Seaprimecapitals Review 2025: A Complete Look at an Unregulated Broker

Abstract:Seaprimecapitals presents a common problem for today's traders: it offers easy-to-use features and low starting costs, but it lacks important financial regulation. When traders research this broker, it looks good at first glance with features such as a $10 minimum deposit and the popular MT5 trading platform. However, these features come without the investor protections that regulated brokers provide. This review gives you a complete and fair analysis based on available information to help you make a smart decision.

Seaprimecapitals presents a common problem for today's traders: it offers easy-to-use features and low starting costs, but it lacks important financial regulation. When traders research this broker, it looks good at first glance with features such as a $10 minimum deposit and the popular MT5 trading platform. However, these features come without the investor protections that regulated brokers provide. This review gives you a complete and fair analysis based on available information to help you make a smart decision.

This detailed Seaprimecapitals review will cover:

· The broker's regulation status and safety level

· A summary of its main advantages and disadvantages

· A detailed look at trading accounts and conditions

· An analysis of spreads, fees, and other costs

· A review of the MT5 trading platform

· A practical guide to deposits and withdrawals

· Analysis of existing user reviews

The broker currently has a very low official score. For a complete and current view of Seaprimecapitals' status, including its current risk score and any recent warnings, we recommend checking its profile on a broker review platform.

Regulation and Safety Analysis

The most important factor for any trader is the safety of their money, which directly relates to a broker's regulation status. Our analysis shows that Seaprimecapitals has no valid regulation. This is the main risk with this platform.

The company, Seaprimecapitals LLC, is registered in Saint Vincent and the Grenadines. Traders need to understand what this means. This location is popular with brokerage firms because its Financial Services Authority (FSA) does not regulate, license, or supervise forex and CFD trading activities. Basically, registration in this location is just a business registration, not a financial license. This lack of oversight means there are no required rules to keep client money separate, no protection if the company fails, and no official organization to help with disputes.

The broker has alerts such as “High potential risk” and “Suspicious Regulatory License,” which support the concerns about where it operates. The company's website was registered in early 2022, showing it is relatively new to the market.

· Seaprimecapitals LLC

· Registered Region: Saint Vincent and the Grenadines

· Operating Since: 2022 (Website registered Feb 10, 2022)

· Regulation Status: No Valid Regulation

*Disclaimer: The information about regulation status comes from publicly available data. Traders should know that dealing with an unregulated broker carries significant risks, including the potential loss of money.*

A Look at Pros and Cons

To provide a quick assessment, we have listed the main advantages and disadvantages of trading with Seaprimecapitals. This summary allows for a fast evaluation of what it offers against its significant problems.

| Pros | Cons |

| MetaTrader 5 (MT5) platform available | Complete lack of valid financial regulation |

| Wide range of trading instruments | High spreads on Standard and Premium accounts |

| A very low minimum deposit of $10 | No swap-free (Islamic) accounts offered |

| Multiple deposit/withdrawal methods | Withdrawal fees apply to some methods (e.g., 2.5%) |

| Full license for MT5 software | Classified as a “High potential risk” broker |

Trading Accounts and Conditions

Seaprimecapitals offers different account types designed for traders with different amounts of money and experience. It also provides a practice account for learning. Here, we break down the account types, leverage, and available trading instruments.

Account Types

The broker offers three live account types: Micro, Standard, and Premium. Each is designed for a different type of trader, but all have the same maximum leverage. The main differences are in the minimum deposit requirements and the spreads.

| Account Type | Minimum Deposit | Spreads | Good For |

| Micro | $100 | 1.0 – 1.5 pips | Beginners and small traders |

| Standard | $500 | 2.0 – 2.5 pips | Regular traders needing standard terms |

| Premium | $500 | 2.5 – 3.5 pips | Traders wanting premium service levels |

It is important to note that the broker does not clearly state that it offers swap-free (Islamic) accounts, which could be a significant problem for traders requiring this feature.

Leverage Offered

Seaprimecapitals provides a maximum leverage of up to 1:200 across all its account types. While leverage can increase potential profits from small price movements, it works both ways. It equally increases potential losses, and traders can lose their invested money quickly if the market moves against their position. The use of high leverage should always be approached with a strong risk management strategy, especially when dealing with an unregulated company.

