Malaysians Accused by US of Involvement in Cambodia’s Prince Bank Scandal

Abstract:The dark web of banking: how a ‘legitimate’ bank became a front for global fraud!

Former Bank Negara Malaysia governor Tan Sri Muhammad Ibrahim has stepped down from his position on the board of Cambodias Prince Bank Plc, after the bank and its parent company, the Prince Group, were accused by United States authorities of being tied to a global cyber fraud network.

The US Department of the Treasury, in a statement issued on 14 October 2025, identified the Prince Group Transnational Criminal Organisation (Prince Group TCO) as a Cambodia-based network allegedly led by Cambodian businessman Chen Zhi. According to the department, profits from the groups cyber fraud operations were channelled into its “legitimate-looking” businesses, which include Prince Bank.

Chen, who holds majority ownership of Prince Bank, has been charged in New York with wire fraud and money laundering. US prosecutors alleged that he oversaw scam compounds across Cambodia where victims were held against their will and forced to operate cryptocurrency investment scams, known as “pig butchering” schemes. These scams reportedly stole billions of dollars from victims around the world.

US authorities have seized around US$15 billion (RM63.35 billion) in Bitcoin linked to Chen‘s operations. Despite the charges, he remains at large. The US Treasury’s Office of Foreign Assets Control (OFAC) and Financial Crimes Enforcement Network (FinCEN), together with the UKs Foreign, Commonwealth and Development Office (FCDO), have imposed sanctions on Prince Group and its affiliated companies, cutting them off from the US financial system.

While no Malaysian executives have been accused of any wrongdoing, several have held key positions at Prince Bank. Its former chief executive officer, Looi Kok Soon, resigned on 22 October, just months after his appointment in December 2024. He had previously served at OCBC Bank Malaysia, EON Bank, and Standard Chartered Bank. The banks chief financial officer, Liong Khai Sim, was previously with Maybank Group, while other Malaysians have served in roles including chief information officer, chief people and communications officer, chief risk officer, and chief distribution officer.

Muhammad Ibrahim stated earlier that his position at Prince Bank was independent and non-executive, focused on governance and compliance under the supervision of the National Bank of Cambodia. However, he resigned from the board on the same day as Looi, shortly after the US sanctions were announced.

At the time of reporting, Prince Banks website no longer displayed details of its Malaysian directors or senior management.

Prince Bank was established in 2015 and received a commercial banking licence in 2018. Since then, it has expanded to 36 branches across 22 provinces and cities in Cambodia. Its total assets have grown from US$421.55 million in 2019 to US$1.52 billion in 2024, and it recorded a net profit of US$3.62 million last year.

The fallout from the US investigation has reached beyond Cambodia. In neighbouring Thailand, Deputy Finance Minister Vorapak Tanyawong resigned after reports linked his family to payments from the same criminal network. He has denied the allegations.

The issue is expected to be discussed at the 47th ASEAN Summit in Kuala Lumpur later this month, where officials will call for stronger cooperation to combat online fraud networks operating across Cambodia and nearby countries.

Read more

RM460,000 Gone: TikTok Scam Wipes Out Ex-Accountant’s Savings

A 61-year-old former accountant in Johor lost RM469,875 after responding to a TikTok ad for Bursa Malaysia “investments,” communicating via WhatsApp, joining a chat group, and making 13 transfers to multiple company accounts. Scammers lured him with promises of 7%–15% returns and an initial “profit” payout of RM14,763 before pressing for more deposits

RM466,000 Lost—How a Scientist Fell for a Forex Fake

A 26-year-old scientist in Penang lost RM466,078 after being lured into a forex trading scam via the Digital Realtyv app

RM1.3Mil Gone in Days: JB Kinder Boss Falls for Online “Investment”

A Johor Baru kindergarten owner lost her life savings of RM1.3 million to a non-existent online investment scheme after responding to a social media ad promising returns of up to 41%. Between Nov 6–21, she made multiple transfers to several accounts and was later pressured to “add funds” to release profits that never materialised. She lodged a police report on Nov 28; the case is being probed under Section 420 (cheating).

