Bull Waves Regulation Uncovered: A Deep Look into Their FSA License and Safety

Abstract:Choosing which broker to trust with your money is one of the most important decisions a trader makes. The most important factor in this choice is whether the broker is properly regulated. In this analysis, we will carefully examine Bull Waves regulation, looking at how the company is organized, the details of its license, and what this means for trader safety. Our goal is to present the facts clearly so you can understand the risks and make a smart decision.

Choosing which broker to trust with your money is one of the most important decisions a trader makes. The most important factor in this choice is whether the broker is properly regulated. In this analysis, we will carefully examine Bull Waves regulation, looking at how the company is organized, the details of its license, and what this means for trader safety. Our goal is to present the facts clearly so you can understand the risks and make a smart decision.

Who is Bull Waves?

Bull Waves is a fairly new broker that started in 2023. The company operates under the legal name `Equitex Capital Limited`. According to its official documents, the company is authorized and regulated by the Seychelles Financial Services Authority (FSA) under license number `SD185`.

This information brings up the main question we want to answer: What does being regulated by the Seychelles FSA actually mean for a trader's safety? As we will see, where a regulatory body is located and how strong it is are just as important as having a license at all.

Why Regulatory Oversight Matters

A broker's regulatory status is the foundation of trader protection. It is not just paperwork; it is a system designed to ensure the company operates properly and keeps client money safe. Strong regulation typically controls:

• Safety of Client Funds: Requiring that client money is kept in separate accounts, away from the company's operating money.

• Dispute Resolution: Providing an independent way to resolve conflicts between traders and brokers.

• Operational Transparency: Requiring regular financial reports and audits to make sure the broker is financially stable.

However, not all regulatory bodies offer the same level of protection. The global financial world is divided into different regulatory levels, from top-level areas like the UK or Australia to offshore centers. But what does 'offshore regulation' really mean for your money? Tools like WikiFX can help traders understand what different regulatory licenses actually mean before choosing a broker.

Understanding the Company Structure

To understand any broker, you must first understand its legal and company foundation. A clear structure shows transparency, while a confusing one can be a warning sign. Here is the verified company information for Bull Waves.

Main Licensed Company

The Bull Waves brand is operated by `Equitex Capital Limited`. This is the company that holds the regulatory license and is legally responsible for the brokerage operations.

| Detail | Information |

| Legal Entity Name | Equitex Capital Limited |

| Trading Name | Bullwaves |

| Registration Number | 8434948-1 |

| Regulator | Seychelles Financial Services Authority (FSA) |

| License Number | SD185 |

| Registered Address | CT House, office number 9A, Providence, Mahe, Seychelles |

| Physical Address | Office No. Al9C, Providence Complex, Providence, Mahe, Seychelles |

Related Company: ETX

The company also mentions a connection with `ETX Services Limited`, a company registered in Cyprus with registration number HE455407. This company is listed as an “independent representative and distributor.” It is important to understand what this connection actually means.

*This company is not regulated in the EU and only provides services to Equitex Capital Ltd.*

This means traders should not confuse the Cyprus-based service company with a CySEC-regulated company. The regulatory protection for Bull Waves clients comes only from the Seychelles-based `Equitex Capital Limited` and its FSA license.

Detailed Look: The License

The heart of our analysis is the Bull Waves license itself. Understanding what it covers, its limitations, and how it compares to global standards is essential for judging the real risk of putting money with this broker.

The FSA SD185 License

The license held by `Equitex Capital Limited` is a “Securities Dealer License” issued by the Seychelles Financial Services Authority. This officially allows the company to offer CFD trading and other securities services. However, the Seychelles FSA is widely known in the industry as an offshore regulatory body.

While the license exists, its enforcement and protection systems are not as strict as those from top-level areas. This is why independent verification is important. Before working with any broker, especially one with offshore regulation, doing a quick check on a platform like [WikiFX](https://www.wikifx.com/) can provide an overall score and risk alerts, giving a clearer picture of the broker's standing.

'Red-Level' Regulation Analysis

Industry review sites such as DayTrading.com classify the Seychelles FSA regulation as “Red-Level” in their trust rating system. This means a lower level of regulatory oversight compared to more established financial centers. To understand the practical differences, a direct comparison is needed.