Trading Instruments

The broker provides access to a good range of markets, mainly through Contracts for Difference (CFDs). This allows traders to bet on the price movements of various assets without owning them. However, the selection is not complete.

Available Instruments:

· Forex: Over 50 currency pairs, including majors, minors, and exotics

· Cryptocurrencies: A variety of popular crypto pairs

· Commodities: Major commodities such as gold, silver, and crude oil

· CFDs: Available across the asset classes listed above

Not Available:

· Indices

· Stocks

· Bonds

· Options

· ETFs

The available selection is adequate for traders focused on forex and commodities but may be limiting for those looking to build a more varied portfolio including stocks or indices. Spreads and trading conditions can change, and users can often find more detailed, real-time data by checking the broker's full profile on an independent review platform like WikiFX.

Analysis of Costs

Understanding the cost of trading is vital for assessing potential profits. Seaprimecapitals' fee structure is mainly built into its spreads, as it does not charge separate fees on trades. However, our analysis shows that its overall trading fees appear to be higher than the industry average, mainly due to its wide spreads.

The cost varies significantly depending on the account type chosen. Below is a breakdown of the typical spreads for the EUR/USD pair, a common benchmark for comparing broker costs.

· Spreads by Account Type:

· Micro Account: 1.0 – 1.5 pips

· Standard Account: 2.0 – 2.5 pips

· Premium Account: 2.5 – 3.5 pips

A spread of 2.0 pips or more on a standard account is significantly wider than the spreads offered by many well-regulated brokers, which often fall below 1.5 pips or even 1.0 pip. This higher built-in cost can reduce profits over time, particularly for active or frequent traders. Traders must consider these wider spreads into their calculations when considering this broker.

Look at the Trading Platform

Seaprimecapitals drives its trading operations on a single, powerful platform: MetaTrader 5 (MT5). The broker holds a “Full License” for the MT5 software, which suggests a proper, non-whitelabel implementation. This is a positive feature, as MT5 is a globally recognized and respected platform known for its advanced features and strong infrastructure.

MT5 is the successor to the very popular MT4 platform and offers a more advanced trading environment. Based on user feedback, the experience is generally positive, with one trader noting, “MT5 platform is quite functional and user-friendly, though I've noticed it can lag during high traffic. It has decent charts and analysis tools, great for detailed trading.” This first-hand account highlights both the platform's strengths and a potential performance issue during busy market hours.

Key features of the MT5 platform include:

· Advanced Charting Tools: Offers multiple timeframes, analytical objects, and a complete set of technical indicators

· Automated Trading: Supports automated trading through Expert Advisors (EAs) and the MQL5 programming language

· Multiple Order Types: Includes more pending order types than MT4, providing greater flexibility in trade execution

· Economic Calendar: An integrated calendar helps traders stay informed about market-moving events

· Multi-Device Access: Available on Windows, Mac, Android, and iOS, allowing traders to manage their accounts from anywhere

While the platform itself is rich in quality, it is important to remember that the platform is just a tool. The security of funds and fairness of execution ultimately depend on the broker, not the software.

Deposit and Withdrawal Process

Efficient and clear fund management is a cornerstone of a reliable brokerage. Seaprimecapitals offers a very accessible entry point with a low minimum deposit of just $10 across multiple methods. It provides a variety of payment options, including popular e-wallets and traditional banking options.

However, traders should pay close attention to the fees and processing times, especially for withdrawals. While many deposit methods are free, withdrawals via bank transfer have a 2.5% fee. Processing times also vary dramatically, from instant for some e-wallets to over a week for bank transfers.

| Method | Minimum Deposit | Deposit Fee | Withdrawal Fee | Withdrawal Time |

| Neteller | $10 | Free | 0 | 1–7 working days |

| Skrill | $10 | Free | Not Specified | Instant |

| VISA | $10 | Not Specified | Not Specified | 6–12 working hours |

| Mastercard | $10 | Free | Not Specified | Instant |

| Bank Transfer | $10 | Not Specified | 2.5% | 1–7 working days |

The combination of a low minimum deposit and instant funding options makes it easy to start trading. However, the potential for withdrawal fees and long processing times for certain methods should be carefully considered.

