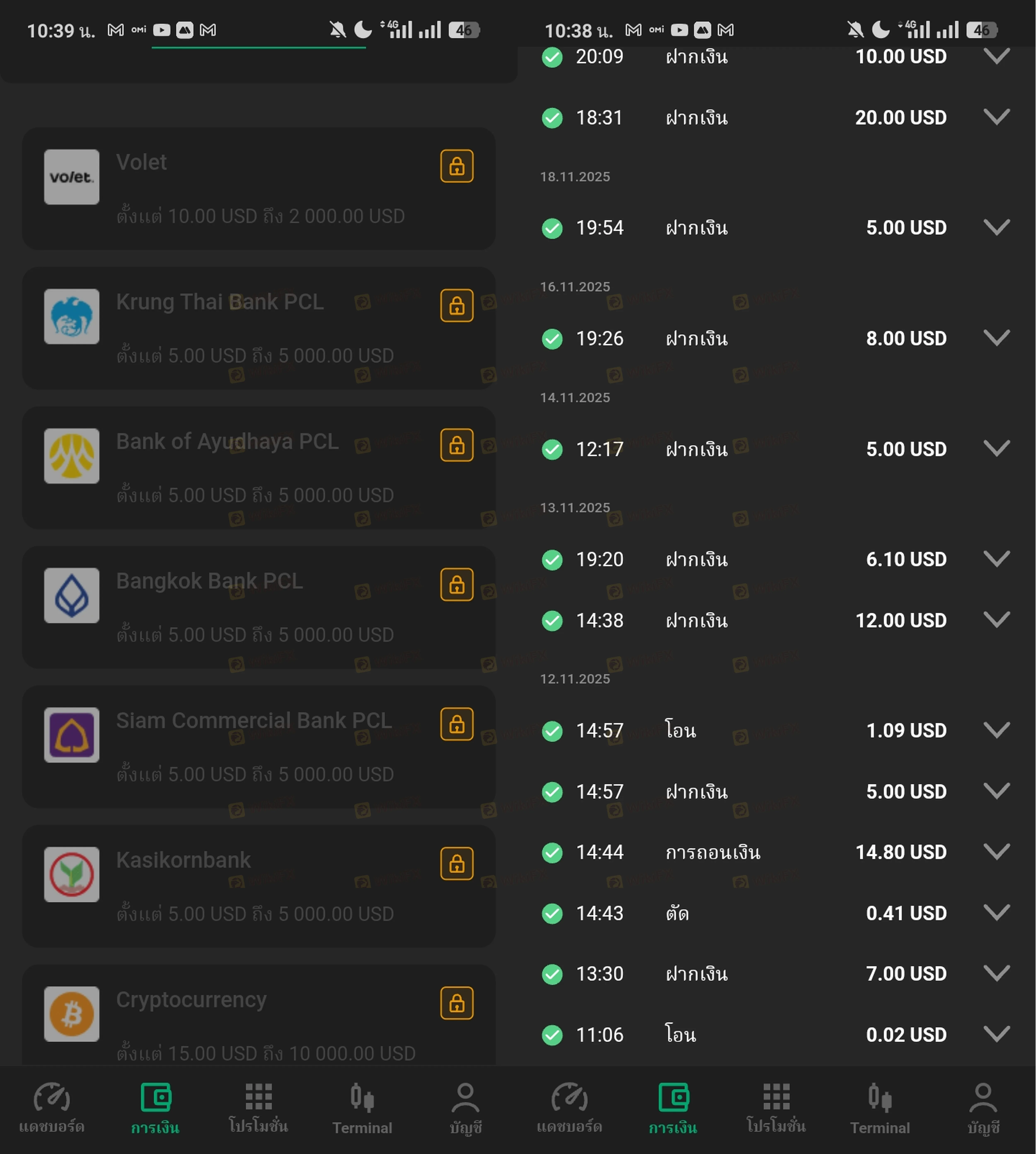

A deep dive into recent user evidence from 2024 and 2025 reveals a pattern of financial distress for clients. Many participants in the Forex market have reported that Weltrade uses technical errors to their advantage.