The following table compares the protections offered by the Seychelles FSA with those required by top-level regulators, such as the Australian Securities and Investments Commission (ASIC) or the Cyprus Securities and Exchange Commission (CySEC).

| Feature | Seychelles FSA (Offshore) | Tier-1 Regulators (e.g., ASIC, CySEC, FCA) |

| Fund Segregation | Yes (Bull Waves claims this) | Mandatory & Strictly Audited |

| Negative Balance Protection | Yes (Bull Waves claims this) | Mandatory for Retail Clients |

| Investor Compensation Scheme | No | Yes (e.g., ICF in Cyprus, FSCS in UK) |

| Financial Transparency | Not required (No public financial disclosure) | Mandatory (Regular, audited financial reports) |

| Dispute Resolution | Limited, less robust process | Strong, independent ombudsman services |

| Industry Trust Rating | Low (“Red-Level”) | High |

What This Means

The results of this table are significant for any trader considering Bull Waves. The most important point is the lack of an investor compensation scheme. In a top-level area, if a broker goes out of business, a government-backed fund pays clients back up to a certain limit. With a Seychelles-regulated broker, no such safety net exists. If the broker fails, client funds are not protected by a third-party scheme.

Also, the lack of required public financial reports means that traders have no way to independently check the company's financial health. You are trusting a company without being able to verify if it is financially stable or profitable.

From our experience analyzing brokers, the absence of a compensation fund and public financial reports are major warning signs. While a broker might operate honestly, these protection layers are designed for worst-case scenarios, and their absence puts all the risk directly on the trader.

The Trader's Experience

Regulatory analysis provides the theoretical framework for safety, but user reviews offer a look into the practical, day-to-day reality of trading with a broker. The online presence for Bull Waves presents a conflicting and concerning story.

The Official Profile

The main Trustpilot profile for bullwaves.com shows a positive picture. With a “Great” rating of 4.1 out of 5 from over 688 reviews as of early 2025, many users report a satisfactory experience. Positive feedback often highlights:

• Good execution speed on trades.

• Tight spreads on certain instruments.

• Professional and responsive customer service.

• Fast and efficient withdrawals.

One typical review states, *“Bullwaves has been outstanding from the excellent customer service to the swift withdrawals.”* This suggests that for many users, the platform delivers on its promises.

The Warning Signs

However, a deeper search reveals a darker side with serious complaints that directly challenge the positive story. These are not minor complaints but accusations that strike at the heart of a broker's trustworthiness.

• Case 1: Account Closure and Profit Confiscation. One user reported: “They are a fraudulent company, they closed my account and confiscated my profits without giving any valid reason. They accused me of 'market abuse' but provided absolutely no evidence to support the allegation.”

• Case 2: Withdrawal Difficulties. Another trader detailed a frustrating experience: “I filled in the wrong bank details and couldn't withdraw... When I consulted the trading platform for a solution, they gave me a very perfunctory answer... It eventually took me over a month to withdraw to a crypto wallet.”

• Case 3: Fake Bonus Allegations. A trader issued a stark warning: “Stay away from them. They will ruin you. They give a fake credit bonus that will be deducted mid-trade and wipe out your entire funds, please stay away, I lost £1000 in a matter of minutes.”

Most concerning is the existence of a second, much lower-rated Trustpilot profile for a `bullwaves.global` domain. This profile has a score of just 2.2 out of 5 and is filled with severe complaints about withdrawal problems and accusations of being a scam. Having two conflicting profiles for the same brand is a major red flag that demands extreme caution from potential clients.

Conclusion: Judging the Risk

Combining the regulatory framework, company structure, and user experiences allows us to form a complete risk assessment of Bull Waves. The picture that emerges is one of a broker with some positive features overshadowed by significant, fundamental risks.

A Summary of Findings

To simplify the assessment, we can organize our findings into green flags (positives) and red flags (risks).

Green Flags (The Positives):

• Holds an official Securities Dealer License (SD185) from the Seychelles FSA.

• Claims to offer client fund segregation and negative balance protection.

• The main Trustpilot profile shows many positive reviews regarding service and withdrawals.

Red Flags (The Risks):

• Weak, offshore regulation that lacks the strong protective measures of top-level areas.

• Complete absence of an investor compensation fund.

• A very short operating history, having been founded in 2023. As of 2025, it has only been operating for two years.

• Serious and specific user complaints regarding profit confiscation, withdrawal problems, and questionable bonus practices.

• A confusing and highly negative secondary Trustpilot profile associated with the brand.

• A lack of financial transparency, with no publicly available financial reports.

Final Recommendation: Focus on Research

Given the significant risks identified—mainly the weak offshore regulation and the serious nature of user complaints—traders must be extremely careful. While Bull Waves is an officially registered company, its regulatory environment does not provide the strong safety nets that protect traders in worst-case scenarios. The short operating history also means it has not yet proven its stability and reliability over a long market cycle.

