TopFX Regulation Review: Safety, License and Compliance

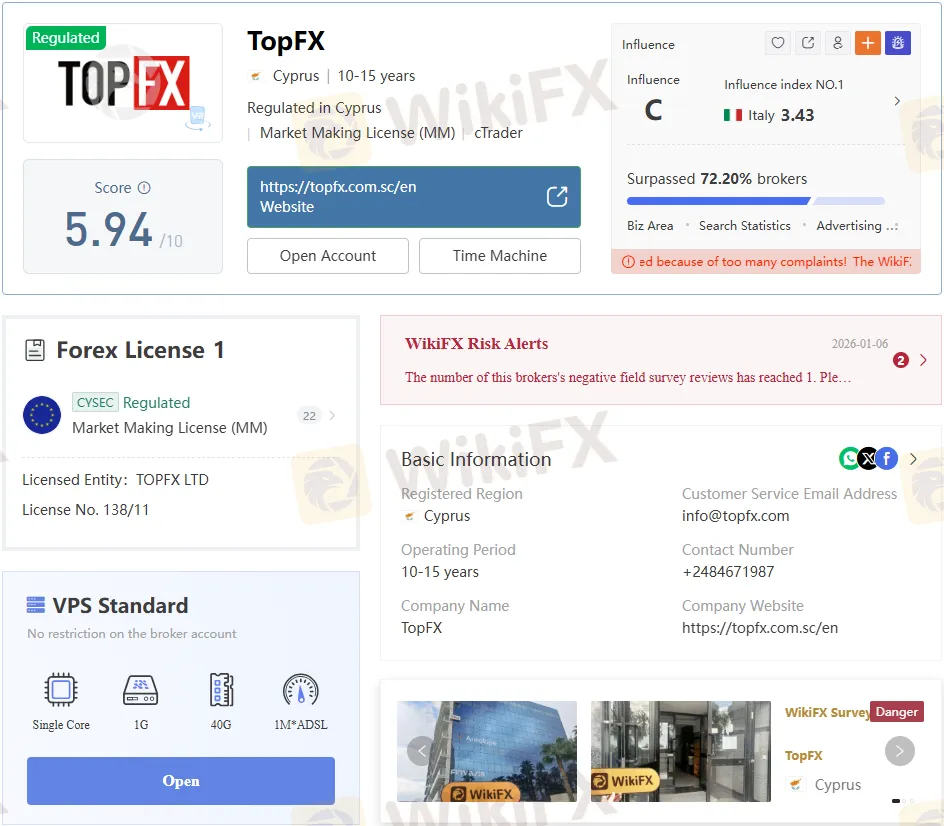

Abstract:TopFX is a regulated broker under CySEC, holding Market Maker license No.138/11 since 2011.

TopFX operates as a Cyprus-based broker under strict oversight from the Cyprus Securities and Exchange Commission (CySEC). Its Market Maker license, No. 138/11, dates back to April 19, 2011, granting permissions across forex, derivatives, securities, and related asset management activities.

CySEC License Details

CySEC license No. 138/11 authorizes TOPFX LTD as a Market Making entity in Cyprus. Effective since 2011-04-19, this regulation extends cross-border services to 21 EU member states, bolstering client protections like segregated funds and investor compensation schemes inherent to CySEC standards. The licensed entity maintains its institution website at www.topfx.com, with an office noted in Limassol District, Cyprus, at Persefonis, though physical verification shows no on-site presence confirmed.

Operational History

Domain topfx.com.sc registered on 2019-11-27, expires 2025-11-27, and updated 2025-01-11 under clientTransferProhibited status with Cloudflare name servers. TopFX has operated for 10-15 years, offering contact via info@topfx.com and +248 4671987. No major reported cases surface in available records, though some trader feedback mentions withdrawal delays.

Trading Instruments Offered

Access 600 CFDs covering forex, indices, shares, metals, energies, cryptocurrencies, and ETFs. Average EURUSD spread hits 0.11 pips, with execution under 30ms highlighted for liquidity. Copy trading integrates for portfolio diversification, allowing followers to mirror experienced managers.

Account Types Breakdown

| Account | Currency | Spread From | Min. Deposit | Leverage | Commission |

| Zero | USD, EUR, GBP, JPY | 1 pip | None | 1:1000 | 0 |

| Raw | USD, EUR, GBP, JPY | 0 pips | $5000 | 1:1000 | $2.75/side/lot |

| VIP | USD, EUR, GBP, JPY | 0.2 pips | $50,000 | Up to 1:1000 | 0 |

Demo accounts suit platform familiarization without deposit requirements. Deposits are accepted by bank wires (up to 5 days), e-payments, and QR (instant).