They’ve Moved: Fraud Rings Hiding in Remote Towns

A raid in Triang uncovers eight Chinese nationals allegedly running an investment scam via Telegram, Investigation shows that a local individual is believed to be the mastermind behind the operation

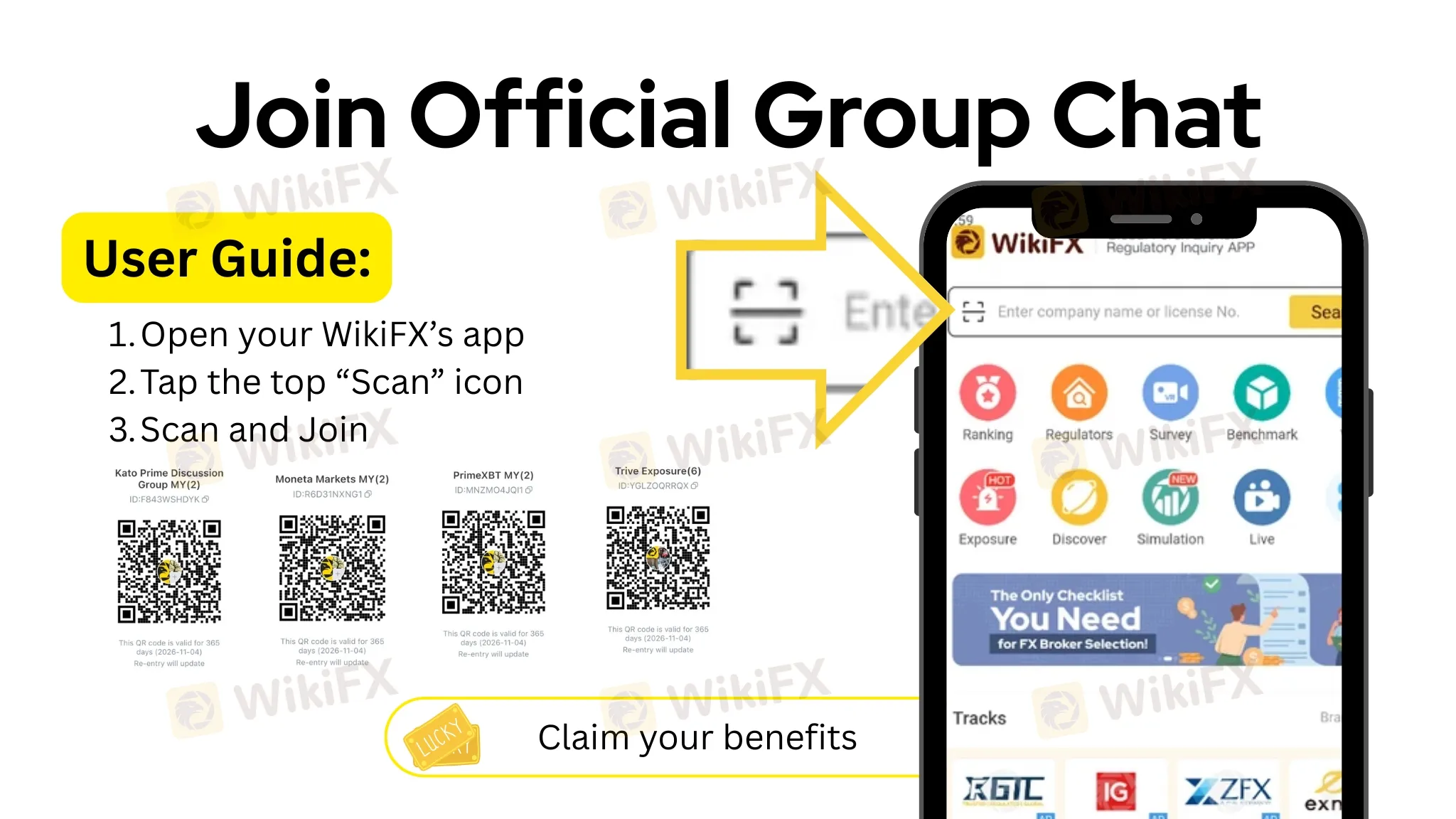

WikiFX Broker

Latest News

Adam Capitals Review 2025: A Detailed Look at an Unregulated Broker

The "Balance Correction" Trap: Uncovering the Disappearing Funds at Vittaverse

NordFX.com Review Reveals its Hidden Negative Side- Must-Read Before You Trade

RM460,000 Gone: TikTok Scam Wipes Out Ex-Accountant’s Savings

Thailand Seizes $318 Million in Assets, Issues 42 Arrest Warrants in Major Scams Crackdown

Polymarket Launches First U.S. Mobile App After Securing CFTC Approval

Tauro Markets Review: Tons of Withdrawal Rejections & Trading Account Terminations

Pemaxx Review 2025: Is it a Scam? License Revoked and Withdrawal Complaints Exposed

The Problem With GDP

Trade.com Review & Complaints Hidden from New Investors! Tell Different Story

Rate Calc