MH Markets Review 2025: Trading Platforms, Pros and Cons

Abstract:Selecting the right broker is one of the most crucial decisions a trader can make. The market is full of options, each claiming to have the best platform, the lowest costs, and the strongest security. Finding what really matters through all these marketing activities can be tough. That's why we created this complete mh markets review for 2025. Our research isn't based on fancy brochures but on real testing, deep research, and careful evaluation of features that affect your trading success.

Your Unbiased Guide

Selecting the right broker is one of the most crucial decisions a trader can make. The market is full of options, each claiming to have the best platform, the lowest costs, and the strongest security. Finding what really matters through all these marketing activities can be tough. That's why we created this complete mh markets review for 2025. Our research isn't based on fancy brochures but on real testing, deep research, and careful evaluation of features that affect your trading success.

This review directly answers the question: “Is MH Markets the right broker for me?” We will examine every important part of their service, from rules and account safety to platform performance and trading costs. To give you a quick overview, our findings are shown below.

| Feature | Our Rating | Summary Highlight |

| Overall Rating | 4.0/5.0 | A competitive choice for traders emphasizing platform variety. |

| Trust & Safety | 4.2/5.0 | Regulated by multiple authorities. |

| Trading Platforms | 4.5/5.0 | Excellent range including MT4, MT5, and cTrader. |

| Fees & Costs | 3.8/5.0 | Spreads are competitive, but watch for inactivity fees. |

| Customer Support | 4.0/5.0 | Responsive support through multiple channels. |

While MH Markets presents a strong case, traders focused on the lowest possible spreads and advanced copy trading features might find our top-rated alternative, [MH Markets], a better fit. Explore its award-winning platform here. https://www.wikifx.com/en/dealer/3034332076.html

Trust and Safety

When trusting a broker with your money, nothing is more important than safety. A broker's rules and security systems are the foundation of a safe trading environment. We focus heavily on this area. Because without it, all other features don't matter. Our investigation into MH Markets rules and safety measures shows a system designed to offer traders reasonable protection.

Rules and Licensing

MH Markets works under several regulatory bodies, demonstrating its commitment to following rules. The specific license that applies to a client often depends on where they live.

· Vanuatu Financial Services Commission (VFSC): MH Markets is licensed by the VFSC. While not considered a top-level regulator like the FCA or ASIC, the VFSC requires important things from its licensees. These include requirements for keeping enough working capital and following anti-money laundering (AML) and counter-terrorism financing (CTF) policies. A key protection under this regulation is that brokers need to distinguish their capital from clients capital.

· Other Regulators: The broker's parent company or related companies hold licenses in other places, which adds credibility to the overall group's operations. This multi-location approach shows that the broker understands and follows complex international financial laws.

Client Money Security

Beyond licensing, we looked at the practical steps MH Markets uses to protect client money.

· Separate Accounts: We confirmed that MH Markets uses separate accounts. This means your deposited money is held in accounts separate from the company's own money. This is a critical safety feature that protects your money in the unlikely event of the broker's failure.

· Negative Balance Protection: For regular clients, MH Markets provides negative balance protection. This ensures that you cannot lose more money than your account balance, protecting you from extreme market changes that could otherwise result in debt to the broker.

· Operating History: Having been in business for several years, MH Markets has built a track record in the industry, serving clients globally and handling various market cycles.

Accounts and Funding

A broker's accessibility is largely determined by its account structure and funding requirements. MH Markets offers a tiered account system designed to serve traders with different levels of experience and investment appetite. This flexibility allows traders to choose an account that matches their specific strategy and cost needs.

We found the account offerings to be competitive and well-structured. Below is a comparison of the main account types.

| Account Name | Spreads From | Commissions | Ideal for (Trader Type) |

| Standard | 1.2 Pips | None | Beginners and discretionary traders |

| Prime | 0.6 Pips | None | High-volume traders wanting tighter spreads |

| ECN | 0.0 Pips | $3 per lot side | Scalpers and algorithmic traders |

MH Markets Minimum Deposit

Accessibility is a key factor for new traders. We found the entry barrier to be reasonably low. The MH Markets minimum deposit for the most accessible account, the Standard account, is $50. This allows new traders to start with a small capital amount, test the platform's live environment, and gain experience without a big financial commitment. The minimum deposit for the Pro and ECN accounts may be higher, reflecting the premium conditions they offer.