Platforms and Fees

MT4 and cTrader support Windows, Android, and iOS, with cTrader adding desktop web access. Spreads start at 0.0 pips; no swap-free noted, and leverage caps at 1:1000 amplify risks. Customer support runs via email (support@topfx.com.sc), phone (+248 4374705), live chat, and social channels, but lacks 24/7 coverage.

Pros and Cons

Pros:

- CySEC-regulated with Market Maker license since 2011.

- Competitive spreads from 0.0 pips and 600 CFDs variety.

- High leverage up to 1:1000 and no minimum on the Zero account.

- MT4/cTrader on multiple devices; copy trading available.

Cons:

- Some complaints on withdrawals persist.

- No 24/7 support or swap-free accounts.

- Higher min. deposits for Raw/VIP tiers.

Competitor Comparisons

TopFX edges its peers like unregulated brokers on legitimacy via CySEC, unlike offshore alternatives lacking EU passporting. Versus other CySEC firms, its 1:1000 leverage exceeds typical 1:30 retail caps elsewhere, but matches Market Maker models; spreads align with cTrader specialists, though min. deposits surpass entry-level rivals. Domain age trails veterans, signaling mid-tier stability.

Bottom Line

TopFX upholds solid regulatory standing through a longstanding CySEC license No. 138/11, prioritizing safety for EU-accessible trading in diverse CFDs. Traders value low spreads and platform choices, yet weigh support gaps and isolated withdrawal notes against its compliant framework. Legitimacy holds for cautious operators seeking Market Maker reliability.

Read more

BlackBull Markets User Reputation: Looking at Real User Reviews and Common Problems to Judge Trust

When traders ask, "Is BlackBull Markets safe or a scam?", they want a simple answer to a hard question. The facts show two different sides. The broker began operating in 2014 and has a strong license from New Zealand's Financial Markets Authority (FMA). It also has an "Excellent" rating on review sites such as Trustpilot. But when searching for "BlackBull Markets complaints," you find many negative user stories, including withdrawal issues and poor trading conditions. This article goes beyond simple "safe" or "scam" labels. We want to carefully look at both the good reviews and common problems, comparing them with how the broker actually works and its licenses. This fact-based approach will give you the full picture of its user reputation, helping you make your own smart decision.

Is BlackBull Markets Legit? An Unbiased 2026 Review for Traders

Is BlackBull Markets legit? Are the "BlackBull Markets scam" rumors you see online actually true? These are the important questions every smart trader should ask before exposing capital to markets. The quick answer isn't just yes or no. Instead, we need to look at the facts carefully. Our goal in this review is to go beyond fancy marketing promises and do a complete legitimacy check. We will examine the broker's rules and regulations, look at its business history, break down common user complaints, and check out its trading technology. This step-by-step analysis will give you the facts you need to make your own smart decision about whether BlackBull Markets is a good and safe trading partner for you.

A Clear BlackBull Markets Review: Trading Conditions, Fees & Platforms Explained

This article gives you a detailed, fair look at BlackBull Markets for 2026. It's written for traders who have some experience and are looking for their next broker. Our goal is to break down what this broker offers and give you facts without taking sides. We'll look at the important things that serious traders care about: how well they're regulated, what trading actually costs, what types of accounts you can get, and how good their technology is. We're not here to tell you to use this broker - we want to give you the facts so that you can decide if it fits your trading style and how much risk you're comfortable with. Making a smart choice means checking things yourself. Before you pick any broker, you need to do your own research. We suggest using websites, such as WikiFX, to check if a broker is properly regulated and see what other users say about it.

SGFX User Reputation: Is it Safe or a Scam? A Detailed Look at User Complaints

The most important question any trader can ask is whether a broker is legitimate. Recently, SGFX, also called Spectra Global, has been mentioned more often, leading to many questions: Is SGFX Safe or Scam? Is it a safe platform for your capital, or is it another clever online scam? This article will give you a clear, fact-based answer to that question. Read on!

WikiFX Broker

Latest News

Bull Waves Regulation Uncovered: A Deep Look into Their FSA License and Safety

OPEC+ Stands Pat: Output Steady Amidst Geopolitical Storm

XTRADE Broker Analysis: Understanding XTRADE Regulation & Verified XTRADE Review

Oil Markets on Edge: OPEC+ Holds Firm Amid Venezuelan Turmoil

Geopolitical Shock: Trump's Venezuela Raid Sparks Oil Volatility & Impeachment Threats

One Click, RM1 Million Gone: Penang Retiree’s Social Media Scam Nightmare

Fed Watch: Paulson See 'Bending' Jobs Market; Yellen Warns of Debt Spirals

Global Crypto Launch Tax Network to 48 Nations

Spanish Regulator Raises Concerns Over Unlicensed Trading Platforms and Messaging-Based Apps

OneRoyal Review: A Complete Look at How This Broker Performs

Rate Calc