ATFX Partners with KX to Enhance Real-Time Trading Solutions

Abstract:ATFX partners with KX to boost real-time data analytics, AI integration, and trading efficiency for global clients through advanced fintech innovation.

ATFX, a globally regulated fintech broker specialising in FX and CFDs, has announced a strategic partnership with KX, a leading provider of time-series data management and analytics solutions. The collaboration is designed to strengthen ATFXs trading infrastructure, delivering faster analytics, smarter automation, and improved operational efficiency across its global operations.

Real-Time Market Intelligence

By integrating KXs flagship technologies, ATFX gains access to advanced tools such as kdb+, a high-performance time-series database built for ultra-low latency. This enables ATFX to process streaming and historical market data instantly, providing trading, risk, and operations teams with actionable insights in real time.

The partnership also introduces the KX MCP Server, an AI-powered interface that allows natural-language queries. This feature makes complex financial data accessible to all ATFX teams, including non-technical users, ensuring faster decision-making without the need for coding expertise.

Enhanced Client Transparency

With the KDB-X platform, ATFX can deliver more accurate and timely client reports. The unified data engine integrates time-series, vector, and AI analytics, boosting transparency for both institutional and retail clients.

As trading volumes continue to grow, ATFX will benefit from scalable infrastructure that maintains performance while controlling costs. AI-powered automation further streamlines workflows, enhancing efficiency across the brokers global network.

Leadership Perspectives

Jeffrey Siu, Chief Operating Officer of ATFX, emphasized the client-focused benefits:

“Our collaboration with KX demonstrates ATFXs commitment to leveraging state-of-the-art technology to deliver real-time data excellence and superior client service.”

Ashok Reddy, Chief Executive Officer of KX, highlighted the innovation potential:

“We are thrilled to collaborate with ATFX. Our MCP Server and KDB-X platform will enable ATFX to harness the full power of real-time market intelligence and AI.”

About ATFX

ATFX operates in 24 global locations and holds nine regulatory licenses, including approvals from the UK‘s FCA, Australia’s ASIC, Cyprus‘ CySEC, and Hong Kong’s SFC. The broker is recognized for its strong compliance standards, innovative technology, and commitment to client satisfaction.

About KX

KX powers real-time analytics across industries, including capital markets, aerospace, and high-tech manufacturing. Its platforms are trusted worldwide for speed, precision, and scalability, enabling organizations to extract actionable insights from streaming and historical data.

Read more

TotalFX Regulation Review: Compliance and Trading Safety

TotalFX review reveals FSCA oversight with license No. 51105, proving compliance and secure trading safety across forex, crypto, and CFDs.

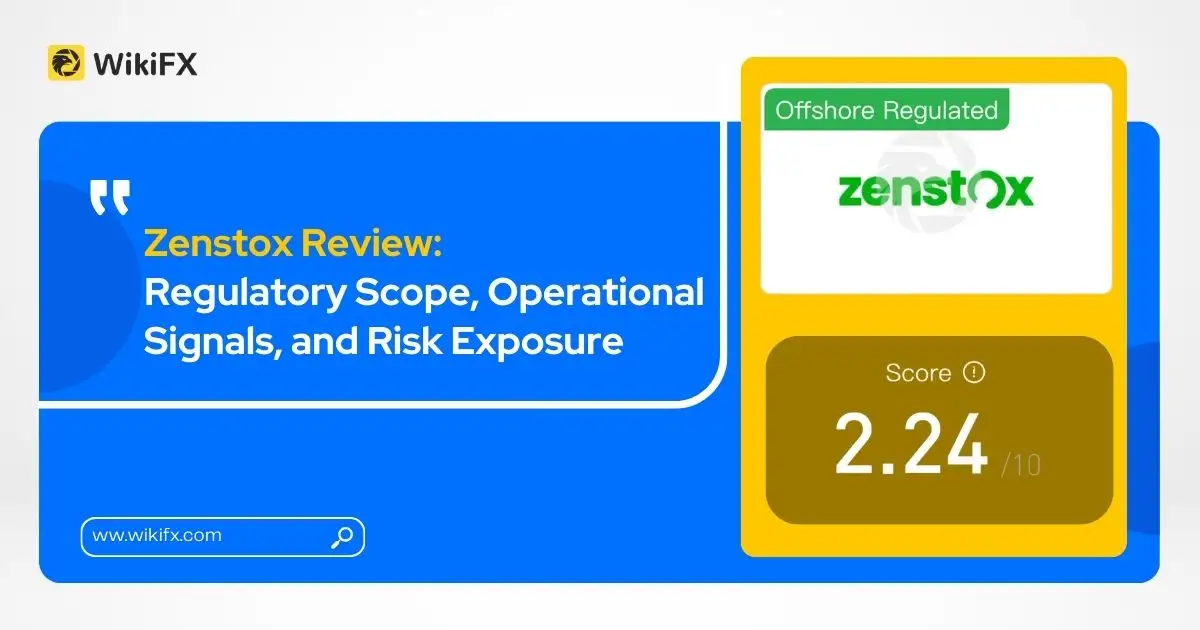

Zenstox Review: Regulatory Scope, Operational Signals, and Risk Exposure

New findings raise concerns over Zenstox’s offshore licensing, internal trading structure, and reported fund access issues.

TopFX Regulation Review: Safety, License and Compliance

TopFX is a regulated broker under CySEC, holding Market Maker license No.138/11 since 2011.

ZFX User Reputation: Is ZFX Safe or a Scam? A Complete Review

When traders research a broker, they always ask the same important question: Will my capital be safe? When looking into ZFX, this question becomes complicated because there are serious scam accusations floating around. This review aims to give you a clear, fact-based answer. Read on!

WikiFX Broker

Latest News

One Click, RM1 Million Gone: Penang Retiree’s Social Media Scam Nightmare

Geopolitical Shock: Trump's Venezuela Raid Sparks Oil Volatility & Impeachment Threats

Precious Metals Surge: Central Banks and Fed Outlook Fuel 'Bare-Knuckle' Bull Market

RIFAN FINANCINDO BERJANGKA Review (2025): Is it Safe or a Scam?

Fed’s Paulson Douses Rate Cut Hopes, Strengthening 'Higher for Longer' Case

WAYONE CAPITAL Review 2025: Institutional Audit & Risk Assessment

Is BotBro Legit or a Scam? 5 Key Questions Answered (2025)

Oil Markets on Edge: OPEC+ Holds Firm Amid Venezuelan Turmoil

Global Crypto Launch Tax Network to 48 Nations

OneRoyal Review: A Complete Look at How This Broker Performs

Rate Calc