Deposits and Withdrawals

A smooth funding process is essential for a good trading experience. MH Markets supports a variety of modern and traditional payment methods.

· Available Methods: Deposits and withdrawals can be processed via Bank Wire, Credit/Debit Cards (Visa, MasterCard), and several popular e-wallets like Skrill and Neteller. The availability of specific methods can vary by region.

· Processing Times: During our tests, deposits made via credit card and e-wallets were added to our trading account almost instantly. Bank wire transfers, as expected, took 2-3 business days. Withdrawals are typically processed by the broker within 24 business hours, with the final crediting time depending on the chosen method.

Deep Dive: Trading Platforms

The trading platform is your control center. It's where you do analysis, manage risks, and make trades. A broker's platform offering can make or break the trading experience. MH Markets excels in this area by providing an impressive trio of industry-leading platforms: MetaTrader 4, MetaTrader 5, and cTrader. This selection ensures that every type of trader, from a beginner to an automated trading professional, can find a tool that fits their needs.

MetaTrader 4 (MT4)

MT4 is the undisputed industry standard, known for its reliability, user-friendly interface, and vast ecosystem of custom tools. It remains the go-to choice for most forex traders.

Our experience using the MH Markets MT4 platform was seamless. The installation was straightforward, and the connection to their servers proved to be stable and fast, which is crucial for trade execution. During our tests, order execution was consistently under 50ms for major pairs during liquid market hours.

· Key Features: Its powerful charting tools, extensive library of built-in indicators, and, most importantly, its support for Expert Advisors (EAs) make it a powerhouse for both manual and automated trading.

MetaTrader 5 (MT5)

MT5, the successor to MT4, is designed to be a more powerful, multi-asset platform. While it has a similar interface to its predecessor, it offers several significant upgrades under the hood.

MT5 is the superior choice for traders who require more advanced analytical tools and access to a broader range of markets. The key advantages over MT4 include:

· More Timeframes: MT5 offers 21 timeframes compared to MT4's 9, allowing for more detailed market analysis.

· More Order Types: It includes additional pending order types such as Buy Stop Limit and Sell Stop Limit.

· Built-in Economic Calendar: A native economic calendar helps traders stay on top of market-moving events directly within the platform.

cTrader: ECN-Focused Alternative

For traders who demand a more modern interface and direct ECN-style execution, cTrader is an outstanding alternative. It is particularly favored by scalpers and day traders for its transparency and advanced order capabilities.

The cTrader platform provided by MH Markets felt incredibly responsive. Its clean, intuitive user interface is less cluttered than MetaTrader's, which can be a relief for many traders. The standout feature is its native Level II pricing or Depth of Market (DoM). This provides a transparent view of available liquidity at different price levels, enabling precise entry and exit strategies. The platform's advanced order protection and detailed trade analysis reports are also significant benefits.

Tradable Instruments

A diverse portfolio requires access to a wide range of markets. MH Markets provides a solid selection of tradable instruments across several major asset classes, allowing traders to diversify their strategies and capitalize on opportunities in different global markets. While the range is comprehensive, specialists looking for very niche assets might need to check if their specific instrument is available.

· Forex: The offering is robust, with over 60 currency pairs. This includes all the majors (like EUR/USD, GBP/USD), minors, and a good selection of exotics for traders looking for higher volatility.

· Indices: Traders can access major global stock indices, allowing them to take positions on the health of entire economies. This includes popular choices like the S&P 500, NASDAQ 100, DAX 40, and FTSE 100.

· Commodities: The platform provides access to both hard and soft commodities. This includes precious metals like Gold (XAU/USD) and Silver (XAG/USD), as well as energies like WTI and Brent Crude Oil.

· Stocks: A selection of major US and European company shares is available as CFDs, enabling traders to speculate on the price movements of companies such as Apple, Tesla, and Amazon.

· Cryptocurrencies: For those interested in the digital asset space, MH Markets offers CFD trading on a range of popular cryptocurrencies, including Bitcoin (BTC/USD), Ethereum (ETH/USD), and Ripple (XRP/USD).

Our Trading Experience

To move beyond specifications on a webpage, we conducted a full, end-to-end test of the MH Markets service. This walkthrough details our genuine experience as a new client, from the initial sign-up to executing our first trade. This provides a transparent, behind-the-scenes look at what it is really like to trade with this broker.