A Mixed User Picture

When evaluating a broker, user reviews can provide valuable insight into the client experience. In the case of Seaprimecapitals, the available feedback presents a mixed and complex picture that requires careful interpretation.

On one hand, there are numerous positive testimonials. Common themes in these reviews include satisfaction with the platform's features, profits, and service. For instance, users have made comments such as:

> “Fast trades execution Fast withdrawals Fast client service 📈”

> “I am making profit every day 5 days in a week in my copy trade account. I am very happy with this broker.”

These reviews paint a picture of a reliable and profitable broker, with particular praise for its copy trading feature and withdrawal speeds.

However, it is crucial to apply critical thinking to this evidence. All of these reviews are marked as “Unverified,” meaning their authenticity has not been independently confirmed. Furthermore, a significant majority of these positive comments come from a single geographical region (India). This concentration, combined with the unverified status, raises questions about how representative they are.

Most importantly, these positive personal experiences must be weighed against the hard, verifiable fact of the broker's unregulated status. While some traders may have had good outcomes, the absence of regulatory protection remains the main risk factor. Without a regulator, there is no guarantee of fair treatment, no help in case of disputes, and no safety net for client funds. Positive reviews cannot substitute for financial oversight.

Final Verdict: An Accessible Broker

After a thorough analysis, our verdict on Seaprimecapitals is clear. The broker successfully creates an appealing package for new and small-scale traders with its very low $10 minimum deposit, access to the powerful MT5 platform, and a diverse range of trading instruments. Features like instant funding and the reported success of its copy trading service add to its surface-level attraction.

However, these benefits are completely overshadowed by one undeniable and critical fact: Seaprimecapitals operates without any valid financial regulation. Its registration in Saint Vincent and the Grenadines offers no investor protection, leaving traders' money exposed to significant risks. The wide spreads on its standard accounts and fees on certain withdrawal methods further reduce its appeal.

In conclusion, while the functional aspects of the platform may seem appealing, the fundamental risk to losing funds with an unregulated company is extremely high. We strongly advise extreme caution. The potential for loss due to a lack of oversight far outweighs the convenience of a low entry barrier.

Before making any financial commitment, we strongly urge traders to perform their own comprehensive research. You can review the full, continuously updated profile for Seaprimecapitals, including any new user reports or changes in its operational status, directly on WikiFX to ensure you have the most current information available.