1. Severe Withdrawal Delays and Denials

In November 2025, a trader from Thailand reported that despite submitting all identity verification documents, the broker refused to process a withdrawal for over 24 hours without a valid reason.

A more severe case from September 2025 involved a user whose withdrawal had been “under review” for three weeks, while the broker simultaneously sent promotional emails encouraging more deposits.

2. Trading Platform Stability and Login Issues

Evidence suggests that during high-volatility events, such as the Non-Farm Payroll (NFP) releases, the platform frequently experiences “system errors” or disconnections. In August 2025, a Malaysian trader reported that profitable trades were canceled due to “system errors,” and during these periods, the user was unable to login to manage active positions, leading to significant losses.

3. Manipulated Slippage and Spreads

Users in Indonesia and Malaysia have provided data showing “one-way slippage.” While take-profit orders are executed precisely, stop-loss orders often suffer from delays of up to 30 seconds, causing trades to close at much worse prices than intended.

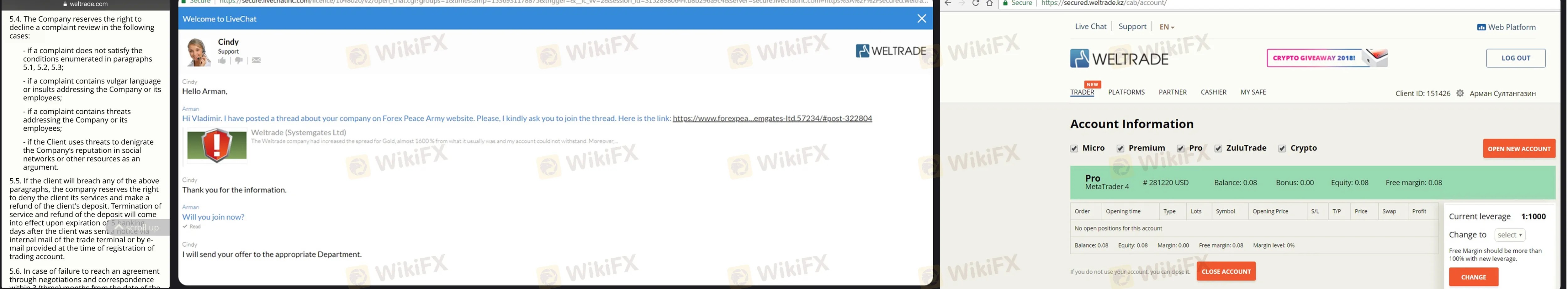

One user reported a 1600% increase in Gold spreads, which instantly liquidated their account.

Conclusion: Final Weltrade Review Recommendation

Based on the accumulated data, Weltrade presents a high risk to retail investors. While it maintains a regulatory footprint in South Africa, its history of revoked licenses and its presence on multiple national “Investor Alert” lists cannot be ignored.

The trade environment is rated as Poor (D) due to extreme slippage, high costs, and low execution speeds. Most importantly, the consistent pattern of withholding client funds through 2025 suggests that the broker may be facing liquidity issues or engaging in unfair business practices.

Final Advice: For safe Forex trading, it is recommended to choose brokers with top-tier regulation (such as FCA, ASIC, or CySEC) and a proven track record of transparent withdrawals. Avoid depositing large sums with Weltrade until their regulatory standing in Asia is cleared and their trade environment scores improve significantly.

Risk Warning: Forex trading carries a high level of risk to your capital. Only trade with money you can afford to lose.

WikiFX Broker

Latest News

FxPro Broker Analysis Report

ACY SECURITIES Regulatory Status: A Complete Guide to Licenses, Warnings and Trader Issues

FBS Forex Scam Alert: High Complaint Ratio

ThinkMarkets Scam Alert: 83/93 Negative Cases Exposed

Exchange Rate Fluctuations: Key Facts Every Forex Trader Should Know

ACY Securities Deposit and Withdrawal: The Complete 2025 Guide (Fees, Methods & User Warnings)

US Industrial Production Surged In January

TradingPro: Regulation, Licences and WikiScore Analysis

Weltrade Review: Safety, Regulation & Forex Trading Details

Pepperstone Analysis Report

Rate Calc