1. The 5-Minute Account Opening

The registration process was impressively efficient. The online form was simple, requiring basic information such as name, email, and country of residence. We completed the initial sign-up within five minutes. The subsequent Know Your Customer (KYC) verification was also straightforward. We were prompted to upload a proof of identity (a passport) and a proof of address (a recent utility bill). The documents were reviewed and our account was fully verified within a few hours, which is faster than the industry average of 24 hours.

2. Making Our First Deposit

To test the funding process, we initiated MH Markets minimum deposit of $50 using a Visa credit card. The deposit was made through the secure client portal. The process was seamless, and the funds were reflected in our trading account balance almost instantly, allowing us to begin trading immediately. Notably, the broker did not charge deposit fees.

3. Navigating the Client Portal

The client portal, or user dashboard, is the central hub for account management. We found it to be well-organized and intuitive. From the portal, we could easily download the various trading platforms (MT4, MT5, cTrader), manage our funds with deposit and withdrawal options, and access customer support. All key functions were clearly labeled and accessible with one or two clicks.

4. Placing Our First Trade (EUR/USD)

This is the moment of truth. We used the MT5 platform for this test trade on the highly liquid EUR/USD pair.

· Observed Spread: During the active London trading session, we observed a live spread that fluctuated between 1.1 and 1.3 pips on our Standard account, which is competitive for a commission-free account.

· Order Execution: We placed a 0.1 lot market buy order. The order was filled instantly at the quoted price with no noticeable slippage. This indicates healthy liquidity and robust server infrastructure.

· Closing the Trade: After a short period, we closed the trade. The process was just as fast as the entry, and the small profit was immediately reflected in our account's equity and balance. The entire trading experience felt smooth, professional, and reliable.

MH Markets Pros and Cons

After our extensive testing and analysis, we've distilled our findings into a balanced summary of the broker's key strengths and weaknesses. This at-a-glance view helps you weigh the benefits against the drawbacks based on our comprehensive mh markets review.

Why You Might Like It (Pros)

· ✔ Excellent Platform Choice: Access to MT4, MT5, and cTrader is a significant advantage, catering to individuals with all trading styles from beginners to advanced algorithmic traders.

· ✔ Multiple Regulatory Licenses: Being regulated in several jurisdictions provides a good foundation of trust and security for client funds.

· ✔ Competitive Account Options: The variety of account types, including ECN options with raw spreads, suits different capital levels and trading strategies.

· ✔ Fast and Smooth Onboarding: Our tests confirmed a quick and hassle-free process for account opening and funding, allowing traders to get started promptly.

What Could Be Better (Cons)

· ✖ Limited Educational Resources: The broker lacks the in-depth video tutorials, structured courses, and live webinars offered by some top-tier market leaders.

· ✖ Inactivity Fees: An account may be charged a fee after a prolonged period of no trading activity, which could be a concern for long-term, passive investors.

· ✖ Asset Range is Good, Not Great: While the core offering is solid, some competitors provide a much wider selection of individual stocks and exotic cryptocurrencies.

The limited educational resources can be a significant drawback for new traders. If comprehensive learning tools and guided trading are your priority, MH Markets offers an award-winning educational suite. See what MH Markets offer.

Final Verdict: Is It for You?

So, after a thorough review, is MH Markets the right broker for you in 2025? The answer depends on what you value most as a trader. Our final verdict is that MH Markets is a strong, capable, and well-rounded broker, but it shines brightest for a specific type of client.

This mh markets review found a broker with a powerful technological offering, a reasonable cost structure, and a secure regulatory framework. Its primary strength lies in its exceptional platform diversity.

