TrioMarkets Launches TrioFunded as Brokers Continue to Expand Into Prop Trading

Abstract:Does TrioMarkets’ entry into funded trading represent an opportunity or a risk? A new analysis reviews the business model, regulatory context, and broker evaluation on WikiFX before making a decision.

The retail forex and CFD industry continues to evolve as brokers search for new ways to diversify revenue and attract active traders. The latest development comes from TrioMarkets, which has introduced a proprietary trading brand called TrioFunded, marking its entry into the fast-growing trader evaluation and funded account segment.

The TrioFunded platform recently went live, offering traders an assessment-based pathway to access trading capital. Rather than operating as a traditional brokerage service, the model centers on predefined performance rules, risk limits, and consistency requirements. This structure reflects a broader shift in the market, where funded trading programs have increasingly become an alternative entry point for traders who may lack sufficient starting capital.

At the same time, the expansion of prop-style models by retail brokers highlights how competitive pressures are reshaping the industry. As client acquisition costs rise and margin compression continues across retail trading, many brokers are exploring adjacent business lines that promise higher engagement and recurring participation.

A Growing but Crowded Prop Trading Landscape

The rise of trader challenge programs has accelerated over the past few years. Initially dominated by independent prop firms, the space has gradually attracted retail brokers looking to integrate evaluation models into their broader ecosystems. This convergence has blurred the traditional boundary between brokerage services and proprietary trading structures.

For brokers, the appeal is clear: evaluation fees generate upfront revenue, while successful traders remain active on platforms for longer periods. For traders, funded programs offer the possibility of scaling without committing large personal capital. However, the model also introduces operational complexity, including stricter risk oversight, payout management, and transparency expectations.

As more brokers launch in-house prop brands, differentiation increasingly depends on execution quality, platform stability, and regulatory credibility — areas that remain under close scrutiny by market participants.

Regulatory Context Remains Part of the Picture

The timing of the TrioFunded launch also coincides with heightened regulatory attention on TrioMarkets operating standards. Earlier, the Cyprus Securities and Exchange Commission (CySEC) reached a €50,000 settlement with EDR Financial Ltd, the licensed entity operating the TrioMarkets brand, following a multi-year review covering the period from 2020 to 2024.

According to CySEC, the review examined organizational governance arrangements as well as compliance with product intervention rules related to the marketing and distribution of CFD products to retail clients. While the case did not escalate into formal legal proceedings, the settlement reflected shortcomings in internal controls and regulatory expectations under the Cyprus Investment Firm framework.

The episode serves as a reminder that regulatory compliance remains a central issue for brokers expanding into new operational models, particularly when dealing with retail-facing products and complex trading structures.

Readers seeking more detail on the regulatory background can refer to the related WikiFX coverage: https://www.wikifx.com/en/newsdetail/202601122834657784.html

What WikiFX Data Shows About TrioMarkets

Based on publicly available information on WikiFX, TrioMarkets operates under a Cyprus Investment Firm license held by EDR Financial Ltd, with a Forex Execution (STP) authorization. The broker has been active in the market for over a decade and provides ECN-style accounts, serving clients primarily within the European regulatory framework.