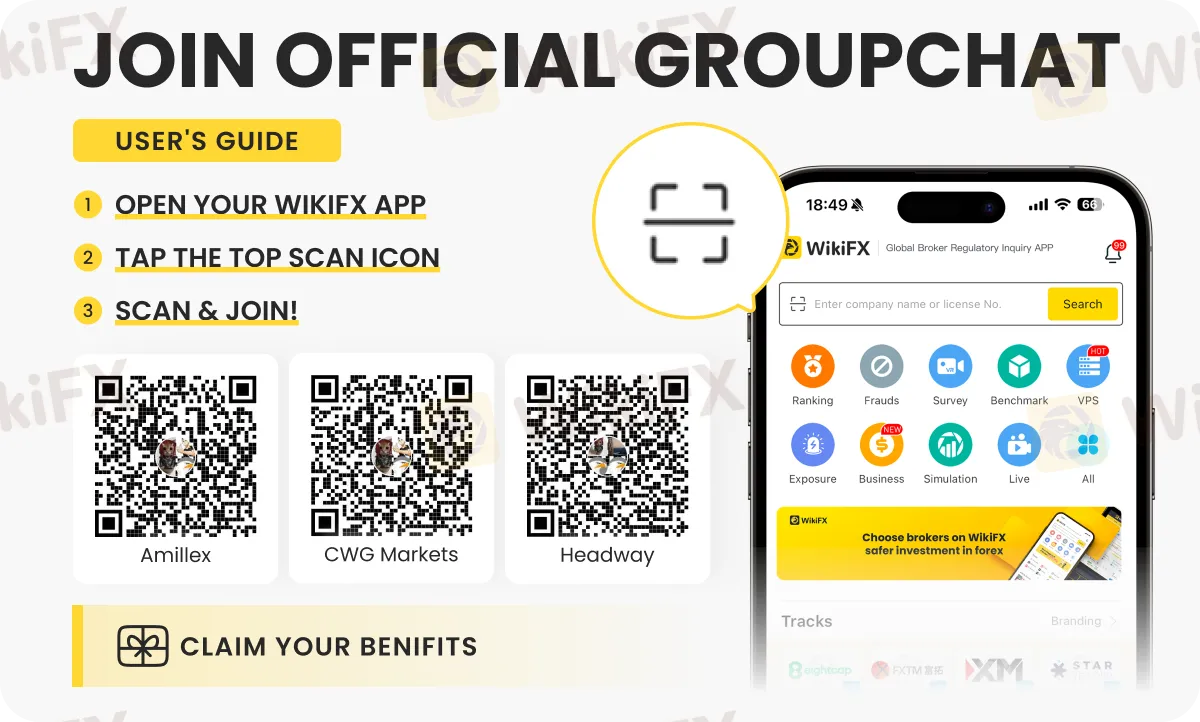

Feel the forex pulse every second through these special chat groups (OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G) by following the simple instructions shown below.

Read more

Seacrest Markets Exposed: Are You Facing Payout Denials and Spread Issues with This Prop Firm?

Seacrest Markets has garnered wrath from traders owing to a variety of reasons, including payout denials for traders winning trading challenges, high slippage causing losses, the lack of response from the customer support official to address withdrawal issues, and more. Irritated by these trading inefficiencies, a lot of traders have given a negative review of Seacrest Markets prop firm. In this article, we have shared some of them. Take a look!

GKFX Review: Are Traders Facing Slippage and Account Freeze Issues?

Witnessing capital losses despite tall investment return assurances by GKFX officials? Do these officials sound too difficult for you to judge, whether they offer real or fake advice? Do you encounter slippage issues causing a profit reduction on the GKFX login? Is account freezing usual at GKFX? Does the United Kingdom-based forex broker prevent you from accessing withdrawals? You are not alone! In this GKFX review guide, we have shared the complaints. Take a look!

Is Seaprimecapitals Regulated? A Complete Look at Its Safety and How It Works

The straightforward answer to this important question is no. Seaprimecapitals works as a broker without proper regulation. This fact is the most important thing any trader needs to know, because it creates serious risks for your capital and how safely the company operates. While this broker offers some good features, like the popular MetaTrader 5 platform and a low starting deposit, these benefits cannot make up for the major risks that come from having no real financial supervision. This article will give you a detailed, fact-based look at Seaprimecapitals regulation, what the company claims to do, the services it provides, and the clear differences between official information and user reviews. Our purpose is to give you the information you need to make a smart decision about the risks and benefits of working with this company.

Major Complaints of MUFG Broker in 2025 You Shouldn’t Ignore

2025 is about to end, and if you still want to be a trader or investor and are looking for a broker to invest with. It is important to read real user complaints first. This will help you understand the kind of problems users are facing with MUFG broker. In this article, we will tell you about the major complaints users have reported about MUFG in 2025, so you know what to watch out for. Do not ignore this MUFG broker article and understand the problems.

WikiFX Broker

Latest News

CQG Partners with Webull Singapore to Power the Broker’s New Futures Trading Offering

【WikiEXPO Global Expert Interviews】Ashish Kumar Singh: Building a Responsible and Interoperable Web3

IEXS Review 2025: A Complete Expert Analysis

CySEC Flags 21 Unauthorized Broker Websites in 2025 Crackdown

IEXS Regulation: A Complete Guide to Its Licenses and Safety Warnings

WinproFx Withdrawal Problems: A Complete Look at Delays and User Reports

Does WealthFX Generate Wealth or Losses for Traders? Find Out in This Review

FONDEX Review: Do Traders Really Face Inflated Spreads & Withdrawal Issues?

FXPrimus Review: Is FXPrimus Regulated and Reliable for 2025?

Simulated Trading Competition Experience Sharing

Rate Calc