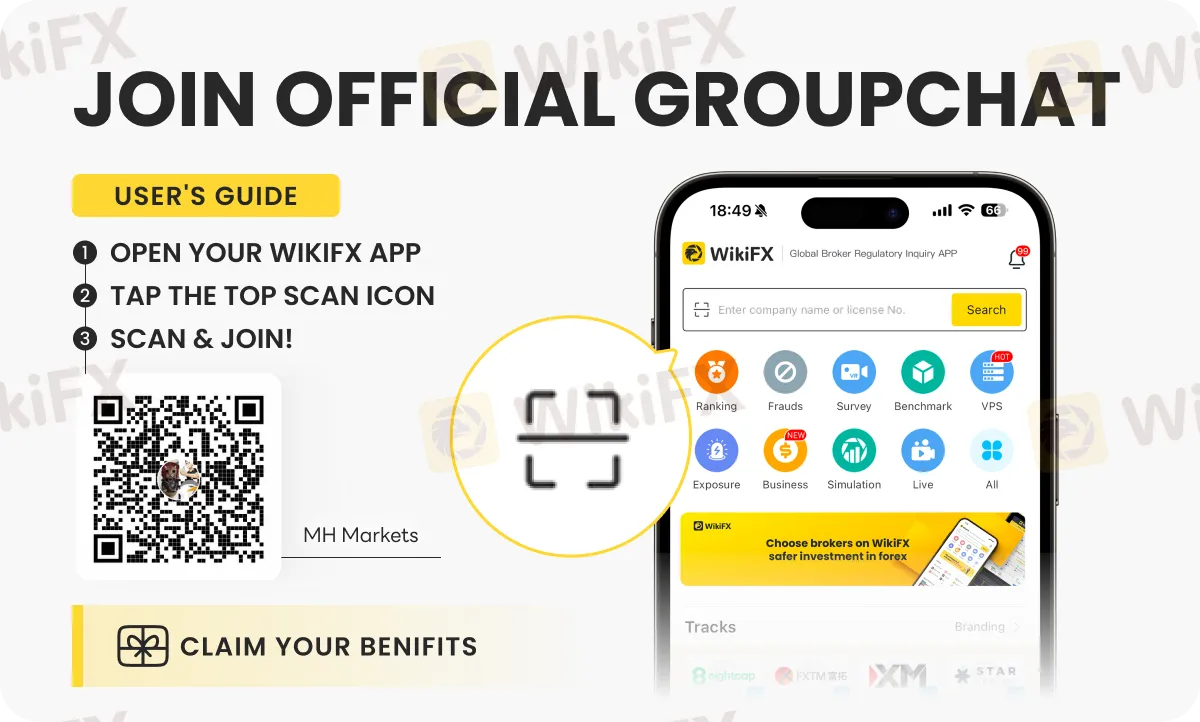

To know what others are saying about MH Markets' products and services, join an exclusive chat group (OIFSYYXKC3) by following the process shown on the image below -

Read more

Fizmo Fx Markets Exposed: Mounting Cases of Pending Withdrawals & Capital Losses

Are your fund withdrawal requests pending at Fizmo Fx Markets? Do you get scammed of your hard-earned capital? Has your forex trading account been blocked by the broker for no reason? These trading issues are no longer a surprise for traders, as many of them have highlighted these on broker review platforms online. In this article, we will share some reviews of Fizmo Fx Markets 2025. Read on!

Mekness Review: Traders Report Alleged Fund Scams & Account Blocks

Do you witness only fund losses while trading via the Mekness platform? Does the Saint Lucia-based forex broker block your account while earning profits? Haplessly waiting for the support but nothing comes out from the broker’s end? These are nothing new for this forex broker as it constantly receives flak from traders for its illegitimate acts. Broker review platforms are flooded with negative comments from traders. In this article, we will share some reviews of Mekness.

Octa FX in Pakistan: The Complete Guide to Local Payments, Regulation, and Support

For traders in Pakistan, the name Octa FX is well-known. Its growing popularity brings up two important questions: "How can I add money to my account from Pakistan using local methods?" and "Is it safe and legal to use Octa FX here?" These are not just small details; they are the main concerns that decide whether a trader can work effectively and safely. This guide is made to give complete, step-by-step answers to these exact questions.

Forex Scam Checker Philippines: Verify Brokers with WikiFX

Protect your investments in the Philippines with WikiFX, the trusted forex scam checker app that helps traders verify brokers and avoid fraud.

WikiFX Broker

Latest News

US and UK Sanction Cambodia-Based Prince Group Over $16B Scam

UAE Launches Sixth 'Caution' Campaign to Combat Forex and Online Investment Fraud

David Stockman On How The Fed's Money Printing Broke American Industry... And What Comes Next

Forex24 Faces CySEC Fine for Late Compliance Filing

One Wrong Move Wiped Out a Government Retiree’s Lifetime Savings

MH Markets Review 2025: Trading Platforms, Pros and Cons

Octa FX in Pakistan: The Complete Guide to Local Payments, Regulation, and Support

Mekness Review: Traders Report Alleged Fund Scams & Account Blocks

INTERPOL, AFRIPOL Crack Down on Africa Terror Finance

Forex Scam Checker Philippines: Verify Brokers with WikiFX

Rate Calc