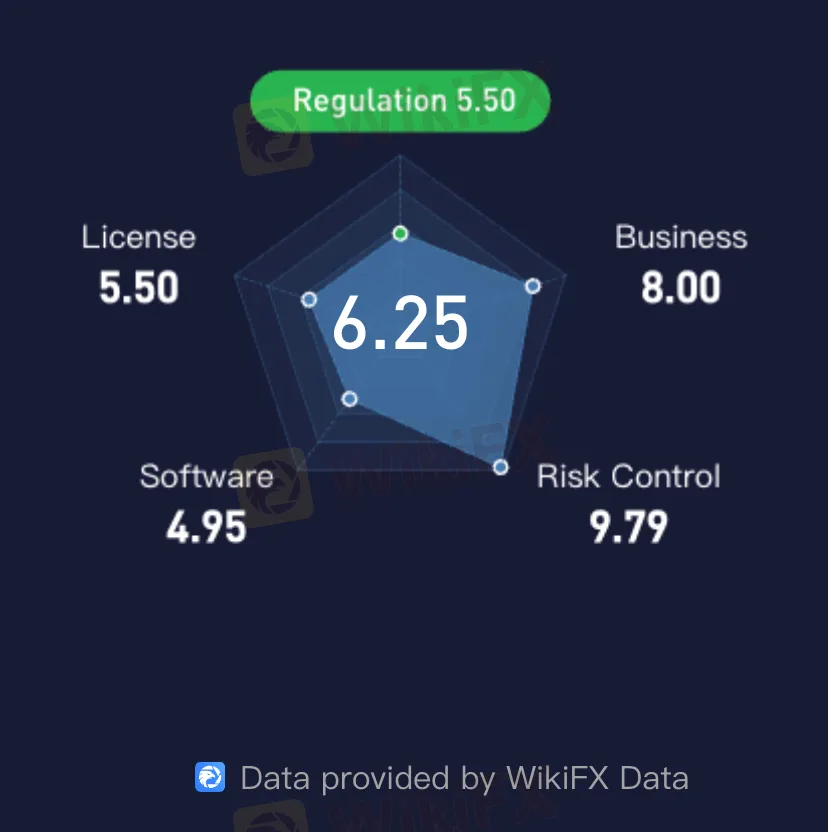

On the WikiFX rating system, TrioMarkets holds an overall score of 6.25 out of 10. The regulatory score reflects a moderate level of oversight under CySEC, while business activity and operational stability indicators suggest a functioning retail brokerage presence. At the same time, software performance metrics remain comparatively weaker, and users are encouraged to assess platform performance and service quality carefully.

From a visibility perspective, the brokers influence index indicates a limited but established market footprint, with a concentration of user interest coming from European regions. Basic company information, including registered entity details, licensing status, and operational history, is available on the WikiFX broker profile for traders who wish to conduct further due diligence.

More background on TrioMarkets can be found on WikiFXs broker profile page: https://www.wikifx.com/en/dealer/1445922039.html

A Measured Step in an Evolving Market

TrioMarkets move into proprietary trading reflects a wider industry trend rather than a standalone shift. As brokers experiment with new engagement models, the sustainability of such initiatives will depend not only on commercial traction, but also on operational discipline and regulatory alignment.

For traders, the launch of TrioFunded adds another option in an increasingly crowded prop trading landscape. At the same time, recent regulatory developments underline the importance of maintaining a balanced view — weighing opportunity alongside governance standards, platform transparency, and historical compliance records.

As the retail trading ecosystem continues to adapt, WikiFX will monitor how broker-led prop trading models evolve and how regulators respond to the growing overlap between brokerage services and funded trading programs.

Read more

EO Broker Exposed: Allegations of Withdrawal Denials, Unfair Trade Execution & Account Blocks

Do you have to constantly witness trade delays on the EO Broker trading platform? Have you encountered cases of unfair trade executions where you have recorded heavy losses? Are inconsistent spreads eating into your trading gains? Is the EO Broker withdrawal process too slow? Is the customer support team incompetent in resolving all these trading queries? You are not alone! Many traders have vehemently opposed the broker’s tactics on review platforms. We have highlighted different EO Broker reviews in this article. Read on!

Achiever FX Review 2026: Do Traders Face Slow Trade Execution and Hidden Fees?

Achiever FX has been receiving flak for numerous reasons, including slow-paced trade execution, lack of transparency, and, importantly, alleged attempts to defraud traders. With its customer support team not able to resolve these issues, traders have allegedly been left alone! They have rightly reviewed the Saint Lucia-based forex broker negatively online. In this Achiever FX review article, we have explored complaints against the forex broker. Keep reading to know the same.

Alpari艾福瑞 Analysis Report

Alpari艾福瑞's notably low overall rating of 2.52 out of 10 raises immediate red flags for traders seeking a reliable forex broker. While the broker has generated sufficient market presence to accumulate 218 documented reviews, the available data presents an unusually opaque picture of their operational strengths and weaknesses. This lack of clear performance metrics across key service areas makes it challenging to provide specific insights into their trading conditions, platform reliability, or customer service quality. Read on for more information.

AXI Analysis Report

AXI stands out as a solid mid-tier forex broker, earning a respectable 8.12 out of 10 rating in our comprehensive analysis. The broker has caught our attention for maintaining a remarkably clean record, with no negative reviews surfacing across the 218 trader experiences we examined. This perfect complaint-free track record suggests AXI takes customer satisfaction seriously and manages potential issues effectively before they escalate into public grievances. Read on to know more about the broker.

WikiFX Broker

Latest News

TopWealth Trading User Reviews: A Complete Look at Real Feedback and Warning Signs

Commodities Focus: Gold Pulls Back & Silver targets Retail Traders

Fed Holds Firm: January Rate Cut Hopes Fade Despite Cooling CPI

A Complete 2026 Review: Is RockwellHalal Legit or a Scam to Stay Away From?

One Message, RM600K Gone: WhatsApp Investment Scam Exposed

Fed

War Risk Premium Explosions: Gold Hits

TrioMarkets Launches TrioFunded as Brokers Continue to Expand Into Prop Trading

Geopolitical Risk Returns: Iran Threatens 'Unforgettable Lesson' as Tensions Mount

FCA Warns on Complex ETP Sales Practices

Rate Calc