Risk Assets Stage a Comeback as Markets Enter a Relief Rally

Abstract:Last Friday, global risk assets mounted a broad-based rebound. After suffering a sharp sell-off over the past week, described by the market as a “bloodbath,” Bitcoin demonstrated notable resilience, c

Last Friday, global risk assets mounted a broad-based rebound. After suffering a sharp sell-off over the past week, described by the market as a “bloodbath,” Bitcoin demonstrated notable resilience, completing a classic “undercut-and-rally” pattern and reclaiming the critical USD 70,000 level by the end of the session.

At the same time, optimism from NVIDIA CEO Jensen Huang provided a strong boost to technology stocks. Huang emphasized that AI infrastructure investment still has at least 7–8 years of growth runway, with computing demand expected to continue accelerating, reinforcing bullish sentiment across the sector.

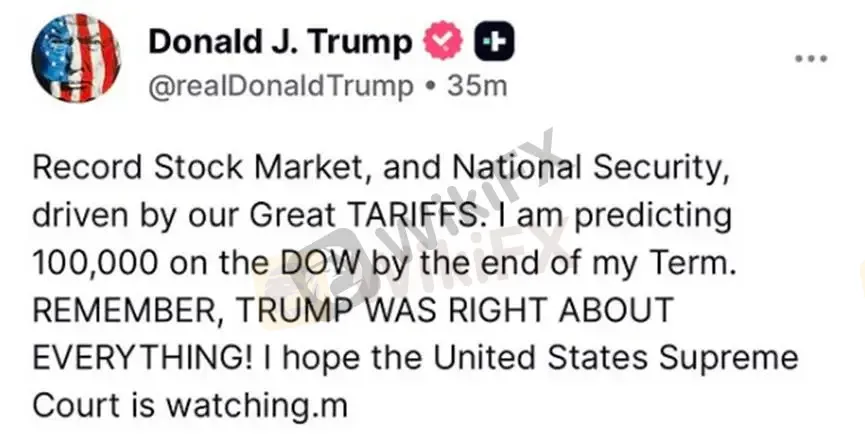

Adding fuel to the rally, Donald Trump posted bold remarks on Truth Social, forecasting that the Dow Jones Industrial Average could reach 100,000 during his presidency. A convergence of positive headlines significantly reignited market risk appetite.

(Chart 1: Trump projects the Dow Jones Industrial Average reaching 100,000 within three years. Source: Truth Social)

Precious Metals Rebound Amid Elevated Volatility

Gold rebounded above the USD 5,000 threshold last Friday, while silver recovered to USD 80 per ounce. On the precious metals front, U.S. Treasury Secretary Scott Bessent commented on Fox News that recent volatility in gold prices was largely driven by what he described as “disorderly speculation” by Chinese traders.

As prices pulled back from record highs, highly leveraged positions triggered a cascade of forced liquidations. Stop-loss orders and margin calls contributed to a wave of selling pressure, further amplifying market volatility.

Bessent characterized the move as a textbook speculative blow-off, a scenario in which prices surge parabolically before facing an elevated risk of a sharp correction.

Medium- to Long-Term Sentiment: De-Dollarization Anchors Gold Bulls

From a medium- to long-term perspective, de-dollarization remains the core conviction underpinning bullish gold positioning. The Peoples Bank of China (PBOC) has increased its gold reserves for 15 consecutive months, reaching 74.19 million ounces as of January. This sustained official accumulation provides a psychological price floor for the market while reinforcing speculative confidence on the long side.

On the geopolitical front, international developments continue to support risk assets. Over the weekend, political clarity emerged from Japan, easing uncertainty. The ruling coalition led by Sanae Takaichi secured a commanding two-thirds majority in the election, ensuring policy continuity. The Nikkei Index responded with a relief-driven rally during the Asian session. However, with short-term technical divergence stretched, investors should remain cautious of profit-taking pressure following the sharp advance.

Weekly Outlook for Precious Metals: Volatility to Ease, Range Trading Likely

As the Lunar New Year approaches, market liquidity is expected to gradually tighten. In the absence of sustained upside catalysts, gold is likely to enter a consolidation phase this week, with limited potential for a fresh directional breakout. Market focus will shift toward reassessing post-holiday demand dynamics.

Technical Analysis

Using Bollinger Bands on the hourly gold chart, prices are currently testing the upper band. Under a range-bound framework, the probability of a pullback appears elevated. Chasing long positions at this stage is not advisable, particularly as the Bollinger Bands have yet to expand in a manner that confirms a directional trend.

From a box-range perspective, the current consolidation zone is defined by:

Upper boundary: 5,091

Lower boundary: 4,663

Whether to adopt a sell-high, buy-low strategy requires further confirmation over the next 1–2 trading sessions.

Momentum indicators show that the MACD histogram has reversed upward from below the zero line, suggesting underlying support for a pullback-biased long setup rather than aggressive downside continuation.

Strategy Recommendation

Gold opened with an upside gap during the Asian session, challenging the USD 5,000 per ounce level. With both bullish and bearish arguments currently in play, a wait-and-see approach is recommended. Traders should remain on the sidelines and reassess positioning after observing todays daily close.

Given the elevated difficulty of intraday trading and the absence of a clear medium-term trend, short-term swing trading is preferred for the remainder of the week.

Key Levels

Resistance

Resistance A: 5,091

Support

Support A: 4,663

Support B: 4,359

Risk Disclaimer:

The above views, analyses, research, prices, or other information are provided for general market commentary only and do not represent the position of this platform. All readers assume full responsibility for their own investment risks. Please trade with caution.

WikiFX Broker

Latest News

If you haven't noticed yet, the crypto market is in free fall, but why?

Emerging Markets: Nigeria's Debt Market Valuation Hits N99.3 Trillion

SkyLine Guide 2026 Thailand — Official Launch of the Judge Panel Formation!

JRJR Review: The Anatomy of a Hong Kong Liquidity Trap

South Africa Macro: Mining Policy Risks Cloud GNU Economic Optimism

JPY In Focus: Takaichi Wins Snap Election to Become Japan's First Female Leader

Vebson Scam Exposure: Forex Withdrawal Failures & Fake Regulation Warning

Amaraa Capital Scam Alert: Forex Fraud Exposure

Galileo FX Exposure: Allegations of Fund Losses Due to Trading Bot-related Issues

EGM Securities Review: Investigating Multiple Withdrawal-related Complaints

Rate Calc