We do not make a direct recommendation for or against using any specific broker. The decision to trade, and with whom, is a personal one based on individual risk tolerance. However, based on this analysis, the risk profile for Bull Waves license is elevated.

Ultimately, the decision rests with the individual trader's risk appetite. To make a truly informed choice, we strongly advise using third-party verification tools before depositing any funds. A comprehensive check on a platform like [WikiFX](https://www.wikifx.com/) can reveal important details, user reviews, and up-to-the-minute risk warnings that are not always apparent on a broker's own website. Protect your capital by doing your own research first.

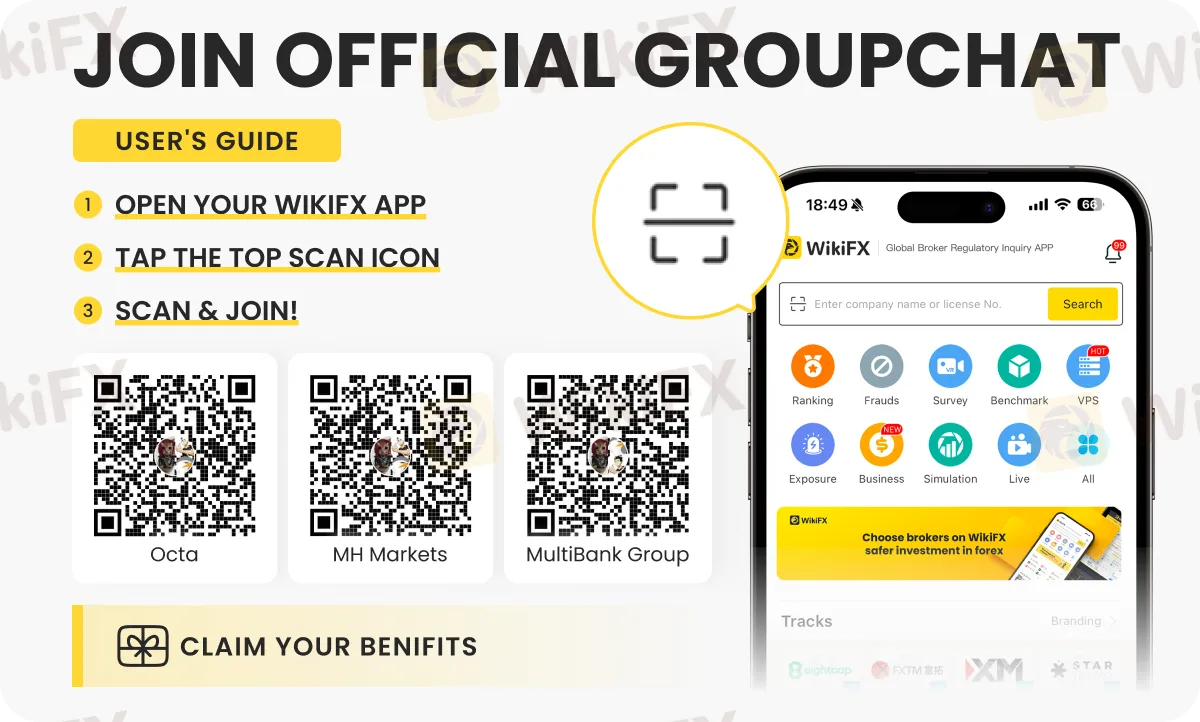

Join official Broker community! Now

You can join the group by scanning the QR code below.

Benefits of Joining This Group

1. Connect with passionate traders – Be part of a small, active community of like-minded investors.

2. Exclusive competitions and contests – Participate in fun trading challenges with exciting rewards.

3. Stay updated – Get the latest daily market news, broker updates, and insights shared within the group.

4. Learn and share – Exchange trading ideas, strategies, and experiences with fellow members.

WikiFX Broker

Latest News

One Click, RM1 Million Gone: Penang Retiree’s Social Media Scam Nightmare

Geopolitical Shock: Trump's Venezuela Raid Sparks Oil Volatility & Impeachment Threats

Oil Markets on Edge: OPEC+ Holds Firm Amid Venezuelan Turmoil

Global Crypto Launch Tax Network to 48 Nations

OneRoyal Review: A Complete Look at How This Broker Performs

CFI Review 2025: Institutional Audit & Risk Assessment

OneRoyal Regulation: A Simple Guide

Bull Waves Regulation Uncovered: A Deep Look into Their FSA License and Safety

Spanish Regulator Raises Concerns Over Unlicensed Trading Platforms and Messaging-Based Apps

OPEC+ Stands Pat: Output Steady Amidst Geopolitical Storm

Rate Calc